2025 年 MOVR 价格预测:Moonriver 生态系统市场趋势及增长潜力分析

深入分析 Moonriver 项目的投资潜力,并提供对 2025 年 MOVR 代币价格的预测。结合市场趋势、历史数据及关键影响因素,助您制定投资策略。了解 MOVR 在 Kusama 生态系统中的定位与作用。简介:MOVR 的市场定位与投资价值

Moonriver(MOVR)是一条兼容 EVM(以太坊虚拟机)的区块链,运行于 Kusama 网络,自 2021 年上线以来取得了显著发展。至 2025 年,Moonriver 市值达到 55,065,411 美元,流通量约为 10,028,303 枚,当前价格约为 5.491 美元。作为以太坊与 Kusama 之间的桥梁,MOVR 在连接以太坊应用与 Kusama 生态方面发挥着日益重要的作用。

本文将系统分析 Moonriver 2025—2030 年的价格趋势,结合历史走势、市场供求、生态建设和宏观经济等因素,为投资者提供专业的价格预测和实用的投资策略。

一、MOVR 价格历史回顾与当前市场现状

MOVR 历史价格演变

- 2021 年:Moonriver 正式上线,9 月 11 日创历史最高价 494.26 美元

- 2023 年:市场下行,10 月 20 日跌至历史最低 3.62 美元

- 2025 年:价格回升趋稳,目前交易价为 5.491 美元

MOVR 当前市场状况

截至 2025 年 9 月 29 日,MOVR 价格为 5.491 美元,24 小时内上涨 3.7%,成交量达 137,021 美元。MOVR 市值为 55,065,411 美元,在全球加密货币市值排名第 647 位,流通供应量为 10,028,303 枚,占总供应量 92.31%。虽然过去一年价格下跌 51.27%,但近期已出现复苏,近 7 天上涨 0.96%。

欢迎访问,了解 MOVR 实时市场价格

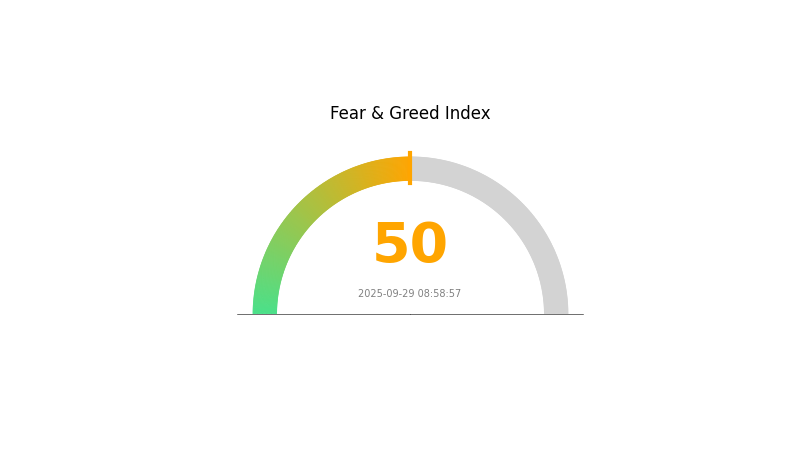

MOVR 市场情绪指标

2025 年 9 月 29 日恐惧与贪婪指数:50(中性)

欢迎访问,了解 恐惧与贪婪指数

投资者目前对 MOVR 持中性态度,恐惧与贪婪指数为 50,市场总体保持平衡。投资者情绪既不悲观,也不过度乐观,这为交易者重新评估策略和分析市场提供了机会。在波动性极高的加密市场,建议持续关注信息并谨慎操作。

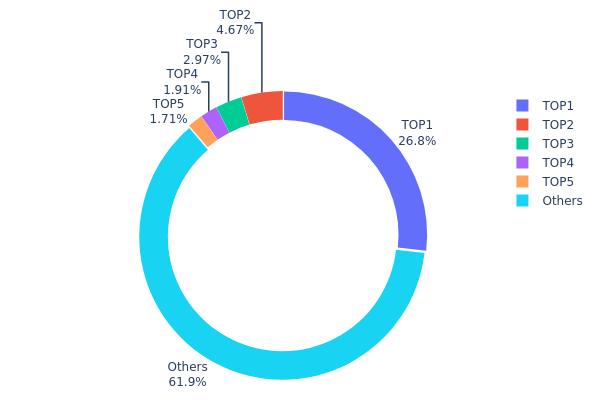

MOVR 持仓分布

MOVR 地址分布数据显示,代币集中于少数头部地址。最大持仓地址占总供应量 26.81%,持有 3,248,500 枚。前五大地址合计持有 38.04%,其余 61.96% 分散于其他地址。

这种集中结构表明 MOVR 代币所有权较为中心化。单一地址持有超过四分之一供应量,存在市场操控和价格波动风险。若出现大额转移或抛售,可能对市场造成显著影响。前五大地址合计持有近 40% 供应量,加剧了中心化程度。

