BitViewOfTheOcean

No content yet

BitViewOfTheOcean

The Nine Yin Manual has been completed, a trend that history has never experienced! Hell or Heaven?

View Original

- Reward

- like

- 13

- Repost

- Share

OldCurrencyHunter :

:

After the expiration, unsubscribe, bro. The platform has closed the tipping function. I am also thinking of ways to refund the subscription fee to you.View More

- Reward

- like

- Comment

- Repost

- Share

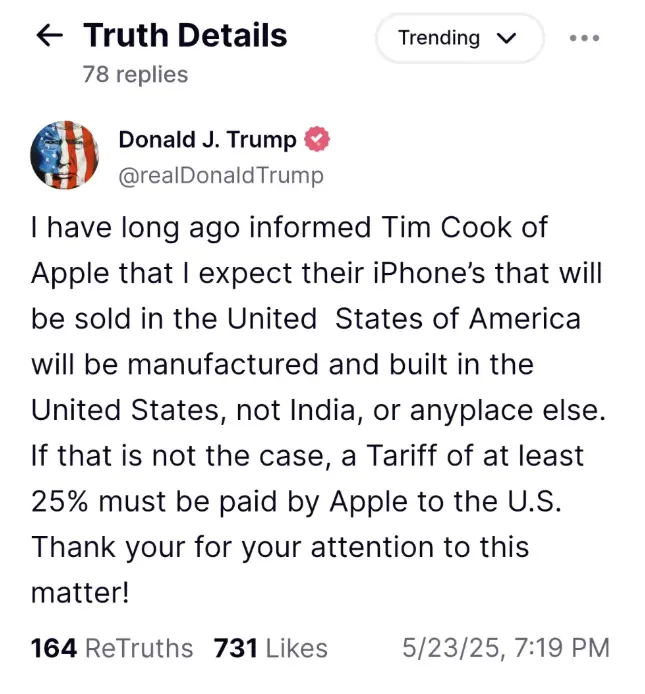

The trade war reignites, Trump "opens fire on two fronts," with dark currents flowing in the crypto world.

The smoke of the trade war has risen again, as the United States unexpectedly swings the "tariff big stick" against both the European Union and its own tech giant Apple. On May 12, the release of the China-US "Joint Statement" had temporarily put the first phase of the trade war on hold. However, Trump couldn't wait and started the second phase of the tariff offensive just ten days later, directly targeting the European Union and Apple.

On May 23, Trump boldly suggested imposing a 50% tar

The smoke of the trade war has risen again, as the United States unexpectedly swings the "tariff big stick" against both the European Union and its own tech giant Apple. On May 12, the release of the China-US "Joint Statement" had temporarily put the first phase of the trade war on hold. However, Trump couldn't wait and started the second phase of the tariff offensive just ten days later, directly targeting the European Union and Apple.

On May 23, Trump boldly suggested imposing a 50% tar

TRUMP0.96%

- Reward

- like

- Comment

- Repost

- Share

Trump "kicking people out" of Harvard hides a political game behind it.

Princess Elizabeth of Belgium, who studied at Harvard, is the eldest daughter of King Philippe of Belgium and the first in line to the throne, and was expected to become the next queen. This 23-year-old future queen has completed her undergraduate studies at Oxford University and has just finished her first year of master's courses at Harvard, but was "kicked out" by Trump.

Trump's move is not aimed at the Belgian royal family, but rather directed at all foreign students studying at Harvard. A notice from the U.S. Embassy

Princess Elizabeth of Belgium, who studied at Harvard, is the eldest daughter of King Philippe of Belgium and the first in line to the throne, and was expected to become the next queen. This 23-year-old future queen has completed her undergraduate studies at Oxford University and has just finished her first year of master's courses at Harvard, but was "kicked out" by Trump.

Trump's move is not aimed at the Belgian royal family, but rather directed at all foreign students studying at Harvard. A notice from the U.S. Embassy

TRUMP0.96%

- Reward

- like

- Comment

- Repost

- Share

The Japanese bond has collapsed, this is a stab at the US dollar.

