2025 FORTH Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: Market Position and Investment Value of FORTH

FORTH, the governance token of the Ampleforth protocol, serves as a pivotal component within the Ethereum-based DeFi ecosystem. Since its inception in 2021, FORTH has established itself as a key governance instrument for the Ampleforth platform. As of December 2025, FORTH boasts a market capitalization of approximately $23.22 million, with a circulating supply of around 11.50 million tokens, currently trading at $1.518. This innovative governance token, often recognized as a "decentralized governance asset," plays an increasingly vital role in shaping the direction of the Ampleforth Elastic Finance ecosystem.

This article will comprehensively analyze FORTH's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

FORTH Market Analysis Report

I. FORTH Price History Review and Current Market Status

FORTH Historical Price Evolution Timeline

-

April 2021: FORTH token launch, reaching its all-time high of $180.47 on April 22, 2021, marking the peak of initial market enthusiasm for the Ampleforth protocol.

-

2021-2024: Extended bear market period, with FORTH experiencing significant price depreciation as the broader cryptocurrency market cycled through various phases.

-

October 2025: FORTH reached its all-time low of $1.17 on October 11, 2025, representing a decline of approximately 99.35% from its historical peak.

FORTH Current Market Status

As of December 21, 2025, FORTH is trading at $1.518, representing a modest recovery from its recent lows. The token shows a marginal positive price movement of 0.2% over the past hour, though it has declined 0.19% in the 24-hour period. Over longer timeframes, FORTH exhibits bearish momentum with a 7-day decline of 11.88% and a 30-day decrease of 23.69%. The year-to-date performance reflects a substantial 70.24% decline from levels at the beginning of 2025.

The token maintains a market capitalization of approximately $17.46 million with a fully diluted valuation of $23.22 million. Daily trading volume stands at $26,375.58, indicating modest liquidity in the market. FORTH is currently ranked 919th by market capitalization among all digital assets. The token maintains an unlimited maximum supply designation, with a circulating supply of approximately 11.50 million FORTH out of a total supply of 15.30 million tokens, representing a circulating ratio of 75.20%.

The market has been characterized by extreme fear conditions, with current sentiment readings indicating heightened risk aversion among investors. FORTH is actively traded across 17 different cryptocurrency exchanges, with the token maintaining its Ethereum-based smart contract address at 0x77fba179c79de5b7653f68b5039af940ada60ce0.

View current FORTH market price

FORTH Market Sentiment Indicator

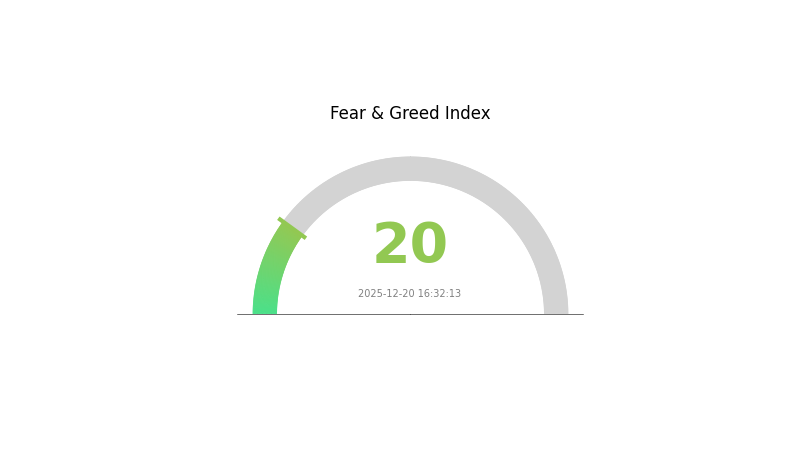

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

The crypto market is experiencing extreme fear conditions. Such readings typically indicate significant market pessimism and panic selling. However, extreme fear often presents contrarian opportunities for long-term investors, as assets may be oversold. Monitor key support levels and consider your risk tolerance before making investment decisions. Diversification and proper position sizing remain essential during volatile periods.

