2025 XLM Price Prediction: Stellar's Potential Surge in the Evolving Crypto Landscape

Introduction: XLM's Market Position and Investment Value

Stellar (XLM), as a decentralized protocol for cross-border transactions, has achieved significant milestones since its inception in 2014. As of 2025, Stellar's market capitalization has reached $10.86 billion, with a circulating supply of approximately 32 billion XLM, and a price hovering around $0.34. This asset, often hailed as the "Swift of cryptocurrencies," is playing an increasingly crucial role in facilitating fast and low-cost international money transfers.

This article will comprehensively analyze Stellar's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. XLM Price History Review and Current Market Status

XLM Historical Price Evolution

- 2014: Stellar (XLM) launched, initial price around $0.002

- 2018: Bull market peak, XLM reached all-time high of $0.875563 on January 3

- 2020: Market recovery, XLM price showed significant growth

- 2022: Bearish trend, XLM price declined along with overall crypto market

XLM Current Market Situation

As of October 15, 2025, XLM is trading at $0.33934, with a market capitalization of $10.86 billion, ranking 18th in the global cryptocurrency market. The 24-hour trading volume is $5,538,150, indicating moderate market activity. XLM has experienced a slight decline of 1.47% in the past 24 hours, but shows a significant increase of 263.09% over the past year. The current price is still 61.24% below its all-time high, suggesting potential room for growth. With a circulating supply of 31,999,747,324 XLM, representing 63.99% of the total supply, XLM maintains a relatively high circulation rate.

Click to view current XLM market price

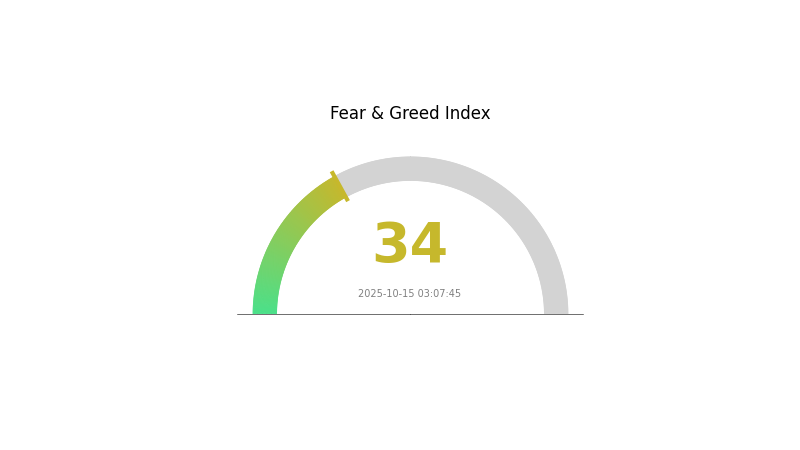

XLM Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for XLM is currently in the "Fear" zone, with a reading of 34 on the Fear and Greed Index. This indicates a cautious atmosphere among investors, potentially signaling undervaluation of XLM. Historically, such periods of fear have often preceded market rebounds. However, traders should remain vigilant and conduct thorough research before making investment decisions. Gate.com offers comprehensive tools and analytics to help navigate these market conditions effectively.

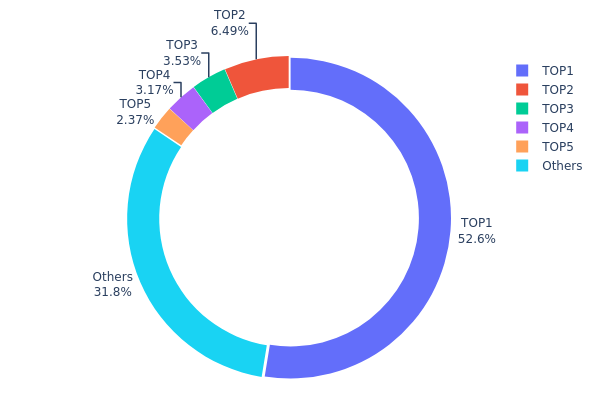

XLM Holdings Distribution

The address holdings distribution data for XLM reveals a highly concentrated ownership structure. The top address holds a staggering 52.57% of the total supply, indicating significant centralization. The subsequent four largest addresses collectively control an additional 15.56% of XLM tokens. This concentration pattern raises concerns about the potential for market manipulation and price volatility.

The distribution pattern suggests that a small number of entities have substantial influence over the XLM ecosystem. With over half of the supply controlled by a single address, there's a risk of market instability if large transfers or liquidations occur. This centralization also challenges the principle of decentralization often associated with cryptocurrencies. However, it's worth noting that 31.87% of XLM is distributed among other addresses, which provides some level of diversification and may help mitigate risks to some extent.

Click to view the current XLM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GALAXY...ZILUTO | 554421152.03K | 52.57% |

| 2 | GDUY7J...LDERI4 | 68461825.55K | 6.49% |

| 3 | GDKIJJ...CCWNMX | 37265991.80K | 3.53% |

| 4 | GBFZPA...ZJJFNP | 33459507.10K | 3.17% |

| 5 | GB6NVE...4MY4AQ | 25008201.71K | 2.37% |

| - | Others | 335822342.69K | 31.87% |

II. Key Factors Influencing XLM's Future Price

Supply Mechanism

- Maximum Supply: The initial maximum supply of XLM was 105 billion tokens. However, the Stellar Foundation burned 55 billion tokens in 2019, significantly reducing the maximum supply.

