2025 BASPrice Prediction: Analyzing Market Trends and Future Outlook for Blockchain-Based Asset Tokens

Introduction: BAS's Market Position and Investment Value

BNB Attestation Service (BAS), as the native verification and reputation layer on BNB Chain, has enabled composable on-chain KYC, identity, and asset verification since its inception. As of 2025, BAS has a market capitalization of $40,950,000, with a circulating supply of approximately 2,500,000,000 tokens, and a price hovering around $0.01638. This asset, known as the "Human Reputation Profile builder," is playing an increasingly crucial role in RWA, DeFi, AI agents, and more.

This article will comprehensively analyze BAS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. BAS Price History Review and Current Market Status

BAS Historical Price Evolution Trajectory

- 2025: BAS launched, price fluctuated between $0.01374 and $0.0228

- September 18, 2025: BAS reached its all-time high of $0.0228

- September 25, 2025: BAS hit its all-time low of $0.01374

BAS Current Market Situation

As of October 1, 2025, BAS is trading at $0.01638, with a 24-hour trading volume of $97,318.75. The token has experienced a slight decline of 0.36% in the past 24 hours. BAS currently ranks 774th in the cryptocurrency market with a market capitalization of $40,950,000. The circulating supply stands at 2,500,000,000 BAS tokens, which represents 25% of the total supply of 10,000,000,000 tokens.

Over the past week, BAS has shown a positive trend with a 1.93% increase. However, the token has seen a significant drop of 30.65% over the last 30 days. Despite this recent downturn, BAS has demonstrated impressive long-term growth, with a remarkable 216.78% increase over the past year.

The current market sentiment for BAS appears to be neutral, with the token trading well above its recent all-time low but still considerably below its all-time high. The relatively low trading volume suggests moderate market activity and interest in the token.

Click to view the current BAS market price

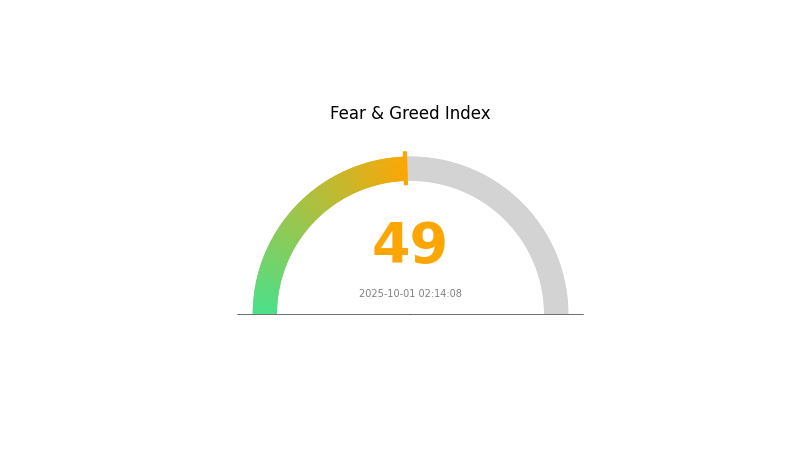

BAS Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index hovering at the midpoint of 49. This neutral reading suggests investors are neither overly pessimistic nor excessively optimistic. While caution persists, there's a sense of stability in the market. Traders on Gate.com are closely monitoring market trends, looking for potential opportunities amidst this equilibrium. As always, it's crucial to conduct thorough research and manage risks effectively in this dynamic crypto landscape.

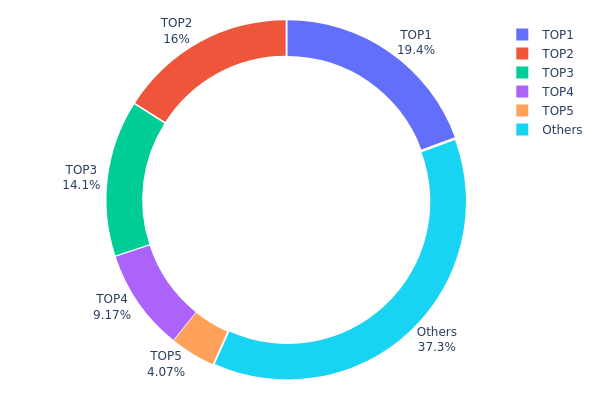

BAS Holdings Distribution

The address holdings distribution data reveals a high concentration of BAS tokens among a few top addresses. The top 5 addresses collectively hold 62.68% of the total supply, with the largest holder possessing 19.40%. This concentration level raises concerns about potential market manipulation and volatility.

The distribution pattern suggests a significant imbalance in token ownership, which could impact market dynamics. With such a large portion of tokens controlled by a small number of addresses, there's an increased risk of price swings if these major holders decide to buy or sell substantial amounts. Additionally, this concentration may affect the project's decentralization efforts and governance processes.

While 37.32% of tokens are distributed among other addresses, the current holdings structure indicates a need for wider distribution to enhance market stability and reduce manipulation risks. This concentration level could be a point of concern for investors and may require monitoring for potential changes in ownership patterns over time.

