Prévisions du prix ERG pour 2025 : analyse des tendances du marché et du potentiel de valorisation future de la cryptomonnaie Ergo

Introduction : Position de marché et valeur d’investissement d’ERG

Ergo (ERG), plateforme de contrats numériques particulièrement flexible, a su s’imposer depuis son lancement en 2019. En 2025, la capitalisation boursière d’Ergo atteint 57 982 894,75 $, avec 82 047 396 jetons en circulation et une valeur d’environ 0,7067 $. Désignée comme une « infrastructure d’application DeFi », cette crypto-monnaie occupe une place stratégique dans la sécurisation et l’efficacité des contrats financiers.

Ce dossier propose une analyse détaillée de la trajectoire de prix d’Ergo de 2025 à 2030, combinant l’étude des tendances historiques, des dynamiques de marché, du développement de l’écosystème et des facteurs macroéconomiques, afin de fournir aux investisseurs des prévisions précises et des stratégies opérationnelles adaptées.

I. Rétrospective des prix d’ERG et état du marché actuel

Historique de l’évolution du prix d’ERG

- 2020 : Introduction sur les marchés, prix autour de 0,094191 $ (plus bas historique)

- 2021 : Sommet du marché haussier, sommet à 18,72 $ le 3 septembre

- 2022-2024 : Correction et stabilisation, fluctuation entre 1 $ et 5 $

Situation actuelle du marché ERG

Au 29 septembre 2025, ERG s’échange à 0,7067 $, avec un volume quotidien de 24 627,62 $. Ce prix traduit une baisse de 96,22 % par rapport à son sommet historique, mais une hausse de 650,07 % par rapport à son plancher. La capitalisation s’établit à 57 982 894,75 $, ce qui place ERG au 630e rang mondial.

Les dernières 24 heures signalent une dynamique positive (+2,36 %), mais la tendance de fond est baissière : -6,68 % sur la semaine, -16,15 % sur le mois, et -8,46 % depuis le début de l’année.

82 047 396 jetons, soit 83,94 % du total de jetons ERG disponibles, circulent actuellement, ce qui indique une circulation élevée susceptible d’influencer la formation des prix par les effets de l’offre et de la demande.

Cliquez pour consulter le cours actuel d’ERG

Indicateur de sentiment du marché ERG

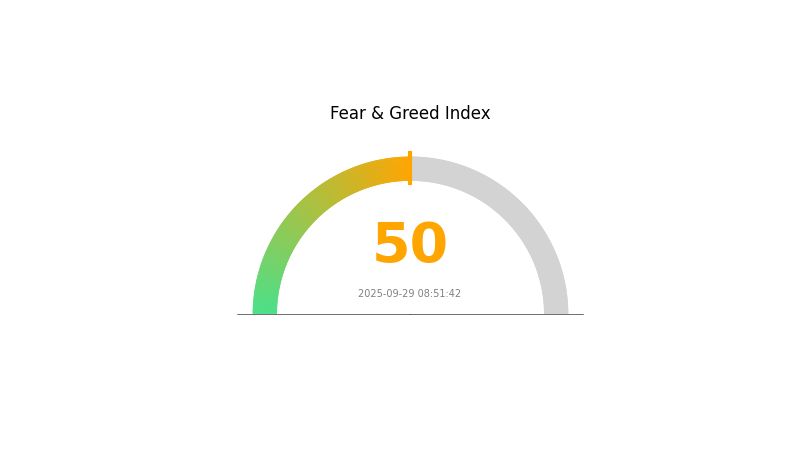

29 septembre 2025 Indice de peur et d’avidité : 50 (Neutre)

Cliquez pour consulter l’actuel Indice de peur et d’avidité

Le marché est actuellement stable, comme l’indique cette neutralité de l’Indice de peur et d’avidité à 50. Ce niveau suggère qu’aucune crainte excessive ni euphorie ne domine, offrant aux investisseurs l’occasion de revoir leur stratégie. Il est judicieux d’adopter une approche équilibrée dans leur portefeuille crypto.

