2025 ZEXPrice Prediction: Analyzing Market Trends and Expert Forecasts for the Future of ZEX Token

Introduction: ZEX's Market Position and Investment Value

Zeta Markets (ZEX) has emerged as a prominent player in the decentralized derivatives exchange sector since its inception. As of 2025, ZEX's market capitalization has reached $24,339,911, with a circulating supply of approximately 181,438,032 tokens and a price hovering around $0.13415. This asset, often referred to as the "Solana-based DEX innovator," is playing an increasingly crucial role in the realm of decentralized finance and derivatives trading.

This article will provide a comprehensive analysis of ZEX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ZEX Price History Review and Current Market Status

ZEX Historical Price Evolution

- 2024: ZEX reached its all-time high of $0.3184 on June 27, marking a significant milestone

- 2024: The token experienced its all-time low of $0.0218 on August 5, demonstrating high volatility

- 2025: ZEX has shown remarkable recovery, with price increasing by 263.55% over the past year

ZEX Current Market Situation

As of October 4, 2025, ZEX is trading at $0.13415. The token has demonstrated strong performance across various timeframes, with a 2.12% increase in the last 24 hours and a substantial 121.22% gain over the past 30 days. The current market capitalization stands at $24,339,911.99, ranking ZEX at 1004 in the cryptocurrency market. With a circulating supply of 181,438,032 ZEX out of a total supply of 1,000,000,000, the token has a circulating ratio of 18.14%. The 24-hour trading volume is $51,378.85, indicating moderate market activity. The fully diluted valuation of ZEX is $134,150,000, suggesting potential for future growth.

Click to view the current ZEX market price

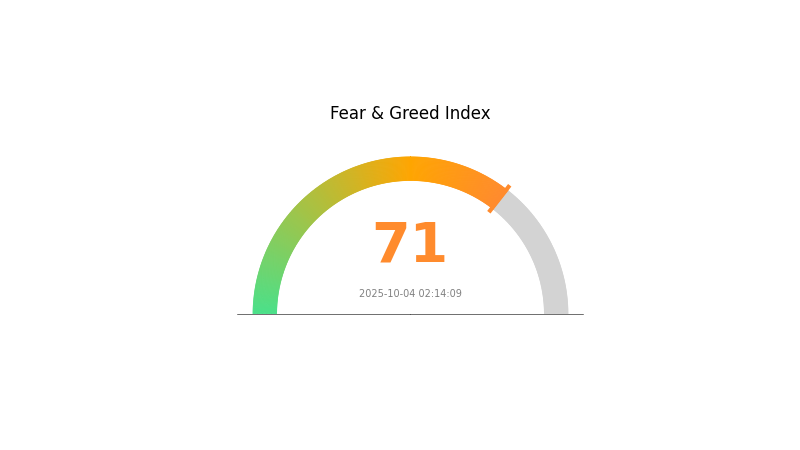

ZEX Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 71. This suggests that investors are becoming increasingly optimistic and may be willing to take on more risk. However, it's important to remember that extreme greed can sometimes precede market corrections. Traders should remain cautious and consider implementing risk management strategies. As always, diversification and thorough research are key when making investment decisions in the volatile crypto market.

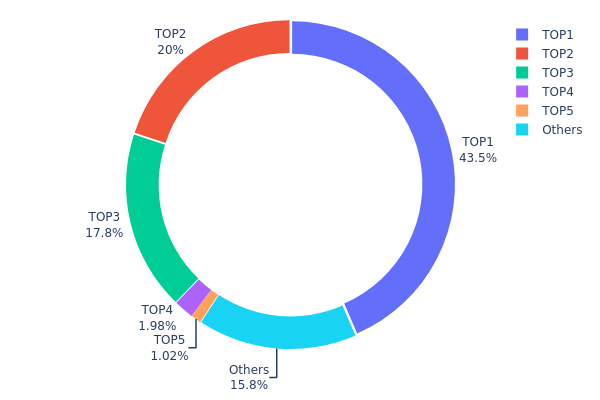

ZEX Holdings Distribution

The address holdings distribution data for ZEX reveals a highly concentrated ownership structure. The top address holds a significant 43.45% of the total supply, while the top three addresses collectively control 81.22% of all ZEX tokens. This level of concentration raises concerns about the token's decentralization and market stability.

Such a concentrated distribution can lead to increased volatility and susceptibility to market manipulation. The top holders have substantial influence over the token's price movements, potentially creating an environment where large sell-offs or accumulations could dramatically impact market dynamics. This concentration also poses risks to the project's governance if voting rights are tied to token ownership.

While the presence of smaller holders (15.8% held by "Others") indicates some level of distribution, the overall picture suggests a need for improved token dispersion to enhance market resilience and decentralization. This current state of ZEX holdings may deter some investors due to perceived centralization risks and potential for price instability.