Indeed, it is the book that can always stab people at critical moments. Americans once organized manpower and resources to deal with Japan by writing a book called "The Chrysanthemum and the Sword". After enjoying good days for too long, they only saw the book's fawning and flattering demeanor, completely forgetting that others idolize Lü Bu and carry small knives with them, waiting for your moment of weakness to stab you in the back. Perhaps even the book never thought that the once high and mighty American empire could decline

Indeed, it is the book that can always stab people at critical moments. Americans once organized manpower and resources to deal with Japan by writing a book called "The Chrysanthemum and the Sword". After enjoying good days for too long, they only saw the book's fawning and flattering demeanor, completely forgetting that others idolize Lü Bu and carry small knives with them, waiting for your moment of weakness to stab you in the back. Perhaps even the book never thought that the once high and mighty American empire could decline

View Original

- Reward

- like

- Comment

- Repost

- Share

After the United States canceled high tariffs on China, government bonds continued to experience a big dump.

In April, Trump launched a global trade war, announcing an exorbitant 145% tariff on China, which triggered two rounds of simultaneous declines in U.S. stocks, bonds, and currency that month, causing U.S. bond yields to soar and forcing Trump to back down.

Because the scale of US debt that needs to be rolled over by 2025 is about 7-8 trillion USD, most of which is concentrated in June, and the previous US debt interest rates were extremely low. Once replaced with high-interest bonds, it

In April, Trump launched a global trade war, announcing an exorbitant 145% tariff on China, which triggered two rounds of simultaneous declines in U.S. stocks, bonds, and currency that month, causing U.S. bond yields to soar and forcing Trump to back down.

Because the scale of US debt that needs to be rolled over by 2025 is about 7-8 trillion USD, most of which is concentrated in June, and the previous US debt interest rates were extremely low. Once replaced with high-interest bonds, it

TRUMP0.96%

- Reward

- like

- Comment

- Repost

- Share

U.S. bonds have collapsed again.

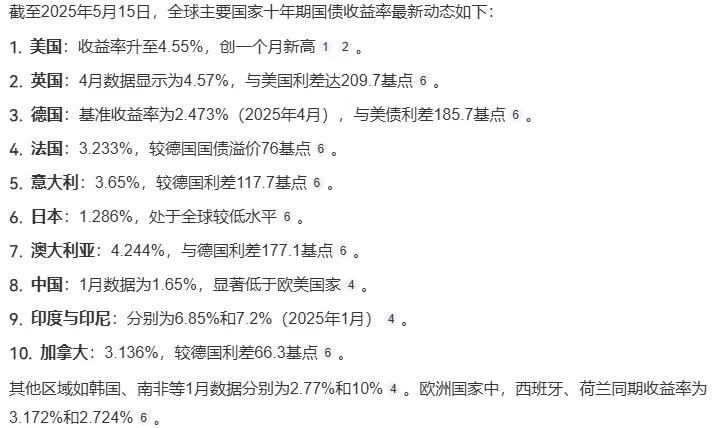

Yesterday, US Treasury yields soared collectively, and you wouldn't believe that the 30-year Treasury yield is close to 5%, while the 10-year yield has already broken past 4.5%.

I searched for the ten-year government bond yields of major countries worldwide using deepseek, and got the results shown in the following chart.

The soaring U.S. Treasury yield indicates that the funds in the market do not recognize U.S. Treasuries; there are fewer buyers, and they can only attract investors with higher yields. Even so, there have been frequent reports this year of coo

View OriginalYesterday, US Treasury yields soared collectively, and you wouldn't believe that the 30-year Treasury yield is close to 5%, while the 10-year yield has already broken past 4.5%.

I searched for the ten-year government bond yields of major countries worldwide using deepseek, and got the results shown in the following chart.

