Pertarungan sebesar $5,6 miliar demi masa depan Hyperliquid

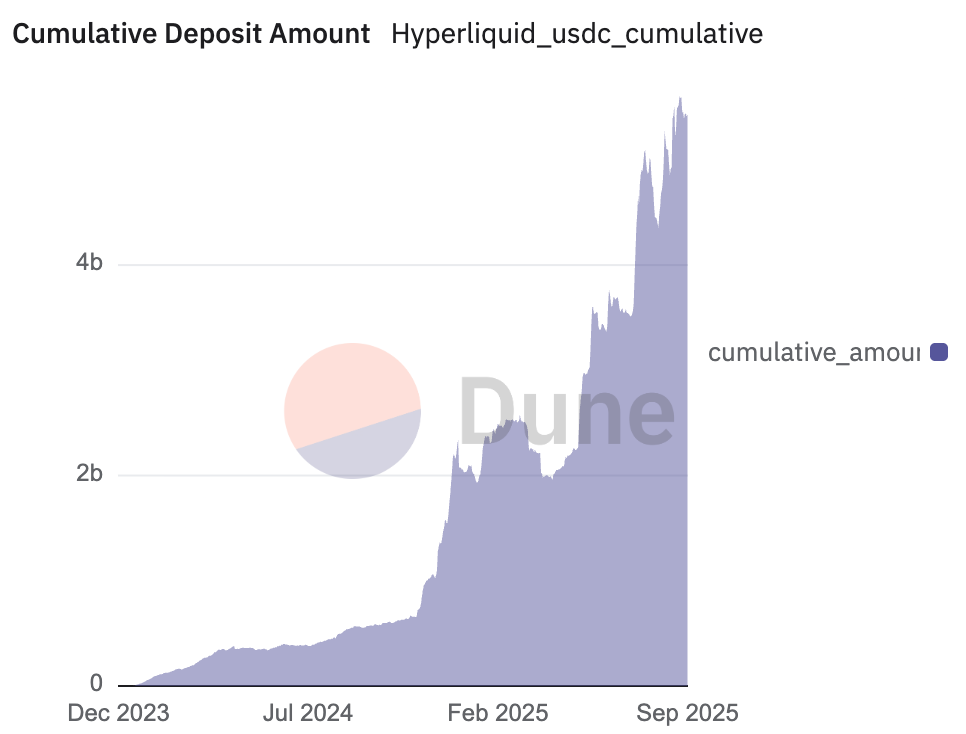

Miliaran dolar hadiah kini terkunci di Hyperliquid, bursa perps dengan pertumbuhan tercepat di sektor DeFi. Berkat UX yang sangat mulus dan jumlah pengguna yang melonjak pesat, bursa ini menjelma menjadi salah satu pusat utama derivatif on-chain, didukung lebih dari 5,6 miliar stablecoin—sebagian besar berupa Circle’s USDC—yang secara aktif memberdayakan mesin perdagangan mereka.

Dana tersebut menghasilkan arus pendapatan sangat besar dari cadangan yang mendasarinya, arus yang selama ini mengalir ke pihak eksternal. Kini komunitas Hyperliquid kini mengambil kendali atas sumber pendapatan tersebut.

Pada 14 September, Hyperliquid akan menghadirkan momen penentuan. Para validator yang melakukan staking HYPE akan menentukan dalam satu pemungutan suara krusial—menentukan siapa yang berhak memegang kunci USDH, stablecoin native pertama di platform. Yang diperebutkan jauh melebihi sekadar token. Kontrol atas mesin finansial yang mampu mengarahkan ratusan juta dolar kembali ke ekosistem menjadi intinya. Proses ini menyerupai lelang obligasi pemerintah atau RFQ bernilai miliaran dolar, namun semuanya dilakukan secara transparan di on-chain. Validator yang melakukan staking HYPE akan menentukan siapa yang akan mencetak USDH dan bagaimana nilai miliaran dolar akan didistribusikan ulang.

Kandidat-kandidat yang bertarung sangat kontras—sekelompok builder crypto-native yang menjanjikan total keselarasan, berhadapan langsung dengan institusi keuangan besar yang solid dalam pendanaan dan sistem kerja.

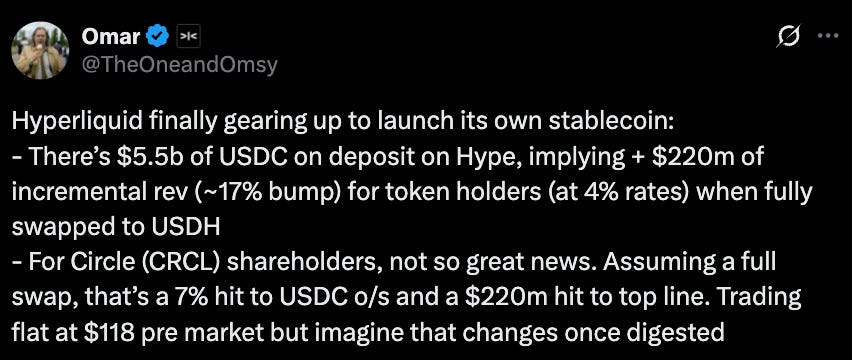

Model Teruji: Peluang Tahunan $220 Juta

Untuk melihat besaran yang dipertaruhkan, telusuri aliran dana: Saat ini mahkota ada di USDC. Circle, sebagai penerbit, meraup keuntungan besar dengan menempatkan cadangan di Treasury AS dan menikmati hasil return—$658 juta hanya dalam satu kuartal. Inilah model bisnis yang ingin diadopsi Hyperliquid.

