2025 BITBOARD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of BITBOARD

BITBOARD (BITBOARD) is a blockchain-based voting and ranking platform that enables users to easily vote for their favorite celebrities at any time. Since its launch in September 2024, the project has established itself as a solution addressing key challenges in existing blockchain infrastructure. As of December 2025, BITBOARD's market capitalization has reached $18,824,400, with a circulating supply of approximately 3,547,800,000 tokens and a current price hovering around $0.002324. This innovative asset, recognized for its focus on providing instant finality and high transaction throughput while reducing application costs, is playing an increasingly vital role in democratizing blockchain-based voting mechanisms.

This article will comprehensively analyze BITBOARD's price trends through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies. By examining the token's performance from its all-time high of $0.27 in December 2024 to its current market conditions, we will offer valuable insights for navigating the cryptocurrency market with confidence.

BITBOARD Market Analysis Report

I. BITBOARD Price History Review and Market Status

BITBOARD Historical Price Evolution Trajectory

- December 2024: Project listing and initial market entry, reaching all-time high of $0.27 on December 7, 2024

- December 2024 - March 2025: Market correction phase, price declined from peak levels

- March 2025: Reached all-time low of $0.0000655 on March 13, 2025, representing significant downward pressure

- March 2025 - December 2025: Consolidation and recovery period, price stabilized at lower levels

BITBOARD Current Market Status

As of December 22, 2025, BITBOARD is trading at $0.002324, reflecting a -2.01% decline over the past 24 hours. The token shows broader weakness with a -23.56% drop over the 7-day period and a -58.63% decline over the past year.

Market Capitalization Metrics:

- Market Cap (Circulating): $8,245,087.20

- Fully Diluted Valuation: $18,824,400.00

- 24-Hour Trading Volume: $63,634.54

- Market Dominance: 0.00058%

- Circulating Supply: 3,547,800,000 BITBOARD (43.8% of total supply)

- Total Supply: 8,100,000,000 BITBOARD

Price Range (24H):

- High: $0.0023753

- Low: $0.002301

Holder Distribution: The token maintains a community of 22,428 holders, indicating moderate distribution across the ecosystem.

Visit current BITBOARD market price on Gate.com

BITBOARD Market Sentiment Index

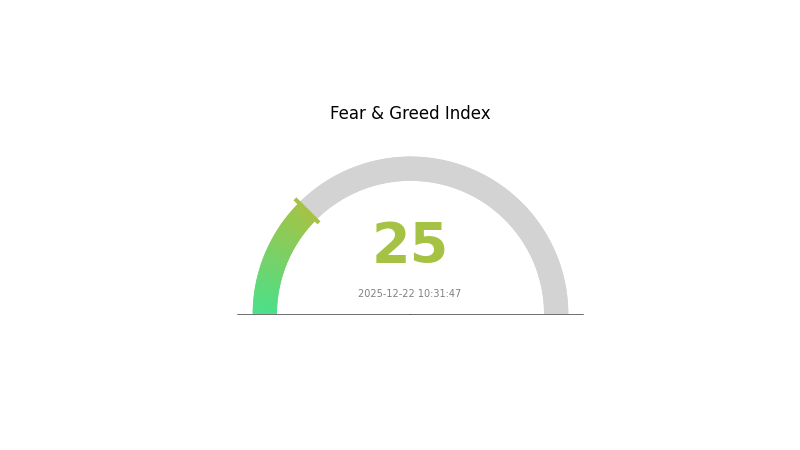

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and investor anxiety. During such periods, volatility typically increases as traders react emotionally to market movements. For long-term investors, extreme fear often presents accumulation opportunities before potential recoveries. However, caution remains essential as downward pressure may continue. Monitor key support levels closely and consider your risk tolerance before making investment decisions on Gate.com.