- Current Impact: The reduced supply has created a scarcity effect, potentially influencing the price positively in the long term.

Institutional and Whale Dynamics

- Corporate Adoption: Stellar's network is being adopted by various companies for cross-border transactions and digital asset issuance, which could drive demand for XLM.

Macroeconomic Environment

- Inflation Hedging Properties: As a decentralized digital asset, XLM may be viewed as a potential hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- Network Upgrades: Stellar plans to implement technical updates after 2025 to enhance network speed and transaction processing capacity.

- Ecosystem Applications: The Stellar network supports various decentralized applications and projects, contributing to its overall utility and potential value.

III. XLM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.25678 - $0.30000

- Neutral prediction: $0.30000 - $0.35000

- Optimistic prediction: $0.35000 - $0.43585 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.25014 - $0.623

- 2028: $0.50369 - $0.65151

- Key catalysts: Technological advancements, increased partnerships, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.59950 - $0.71040 (assuming steady market growth and adoption)

- Optimistic scenario: $0.71040 - $0.82131 (assuming strong market performance and increased utility)

- Transformative scenario: $0.82131 - $1.04429 (assuming major breakthroughs and widespread adoption)

- 2030-12-31: XLM $1.04429 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.43585 | 0.33787 | 0.25678 | 0 |

| 2026 | 0.55708 | 0.38686 | 0.2592 | 14 |

| 2027 | 0.623 | 0.47197 | 0.25014 | 39 |

| 2028 | 0.65151 | 0.54749 | 0.50369 | 61 |

| 2029 | 0.82131 | 0.5995 | 0.32972 | 76 |

| 2030 | 1.04429 | 0.7104 | 0.53991 | 109 |

IV. XLM Professional Investment Strategies and Risk Management

XLM Investment Methodology

(1) Long-term holding strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate XLM during market dips

- Set price targets and rebalance portfolio periodically

- Store XLM in secure hardware wallets

(2) Active trading strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Use stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

XLM Risk Management Framework

(1) Asset allocation principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk hedging solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure storage solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term storage

- Security precautions: Never share private keys, use two-factor authentication

V. Potential Risks and Challenges for XLM

XLM Market Risks

- High volatility: XLM price can experience significant fluctuations

- Competition: Emergence of new blockchain platforms for cross-border payments

- Adoption challenges: Slow integration by traditional financial institutions

XLM Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on cryptocurrencies

- Cross-border compliance: Varying regulations across different jurisdictions

- Security token classification: Potential reclassification of XLM as a security

XLM Technical Risks

- Network congestion: Potential scalability issues during high-volume periods

- Smart contract vulnerabilities: Risks associated with smart contract deployments

- Cybersecurity threats: Potential for hacks or attacks on the Stellar network

VI. Conclusion and Action Recommendations

XLM Investment Value Assessment

XLM presents long-term potential in cross-border payments and asset tokenization, but faces short-term volatility and regulatory uncertainties.

XLM Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics

✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading

✅ Institutional investors: Explore strategic partnerships and integration of Stellar technology

XLM Trading Participation Methods

- Spot trading: Buy and sell XLM on Gate.com

- Staking: Participate in XLM staking programs for passive income

- DeFi integration: Explore decentralized finance applications built on Stellar

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will XLM go in 2025?

XLM is predicted to reach a high of $1.29 in 2025, based on current market trends and analysis.

Can XLM go to $10?

XLM reaching $10 is unlikely soon. Major market changes and adoption are needed. Current predictions expect XLM to trade between $0.50 and $1.

How high can XLM realistically go?

XLM could potentially reach $10 in the long term, depending on market conditions and adoption. However, predicting a specific maximum price is challenging due to the volatile nature of cryptocurrencies.

What is the price prediction for XLM in 2030?

XLM is predicted to reach a high of $1.062 and a low of $0.738 by 2030, influenced by market conditions and technological advancements.

2025 CFX Price Prediction: Analyzing Growth Potential and Market Factors for Conflux Network Token

2025 GRT Price Prediction: Analyzing Graph Protocol's Future Value Trajectory and Market Potential

2025 SLC Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SYSPrice Prediction: Analyzing Market Trends, Technical Factors, and Institutional Adoption Potential

2025 TLOS Price Prediction: Market Analysis and Growth Potential for Telos Blockchain

2025 REI Price Prediction: Market Analysis and Growth Forecast for the Real Estate Token Economy

What is Stellar (XLM) and How Does Its Cross-Border Payment Technology Work?

Introducing Affordable Electric Vehicle Solutions and Charging Stations in Sri Lanka

How to Use Technical Indicators (MACD, RSI, KDJ, Bollinger Bands) to Trade Crypto in 2025?

What is SCR: A Comprehensive Guide to Selective Catalytic Reduction Technology

What is TAI: A Comprehensive Guide to Total Addressable Income and Its Impact on Business Growth