2025 PIXEL Price Prediction: Expert Analysis and Market Forecast for Google's Revolutionary AI Chip Token

Introduction: Market Position and Investment Value of PIXEL

Pixels (PIXEL) is a social casual Web3 game powered by the Ronin Network, featuring an engaging open-world experience centered around farming, exploration, and creation. Since its launch in February 2024, the project has established itself as a notable player in the GameFi ecosystem. As of December 2025, PIXEL maintains a market capitalization of approximately $6.1 million with a circulating supply of 771.04 million tokens, trading at around $0.007908 per token.

This article will provide a comprehensive analysis of PIXEL's price trends and market dynamics, incorporating historical performance, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period through 2030.

PixelVerse (PIXEL) Market Analysis Report

I. PIXEL Price History Review and Current Market Status

PIXEL Historical Price Movement Trajectory

- February 2024: PIXEL reached its all-time high of $2.2908 on February 19, 2024, marking the peak of market sentiment following the project's launch phase.

- 2024-2025: The token experienced significant depreciation, declining from its historical peak as market conditions shifted and the broader crypto market faced headwinds.

- October 2025: PIXEL touched its all-time low of $0.00637 on October 10, 2025, representing a 99.7% decline from the all-time high over the course of approximately 19 months.

PIXEL Current Market Status

Price Performance: As of December 23, 2025, PIXEL is trading at $0.007908, reflecting a modest recovery of 0.33% over the past hour and 2.76% over the past 24 hours. However, the token remains significantly depressed on a longer timeframe, with year-to-date performance showing a decline of 94.94%.

Market Capitalization and Supply Metrics: PIXEL maintains a fully diluted valuation of $39,540,000 with a current market capitalization of $6,097,397.50. The circulating supply stands at 771,041,667 tokens out of a total supply of 5,000,000,000 tokens, representing 15.42% circulation. The token currently ranks 1,424th by market capitalization, with a market dominance of 0.0012%.

Trading Activity: The 24-hour trading volume amounts to $126,626.39, indicating relatively modest liquidity. PIXEL is listed across 31 exchanges, with the token trading within a 24-hour range of $0.007684 to $0.007982.

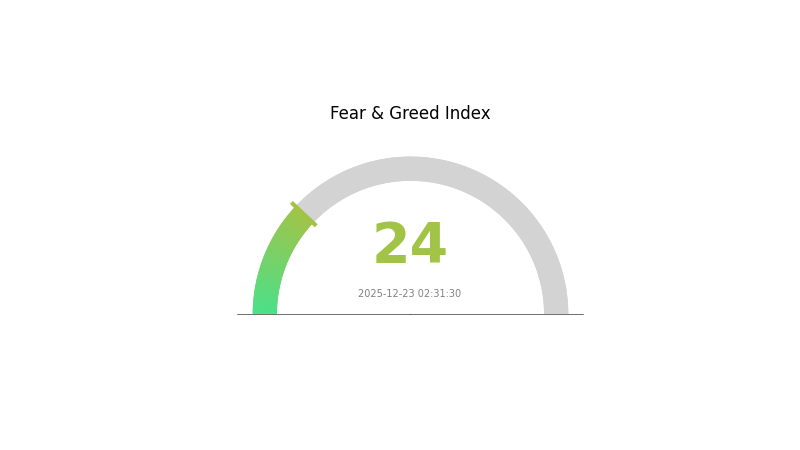

Market Sentiment: Current market sentiment reflects extreme fear (VIX: 24), consistent with broader market conditions affecting digital assets.

Click to view current PIXEL market price

PIXEL Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates severe market pessimism and heightened selling pressure among investors. During such periods, risk-averse traders typically reduce exposure, while contrarian investors may view this as a potential accumulation opportunity. Market volatility tends to spike under extreme fear conditions. Monitor key support levels closely and consider your risk tolerance before making trading decisions on Gate.com.

