2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

Introduction: AIOT's Market Position and Investment Value

OKZOO (AIOT) represents the world's first urban-scale decentralized environmental data network powered by advanced AIoT machines. Since its launch in August 2025, the project has established itself as an innovative player in the decentralized data infrastructure space. As of December 2025, AIOT has achieved a market capitalization of approximately $14.13 million, with a circulating supply of 111.2 million tokens, currently trading at $0.12711 per token. This pioneering asset is playing an increasingly important role in environmental data collection and decentralized IoT applications.

This article will comprehensively analyze AIOT's price trends through 2030, incorporating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

OKZOO (AIOT) Market Analysis Report

I. AIOT Price History Review and Market Status

AIOT Historical Price Movement Trajectory

AIOT reached its all-time high of $1.85 on September 6, 2025, representing a peak valuation period for the token. The project subsequently experienced significant market correction, with the price declining to its all-time low of $0.01 on August 30, 2025. Over a one-year period, AIOT has demonstrated a net positive performance with a 26.65% gain, despite recent volatility.

AIOT Current Market Performance

As of December 21, 2025, AIOT is trading at $0.12711, reflecting a 24-hour decline of -0.32%. The token has experienced substantial downward pressure over the medium term, declining -53.71% over the past 7 days and -70.03% over the past 30 days. The 1-hour price movement shows a marginal decrease of -0.31%.

The current trading volume over 24 hours stands at approximately $107,085.78, with a circulating supply of 111.2 million tokens out of a maximum supply of 1 billion AIOT tokens. The fully diluted market capitalization is valued at $127.11 million, with a circulation ratio of 11.12%.

The project maintains a ranking of 1,006 by market capitalization with a market dominance of 0.0039%. AIOT is supported across 10 exchange platforms and has attracted 638,622 token holders. The current market sentiment indicator reflects extreme fear conditions.

Click to view current AIOT market price

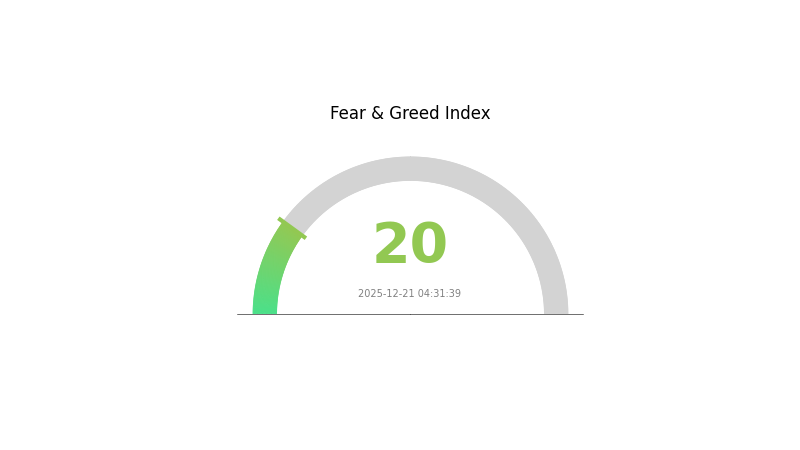

AIOT Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The AIOT market is experiencing extreme fear with an index reading of 20, signaling significant market pessimism and risk aversion among investors. This level typically indicates oversold conditions where asset prices may have declined substantially. Market participants should exercise caution during periods of extreme fear, as they often precede potential recovery opportunities. Consider your risk tolerance and investment strategy carefully before making trading decisions. Monitor market developments closely on Gate.com for real-time data and analysis to make informed choices in this volatile environment.

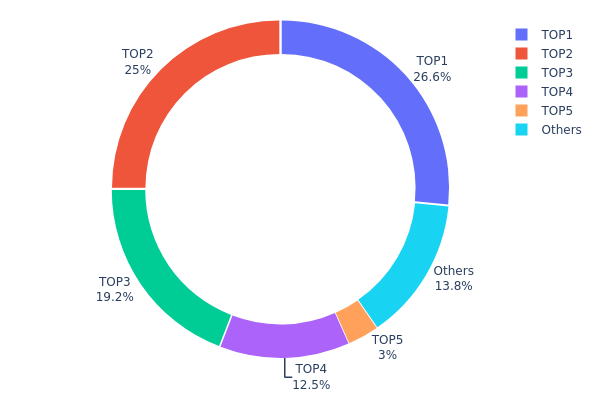

AIOT Holdings Distribution

The address holdings distribution chart illustrates how AIOT tokens are distributed across different wallet addresses on the blockchain, serving as a critical indicator of token concentration and decentralization levels. This metric reveals the ownership structure and potential market concentration risks by tracking the percentage of total token supply held by individual addresses.