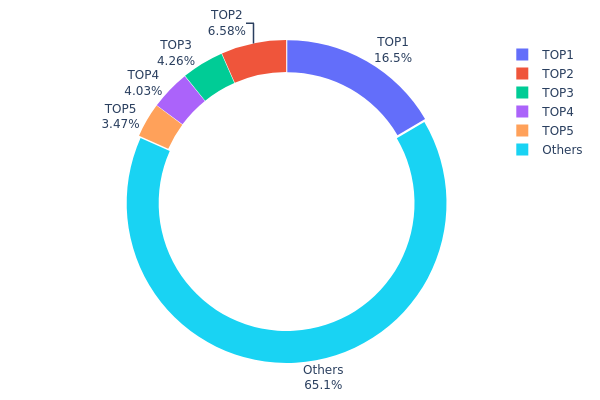

BITBOARD Holdings Distribution

The address holdings distribution chart illustrates how BITBOARD tokens are concentrated across blockchain addresses, revealing the decentralization level and potential market structure risks. By analyzing the proportion of tokens held by top addresses relative to total supply, this metric provides critical insight into whether the token exhibits healthy distribution or faces concentration risks that could facilitate market manipulation.

Current distribution analysis reveals moderate concentration characteristics within the BITBOARD ecosystem. The top five addresses collectively control approximately 34.83% of the circulating supply, with the leading address commanding 16.52% alone. While this represents significant concentration, the remaining 65.17% distributed among other addresses suggests a diversified holder base. The top holder's position is notable but does not constitute the extreme concentration patterns observed in some emerging tokens, indicating a relatively balanced capital structure compared to projects with single-entity dominance exceeding 25-30% thresholds.

The current address distribution pattern presents important implications for market dynamics and stability. With nearly two-thirds of tokens dispersed across numerous addresses, BITBOARD maintains reasonable resilience against sudden large-scale liquidations or coordinated sell-offs by dominant holders. However, the concentration of over 16% in a single address warrants monitoring, as coordinated movements by top-tier holders could influence price volatility and liquidity conditions. This distribution structure reflects a maturing project with sufficient decentralization to support organic market participation, while the continued presence of significant institutional or early-stage holders maintains the token's underlying value anchors.

Click to view current BITBOARD holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 1338503.08K | 16.52% |

| 2 | 0x4063...3ba70f | 532584.88K | 6.57% |

| 3 | 0x49ae...6883ba | 345000.00K | 4.25% |

| 4 | 0xbad5...aa95a6 | 326465.55K | 4.03% |

| 5 | 0x44d5...2f46be | 280700.06K | 3.46% |

| - | Others | 5276746.42K | 65.17% |

II. Core Factors Affecting BITBOARD's Future Price

Macroeconomic Environment

-

Market Sentiment Impact: Investor emotions and confidence directly influence price movements. Market sentiment plays a crucial role in short-term price fluctuations.

-

Regulatory Environment: Government policies and regulatory frameworks directly impact BITBOARD's price trajectory. Regulatory changes represent a significant factor in determining future price direction.

-

Market Trends and Technical Development: Market trends, combined with technological development, provide valuable insights into potential future price movements. Technical analysis of historical trends can help forecast potential price behavior.

Three、2025-2030 BITBOARD Price Forecast

2025 Outlook

- Conservative Forecast: $0.0013 - $0.00232

- Neutral Forecast: $0.00232

- Optimistic Forecast: $0.00256 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth as the asset builds fundamental value and market adoption expands

- Price Range Forecast:

- 2026: $0.00137 - $0.00349

- 2027: $0.00202 - $0.00397

- 2028: $0.00264 - $0.00406

- Key Catalysts: Ecosystem expansion, increased institutional participation, technological upgrades, and growing market liquidity on platforms such as Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.00218 - $0.00474 (assuming steady adoption and stable macroeconomic conditions)

- Optimistic Case: $0.00383 - $0.00549 (assumes accelerated project development, mainstream integration, and favorable regulatory environment)

- Transformative Case: $0.00549+ (extreme favorable conditions including breakthrough utility adoption, major partnership announcements, and significant market expansion)

- 2025-12-22: BITBOARD remains in early price discovery phase with 0% year-to-date change, positioning for potential 82% cumulative gains by 2030

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00256 | 0.00232 | 0.0013 | 0 |

| 2026 | 0.00349 | 0.00244 | 0.00137 | 4 |

| 2027 | 0.00397 | 0.00296 | 0.00202 | 27 |

| 2028 | 0.00406 | 0.00347 | 0.00264 | 49 |

| 2029 | 0.00474 | 0.00376 | 0.00218 | 61 |

| 2030 | 0.00549 | 0.00425 | 0.00383 | 82 |

BITBOARD Professional Investment Strategy and Risk Management Report

I. BITBOARD Overview

BITBOARD is a ranking chart platform built on the Polygon blockchain that allows users to vote for their favorite stars at any time. The project aims to provide instant finality, high transaction throughput (TPS) suitable for real-world use cases, and reduce the operational costs of blockchain applications, thereby lowering entry barriers for end users and addressing existing blockchain limitations.