PIXEL Token Distribution

Click to view current PIXEL token holdings distribution

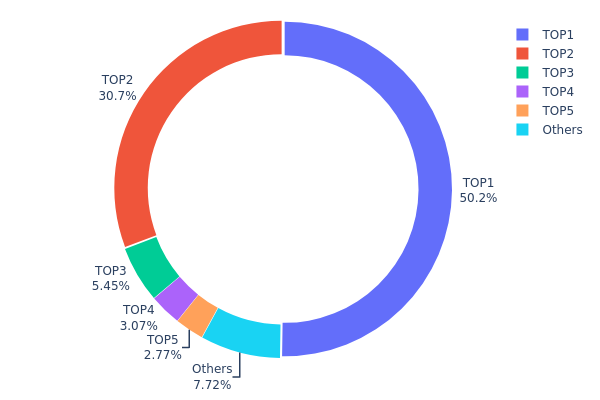

The address holding distribution map illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization level and potential market structure vulnerabilities. By analyzing the top holders and their proportional ownership, investors can assess liquidity concentration risks, governance dynamics, and the likelihood of coordinated market movements.

PIXEL currently exhibits a highly concentrated token distribution pattern, with significant centralization concerns. The top two addresses control approximately 80.98% of the total token supply, with the leading address alone holding 50.24% and the second-largest holder maintaining 30.74%. This extreme concentration in the upper tier represents a critical structural vulnerability. The third through fifth addresses hold 5.44%, 3.06%, and 2.77% respectively, demonstrating a steep declining curve. Only 7.75% of tokens are distributed among remaining addresses, indicating an extraordinarily narrow holder base.

This pronounced concentration creates substantial systemic risks for the PIXEL ecosystem. The dominance of two addresses suggests potential governance imbalances and heightened vulnerability to large-scale liquidations or coordinated selling pressure. Market price volatility may be substantially influenced by the trading decisions of these major holders, as their positions are disproportionately large relative to typical trading volumes. Furthermore, the lack of broad-based distribution reduces organic market resilience and increases counterparty risks for participants. The current on-chain structure reflects minimal decentralization, with the token distribution pattern indicating a market architecture heavily dependent on institutional or early-stage participants maintaining their holdings.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe26d...51f73c | 2512318.82K | 50.24% |

| 2 | 0xfb94...24d825 | 1537083.34K | 30.74% |

| 3 | 0xd107...6d6e04 | 272344.33K | 5.44% |

| 4 | 0xf977...41acec | 153497.15K | 3.06% |

| 5 | 0x5a52...70efcb | 138564.08K | 2.77% |

| - | Others | 386192.28K | 7.75% |

II. Core Factors Affecting Future PIXEL Price

Supply Mechanism

-

Post-Mainnet Launch Token Release: Following Pi Network's mainnet launch, early miners accumulated tokens over several years finally became freely tradeable, resulting in massive selling pressure. Circulating supply rapidly increased to 5.56 billion tokens in the initial mainnet period, but actual demand failed to keep pace, creating severe supply-demand imbalance that triggered a 50% price decline (from $1.97 to $0.7).

-

Historical Pattern: The sudden availability of locked tokens created a one-time supply shock that directly pressured prices downward when real market demand could not absorb the influx.

-

Current Impact: The resolution of this acute supply pressure phase will be critical for price stabilization. As early mining rewards are exhausted and unlock schedules normalize, supply dynamics may shift toward equilibrium.

Institutional and Whale Dynamics

-

Exchange Support: PIXEL initially lacked support from major exchanges like top-tier platforms, with insufficient liquidity constraining new investor entry and exacerbating price volatility. While some platforms announced trading support, market confidence remained questioned.

-

User Base Reality: Despite Pi Network claiming over 60 million registered users, only approximately 15% of users actually migrated to mainnet and completed KYC verification, indicating a significant gap between claimed adoption and active participation.

Macroeconomic Environment

-

Market Sentiment Impact: The broader cryptocurrency market trajectory (such as Bitcoin bull cycles) will influence PIXEL's short-term performance. Community sentiment remains divided between long-term believers and traders seeking quick exits.

-

Price Discovery Challenges: Massive divergence between off-exchange (OTC) futures speculation (prices inflated to $200) and actual market prices ($1.6 range) caused severe investor expectation collapse, triggering panic selling when reality diverged from speculation.

Technology Development and Ecosystem Building

-

Ecosystem Limitations: Pi Network currently lacks effective decentralized applications (dApps) and payment use cases within its ecosystem, limiting token utility. The ecosystem suffers from limited practical applications that could drive demand.

-

Future Ecosystem Expansion Plans: Pi Network plans to extend application scenarios through merchant integration and cross-chain partnerships. If ecosystem applications materialize (supporting barter transactions or DeFi applications), demand pressure could potentially ease selling pressure and support price recovery.