Répartition des détentions ERG

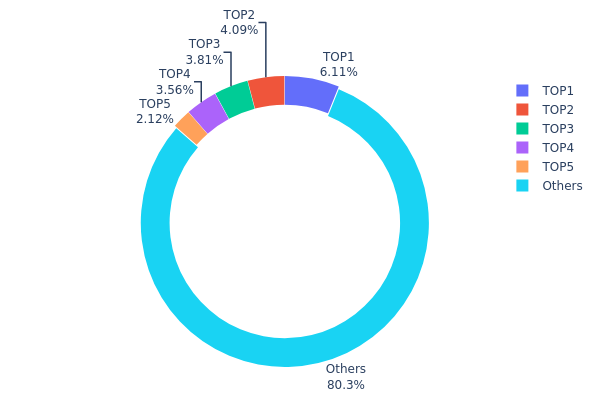

L’analyse de la distribution des adresses de détention révèle une structure relativement décentralisée : les cinq premières adresses regroupent 19,69 % de l’offre, dont 6,11 % pour la principale. Ce niveau de concentration est courant dans le secteur.

De nombreux petits portefeuilles détiennent la majeure partie des jetons ERG (80,31 %), ce qui assure une base d’investisseurs large et contribue à la stabilité du marché. Cependant, la présence de gros détenteurs implique un risque résiduel de mouvements d’envergure pouvant influencer le marché.

La répartition actuelle reflète un équilibre sain entre grands acteurs et la communauté, favorisant la décentralisation tout en maintenant la liquidité nécessaire aux échanges.

Cliquez pour consulter la distribution des détentions ERG

| Top | Adresse | Quantité détenue | Pourcentage (%) |

|---|---|---|---|

| 1 | 9iKFBB...D4VykC | 5 013,45K | 6,11% |

| 2 | 9fpUtN...aBar1Z | 3 356,06K | 4,09% |

| 3 | 9gD9kh...MRgd8i | 3 129,38K | 3,81% |

| 4 | HNJiaJ...Gpd9sL | 2 924,37K | 3,56% |

| 5 | 9fu1mL...EAJENo | 1 740,25K | 2,12% |

| - | Autres | 65 880,03K | 80,31% |

II. Principaux facteurs influençant l’évolution future du prix d’ERG

Environnement macroéconomique

- Impact des politiques monétaires : Les décisions des banques centrales majeures auront un effet direct sur le prix d’ERG en modulant le climat du marché des crypto-actifs.

- Facteurs géopolitiques : Les tensions internationales, notamment en Europe de l’Est, peuvent affecter la stabilité économique mondiale et influencer la valorisation d’ERG.

Développement technologique et évolution de l’écosystème

- Applications de l’écosystème : La multiplication des DApps et des projets sur la plateforme Ergo sera déterminante pour la croissance de la valeur d’ERG.

- Améliorations techniques : Les mises à jour continues de la blockchain et la capacité d’Ergo à répondre aux besoins du marché constituent des facteurs majeurs d’évolution du cours.

III. Prévisions de prix ERG pour 2025-2030

Perspectives 2025

- Prévision prudente : 0,45 $ - 0,60 $

- Prévision neutre : 0,60 $ - 0,75 $

- Prévision optimiste : 0,75 $ - 0,89 $ (sous réserve de conditions favorables et d’une adoption accrue)

Perspectives 2027-2028

- Phase anticipée : Croissance potentielle et adoption renforcée

- Fourchette de prix :

- 2027 : 0,66 $ - 1,02 $

- 2028 : 0,67 $ - 1,18 $

- Moteurs principaux : Avancées technologiques, reprise du marché global, essor de l’écosystème

Perspectives long terme 2029-2030

- Scénario de base : 1,05 $ - 1,28 $ (croissance régulière et stabilité)

- Scénario optimiste : 1,28 $ - 1,51 $ (forte adoption et environnement favorable)

- Scénario transformation : 1,51 $ - 1,81 $ (innovations majeures et adoption grand public)

- 31 décembre 2030 : ERG à 1,80 $ (pic potentiel, selon la dynamique du marché)

| Année | Prix maximal attendu | Prix moyen attendu | Prix minimal attendu | Variation (%) |

|---|---|---|---|---|

| 2025 | 0,88641 | 0,7035 | 0,45024 | 0 |

| 2026 | 0,87445 | 0,79496 | 0,66776 | 12 |

| 2027 | 1,01834 | 0,8347 | 0,65942 | 18 |

| 2028 | 1,17668 | 0,92652 | 0,66709 | 31 |

| 2029 | 1,5143 | 1,0516 | 0,88334 | 48 |

| 2030 | 1,80896 | 1,28295 | 0,83392 | 81 |

IV. Stratégies d’investissement professionnelles et gestion des risques pour ERG

Approche méthodique pour investir dans ERG

(1) Stratégie de détention longue durée

- Profil visé : Investisseurs à forte tolérance au risque et vision long terme

- Recommandations :