Click to view the latest Fear & Greed Index

FORTH Holdings Distribution

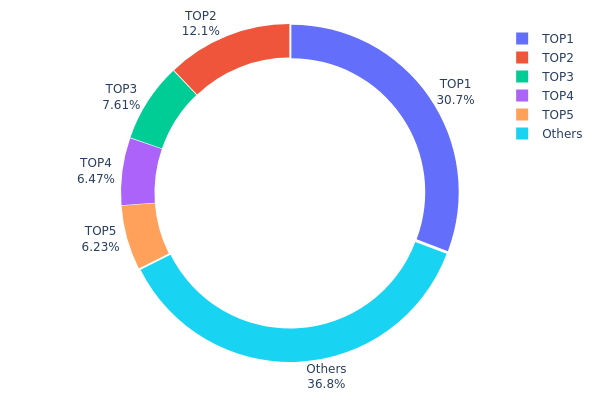

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing tokenomics health and decentralization. This distribution reveals how FORTH tokens are allocated among major holders, providing insights into potential centralization risks and market structure dynamics.

The current FORTH holdings distribution exhibits pronounced concentration among top holders. The leading address commands 30.74% of total supply, while the top five addresses collectively control 63.13% of circulating tokens. This level of concentration warrants careful consideration, as it indicates significant ownership power concentrated in a limited number of entities. The second-largest holder maintains 12.10% of the supply, followed by three additional addresses each holding between 6.23% and 7.60%. This tiered distribution suggests a moderately centralized structure, where decision-making power and potential market influence are unevenly distributed rather than organically dispersed across the network.

The remaining 36.87% dispersed among other addresses demonstrates that while FORTH has achieved some degree of holder fragmentation, the protocol's governance and market dynamics remain substantially influenced by a select group of stakeholders. This concentration pattern creates potential vulnerabilities regarding price manipulation and governance participation, as coordinated actions by top holders could disproportionately impact market movements and protocol decisions. The distribution reflects a market structure characteristic of mid-stage tokens transitioning from concentrated ownership toward broader distribution, though meaningful progress toward decentralization remains necessary to strengthen network resilience and reduce systematic risks.

Click to view current FORTH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 4703.39K | 30.74% |

| 2 | 0x2235...1539a9 | 1851.58K | 12.10% |

| 3 | 0x37fa...320680 | 1163.67K | 7.60% |

| 4 | 0x3dd9...c471c4 | 989.39K | 6.46% |

| 5 | 0xa65c...ee11e0 | 953.38K | 6.23% |

| - | Others | 5636.49K | 36.87% |

II. Core Factors Affecting FORTH's Future Price

Supply Mechanism

- Elastic Supply System: The Ampleforth protocol maintains price stability by adjusting AMPL's supply through an elastic supply mechanism. FORTH serves as the governance token for this innovative protocol.

- Current Impact: FORTH exhibits relatively high price volatility, influenced by changes in the underlying protocol's supply adjustments and market liquidity conditions.

Technology Development and Ecosystem Building

- Protocol Stability and Innovation: The stability and innovation of the Ampleforth protocol itself represent key factors influencing FORTH's future trajectory. The protocol's ability to maintain price stability through supply adjustments directly impacts the governance token's value proposition.

- Ethereum Network Infrastructure: FORTH operates on the Ethereum blockchain, leveraging its global decentralized exchange network to ensure high liquidity for the token.

- DeFi Adoption: Increased interest in decentralized finance (DeFi) and the Ampleforth protocol's unique elastic supply system can drive user growth and enhance overall liquidity in the ecosystem.

Market Sentiment and Trading Dynamics

- Market Sentiment: Overall market sentiment plays a crucial role in determining FORTH's price movements.

- Trading Volume: Transaction volume has significant impact on price fluctuations and market liquidity.

- User Adoption Trends: Growth in user adoption of the Ampleforth protocol and its governance mechanisms directly influences FORTH's demand and valuation.