Click to view the current BAS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1536...e66c80 | 485000.00K | 19.40% |

| 2 | 0x77e4...2bc283 | 400000.00K | 16.00% |

| 3 | 0x8d70...8d6daa | 351340.00K | 14.05% |

| 4 | 0xda9a...0919e5 | 229129.68K | 9.16% |

| 5 | 0x5979...8bff52 | 101744.29K | 4.07% |

| - | Others | 932551.74K | 37.32% |

II. Key Factors Influencing BAS Future Price

Supply Mechanism

- Production Capacity: Changes in BASF's production capacity can significantly impact supply and price.

- Historical Patterns: Past fluctuations in supply have shown a direct correlation with price movements.

- Current Impact: Any upcoming changes in production capacity are likely to influence future pricing.

Institutional and Whale Dynamics

- Corporate Adoption: Major companies utilizing BASF products can drive demand and price.

- Government Policies: National-level policies related to chemical industries can affect BASF's operations and pricing.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of major economies, can influence raw material costs and demand for BASF products.

- Geopolitical Factors: International tensions or trade disputes can disrupt supply chains and impact pricing.

Technological Development and Ecosystem Building

- Innovation in Chemical Processes: Advancements in production techniques can affect costs and pricing.

- Sustainability Initiatives: Development of more environmentally friendly products can open new markets and influence pricing strategies.

III. BAS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01246 - $0.01639

- Neutral prediction: $0.01639 - $0.01721

- Optimistic prediction: $0.01721 - $0.01803 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2027: $0.01576 - $0.02548

- 2028: $0.0138 - $0.02606

- Key catalysts: Technological advancements and wider market acceptance

2029-2030 Long-term Outlook

- Base scenario: $0.02398 - $0.02686 (assuming steady market growth)

- Optimistic scenario: $0.02974 - $0.03438 (assuming strong bullish trends)

- Transformative scenario: $0.03438+ (extreme favorable market conditions)

- 2030-12-31: BAS $0.03438 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01803 | 0.01639 | 0.01246 | 0 |

| 2026 | 0.01945 | 0.01721 | 0.01394 | 5 |

| 2027 | 0.02548 | 0.01833 | 0.01576 | 11 |

| 2028 | 0.02606 | 0.0219 | 0.0138 | 33 |

| 2029 | 0.02974 | 0.02398 | 0.01559 | 46 |

| 2030 | 0.03438 | 0.02686 | 0.01907 | 63 |

IV. Professional Investment Strategies and Risk Management for BAS

BAS Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate BAS tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure cold storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Look for convergence/divergence between price and volume

BAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for BAS

BAS Market Risks

- High volatility: BAS price may experience significant fluctuations

- Liquidity risk: Limited trading volume could impact price stability

- Competition: Other blockchain attestation services may emerge

BAS Regulatory Risks

- Uncertain regulatory landscape: Potential changes in crypto regulations

- KYC/AML compliance: Increased scrutiny on identity verification services

- Cross-border restrictions: Varying regulations across different jurisdictions

BAS Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the BAS protocol

- Scalability challenges: Possible network congestion on the BNB Chain

- Oracle dependencies: Risks associated with external data sources

VI. Conclusion and Action Recommendations

BAS Investment Value Assessment

BAS offers long-term potential as a crucial infrastructure for blockchain identity and asset verification. However, short-term volatility and regulatory uncertainties pose significant risks.

BAS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the technology ✅ Experienced investors: Consider dollar-cost averaging and set clear exit strategies ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

BAS Trading Participation Methods

- Spot trading: Purchase BAS tokens on Gate.com

- Staking: Participate in BAS staking programs if available

- DeFi integration: Explore potential yield farming opportunities with BAS tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for BNS 2025?

Based on current market analysis, BNS stock is predicted to trade between $62.96 and $71.55 in 2025, with an average price around $67.25.

Will bat prices increase?

BAT prices may increase, but significant growth is unlikely soon. A substantial rise would require a 22,000% increase, which is improbable in the near term.

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price, followed by Ethereum. These two cryptocurrencies are expected to maintain their leading positions in terms of value and market dominance.

What is a bas token?

A BAS token is a BEP-20 standard token used in the BNB Attestation Service for payments, staking rewards, and governance. It enables attestations and access to advanced features.

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

2025 AR Price Prediction: Analyzing Growth Factors and Market Dynamics in the Arweave Ecosystem

2025 API3 Price Prediction: Analyzing Market Trends and Growth Potential for the Decentralized Oracle Token

2025 ICP Price Prediction: Bullish Outlook as Adoption and Development Soar

2025 STORJ Price Prediction: Analyzing Future Growth Potential in the Decentralized Storage Market

2025 AKT Price Prediction: Bullish Outlook for Akash Network's Token in the Cloud Computing Market

Top 5 Best Crypto Mining Apps for Mobile Devices

What is RARI: A Comprehensive Guide to the Decentralized Art NFT Platform

What is BLD: A Comprehensive Guide to Binaural Beat Lucid Dreaming Techniques

Understanding TRC20: The Token Standard on the TRON Blockchain

What is HIFI: A Complete Guide to High-Fidelity Audio Systems and Technology