Three、2025-2030 PIXEL Price Forecast

2025 Outlook

- Conservative Forecast: $0.0061 - $0.00792

- Neutral Forecast: $0.00792

- Bullish Forecast: $0.01061 (requires sustained market interest and ecosystem development)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing adoption metrics

- Price Range Forecast:

- 2026: $0.00648 - $0.01019 (17% upside potential)

- 2027: $0.00934 - $0.0105 (22% upside potential)

- Key Catalysts: Enhanced platform functionality, strategic partnerships, increased user engagement, and broader market sentiment recovery

2028-2030 Long-term Outlook

- Base Case: $0.00981 - $0.01426 (27% growth by 2028, supported by sustained ecosystem expansion)

- Bullish Case: $0.01129 - $0.01622 (64% growth by 2030, contingent on mainstream adoption and positive regulatory environment)

- Transformative Case: $0.01377 - $0.01622 by 2029-2030 (54-64% cumulative growth, driven by breakthrough technological innovations and institutional capital inflows)

Analysis Summary: PIXEL demonstrates a consistent upward trajectory across the forecast period, with cumulative gains of approximately 64% by 2030. The token's price stability, supported by moderate average price growth, suggests a measured development pathway rather than speculative volatility. Monitor key metrics on Gate.com and track ecosystem milestones for validation of these projections.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01061 | 0.00792 | 0.0061 | 0 |

| 2026 | 0.01019 | 0.00926 | 0.00648 | 17 |

| 2027 | 0.0105 | 0.00972 | 0.00934 | 22 |

| 2028 | 0.01426 | 0.01011 | 0.00981 | 27 |

| 2029 | 0.01377 | 0.01219 | 0.0067 | 54 |

| 2030 | 0.01622 | 0.01298 | 0.01129 | 64 |

PIXEL Investment Strategy and Risk Management Analysis

IV. PIXEL Professional Investment Strategy and Risk Management

PIXEL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Web3 gaming enthusiasts and blockchain ecosystem believers who have a 1-3 year investment horizon

- Operation Suggestions:

- Accumulate PIXEL during market downturns when prices are below $0.01, leveraging dollar-cost averaging to reduce entry-point risk

- Hold positions through market cycles, as the Ronin Network ecosystem continues to mature and expand its user base

- Monitor Pixels game development milestones and community engagement metrics as indicators of long-term value potential

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average (MA): Use 20-day and 50-day moving averages to identify trend reversals and consolidation patterns in PIXEL's price action

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to time entry and exit points more effectively

- Wave Trading Key Points:

- Capitalize on the recurring price volatility between $0.007 and $0.008 support and resistance levels for short-term gains

- Watch for volume spikes accompanying price movements, as they may indicate strong institutional or retail interest

PIXEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation, treating PIXEL as a speculative position within a diversified crypto portfolio

- Aggressive Investors: 3-5% of total portfolio allocation, appropriate for those with higher risk tolerance and longer investment timelines

- Professional Investors: 5-10% of total portfolio allocation, suitable for dedicated crypto hedge funds with sophisticated risk models

(2) Risk Hedging Solutions

- Position Sizing: Never allocate more than 5% of your liquid trading capital to any single PIXEL trade to limit downside exposure

- Portfolio Diversification: Balance PIXEL holdings with stablecoins and other established blockchain assets to reduce overall portfolio volatility

(3) Secure Storage Solutions

- Hot wallet Option: Gate Web3 Wallet provides convenient access for frequent traders, with integrated security features and direct trading capabilities through Gate.com

- Cold Storage Method: Transfer PIXEL to air-gapped hardware wallets for long-term holdings exceeding 3 months

- Security Precautions: Enable two-factor authentication on all accounts, never share private keys or seed phrases, and verify all transaction addresses before confirming

V. PIXEL Potential Risks and Challenges

PIXEL Market Risk

- Extreme Price Volatility: PIXEL has experienced a 94.94% decline over the past year, demonstrating extreme sensitivity to market sentiment and gaming adoption cycles

- Low Liquidity Depth: With only $126,626 in 24-hour trading volume across 31 exchanges, large orders can significantly impact the price and create slippage risks