Current analysis of AIOT's address distribution reveals significant concentration concerns. The top four addresses collectively control 83.24% of the total token supply, with the leading address alone accounting for 26.59% of holdings. The top two addresses represent over 51% of all AIOT tokens, indicating substantial concentration risk. The third and fourth largest holders maintain substantial positions at 19.15% and 12.50% respectively, further reinforcing the dominance of major stakeholders. Only 13.76% of tokens are dispersed among remaining addresses, suggesting limited distribution among smaller holders and a notable gap between major holders and retail participants.

This concentrated distribution structure poses meaningful implications for market dynamics and price stability. With such significant token accumulation in relatively few addresses, AIOT exhibits vulnerability to potential large-scale sell pressure or market manipulation scenarios. The narrow holder base reduces the resilience of the token against sudden liquidity events and increases sensitivity to decisions made by top stakeholders. This concentration level indicates that AIOT remains in a relatively early-stage distribution phase, with limited decentralization. The current holder structure suggests that market movements may be more susceptible to influence from major address activities, and the token has not yet achieved the distributed ownership pattern typically associated with mature, decentralized projects.

Click to view current AIOT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x71db...c5eb0c | 265916.67K | 26.59% |

| 2 | 0x48a5...9bba8a | 250000.00K | 25.00% |

| 3 | 0xa8c9...d5d526 | 191566.67K | 19.15% |

| 4 | 0xdfc5...f7851c | 125000.00K | 12.50% |

| 5 | 0x9528...f01466 | 30000.00K | 3.00% |

| - | Others | 137516.67K | 13.76% |

II. Core Factors Affecting Future AIoT Pricing

Supply Mechanism

-

Upstream Cost Reduction: Sensor costs, data processing costs, and broadband costs show consistent downward trends. As upstream components experience volume increases with price decreases, overall supply chain efficiency improves, creating favorable conditions for downstream market expansion.

-

Historical Patterns: Past supply chain disruptions, particularly chip price surges and extended delivery cycles (exacerbated by geopolitical tensions), have constrained market growth. However, long-term investments in additional production capacity are expected to stabilize supplies and support sustainable pricing.

-

Current Impact: Supply chain stabilization is anticipated to gradually alleviate cost pressures, enabling more competitive pricing for AIoT solutions and accelerating market adoption across manufacturing, healthcare, and other verticals.

Institutional and Major Player Dynamics

-

Enterprise Adoption: Leading technology companies and major industrial players are actively implementing AIoT solutions. Examples include Amazon Go stores utilizing AIoT for automated retail operations, Hitachi accelerating industrial robotics deployment across manufacturing, and various enterprises adopting predictive maintenance and process optimization applications.

-

Government Policy Support: Comprehensive policy frameworks from Chinese authorities including the "New Generation Artificial Intelligence Development Plan" (targeting RMB 1 trillion core industry scale by 2023), "Industrial Internet Development Guidance," "Enterprise Cloud Migration Implementation Guide," and "Network Security Grade Protection" regulations have created a supportive ecosystem for AIoT development and deployment.

Macroeconomic Environment

-

Market Growth Projections: The global AIoT market was valued at USD 27.92 billion in 2022 and is projected to reach USD 35.65 billion by 2030, representing a compound annual growth rate of 32.4 percent. North America dominated with 35.6 percent market share in 2022, while Asia-Pacific is expected to witness rapid expansion driven by China, India, and Japan.

-

Industry Demand Drivers: Physical IoT ARPU (Average Revenue Per User) values continue to rise while connection growth rates increasingly outpace revenue growth rates, narrowing the gap between connections and actual revenue generation. This indicates growing monetization of IoT services across intelligent manufacturing, smart transportation, and smart public utilities sectors.

Technology Development and Ecosystem Building

-

5G Infrastructure Advancement: China ranks in the top global tier for 5G technology development with substantial R&D investment and capital expenditures. The proliferation of 5G base stations enables higher data speeds, reduced latency, enhanced network reliability, and expanded device connectivity, directly supporting AIoT market expansion.

-

AI Algorithm Optimization: Advances in neural network optimization and deep learning have enhanced efficiency in image recognition, voice recognition, training, and inference domains. Combined with increasing computational power and data availability, AI technology enables more intelligent and responsive IoT applications.