The soaring U.S. Treasury yield indicates that the funds in the market do not recognize U.S. Treasuries; there are fewer buyers, and they can only attract investors with higher yields. Even so, there have been frequent reports this year of coo

- Reward

- like

- 1

- Repost

- Share

SkyRelease :

:

A bit of skill [强]Mr. Know-it-all's Middle East tour, the political game behind large orders of arms sales and the undercurrents in the crypto world.

First, let's feel sorry for Mr. Know-it-all for a second. His trip to the Middle East was truly full of incidents. He rubbed his little hands, politely holding a cup of coffee in front of Prince Salman with a look of grievance, not daring to complain about the prince wearing slippers, nor asking for a cup of his beloved cola. This scene makes one wonder: dear, after all, you are the chief of America, is it really necessary to be treated this way just for a visit t

View OriginalFirst, let's feel sorry for Mr. Know-it-all for a second. His trip to the Middle East was truly full of incidents. He rubbed his little hands, politely holding a cup of coffee in front of Prince Salman with a look of grievance, not daring to complain about the prince wearing slippers, nor asking for a cup of his beloved cola. This scene makes one wonder: dear, after all, you are the chief of America, is it really necessary to be treated this way just for a visit t

- Reward

- like

- Comment

- Repost

- Share

Mr. Know-it-all's Middle East tour, the political game behind large orders of arms sales and the undercurrents in the crypto world.

First, let's feel sorry for Mr. Know-it-all for a second. His trip to the Middle East was truly full of incidents. He rubbed his little hands, politely holding a cup of coffee in front of Prince Salman with a look of grievance, not daring to complain about the prince wearing slippers, nor asking for a cup of his beloved cola. This scene makes one wonder: dear, after all, you are the chief of America, is it really necessary to be treated this way just for a visit t

View OriginalFirst, let's feel sorry for Mr. Know-it-all for a second. His trip to the Middle East was truly full of incidents. He rubbed his little hands, politely holding a cup of coffee in front of Prince Salman with a look of grievance, not daring to complain about the prince wearing slippers, nor asking for a cup of his beloved cola. This scene makes one wonder: dear, after all, you are the chief of America, is it really necessary to be treated this way just for a visit t

- Reward

- like

- Comment

- Repost

- Share

The shocking lie can rest! Mixed-blood is at a disadvantage!

Looking back over the past hundred years, China was once mired in poverty and weakness, with colonial thinking shadowing it, long shrouding this land.

Dispersing the invisible colonial mindset that looms over the hearts of the Chinese people is undoubtedly a daunting and lengthy task that requires steady and methodical progress step by step.

Today, what I want to expose is the rumor of a 个长期误导国人 - "mixed blood". This rumor invades people's minds like a tumor.

The reason I am paying attention to this matter is due to a trending topic.

Looking back over the past hundred years, China was once mired in poverty and weakness, with colonial thinking shadowing it, long shrouding this land.

Dispersing the invisible colonial mindset that looms over the hearts of the Chinese people is undoubtedly a daunting and lengthy task that requires steady and methodical progress step by step.

Today, what I want to expose is the rumor of a 个长期误导国人 - "mixed blood". This rumor invades people's minds like a tumor.

The reason I am paying attention to this matter is due to a trending topic.

View Original

- Reward

- like

- 1

- Repost

- Share

Smhayby :

:

You have to👍buy teddy, you have to replenish the stocks, y. t. dLet's talk about the potential impact of China-U.S. trade negotiations on the A-share market.

In the short term, trade negotiations will indeed have a certain impact on the market, but if we extend the time frame, this effect is actually quite limited. After all, China in 2025 is no longer comparable to 2018, and we no longer need to overly consider the opinions of the United States.

Back in 2018, the United States imposed a supply ban on ZTE, and China had no choice but to accept a fine of up to $1.4 billion. At that time, this figure was jokingly referred to as "one dollar per person," but t

View OriginalIn the short term, trade negotiations will indeed have a certain impact on the market, but if we extend the time frame, this effect is actually quite limited. After all, China in 2025 is no longer comparable to 2018, and we no longer need to overly consider the opinions of the United States.