- Market Concentration Risk: The relatively small market capitalization of $6.1 million makes PIXEL susceptible to whale manipulation and sudden capital withdrawal events

PIXEL Regulatory Risk

- Gaming Regulation Uncertainty: As Web3 gaming attracts increasing regulatory scrutiny, changes in legislation regarding in-game tokens could adversely affect PIXEL's utility and value

- Cross-Border Compliance: The global nature of Ronin Network and Pixels game means regulatory changes in major jurisdictions (US, EU, Asia) could restrict market access and reduce trading liquidity

- Securities Classification Risk: Regulators in some jurisdictions may reclassify PIXEL as a security rather than a utility token, imposing additional compliance requirements and trading restrictions

PIXEL Technology Risk

- Smart Contract Vulnerability: Any critical bugs or exploits discovered in PIXEL's ERC20 contract on Ethereum or RON token implementation could result in funds freezing or loss

- Ronin Network Dependency: As Pixels relies on the Ronin Network for functionality, network outages, consensus failures, or security breaches would directly impact game playability and token liquidity

- Game Adoption Risk: If Pixels fails to attract and retain a sustainable player base, PIXEL token utility diminishes significantly, potentially rendering the token worthless

VI. Conclusion and Action Recommendations

PIXEL Investment Value Assessment

PIXEL presents a speculative opportunity within the Web3 gaming sector, backed by the established Ronin Network infrastructure. However, the token faces significant headwinds: a 94.94% year-over-year decline, minimal trading volume, and high dependence on Pixels game adoption metrics. The current valuation of $0.0079 represents a recovery opportunity only for investors who believe in long-term Web3 gaming mainstream adoption and Ronin Network expansion. The 15.42% circulating-to-fully-diluted valuation ratio suggests considerable token dilution risks as the project scales.

PIXEL Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) exclusively through Gate.com's regulated platform, using only capital you can afford to lose entirely. Focus on understanding the Pixels game mechanics before committing additional funds.

✅ Experienced Investors: Implement a staged accumulation strategy during further price declines, targeting support levels around $0.006-$0.007. Use technical analysis to time wave trades within the established volatility bands, and maintain strict stop-loss orders at 15-20% below entry points.

✅ Institutional Investors: Conduct thorough due diligence on Pixels game metrics (daily active users, retention rates, in-game transaction volumes) before allocating capital. Consider PIXEL as a long-term infrastructure bet on Ronin Network's ecosystem growth rather than short-term token appreciation.

PIXEL Trading Participation Methods

- Gate.com Spot Trading: Buy and sell PIXEL directly using USD, USDT, or other supported trading pairs with competitive spreads and reliable liquidity

- Wallet-Based Transactions: Hold PIXEL in Gate Web3 Wallet or self-custodied wallets for direct participation in Pixels game rewards and staking mechanisms

- Dollar-Cost Averaging: Set recurring monthly purchases through Gate.com's automated investment tools to systematically build positions regardless of short-term price fluctuations

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consult professional financial advisors before making significant investments. Never invest capital you cannot afford to lose completely.

FAQ

Will PIXEL Coin reach $1?

PIXEL Coin is projected to reach $1 by 2029 based on current market trends and growth analysis. While this remains speculative, the trajectory suggests potential for this milestone within the next few years.

What is the PIXEL price prediction for 2025?

PIXEL is predicted to trade at an average of $1.2 and reach a maximum of $1.4 in 2025, based on current market analysis and technical forecasts.

What is the PIXEL price forecast?

PIXEL is forecasted to trade between $0.005285 and $0.02087 by 2030. If reaching the upper target, PIXEL could surge 168.27%, driven by growing market adoption and ecosystem development trends.

What is the PIXEL coin price prediction for 2050?

Based on current analysis, PIXEL coin is expected to trade between $1.32 and $5.08 by 2050, reflecting a positive long-term outlook for the project's adoption and market development.

2025 PORTAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

2025 MBXPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for MBX Token

2025 WNCGPrice Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential for Wrapped NCG Token

2025 GMEE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Explore Quantitative Tightening in the Cryptocurrency World

Comprehensive Guide to Crypto Innovation: Updates, Presale & Airdrop

Top Cryptocurrencies Poised for Explosive Returns by 2025

TapSwap Updates and Insights Today | Latest News

Understanding Crypto Faucets: How They Work and What You Need to Know