It's over, this Ether is weak.

Market Interpretation

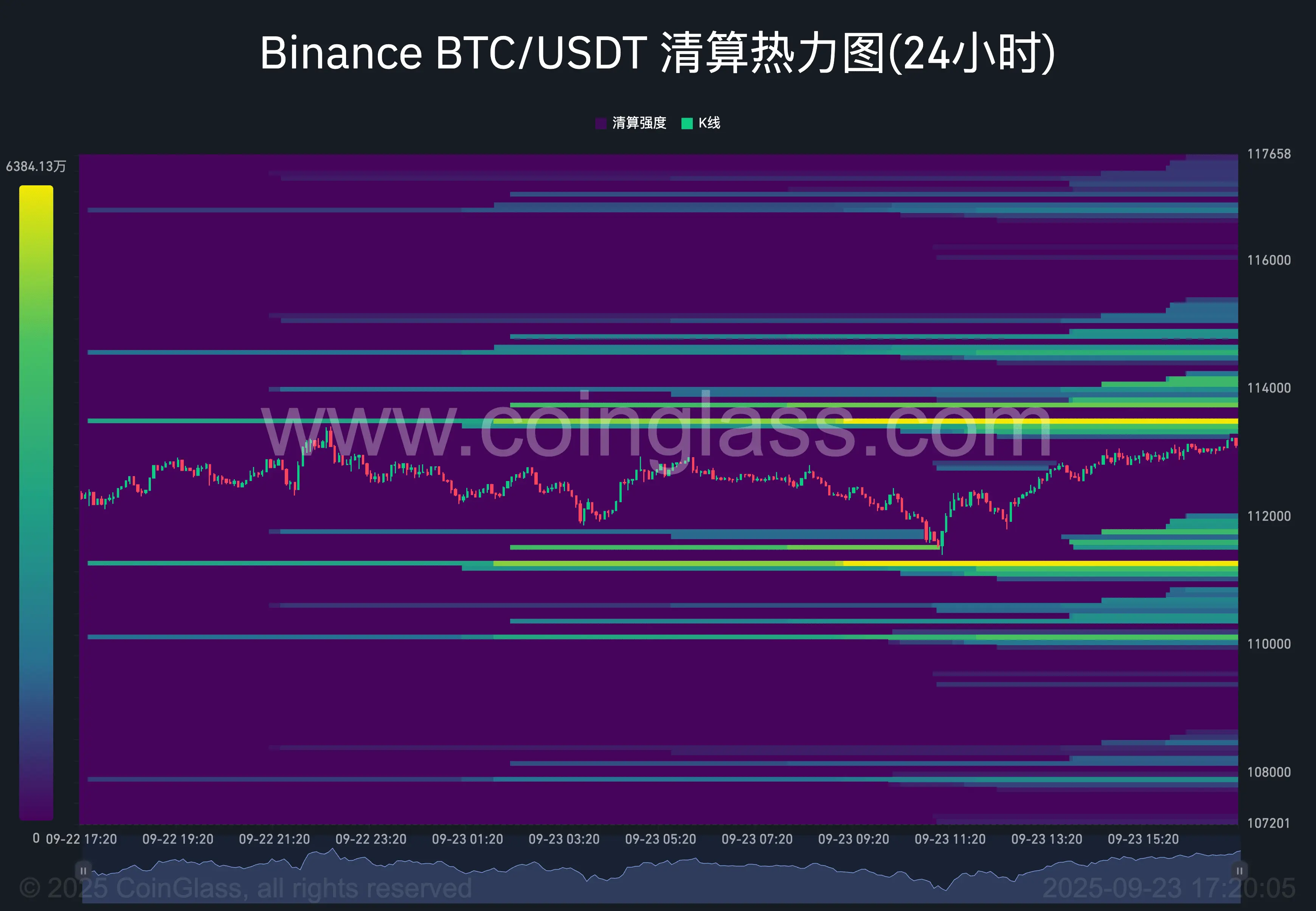

$BTC has been oscillating in the range of 111.8k–113.5k, overall showing a weak recovery.

