Predicción del precio de USUAL en 2025: dinámica de mercado y oportunidades de inversión en la economía pospandémica

Introducción: posición de mercado y valor de inversión de USUAL

Usual (USUAL), como emisor de stablecoins respaldadas por dinero fiduciario, seguras y descentralizadas, lleva redistribuyendo la propiedad y el valor desde su inicio. En 2025, la capitalización de mercado de USUAL alcanza los 54 813 682 dólares, con una oferta circulante de aproximadamente 1 048 664 295 tokens y un precio en torno a 0,05227 dólares. Este activo, conocido como "redistribuidor de valor", está adquiriendo un papel esencial en el sector de las finanzas descentralizadas y la emisión de stablecoins.

En este artículo se analiza en profundidad la evolución del precio de USUAL de 2025 a 2030, combinando patrones históricos, oferta y demanda, desarrollo del ecosistema y entorno macroeconómico, para ofrecer previsiones profesionales y estrategias de inversión prácticas a los inversores.

I. Revisión histórica del precio de USUAL y situación actual del mercado

Evolución histórica del precio de USUAL

- 2024: USUAL alcanzó su máximo histórico de 1,6555 dólares el 20 de diciembre, lo que supuso un hito importante para el proyecto.

- 2025: El mercado entró en una fase bajista y el precio de USUAL descendió notablemente durante el año.

- 2025: USUAL registró su mínimo histórico de 0,04915 dólares el 26 de septiembre, una caída drástica desde su máximo.

Situación actual del mercado de USUAL

A 29 de septiembre de 2025, USUAL cotiza a 0,05227 dólares, con un incremento del 2,93 % en las últimas 24 horas. La capitalización de mercado del token es de 54 813 682 dólares, ocupando la posición 648 en el mercado global de criptomonedas. Pese a la subida diaria reciente, USUAL ha experimentado fuertes pérdidas en períodos más amplios: un 9,24 % en la última semana y una caída significativa del 21,4 % en los últimos 30 días. El rendimiento anual del token ha sido especialmente negativo, con un descenso del 88,41 %, reflejando la tendencia bajista general del mercado.

El volumen de negociación de USUAL en las últimas 24 horas es de 549 965 dólares, lo que indica una actividad de mercado moderada. La oferta circulante del token asciende a 1 048 664 295 USUAL, representando el 26,22 % de la oferta máxima de 4 000 000 000 tokens. Esta ratio de circulación relativamente baja sugiere potencial para futuras emisiones o liberaciones de tokens.

El precio actual de USUAL está muy lejos de su máximo histórico, cotizando apenas al 3,16 % de su valor pico. Esta fuerte caída pone de manifiesto la volatilidad del mercado de criptomonedas y los retos que enfrenta el proyecto USUAL para mantener su propuesta de valor en una fase bajista.

Haz clic para consultar el precio de mercado actual de USUAL

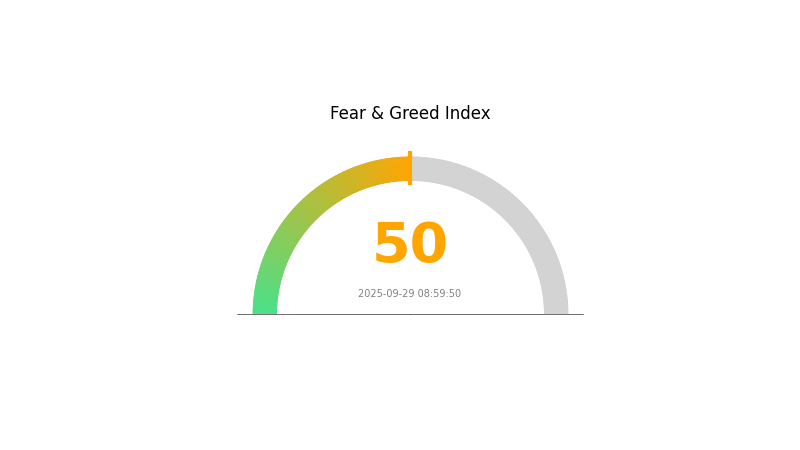

Indicador de sentimiento de mercado USUAL

29-09-2025 Índice Fear and Greed: 50 (Neutral)

Haz clic para consultar el Índice Fear & Greed actual

El sentimiento en el mercado cripto está equilibrado, con el índice Fear and Greed en 50, lo que indica una situación neutral. Esto implica que los inversores no muestran ni pesimismo ni optimismo excesivo. Tal equilibrio suele ofrecer oportunidades para tomar decisiones de trading meditadas. Aunque el mercado no presenta emociones extremas, es fundamental mantenerse informado y realizar un análisis riguroso antes de invertir. Ten en cuenta que las condiciones pueden cambiar rápidamente, así que gestiona tu cartera cripto con atención constante.