Three. 2025-2030 FORTH Price Forecast

2025 Outlook

- Conservative Forecast: $1.38-$1.50

- Neutral Forecast: $1.50-$1.60

- Optimistic Forecast: $1.55-$1.60 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by moderate growth as the protocol gains market recognition and utility expansion

- Price Range Forecasts:

- 2026: $1.43-$2.06 (2% upside potential)

- 2027: $1.52-$2.67 (19% upside potential)

- Key Catalysts: Protocol upgrades and feature releases, expansion of DeFi integrations on Gate.com and other major trading venues, growing community engagement, and institutional recognition of FORTH's governance value

2028-2030 Long-term Outlook

- Base Case: $1.23-$2.91 (47% upside by 2028, assumes steady adoption and market normalization)

- Optimistic Case: $2.29-$3.63 (69% upside by 2029, assumes accelerated protocol adoption and broader cryptocurrency market recovery)

- Transformative Case: $2.05-$4.60 (104% upside by 2030, assumes FORTH becomes a key governance token in the decentralized finance ecosystem with significant institutional backing)

- December 21, 2025: FORTH trading at baseline levels with consolidation pattern established for medium-term growth trajectory

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.596 | 1.52 | 1.3832 | 0 |

| 2026 | 2.05656 | 1.558 | 1.43336 | 2 |

| 2027 | 2.67477 | 1.80728 | 1.51812 | 19 |

| 2028 | 2.91334 | 2.24103 | 1.23256 | 47 |

| 2029 | 3.63383 | 2.57718 | 2.29369 | 69 |

| 2030 | 4.59615 | 3.1055 | 2.04963 | 104 |

FORTH Investment Strategy and Risk Management Report

IV. FORTH Professional Investment Strategy and Risk Management

FORTH Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: DeFi protocol participants, governance enthusiasts, and long-term believers in decentralized finance innovation

- Operational recommendations:

- Accumulate FORTH during market downturns to build governance positions

- Participate actively in Forth DAO governance to influence protocol development and treasury management decisions

- Hold positions through protocol upgrades and ecosystem expansion phases

(2) Active Trading Strategy

-

Price volatility considerations:

- FORTH has experienced significant volatility, declining 70.24% over the past year

- 24-hour trading volume of $26,375.58 indicates moderate liquidity for trading operations

- Current price of $1.518 reflects substantial depreciation from all-time high of $180.47 in April 2021

-

Market entry points:

- Monitor governance proposal announcements that could drive protocol improvements

- Track AMPL ecosystem developments that impact FORTH demand

- Watch for Forth DAO treasury initiatives and fund allocation decisions

FORTH Risk Management Framework

(1) Market Risk Assessment

- Volatility exposure: FORTH's -70.24% year-over-year decline demonstrates high price volatility

- Liquidity constraints: Daily trading volume of approximately $26,375 may present execution challenges for large position accumulation or liquidation

- Market depth: With 26,037 token holders and a $23.22 million market capitalization, FORTH remains relatively small-cap by cryptocurrency standards

(2) Risk Mitigation Strategies

- Position sizing: Limit FORTH allocation to a small percentage of overall crypto portfolio, typically 1-3% for conservative investors

- Dollar-cost averaging: Regular purchases over extended periods reduce exposure to price volatility

- Governance monitoring: Active participation in Forth DAO discussions and voting to influence protocol development

(3) Secure Storage Considerations

- On-chain security: Store FORTH on Ethereum-based addresses with proper security protocols

- Smart contract risks: Be aware of potential vulnerabilities in the Ampleforth protocol smart contracts

- Key management: Maintain secure backup of private keys and recovery phrases

V. FORTH Potential Risks and Challenges

FORTH Market Risk

- Extreme price volatility: The token has declined from $180.47 to current levels, representing a 99.2% loss from peak values

- Limited liquidity depth: Moderate daily trading volume may result in slippage for significant trades

- Market capitalization concentration: Relatively small market cap of $23.22 million compared to major DeFi tokens creates price pressure risk

FORTH Governance Risk

- Voter participation: Governance effectiveness depends on active FORTH holder participation and informed decision-making

- Protocol modification risk: Governance decisions may introduce technical changes that impact token utility or protocol functionality

- Treasury management: Forth DAO's management of protocol treasury funds, including FORTH minting proceeds, carries execution risk

FORTH Technology Risk

- Smart contract vulnerabilities: Ampleforth protocol operates on Ethereum through smart contracts that may contain undiscovered security flaws