Back in 2018, the United States imposed a supply ban on ZTE, and China had no choice but to accept a fine of up to $1.4 billion. At that time, this figure was jokingly referred to as "one dollar per person," but t

- Reward

- like

- Comment

- Repost

- Share

One day after launching a counteroffensive in Pakistan, India agreed to cease military conflict.

In this round of the India-Pakistan conflict, India used various excuses as a pretext, carried out a prolonged period of provocation, and ultimately launched military action against Pakistan on May 7.

India actively provoked this war, and there must be considerations behind it. Although the specific reasons are unknown, it is evident that it is based on certain demands and calculations. India may believe that as long as it wins, it can achieve its goals, even if it requires paying a certain price.

In this round of the India-Pakistan conflict, India used various excuses as a pretext, carried out a prolonged period of provocation, and ultimately launched military action against Pakistan on May 7.

India actively provoked this war, and there must be considerations behind it. Although the specific reasons are unknown, it is evident that it is based on certain demands and calculations. India may believe that as long as it wins, it can achieve its goals, even if it requires paying a certain price.

TRUMP0.96%

- Reward

- like

- Comment

- Repost

- Share

The U.S. and the Houthis: The Complex Game Behind a 'Stalemate'

Recently, the United States surprisingly reached some sort of "ceasefire" situation with the Houthi armed group in Yemen, which is indeed unexpected. It is important to note that the Houthi armed group, as a highly influential organization in the world military field, has never signed a ceasefire agreement without achieving victory on the battlefield since its establishment, consistently presenting a tough stance.

However, a situation has emerged where the United States and the Houthi forces are "at peace". On May 6th, President T

Recently, the United States surprisingly reached some sort of "ceasefire" situation with the Houthi armed group in Yemen, which is indeed unexpected. It is important to note that the Houthi armed group, as a highly influential organization in the world military field, has never signed a ceasefire agreement without achieving victory on the battlefield since its establishment, consistently presenting a tough stance.

However, a situation has emerged where the United States and the Houthi forces are "at peace". On May 6th, President T

TRUMP0.96%

- Reward

- like

- Comment

- Repost

- Share

Mr. Know-it-all "calculates" the world, the truth behind the chaos in the market and geopolitics.

Goodness, this Mr. Know-it-all is really extremely cunning, cleverly using the situation to give the whole world a "warning." Look at the trade data between the UK and the US: in 2024, the UK exported £59.3 billion to the US and imported £57.2 billion, with a mere surplus of £2 billion. Compared to the scale of Sino-US trade, this is simply not on the same level. Is there even a need to bring this up?

One can't help but sigh; sometimes this world feels like a gigantic amateur theater troupe. The c

View OriginalGoodness, this Mr. Know-it-all is really extremely cunning, cleverly using the situation to give the whole world a "warning." Look at the trade data between the UK and the US: in 2024, the UK exported £59.3 billion to the US and imported £57.2 billion, with a mere surplus of £2 billion. Compared to the scale of Sino-US trade, this is simply not on the same level. Is there even a need to bring this up?

One can't help but sigh; sometimes this world feels like a gigantic amateur theater troupe. The c

- Reward

- like

- Comment

- Repost

- Share

Bitcoin breaks through 100,000 again: analysis and views for the future

In the field of digital currency, Bitcoin is undoubtedly the most iconic presence. When Bitcoin once again broke through the $100,000 barrier, this event not only drew widespread attention from the market but also prompted us to conduct an in-depth analysis of its subsequent trends. This article will explore multiple dimensions of the analysis regarding Bitcoin's performance after breaking through $100,000.

1. Background and Reasons for the Breakthrough

The recent breakthrough of Bitcoin surpassing 100,000 USD was not an o

In the field of digital currency, Bitcoin is undoubtedly the most iconic presence. When Bitcoin once again broke through the $100,000 barrier, this event not only drew widespread attention from the market but also prompted us to conduct an in-depth analysis of its subsequent trends. This article will explore multiple dimensions of the analysis regarding Bitcoin's performance after breaking through $100,000.

