ZEENIA

“I hold bags heavier than your ego. Talk charts or don’t talk at all.”

Pin

ZEENIA

- Reward

- like

- 11

- Repost

- Share

ZEENIA :

:

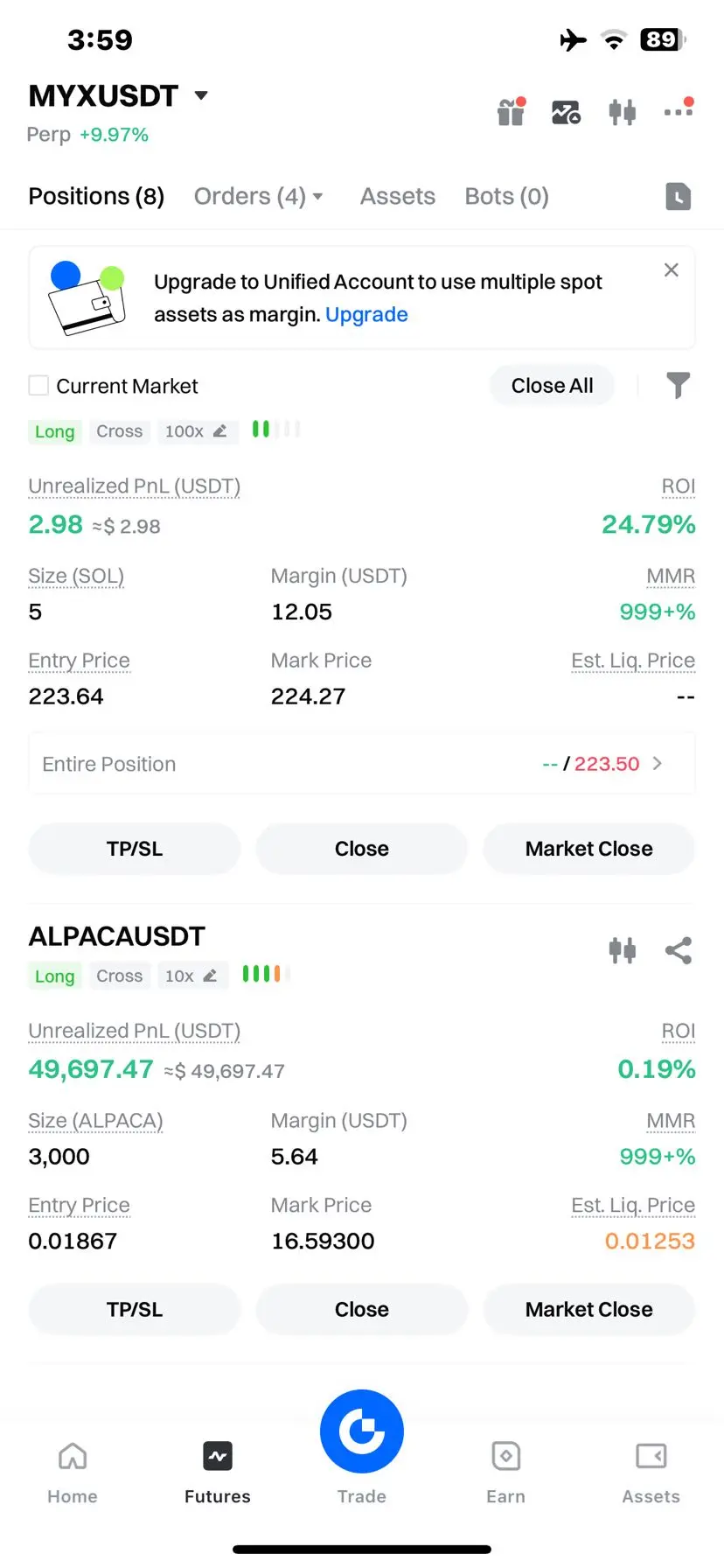

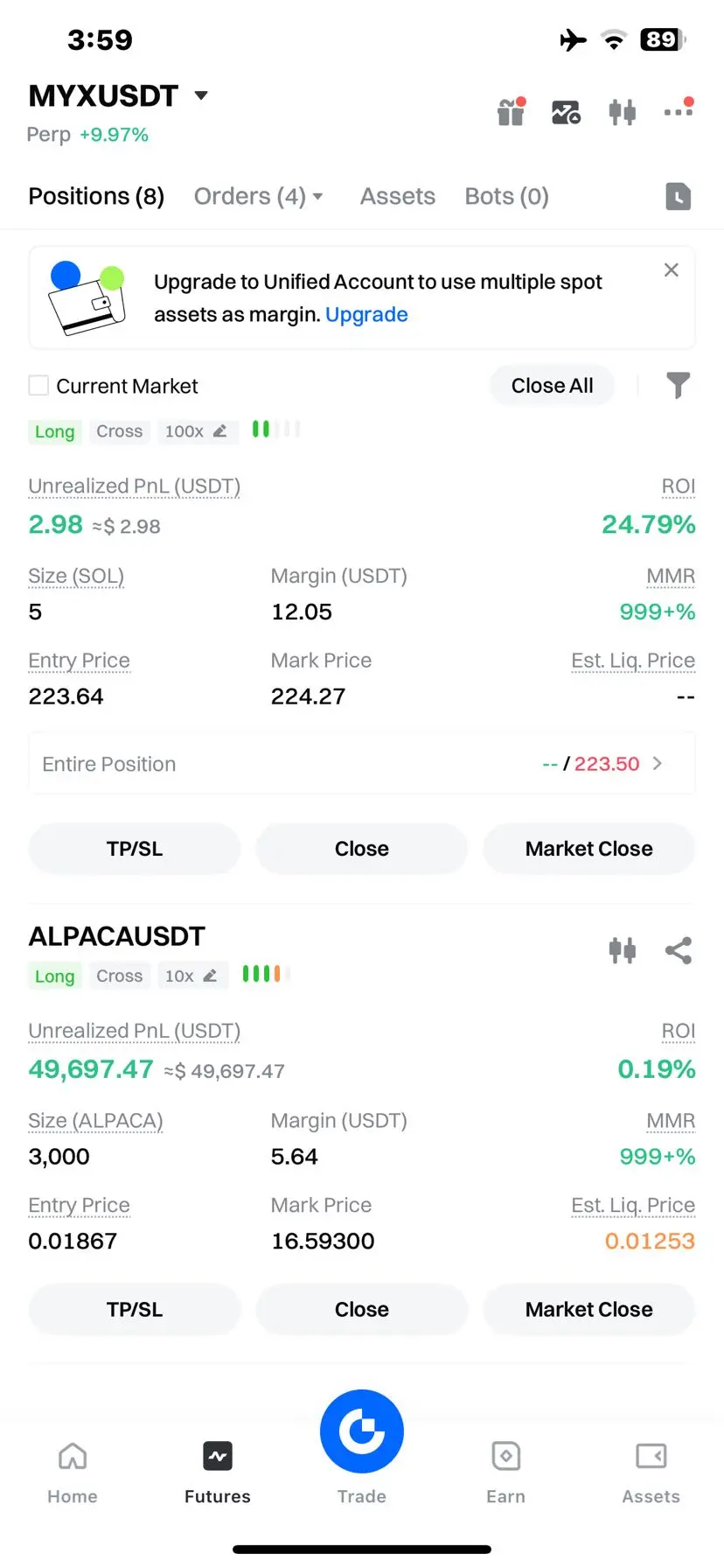

relax! it was glitch , and of course i couldnt book the profit, but i wish it was real though 🫰🫰View More

- Reward

- like

- Comment

- Repost

- Share

Bitcoin’s Bollinger Bands Hit Record Squeeze . what next? 🥵🥵

#Gatelayerofficiallylaunches #Joingrowthpointsdrawtowiniphone17 #BtcPriceAnalysis

#Gatelayerofficiallylaunches #Joingrowthpointsdrawtowiniphone17 #BtcPriceAnalysis

BTC0.05%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

ADA / USDT

- ADA is forming what many see as a bullish reversal setup. Signs include falling wedge or maybe cup-and-handle or higher lows. - Key levels: $0.86-$0.90 as major resistance to reclaim. These would be needed to flip momentum. - Support around $0.80 relies on staying above that zone. If that fails, downside is more likely.

Trade setup: — Entry: Buy near current levels (if ADA is ~$0.86-$0.90) OR better entry on pullback toward ~$0.80 if you can risk waiting — Stop-loss: ~5-8% below entry; e.g. if entry at $0.90, SL ~$0.82; if entry at ~$0.80, SL ~$0.73 — Take-profits: •

- ADA is forming what many see as a bullish reversal setup. Signs include falling wedge or maybe cup-and-handle or higher lows. - Key levels: $0.86-$0.90 as major resistance to reclaim. These would be needed to flip momentum. - Support around $0.80 relies on staying above that zone. If that fails, downside is more likely.