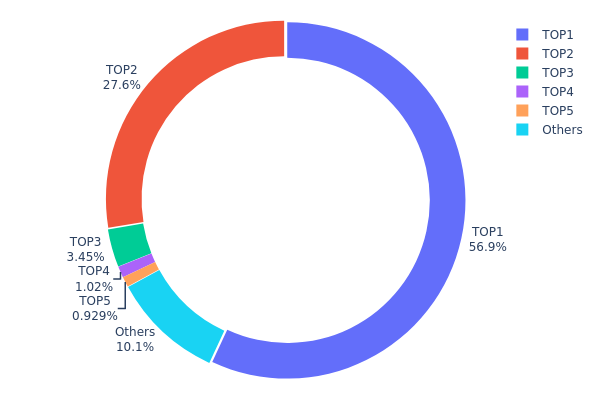

Distribución de tenencias de USUAL

El gráfico de distribución de direcciones de USUAL muestra una estructura de propiedad de tokens muy concentrada. La dirección principal posee el 56,91 % del total de tokens, mientras que el segundo mayor titular controla el 27,59 %. Entre ambas direcciones suman más del 84 % de todos los USUAL, lo que evidencia una distribución extremadamente centralizada.

Este nivel de concentración genera preocupación por la potencial manipulación de mercado y la volatilidad de precios. Con una proporción tan alta de tokens en pocas manos, operaciones masivas de compra o venta pueden afectar drásticamente el precio de USUAL. Además, esta concentración puede limitar la liquidez y desalentar la participación en el mercado.

Desde la perspectiva de la descentralización, la distribución actual de USUAL indica baja estabilidad estructural en la cadena. La alta concentración en las direcciones principales puede suponer riesgos para el ecosistema y la gobernanza del token si se mantiene. Tanto inversores como participantes deben considerar estas características al analizar la dinámica de mercado y el potencial a largo plazo de USUAL.

Haz clic para consultar la distribución de tenencias actual de USUAL

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | 0x06b9...4d4b8e | 812 490,01K | 56,91 % |

| 2 | 0xf977...41acec | 393 944,84K | 27,59 % |

| 3 | 0x28c6...f21d60 | 49 274,96K | 3,45 % |

| 4 | 0x1ab4...8f8f23 | 14 536,22K | 1,01 % |

| 5 | 0x0d07...b492fe | 13 263,80K | 0,92 % |

| - | Otros | 144 104,17K | 10,12 % |

II. Factores clave que influyen en el precio futuro de USUAL

Mecanismo de suministro

- Token Economics: Las modificaciones en la economía del token o la introducción de nuevas funcionalidades pueden provocar variaciones en el precio.

- Impacto actual: La tasa de adopción de USD0 y su uso en plataformas DeFi inciden directamente en la demanda de USUAL.

Dinámica institucional y de grandes tenedores

- Entorno regulatorio: Cambios en la normativa sobre criptomonedas o una mayor vigilancia por parte de organismos reguladores pueden afectar al precio de USUAL.

Entorno macroeconómico

- Volatilidad de mercado: La volatilidad general en el mercado cripto repercute en el precio de USUAL.

Desarrollo técnico y del ecosistema

- Implementación DeFi: La integración de USUAL en plataformas DeFi influye directamente en la demanda del token.

- Aplicaciones en el ecosistema: El desarrollo del ecosistema y el crecimiento de la comunidad son factores relevantes en la evolución del precio de USUAL.

III. Predicción de precio para USUAL entre 2025 y 2030

Perspectiva 2025

- Previsión conservadora: 0,03345 - 0,04500 dólares

- Previsión neutral: 0,04500 - 0,05500 dólares

- Previsión optimista: 0,05500 - 0,0648 dólares (requiere recuperación del mercado y mayor adopción)

Perspectiva 2027-2028

- Fase de mercado esperada: Potencial crecimiento con mayor volatilidad

- Rango de precios previsto:

- 2027: 0,05821 - 0,08971 dólares

- 2028: 0,05774 - 0,11311 dólares

- Catalizadores clave: Avances tecnológicos, tendencias de mercado y posibles alianzas

Perspectiva a largo plazo 2030

- Escenario base: 0,08802 - 0,10235 dólares (con crecimiento sostenido)

- Escenario optimista: 0,10235 - 0,12000 dólares (con fuerte desempeño y mayor utilidad)

- Escenario transformador: 0,12000 - 0,14022 dólares (con desarrollos disruptivos y adopción masiva)

- 31-12-2030: USUAL 0,14022 dólares (máximo potencial en condiciones muy favorables)

| Año | Máximo previsto | Precio medio previsto | Mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,0648 | 0,05226 | 0,03345 | 0 |

| 2026 | 0,07843 | 0,05853 | 0,04097 | 11 |

| 2027 | 0,08971 | 0,06848 | 0,05821 | 31 |

| 2028 | 0,11311 | 0,0791 | 0,05774 | 51 |

| 2029 | 0,1086 | 0,0961 | 0,05958 | 83 |

| 2030 | 0,14022 | 0,10235 | 0,08802 | 95 |

IV. Estrategias profesionales de inversión y gestión de riesgos para USUAL

Metodología de inversión en USUAL

(1) Estrategia de tenencia a largo plazo

- Indicada para: Inversores tolerantes al riesgo y con visión a largo plazo

- Recomendaciones operativas:

- Acumula USUAL durante correcciones de mercado

- Define objetivos de precio para tomar beneficios parciales

- Guarda tus tokens en una billetera de hardware segura

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Úsalas para detectar tendencias y posibles puntos de giro

- Índice de Fuerza Relativa (RSI): Evalúa niveles de sobrecompra o sobreventa

- Puntos clave para trading de rango:

- Monitoriza el sentimiento de mercado y las noticias que afectan a las stablecoins

- Configura órdenes stop-loss para limitar el riesgo a la baja

Marco de gestión de riesgos para USUAL

(1) Principios de asignación de activos

- Inversores conservadores: 1-3 %

- Inversores agresivos: 5-10 %

- Inversores profesionales: 10-15 %

(2) Soluciones de cobertura de riesgo

- Diversificación: Distribuye tus inversiones entre diferentes criptoactivos

- Órdenes stop-loss: Implántalas para limitar pérdidas potenciales

(3) Soluciones de almacenamiento seguro

- Billetera caliente recomendada: Gate Web3 Wallet

- Almacenamiento en frío: Billetera de hardware para las posiciones a largo plazo

- Medidas de seguridad: Activa la autenticación en dos pasos y emplea contraseñas fuertes

V. Riesgos y desafíos potenciales de USUAL

Riesgos de mercado de USUAL

- Volatilidad: Fuertes fluctuaciones de precio habituales en el sector cripto

- Competencia: Proliferación de nuevos proyectos de stablecoins

- Liquidez: Riesgo de falta de liquidez en situaciones de estrés del mercado

Riesgos regulatorios de USUAL

- Regulación de stablecoins: Nuevas leyes potenciales sobre emisores de stablecoins

- Restricciones internacionales: Reglamentos diferentes según jurisdicción

- Obligaciones de cumplimiento: Mayor exigencia de KYC/AML para usuarios de stablecoins

Riesgos técnicos de USUAL

- Vulnerabilidades de smart contract: Posibles fallos en el contrato del token

- Problemas de escalabilidad: Dificultades para gestionar grandes volúmenes de transacciones

- Riesgos de integración: Obstáculos al integrarse con otras plataformas

VI. Conclusión y recomendaciones de acción

Valoración del potencial de inversión de USUAL

USUAL ofrece una propuesta de valor distintiva como stablecoin respaldada por dinero fiduciario y gobernanza descentralizada. Si bien presenta potencial de desarrollo a largo plazo, existen riesgos a corto plazo ligados a la volatilidad del mercado y la incertidumbre regulatoria.

Recomendaciones de inversión en USUAL

✅ Principiantes: Empieza con posiciones pequeñas y prioriza el aprendizaje tecnológico ✅ Inversores experimentados: Adopta una estrategia equilibrada, combinando tenencia a largo plazo y trading activo ✅ Inversores institucionales: Incluye USUAL en una cartera cripto diversificada y realiza una evaluación exhaustiva

Métodos de participación en el trading de USUAL

- Trading spot: Compra y vende USUAL en Gate.com

- Staking: Participa en programas de generación de rendimientos si están disponibles

- Gobernanza: Participa en la toma de decisiones del proyecto mediante votaciones con tokens

La inversión en criptomonedas implica riesgos muy elevados y este artículo no representa asesoramiento de inversión. Decide siempre con cautela en función de tu tolerancia al riesgo y consulta a profesionales financieros. No inviertas nunca más de lo que puedas permitirte perder.

FAQ

¿Cuál es el futuro de Usual Coin?

El futuro de Usual Coin es atractivo como token de protocolo de stablecoin descentralizada. Las tendencias del mercado y la adopción serán determinantes para su crecimiento a largo plazo, y se espera un desempeño estable hasta 2030.

¿Puede Usual Coin llegar a los 10 dólares?

Es posible, aunque poco probable. Para ello, USUAL necesitaría una capitalización de mercado de 40 000 millones de dólares, muy por encima de su valor actual en 2025.

¿Se recuperará Usual Coin?

Sí, es probable que Usual Coin se recupere. El mercado suele experimentar bajadas temporales, pero los tokens sólidos tienden a repuntar con el tiempo. La paciencia es fundamental para el crecimiento futuro.

¿Cuál es el precio habitual de USUAL?

El precio habitual de USUAL es 0,05076 dólares. Ha registrado una caída del 4,80 % en las últimas 24 horas, con un volumen de negociación de 21,44 millones de dólares.

Compartir

Contenido