1. Background and Reasons for the Breakthrough

The recent breakthrough of Bitcoin surpassing 100,000 USD was not an o

BTC1.67%

- Reward

- 1

- 1

- Repost

- Share

GateUser-454666df :

:

BTC going to 115k by Sunday!Let's chat.

Yesterday, the market was as lively as during the New Year, with heavy news coming in one after another, dazzling people.

Let's first talk about the financial policy aspect. The reduction of the reserve requirement ratio and interest rates was actually anticipated by everyone. I mentioned in my paid article before that in order to cope with the impact of the trade war, the country will definitely introduce a series of policies to stimulate the economy, and this is just the first wave. If the situation doesn't improve, there are still several more waves of policies waiting ahead.

Lo

View OriginalYesterday, the market was as lively as during the New Year, with heavy news coming in one after another, dazzling people.

Let's first talk about the financial policy aspect. The reduction of the reserve requirement ratio and interest rates was actually anticipated by everyone. I mentioned in my paid article before that in order to cope with the impact of the trade war, the country will definitely introduce a series of policies to stimulate the economy, and this is just the first wave. If the situation doesn't improve, there are still several more waves of policies waiting ahead.

Lo

- Reward

- like

- Comment

- Repost

- Share

The fire of party struggle reaches Hollywood: The power struggle behind Trump's tariff policy also serves as a lesson for the crypto world.

Political strife is rising again, and Trump actually wielded the big stick of tariffs against Hollywood movies in the United States, announcing a 100% tariff. Trump argued that America's national security is once again under threat, and this time, the source of the threat is movies, those films from abroad.

On May 5, Trump authorized the Department of Commerce and the U.S. Trade Representative to immediately initiate procedures to impose a 100% tariff on a

Political strife is rising again, and Trump actually wielded the big stick of tariffs against Hollywood movies in the United States, announcing a 100% tariff. Trump argued that America's national security is once again under threat, and this time, the source of the threat is movies, those films from abroad.

On May 5, Trump authorized the Department of Commerce and the U.S. Trade Representative to immediately initiate procedures to impose a 100% tariff on a

TRUMP0.96%

- Reward

- 1

- Comment

- Repost

- Share

Trump calls out: Business students and crypto world speculators, don't just think about making money, go work in factories and mines!

How can America be made great again? President Trump believes that the only way is to revive American manufacturing. To achieve this goal, a large number of people must engage in manufacturing. After all, having people working doesn’t guarantee success, but having no one working is absolutely out of the question.

In the United States, engaging in finance and business is quite appealing, easy and respectable, with high income. But the manufacturing industry is to

View OriginalHow can America be made great again? President Trump believes that the only way is to revive American manufacturing. To achieve this goal, a large number of people must engage in manufacturing. After all, having people working doesn’t guarantee success, but having no one working is absolutely out of the question.

In the United States, engaging in finance and business is quite appealing, easy and respectable, with high income. But the manufacturing industry is to

- Reward

- like

- Comment

- Repost

- Share

💰💰💰Money is coming, money is flooding in here!

During the May Day holiday, Asian currencies really surged!

You thought the Renminbi was strong enough? Hey, take a look at the New Taiwan Dollar, it surged 4% in a day. Surprised? Unexpected?

The RMB has a large market, while the TWD has a small market. Capital is fleeing from the United States, and Europe was originally the first choice. But look at Europe now; does it still have the strength to absorb this capital?

If the understanding king (specifically referring to a certain former U.S. president) can't even handle Russia, what does it mat

During the May Day holiday, Asian currencies really surged!

You thought the Renminbi was strong enough? Hey, take a look at the New Taiwan Dollar, it surged 4% in a day. Surprised? Unexpected?

The RMB has a large market, while the TWD has a small market. Capital is fleeing from the United States, and Europe was originally the first choice. But look at Europe now; does it still have the strength to absorb this capital?

If the understanding king (specifically referring to a certain former U.S. president) can't even handle Russia, what does it mat

PIG9.25%

- Reward

- like

- Comment

- Repost

- Share