Key Metrics (As of December 22, 2025):

- Current Price: $0.002324

- Market Cap: $8,245,087.2

- Fully Diluted Valuation: $18,824,400

- Circulating Supply: 3,547,800,000 BITBOARD

- Total Supply: 8,100,000,000 BITBOARD

- 24h Volume: $63,634.54

- Market Ranking: #1276

- Holders: 22,428

II. Price Performance Analysis

Historical Price Movements

- All-Time High (ATH): $0.27 (December 7, 2024)

- All-Time Low (ATL): $0.0000655 (March 13, 2025)

- Current Price Deviation: 99.14% below ATH

Recent Price Trends

| Time Period | Change | Price Movement |

|---|---|---|

| 1 Hour | -0.38% | -$0.000008864 |

| 24 Hours | -2.01% | -$0.000047670 |

| 7 Days | -23.56% | -$0.000716293 |

| 30 Days | -22.62% | -$0.000679360 |

| 1 Year | -58.63% | -$0.003293597 |

The token has experienced significant downward pressure across all timeframes, with particularly notable declines over the medium to long-term periods.

III. Market Position and Distribution

- Circulating Supply Ratio: 43.8% of total supply is in circulation

- Market Dominance: 0.00058%

- Exchange Availability: Listed on Gate.com

- Network: Polygon (MATIC chain)

- Contract Address: 0x4f7cc8ef14f3dc76ee2fb60028749e1b61cea162

IV. BITBOARD Professional Investment Strategy and Risk Management

BITBOARD Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors: Blockchain enthusiasts with high risk tolerance, believers in the voting/ranking economy use case, and investors with 2+ year investment horizons.

Operational Recommendations:

- Establish positions during market consolidation phases, avoiding purchases near resistance levels

- Implement dollar-cost averaging (DCA) strategy to mitigate volatility impact, committing consistent capital over 6-12 month periods

- Secure storage using Gate.com Web3 Wallet with hardware security best practices for long-term positions

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price zones at $0.002301 (24h low) and $0.27 (ATH) for position sizing decisions

- Volume Analysis: Current 24h volume of $63,634 remains relatively modest; trade with caution during low-volume periods to avoid slippage

Wave Trading Considerations:

- Exercise heightened caution given the -23.56% weekly decline; this indicates strong bearish momentum

- Use tight stop-loss orders positioned 5-10% below entry points to manage downside risk

- Avoid counter-trend positions until clear reversal signals emerge (higher lows, volume increase)

BITBOARD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of portfolio allocation maximum, suitable only for those who can afford complete loss of capital

- Aggressive Investors: 2-5% of portfolio allocation, with strict position sizing and stop-loss discipline

- Institutional Investors: Below 0.5% allocation, subject to comprehensive due diligence and risk committee approval

(2) Risk Hedging Solutions

- Portfolio Diversification: Limit BITBOARD exposure and balance with established layer-1 blockchain assets or stablecoins to reduce concentration risk

- Stablecoin Pairing: Maintain parallel stablecoin positions to enable rapid exit strategies if adverse price action occurs

(3) Secure Storage Solutions

- Custody Method: Gate.com Web3 Wallet with multi-signature security enabled for smaller holdings, providing convenient access while maintaining reasonable security standards

- Cold Storage Method: For significant positions, utilize hardware wallet solutions with offline key management to eliminate exchange counterparty risk

- Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract addresses before transactions to prevent token swap scams

V. BITBOARD Potential Risks and Challenges

BITBOARD Market Risks

- Severe Price Depreciation: Token has declined 58.63% over the past year and 23.56% in the last 7 days, indicating sustained selling pressure and potentially weak holder conviction

- Low Trading Volume: 24-hour volume of only $63,634 suggests poor liquidity; large trades could experience significant slippage or price impact

- Limited Market Depth: With only 22,428 holders and single-exchange listing on Gate.com, the token lacks the distributed holder base needed for healthy price discovery