虽然加密资产普遍存在持仓集中现象,MOVR 的分布去中心化程度低于主流资产,价格更易受大户行为波动影响,生态稳定性也可能受到影响。

欢迎访问,了解 MOVR 持仓分布详情

| 排名 | 地址 | 持仓数量 | 持仓占比 |

|---|---|---|---|

| 1 | 0xf977...41acec | 3248.50K | 26.81% |

| 2 | 0x5a04...4020a3 | 565.76K | 4.66% |

| 3 | 0xb0a3...7e4411 | 359.83K | 2.96% |

| 4 | 0x381d...a362a7 | 232.01K | 1.91% |

| 5 | 0x14d7...632bcc | 207.19K | 1.70% |

| - | 其他 | 7503.33K | 61.96% |

二、影响 MOVR 未来价格的关键因素

机构与大户动态

- 机构持仓:机构投资者对 MOVR 的关注持续提升,推动 2025 年价格上涨。

- 企业应用:Web3 生态快速扩张,促使更多企业采用 MOVR。

宏观经济环境

- 抗通胀属性:MOVR 作为加密货币,有望在当前经济形势下充当通胀对冲工具。

- 地缘政治因素:国际政治形势持续影响加密市场和 MOVR 价格。

技术发展与生态建设

- 跨链互操作性:MOVR 未来机遇在于提升跨链能力与多链生态协同。

- 生态应用扩展:Moonriver 上 DApp 和生态项目的成长是 MOVR 价值提升的关键。

三、MOVR 2025—2030 年价格预测

2025 年展望

- 保守预测:3.40—5.49 美元

- 中性预测:5.49—6.50 美元

- 乐观预测:6.50—7.52 美元(取决于市场情绪与项目进展)

2027—2028 年展望

- 市场阶段预期:有望进入增长期,采用率上升

- 价格区间预测:

- 2027 年:6.08—8.06 美元

- 2028 年:6.18—9.08 美元

- 主要驱动因素:生态扩张、技术突破、整体市场趋势

2030 年长期展望

- 基础情景:7.93—9.26 美元(假设稳步增长与持续采用)

- 乐观情景:9.26—11.94 美元(生态大规模扩展、市场渗透提升)

- 变革情景:突破 11.94 美元(重大创新与大规模用户采用)

- 2030 年 12 月 31 日:MOVR 预计均价 9.26 美元

| 年份 | 预测最高价 | 预测均价 | 预测最低价 | 涨跌幅 (%) |

|---|---|---|---|---|

| 2025 | 7.52541 | 5.493 | 3.40566 | 0 |

| 2026 | 7.16013 | 6.50921 | 4.23098 | 18 |

| 2027 | 8.0649 | 6.83467 | 6.08285 | 24 |

| 2028 | 9.08874 | 7.44979 | 6.18332 | 35 |

| 2029 | 10.25388 | 8.26926 | 7.93849 | 50 |

| 2030 | 11.94743 | 9.26157 | 5.18648 | 68 |

四、MOVR 专业投资策略与风险管理

MOVR 投资方法论

(1) 长线持有策略

- 适用对象:具备风险承受力、以长期为目标的投资者

- 操作建议:

- 市场调整期间分批买入 MOVR

- 质押 MOVR 获得奖励并参与网络安全

- 存储于安全的非托管钱包

(2) 主动交易策略

- 技术分析工具:

- 均线指标:识别趋势与反转点

- 相对强弱指数(RSI):判断超买或超卖区间

- 波段交易要点:

- 关注 Kusama 生态进展和平行链拍卖动态

- 跟踪 MOVR/ETH、MOVR/BTC 交易对的相对强势表现

MOVR 风险管理框架

(1) 资产配置原则

- 保守型:加密资产仓位控制在 1—3%

- 激进型:加密资产仓位 5—10%

- 专业型:加密资产最高可达 15%

(2) 风险对冲方案

- 分散投资:MOVR 搭配其他加密资产及传统金融产品

- 设置止损:合理止损点,限制最大亏损

(3) 安全存储方案

- 热 钱包推荐:Gate Web3 钱包

- 冷钱包解决方案:长期持有建议使用硬件钱包

- 安全措施:启用双重验证、强密码,并备份私钥

五、MOVR 潜在风险与挑战

MOVR 市场风险

- 高波动性:价格剧烈变动为加密市场常态

- 流动性问题:大额交易可能面临流动性不足

- 竞争加剧:其他 EVM 兼容链或抢占市场份额

MOVR 合规风险

- 监管不确定:政策变化影响 MOVR 采纳前景

- 跨境合规:不同地区法规标准不一

- 税收调整:加密资产和质押奖励税务政策变化

MOVR 技术风险

- 智能合约漏洞:Moonriver 上 DApp 可能被攻击或利用

- 网络拥堵:高峰期存在扩展性瓶颈

- 互操作性风险:跨链桥和集成过程存在潜在隐患

六、结论与行动建议

MOVR 投资价值评估

MOVR 作为 Kusama 和 Polkadot 生态的重要组成部分,具备长期成长空间。短期内则面临价格波动及 EVM 兼容链的竞争压力。

MOVR 投资建议

✅ 建议新手投资者定投小额,逐步建立仓位 ✅ 进阶投资者可关注质押和流动性挖矿机会 ✅ 机构投资者可持续关注 Moonriver 生态扩展,考虑战略性配置

MOVR 参与方式

- 现货交易:可在 Gate.com 购买 MOVR

- 参与质押:提升网络安全并获得奖励

- 体验 DeFi:探索 Moonriver 生态下的去中心化应用

加密货币投资风险极高,本文不构成投资建议。请投资者根据自身风险承受能力慎重决策,并建议咨询专业理财顾问。请勿投入无法承受损失的资金。

常见问题 FAQ(常见问答)

Moonriver 是否有发展前景?

有,Moonriver 发展前景广阔,预计价格将进入牛市趋势,未来市场增长可期。

MOVE 代币 2030 年价格预测是多少?

根据近期价格数据分析,MOVE 代币预计到 2030 年将升至 2.29 美元,较当前价格增长 17.06 倍。

2025 年哪些 Meme 币有爆发潜力?

Dogecoin(DOGE)有望领跑,PEPE 和 Shiba Inu 也具备增长潜力。Mog Coin 2025 年最高价预计为 0.0000005719 美元。

投资 Moonriver 有哪些风险?

主要风险包括高波动性、历史数据有限、监管政策变化及市场竞争等,均可能影响 MOVR 的价值及采用。

分享

目录