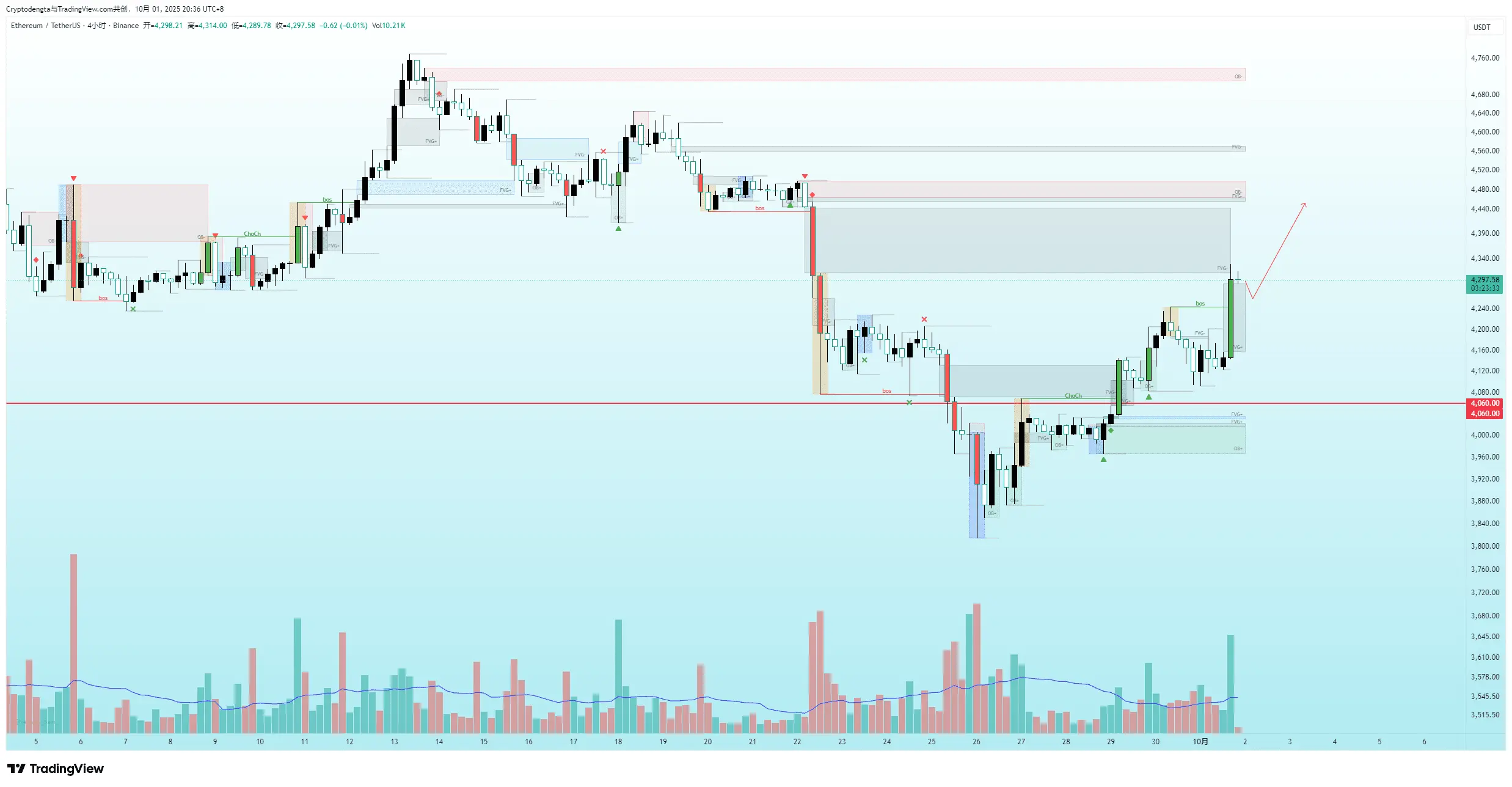

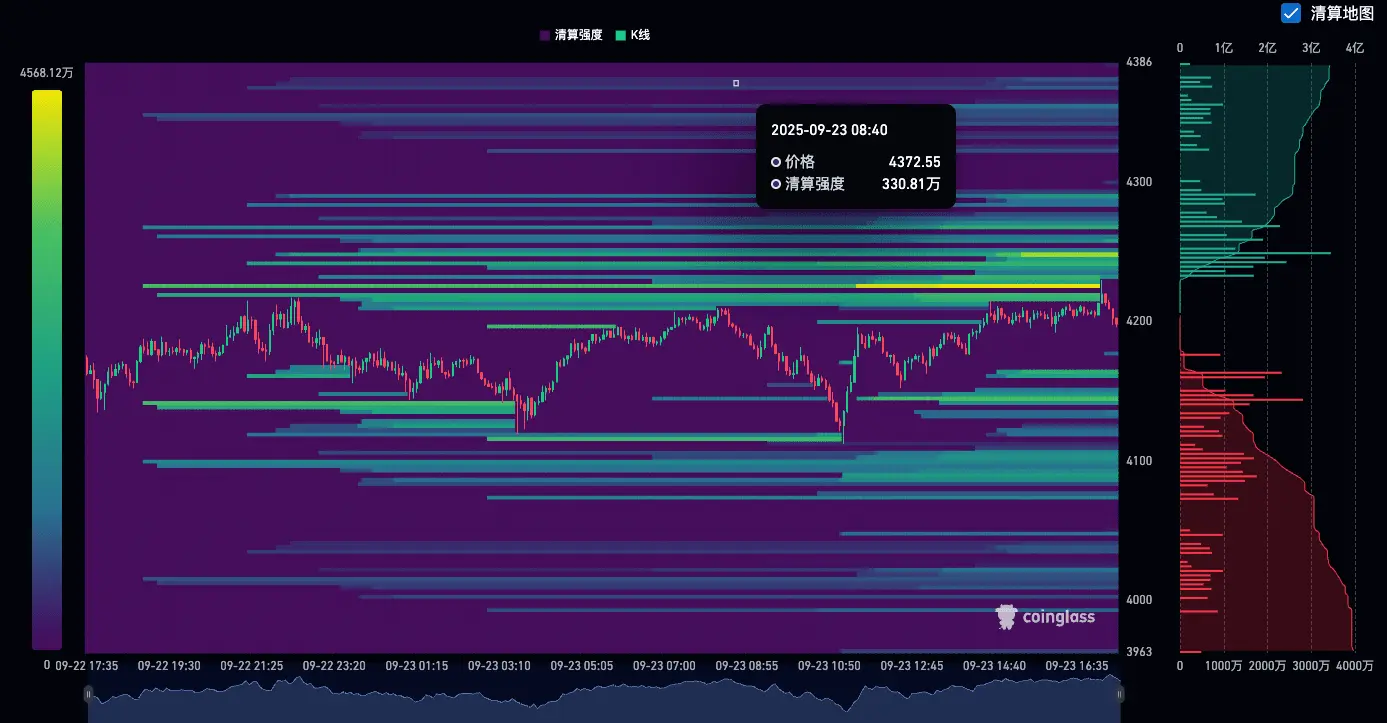

$ETH is relatively weaker, did not break above the 4200 resistance zone yesterday, continuing to look for short-term support with a bearish bias, not predicting where the low will be.

The short-term BTC is 113.2–113.6k with obvious selling pressure above, while looking at the gap support at 111.5–111.8k below.

ETH dipped down to 4060 but rebounded with OI rising and CVD weakening, indicating a shift from bulls to bears. Continue to be bearish and