BITBOARD Regulatory Risks

- Blockchain Regulatory Uncertainty: Polygon network and voting-based applications face evolving regulatory frameworks globally; changes could impact platform operations or token utility

- Compliance Exposure: Voting mechanisms could face scrutiny as potentially resembling unregistered securities or gambling in certain jurisdictions

- Geographic Restrictions: Future regulatory actions in major markets could limit user participation or token trading availability

BITBOARD Technology Risks

- Polygon Network Dependency: Token operates entirely on the Polygon chain; any critical Polygon network failures directly impact BITBOARD accessibility and trading

- Smart Contract Vulnerabilities: As a relatively nascent project with moderate token holders, potential undiscovered smart contract bugs could lead to fund loss or operational disruptions

- Scalability of Use Case: The voting platform must demonstrate sustainable user growth and engagement; failure to achieve product-market fit could result in network abandonment

VI. Conclusions and Action Recommendations

BITBOARD Investment Value Assessment

BITBOARD presents a high-risk, speculative investment opportunity centered on a blockchain-based voting/ranking platform built on Polygon. While the project attempts to address real blockchain limitations through improved transaction efficiency, the token has experienced severe depreciation (down 58.63% annually and 23.56% weekly), low trading liquidity, and limited market adoption (22,428 holders). The voting economy use case remains unproven at scale. Investors must recognize this as a highly speculative position suitable only for experienced participants with capital preservation discipline and high risk tolerance.

BITBOARD Investment Recommendations

✅ Beginners: Exercise extreme caution; allocate no more than 0.25% of portfolio if you choose to participate. Prioritize learning about Polygon ecosystem fundamentals before investing. Consider waiting for clearer adoption signals before entry.

✅ Experienced Investors: Conduct thorough due diligence on the voting platform's user growth metrics, transaction activity, and developer engagement. Implement strict risk management with 5-10% stop-losses. Consider this a high-risk speculation rather than core holding.

✅ Institutional Investors: Require comprehensive analysis of the platform's commercial viability, competitive positioning versus established Web2 voting systems, and regulatory exposure across target markets. Position sizing should reflect extreme risk profile; consider this below investable thresholds unless strategic partnership opportunities exist.

BITBOARD Trading Participation Methods

- Gate.com Exchange Trading: Direct spot trading available; ensure adequate liquidity before executing large orders to minimize slippage impact

- Polygon Network Transactions: Direct wallet-to-wallet transfers possible using the contract address on Polygonscan; suitable for long-term holders wanting to move tokens off exchange custody

- DCA Entry Strategy: Implement regular periodic purchases over 6-12 months to average entry costs if maintaining long-term conviction, reducing timing risk

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Always consult qualified financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

How much is the bitboard price?

The current price of BitBoard is $0.0027. The circulating supply is 5,360,135,835 BB2, with a market cap of approximately $14,284,762. BitBoard continues to establish itself in the cryptocurrency market.

Which AI can predict crypto prices?

Explainable artificial intelligence (XAI) models can effectively predict cryptocurrency prices. These models offer transparency in forecasting methods and have demonstrated strong performance during market downturns, utilizing machine learning algorithms to analyze price patterns and market trends.

What factors affect BITBOARD price prediction?

BITBOARD price prediction is influenced by whale activity, market sentiment, trading volume, and overall cryptocurrency market trends. Large holder transactions significantly impact price movements, while bullish or bearish market conditions drive demand fluctuations.

How accurate are BITBOARD price forecasts?

BITBOARD price forecasts predict a range from $0.001890 to $0.007539 by 2030, with potential for a 173% increase. Accuracy varies, as cryptocurrency forecasts are inherently speculative and subject to market volatility.

What is the historical price trend of BITBOARD?

BITBOARD reached its peak of $0.2451 USD on October 1, 2024. Since then, the price has experienced fluctuations. Historical data shows varying performance throughout 2024, with the token demonstrating volatility typical of emerging digital assets in the market.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Discover the Features of a Leading Cryptocurrency Platform

Exploring Biometric Authentication in Blockchain: A Guide to BIO Protocol

Understanding Cryptocurrency Slang and Terminology in Web3

Guide to Joining Web3 Airdrop Opportunities: Simplified Steps

Guide to Setting up Your Helium Hotspot Miner