Trade setup: — Entry: Buy near current levels (if ADA is ~$0.86-$0.90) OR better entry on pullback toward ~$0.80 if you can risk waiting — Stop-loss: ~5-8% below entry; e.g. if entry at $0.90, SL ~$0.82; if entry at ~$0.80, SL ~$0.73 — Take-profits: •

ADA0.7%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

LINK / USDT

(WAIT FOR ENTY ) if breaks sbove 28

- LINK is testing resistance near $27.87–$29–$32 in some projections. If it breaks, upside is good. - Key supports around $21 region (golden retracement / moving averages) that have held in past analyses. If that holds, structure stays bullish.

Trade setup: — Entry: Ideally on break above $28 (resistance) OR a safer pullback toward $23-$25 if price dips — Stop-loss: ~5-7% below entry; for example, if entering at $28, SL at ~$25; if pullback entry at $23, SL ~$21 — Take-profits: • TP1: ~$34–$36 • TP2: ~$40-45 if momentum strong and r

(WAIT FOR ENTY ) if breaks sbove 28

- LINK is testing resistance near $27.87–$29–$32 in some projections. If it breaks, upside is good. - Key supports around $21 region (golden retracement / moving averages) that have held in past analyses. If that holds, structure stays bullish.

Trade setup: — Entry: Ideally on break above $28 (resistance) OR a safer pullback toward $23-$25 if price dips — Stop-loss: ~5-7% below entry; for example, if entering at $28, SL at ~$25; if pullback entry at $23, SL ~$21 — Take-profits: • TP1: ~$34–$36 • TP2: ~$40-45 if momentum strong and r

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

SOL / USDT

- SOL is consolidating just under a major resistance at ~$248–$250, which is seen as a “supply wall.” - Support zone around $230 is important. Holding above that gives bullish potential. - If price breaks cleanly above $248–$250 with strength/volume, it could swing up toward next resistance zones.

Trade setup: — Entry: buy on breakout above $250 OR conservative entry on pullback near $230–$235 — Stop-loss: if entry at $250, SL around $230; if entry at pullback, SL around $215–$220 — Take-profits: • TP1: ~$280–$300 • TP2: ~$330-350 if breakout is strong and holds —

- SOL is consolidating just under a major resistance at ~$248–$250, which is seen as a “supply wall.” - Support zone around $230 is important. Holding above that gives bullish potential. - If price breaks cleanly above $248–$250 with strength/volume, it could swing up toward next resistance zones.

Trade setup: — Entry: buy on breakout above $250 OR conservative entry on pullback near $230–$235 — Stop-loss: if entry at $250, SL around $230; if entry at pullback, SL around $215–$220 — Take-profits: • TP1: ~$280–$300 • TP2: ~$330-350 if breakout is strong and holds —

SOL-1.45%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

SOMI/USDT Short-Term Trade Setup

Trade Direction: We favor a LONG (buy) setup. SOMI has pulled back sharply from its Sept. 7, 2025 all-time high (~$1.9061 ) into the ~$1.22–1.30 zone. Multiple analyses suggest this area is strong support and likely to “bounce”  . For example, one signal notes that after the $1.90 peak, SOMI “is stabilizing near 1.22–1.25 support” and a “strong bounce zone” exists at $1.22 . Meanwhile, technical indicators remain constructive: short EMAs are still aligned bullishly and the MACD has turned positive . Funding rates are only slightly positive (e.g. +0.0100% o

Trade Direction: We favor a LONG (buy) setup. SOMI has pulled back sharply from its Sept. 7, 2025 all-time high (~$1.9061 ) into the ~$1.22–1.30 zone. Multiple analyses suggest this area is strong support and likely to “bounce”  . For example, one signal notes that after the $1.90 peak, SOMI “is stabilizing near 1.22–1.25 support” and a “strong bounce zone” exists at $1.22 . Meanwhile, technical indicators remain constructive: short EMAs are still aligned bullishly and the MACD has turned positive . Funding rates are only slightly positive (e.g. +0.0100% o

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

OnlyLoveToPlayWithA :

:

Hold on tight, we're about to To da moon 🛫