Click to view the current ZEX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Bs5XaF...T2DBXt | 434524.48K | 43.45% |

| 2 | 3zmHxC...NfrbAN | 200000.00K | 20.00% |

| 3 | EibcRb...HqyrAT | 177703.40K | 17.77% |

| 4 | AC5RDf...CWjtW2 | 19763.94K | 1.97% |

| 5 | 9zrxxf...e1zqwC | 10186.28K | 1.01% |

| - | Others | 157819.30K | 15.8% |

II. Key Factors Influencing ZEX's Future Price

Supply Mechanism

- Experimental Scarcity Model: ZEX employs an experimental scarcity model that could significantly impact its price dynamics.

- Current Impact: The unique supply mechanism is expected to create speculation and potentially drive price volatility.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of ZEX by notable enterprises could influence its future price trajectory.

Macroeconomic Environment

- Inflation Hedging Properties: ZEX's performance in inflationary environments may affect its price and adoption.

Technological Development and Ecosystem Building

- Community Engagement: The level of community participation and ecosystem development will play a crucial role in ZEX's future valuation.

- Ecosystem Applications: The development of DApps and other ecosystem projects could drive ZEX's utility and, consequently, its price.

III. ZEX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12074 - $0.13415

- Neutral prediction: $0.13415 - $0.16098

- Optimistic prediction: $0.16098 - $0.18781 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.1143 - $0.18835

- 2027: $0.16768 - $0.2358

- Key catalysts: Increased adoption, technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.20523 - $0.269 (assuming steady market growth)

- Optimistic scenario: $0.269 - $0.32012 (assuming strong market performance)

- Transformative scenario: $0.32012+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: ZEX $0.32012 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.18781 | 0.13415 | 0.12074 | 0 |

| 2026 | 0.18835 | 0.16098 | 0.1143 | 20 |

| 2027 | 0.2358 | 0.17466 | 0.16768 | 30 |

| 2028 | 0.29758 | 0.20523 | 0.19907 | 52 |

| 2029 | 0.2866 | 0.25141 | 0.14833 | 87 |

| 2030 | 0.32012 | 0.269 | 0.14257 | 100 |

IV. Professional Investment Strategies and Risk Management for ZEX

ZEX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational advice:

- Accumulate ZEX during market dips

- Set price targets and regularly reassess the project's fundamentals

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem developments that may impact ZEX

- Set stop-loss orders to manage downside risk

ZEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Software wallet option: Official Solana wallet

- Security precautions: Use two-factor authentication, backup seed phrases securely

V. Potential Risks and Challenges for ZEX

ZEX Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential challenges in executing large orders

- Competition: Other DEX projects on Solana may impact market share

ZEX Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of DeFi platforms

- Compliance requirements: Possible need for KYC/AML implementation

- Cross-border restrictions: Varying legal status in different jurisdictions

ZEX Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Dependent on Solana network performance

- Interoperability issues: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

ZEX Investment Value Assessment

ZEX shows promise as a fast and secure DEX on Solana, but faces significant competition and regulatory uncertainty. Long-term potential exists, but short-term volatility and risks are high.

ZEX Investment Recommendations

✅ Beginners: Start with small positions, focus on education

✅ Experienced investors: Consider as part of a diversified DeFi portfolio

✅ Institutional investors: Monitor project development and regulatory landscape closely

ZEX Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- DeFi interactions: Engage directly with Zeta Markets protocol

- Staking: Participate in protocol governance and earn rewards

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What is the price prediction for ZEC in 2030?

Based on current market analysis, the price prediction for ZEC in 2030 is $196.11. This forecast suggests a potential increase from current levels.

What is the price of ZEX today?

As of today, the price of ZEX is $0.1346, showing a slight decrease of 0.94% in the past 24 hours. The current trading volume stands at $742,724.

What is Zex crypto?

ZEX is the native cryptocurrency of Zeta Markets, a decentralized exchange on Solana. It's used for governance, staking, trading incentives, and as a gas token for Zeta X, a DeFi Layer 2 solution.

What is the price prediction for Zoo Token 2025?

Zoo Token is predicted to reach $0.0₁₁3277 by October 1, 2025, a 10.15% decrease. The price is expected to range between $0.0₁₁2046 and $0.0₁₁3650 in 2025.

Is Zeta Markets (ZEX) a Good Investment?: Analyzing Growth Potential and Risks in the DeFi Options Market

Is Drift Protocol (DRIFT) a good investment?: Analyzing the potential and risks of this decentralized trading platform

Is Drift Protocol (DRIFT) a good investment?: Analyzing the potential and risks of this decentralized derivatives platform

2025 ORCA Price Prediction: Will This DeFi Token Surge or Sink in the Crypto Ocean?

TURBOS vs SOL: The Battle of High-Performance Engines in Modern Automotive Engineering

Forecasting Jupiter's Value: Can JUP Reach $2 By 2030?

Is Zeta Markets (ZEX) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Prospects

Is Alien Worlds (TLM) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Explore Anoma XAN: A Blockchain Protocol Boosting Web3 Evolution

深入探索Nillion:盲计算在数据隐私保护中的革命性应用

Is NAVI Protocol (NAVX) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024