- Accumuler ERG lors des replis du marché

- Fixer des objectifs de vente partielle pour sécuriser les gains

- Conserver les jetons sur des portefeuilles dont l’utilisateur détient les clés privées

(2) Stratégie de trading actif

- Outils d’analyse technique :

- Moyennes mobiles : Surveiller les MM 50 et 200 jours pour valider les tendances

- RSI : Exploiter les niveaux de surachat/survente pour optimiser les entrées et sorties

- Principes du trading par oscillation :

- Placer des ordres stop pour maîtriser le risque

- Prendre des bénéfices sur les résistances identifiées à l’avance

Cadre de gestion des risques pour ERG

(1) Principes d’allocation d’actifs

- Profil prudent : 1 à 3 % du portefeuille crypto

- Profil dynamique : 5 à 10 % du portefeuille

- Profil professionnel : Jusqu’à 15 % du portefeuille

(2) Solutions de couverture du risque

- Diversification : Répartir les placements sur plusieurs crypto-actifs

- Ordres stop : Mettre en œuvre pour limiter les pertes potentielles

(3) Solutions de stockage sécurisé

- Recommandation portefeuille matériel : Gate Web3 Wallet

- Stockage à froid : Portefeuilles papier pour la conservation sur le long terme

- Mesures de sécurité : Utiliser l’authentification à deux facteurs et conserver les clés privées hors ligne

V. Risques et défis potentiels pour ERG

Risques de marché liés à ERG

- Volatilité : Forte variabilité des prix inhérente aux crypto-actifs

- Liquidité : Volume d’échange limité pouvant affecter la liquidité des ordres importants

- Concurrence : L’arrivée de nouveaux protocoles blockchain peut fragiliser la position d’ERG

Risques réglementaires pour ERG

- Environnement règlementaire incertain : Possibilité d’un durcissement des réglementations crypto

- Impacts fiscaux : Évolutions législatives susceptibles d’affecter l’investissement ERG

- Changements de politiques internationales : Réglementations variables pouvant influencer l’adoption d’ERG

Risques techniques pour ERG

- Failles des smart contracts : Risque d’exploitation sur les applications DeFi développées via Ergo

- Défis de scalabilité : Limites potentielles du réseau en cas d’augmentation du volume de transactions

- Obsolescence technologique : L’innovation rapide dans la blockchain peut dépasser la cadence de développement d’Ergo

VI. Conclusion et recommandations pratiques

Évaluation de la valeur d’investissement d’ERG

Ergo (ERG) propose une valeur différenciante grâce à son orientation DeFi et son modèle UTXO. Les investisseurs doivent cependant prendre en compte la volatilité à court terme et les incertitudes réglementaires du secteur crypto.

Recommandations d’investissement ERG

✅ Débutants : Privilégier des investissements réguliers et modérés pour appréhender le marché ✅ Investisseurs expérimentés : Choisir une stratégie mixte entre détention longue durée et trading ciblé ✅ Investisseurs institutionnels : Mener une analyse approfondie et intégrer ERG dans une allocation crypto diversifiée

Méthodes de trading ERG

- Trading au comptant : Achat et vente d’ERG sur Gate.com

- Participation au yield farming et à la fourniture de liquidité sur les plateformes basées sur Ergo

- Minage : S’engager dans le minage ERG pour soutenir le réseau et percevoir des récompenses

L’investissement en crypto-actifs présente un niveau de risque très élevé. Ce contenu ne constitue pas un conseil financier. Les investisseurs doivent agir avec discernement selon leur profil de risque et consulter un professionnel. N’investissez jamais plus que ce que vous êtes prêt à perdre.

FAQ

Ergo a-t-il un avenir ?

Ergo présente un potentiel intéressant. Les analyses techniques suggèrent une dynamique haussière et ses fondamentaux sont solides pour une adoption croissante dans l’écosystème crypto.

ERG est-il un investissement pertinent ?

ERG affiche des perspectives de croissance. Les prévisions indiquent 1,83 $ en 2025 et 2,12 $ en 2026. Il est conseillé de tenir compte des tendances de marché et de votre propre tolérance au risque.

Quelle sera la valeur de 1 ETH en 2030 ?

Selon les estimations actuelles, 1 ETH pourrait se situer entre 19 540 $ et 24 970 $ en 2030, en fonction de la croissance et de l’adoption du marché.

Quelle est la prévision de prix pour Nvidia en 2025 ?

D’après les tendances actuelles, l’action Nvidia est estimée à 181,96 $ en septembre 2025, après une légère correction le mois précédent.

Partager

Contenu