- AMPL token mechanism risk: The innovative elastic supply mechanism of AMPL could experience unintended consequences during extreme market conditions

- DeFi ecosystem dependencies: Protocol relies on broader Ethereum ecosystem stability and Layer 1 network security

VI. Conclusion and Action Recommendations

FORTH Investment Value Assessment

FORTH functions as a governance token for the Ampleforth protocol, offering participation rights in a decentralized finance platform built on Ethereum. The protocol features innovative tokenomics with the elastic supply AMPL token and governance through a six-phase proposal system. However, the token has experienced significant depreciation from its historical highs, declining 70.24% year-over-year. Investment in FORTH should be considered speculative due to its small market capitalization, moderate liquidity, and dependency on the success of the broader Ampleforth ecosystem.

FORTH Investment Recommendations

✅ Beginners: Start with small allocations (under 1% of portfolio) through Gate.com to learn governance mechanics without excessive exposure. Focus on understanding the six-phase governance process before significant participation.

✅ Experienced investors: Consider strategic accumulation during market weakness if convinced of protocol fundamentals. Participate actively in Forth DAO governance to influence development direction and potentially drive long-term value creation.

✅ Institutional investors: Evaluate FORTH primarily as a governance mechanism rather than a speculative asset. Consider participation if protocol innovation aligns with institutional DeFi strategy, with positions sized appropriately for illiquidity and volatility.

FORTH Trading and Participation Methods

- Centralized exchange trading: Purchase FORTH on Gate.com where the token is actively listed with standard trading pairs

- Governance participation: Hold FORTH to vote on protocol proposals through the Forth DAO governance portal, delegating voting power if desired

- Ecosystem engagement: Use FORTH to participate in Ampleforth protocol governance discussions across Discord, community DAOs, and official governance channels

Cryptocurrency investments carry extremely high risk and may result in substantial or total loss of capital. This report does not constitute investment advice. All investors should carefully evaluate their risk tolerance and conduct thorough due diligence before making any investment decisions. It is strongly recommended to consult with a qualified financial advisor before investing. Never invest more than you can afford to lose completely.

FAQ

Is ForTube a good coin?

ForTube (FOR) shows promising potential as a DeFi protocol with strong fundamentals. It offers decentralized lending and borrowing services with competitive rates. FOR has demonstrated solid trading volume and community engagement. With expected growth projections through 2028, ForTube presents an attractive opportunity for investors seeking exposure to innovative DeFi solutions.

What factors will drive FORTH price in the future?

FORTH price will be driven by platform adoption growth, governance participation, trading volume expansion, ecosystem development, and market sentiment. Increased utility and DeFi integration will support long-term price appreciation.

What is FORTH and what is ForTube protocol used for?

FORTH is the governance token of ForTube, an open-source DeFi lending protocol. ForTube enables decentralized lending and borrowing services on blockchain, allowing users to earn interest on deposits and access loans without intermediaries.

What are the risks of investing in FORTH token?

FORTH token investments carry market volatility risks with unpredictable price swings. Being speculative in nature, values can fluctuate significantly. Conduct thorough research before investing to understand potential losses.

Is HTX DAO (HTX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is DAO Maker (DAO) a Good Investment?: Analyzing the Potential and Risks in the Current Crypto Market

2025 DEXE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Stella (ALPHA) a Good Investment?: Analyzing Potential Returns and Risks in the Current Crypto Market

Is Dorayaki (DORA) a Good Investment?: Analyzing Its Potential in the Cryptocurrency Market

Is AladdinDAO (ALD) a Good Investment?: Analyzing the Potential and Risks of This DeFi Protocol Token in Today's Market

Upcoming Blum Listing Schedule

What is EVER: A Comprehensive Guide to Understanding Exponential Value Enhancement and Recognition

Cheems Coin: A Comprehensive Overview of the Popular Meme Currency

What is PEPECOIN: A Comprehensive Guide to the Meme-Inspired Cryptocurrency and Its Market Impact

What is METFI: A Comprehensive Guide to Decentralized Finance on the Metaverse