-

Ecosystem Applications: Major downstream applications include video surveillance systems, predictive maintenance solutions, smart connected vehicles (projected to reach 72.2 million units globally by 2023 with 9.3 percent annual growth), and VR/AR devices (expected to achieve 66.78 percent compound annual growth from 2019-2023). Smart city infrastructure solutions, remote patient monitoring systems, and industrial automation platforms represent rapidly expanding application areas across healthcare, manufacturing, retail, agriculture, logistics, and transportation sectors.

III. 2025-2030 AIOT Price Forecast

2025 Outlook

- Conservative Forecast: $0.0783 - $0.1283

- Base Case Forecast: $0.1283

- Bullish Forecast: $0.1706 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual upward pressure as the ecosystem matures and utility adoption increases.

- Price Range Predictions:

- 2026: $0.1166 - $0.2078 (expected growth of 17%)

- 2027: $0.1608 - $0.2215 (anticipated growth of 40%)

- 2028: $0.1560 - $0.2301 (projected growth of 57%)

- Key Catalysts: Ecosystem development expansion, institutional interest, technological upgrades, and broader market recovery in the crypto sector.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1570 - $0.2581 in 2029 and $0.1254 - $0.2791 in 2030 (assumes steady adoption and moderate market conditions)

- Bullish Scenario: $0.2581 (2029) and $0.2791 (2030) representing 69% and 86% growth respectively (requires accelerated utility adoption and positive regulatory developments)

- Transformative Scenario: Sustained price appreciation exceeding $0.28 by 2030 (contingent on breakthrough technological milestones, mass mainstream adoption, and favorable macroeconomic conditions)

- 2030-12-31: AIOT targets $0.279 (baseline accumulation phase completed with established market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17064 | 0.1283 | 0.07826 | 0 |

| 2026 | 0.20776 | 0.14947 | 0.11659 | 17 |

| 2027 | 0.22148 | 0.17862 | 0.16075 | 40 |

| 2028 | 0.23006 | 0.20005 | 0.15604 | 57 |

| 2029 | 0.25806 | 0.21505 | 0.15699 | 69 |

| 2030 | 0.27914 | 0.23656 | 0.12538 | 86 |

OKZOO (AIOT) Professional Investment Strategy and Risk Management Report

I. Project Overview

OKZOO (AIOT) is positioned as the world's first urban-scale decentralized environmental data network powered by advanced AIoT machines. The project leverages artificial intelligence and Internet of Things technologies to create a distributed infrastructure for environmental data collection and monitoring.

Key Project Metrics (as of December 21, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.12711 |

| Market Capitalization | $14,134,632 |

| Fully Diluted Valuation | $127,110,000 |

| Circulating Supply | 111,200,000 AIOT |

| Total Supply | 1,000,000,000 AIOT |

| Circulating Supply Ratio | 11.12% |

| 24H Trading Volume | $107,085.78 |

| Market Ranking | #1006 |

| Number of Holders | 638,622 |

Network Deployment

- Blockchain: BSC (Binance Smart Chain)

- Contract Address: 0x55ad16bd573b3365f43a9daeb0cc66a73821b4a5

- Listed Exchanges: 10 platforms including Gate.com

II. Price Performance Analysis

Recent Price Trends

| Timeframe | Price Change | Change Amount |

|---|---|---|

| 1 Hour | -0.31% | -$0.000395 |

| 24 Hours | -0.32% | -$0.000408 |

| 7 Days | -53.71% | -$0.147485 |

| 30 Days | -70.03% | -$0.297014 |

| 1 Year | +26.65% | +$0.026747 |

Historical Price Extremes

- All-Time High (ATH): $1.85 (September 6, 2025)

- All-Time Low (ATL): $0.01 (August 30, 2025)

- 24H Price Range: $0.1207 - $0.12892

III. AIOT Professional Investment Strategy and Risk Management

AIOT Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Believers in decentralized environmental data infrastructure, ESG-focused investors, and those with 2-5 year investment horizons.

Operational Recommendations:

- Accumulate during periods of high volatility when price drops below the 1-year moving average

- Maintain a position size no larger than 2-5% of total portfolio allocation

- Implement a dollar-cost averaging (DCA) approach to reduce entry-price risk

Storage Solution:

- Use Gate Web3 Wallet for secure on-chain asset management

- Maintain recovery seed phrases in secure offline storage

- Consider multi-signature solutions for positions exceeding $10,000

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor $0.12 (current support) and $0.15 (near-term resistance)

- Volume Analysis: Watch for breakout confirmations when daily volume exceeds $150,000

Trading Strategy Key Points:

- Trade only with portions of your portfolio you can afford to lose

- Set stop-loss orders at 15-20% below entry points

- Take profits at designated resistance levels to secure gains

AIOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% portfolio allocation

- Balanced Investors: 2-5% portfolio allocation

- Aggressive Investors: 5-10% portfolio allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Never allocate more than 10% of crypto holdings to a single project, especially early-stage projects with volatile price history

- Stablecoin Reserves: Maintain 20-30% of trading capital in stablecoins for opportunistic entries during market downturns

(3) Security Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for frequent trading and active management

- Cold Storage Approach: Transfer long-term holdings to hardware wallets for enhanced security

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware security keys, never share private keys or seed phrases, and verify all transaction addresses before confirming transfers

IV. Potential Risks and Challenges

AIOT Market Risks

- Severe Price Volatility: The token has experienced a 70.03% decline over the past 30 days, indicating extreme market sensitivity and potential liquidity concerns

- Low Trading Volume: With only $107,085.78 in 24-hour volume and 11.12% circulating supply ratio, large position exits could face significant slippage

- Early-Stage Project Risk: As a relatively new project (launched in 2025), AIOT lacks the market maturity and established track record of established cryptocurrencies

AIOT Regulatory Risks

- Environmental Data Regulations: Depending on operational jurisdiction, the project may face compliance challenges from data protection and privacy regulations (GDPR, CCPA)

- IoT Device Regulations: Different countries impose varying regulations on IoT devices and data transmission, which could impact project expansion

- Cryptocurrency Regulation Uncertainty: Future regulatory changes affecting AI and blockchain technologies could materially impact project viability

AIOT Technology Risks

- AIoT Device Infrastructure Scalability: The project's success depends on achieving widespread adoption of distributed AIoT devices, which faces technical and commercial challenges

- Data Accuracy and Consensus Mechanisms: Ensuring environmental data integrity in a decentralized network requires robust consensus mechanisms that are unproven at scale

- Smart Contract Vulnerabilities: Potential security exploits in the project's smart contracts could result in fund loss or network compromise

V. Conclusion and Action Recommendations

AIOT Investment Value Assessment

OKZOO (AIOT) represents a speculative opportunity in the emerging intersection of environmental monitoring, IoT, and blockchain technology. The project's long-term value proposition depends on successful real-world adoption of its decentralized data network infrastructure. However, current market conditions show significant downward pressure (70% monthly decline), suggesting either correction of over-valuation or fundamental concerns about project execution. The extremely limited trading volume relative to market cap indicates liquidity risks for large position holders. Investors should approach this project as a high-risk, high-reward opportunity suitable only for capital that can withstand total loss.

AIOT Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) through periodic small purchases on Gate.com, enabling learning about AIoT projects without excessive risk exposure.

✅ Experienced Investors: Implement tactical accumulation during extreme volatility, maintain strict stop-loss discipline at -20% from entry, and use technical analysis to identify support zone purchases.

✅ Institutional Investors: Conduct thorough due diligence on the project's environmental data network deployment metrics, device adoption rates, and revenue generation mechanisms before considering allocation.

AIOT Trading Participation Methods

- Direct Exchange Trading: Purchase AIOT tokens on Gate.com using established trading pairs, with full control over custody and trading execution

- Spot Trading: Long-term holders can use Gate.com's spot trading to establish positions at favorable price levels

- Periodic Rebalancing: Implement quarterly portfolio reviews to adjust AIOT allocation based on performance and changing risk tolerance

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. Always consult with qualified financial professionals before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is AIOT stock a buy?

Yes, AIOT receives a Strong Buy rating from analysts with a 12-month target price of $10.5, representing a 95.90% upside potential. This indicates significant growth opportunities for investors seeking exposure to AI of Things technology.

Which AI is best for stock price prediction?

The best AI for stock price prediction combines DDG-DA with TFT, leveraging hybrid models for superior adaptability and accuracy. HIST and ADARNN also demonstrate strong performance in handling dynamic market conditions and concept drift.

What are analysts' ratings for AIOT?

Analysts rate AIOT with a consensus score of 84.6154 out of 100, indicating a strongly positive outlook. This rating reflects robust analyst support and confidence in the project's fundamentals and growth potential.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

2025 BLESS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

What is NIL (Nillion) price today and 24-hour trading volume?

How to Use Phantom Wallet Safely: A Beginner’s Guide

Understanding Grok Crypto: Ultimate Guide to Its Token Basics

What is Token Economics Model: How do Token Distribution, Inflation Design, and Burn Mechanisms Work?

Understanding Popcat Meme Crypto: A Guide to Solana's Cat Coin