Dengan menggantikan stablecoin pihak ketiga dengan USDH native, platform dapat menghentikan arus nilai yang keluar dan mengalirkan sumber keuntungan ke dalam ekosistem. Berdasarkan saldo saat ini, cadangan USDH berpotensi menghasilkan $220 juta per tahun. Transisi ini mengubah posisi Hyperliquid dari “pengguna” menjadi “pengelola”—tak lagi bergantung pada stablecoin eksternal, namun menguasai pondasinya sendiri. Bagi Circle, risikonya besar: kehilangan dana Hyperliquid dapat memangkas hingga 10% pendapatan Circle secara instan, memperlihatkan ketergantungan mereka pada pendapatan bunga.

Pertanyaan utama yang dihadapi komunitas kini bukan apakah akan mengejar peluang ini, melainkan siapa yang layak dipercaya untuk membangunnya.

Circle pun tidak tinggal diam. Bahkan sebelum rencana USDH diumumkan, Circle telah mengambil langkah memperkuat posisinya di Hyperliquid, mengumumkan USDC native dan CCTP V2 akhir Juli lalu. Upgrade ini memungkinkan transfer USDC lintas blockchain dengan efisiensi modal lebih tinggi, tanpa token wrapped dan tanpa jembatan konvensional. Circle juga mengintegrasikan on-ramp/off-ramp institusional via Circle Mint. Pesannya jelas: penerbit USDC yang telah go public tak akan menyerahkan likuiditas Hyperliquid kepada kompetitor tanpa perlawanan sengit.

Kandidat: Adu Filosofi dan Strategi

Beragam visi untuk USDH kini bermunculan, masing-masing menawarkan jalur strategis berbeda bagi Hyperliquid.

Native Markets, tim asli Hyperliquid, cepat masuk bursa setelah pengumuman USDH, mengusung stablecoin sesuai GENIUS Act yang dirancang khusus untuk platform. Proposal mereka meliputi gateway fiat terintegrasi untuk proses on-ramp/off-ramp yang efisien serta pembagian pendapatan bersama Hyperliquid Assistance Fund. Tim ini dimotori figur senior seperti MC Lader (mantan presiden Uniswap Labs), meski sebagian komunitas masih menyoroti soal waktu dan sumber daya pelaksanaan proposal. Native Markets tampil sebagai opsi paling selaras secara lokal—menggabungkan kepatuhan, keahlian on-chain, dan komitmen mengembalikan nilai ke ekosistem. Nilai lebihnya jelas: proyek domestik yang menjamin aspek regulasi dan keterikatan erat dengan $HYPE. Kekurangannya terletak pada kesiapan sumber daya dan ketepatan waktu eksekusi skala besar.

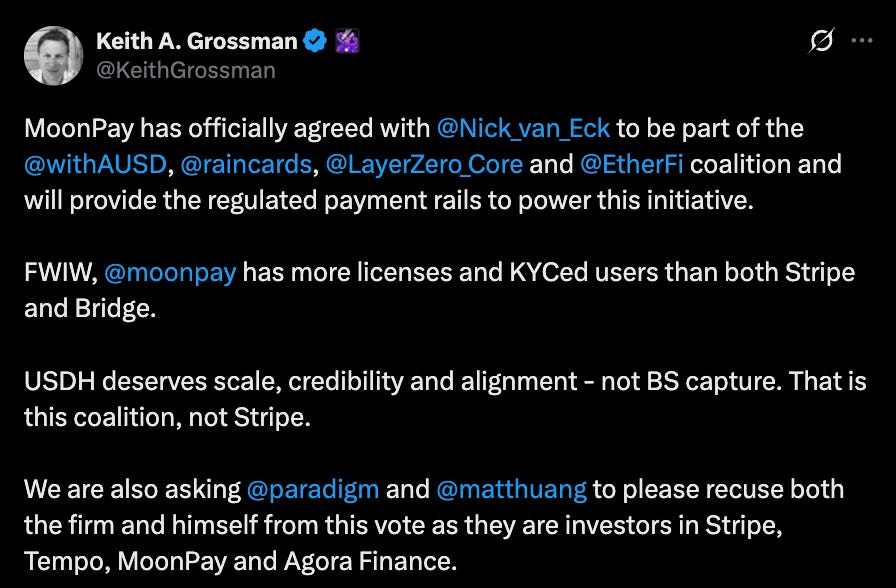

Kandidat lain yang memperoleh momentum besar adalah Agora, penyedia infrastruktur stablecoin, yang membentuk koalisi bersama sejumlah mitra mapan. Agora didukung MoonPay, layanan on-ramp crypto dengan cakupan yurisdiksi berlisensi dan pengguna KYC yang lebih luas daripada Stripe;

Rain, untuk pembayaran on-chain serta layanan kartu yang seamless; dan LayerZero untuk interoperabilitas lintas rantai yang superior.

Didukung pendanaan $50 juta dari Paradigm dan fokus pada kepatuhan melalui proof-of-reserves, Agora menawarkan keselarasan penuh dengan Hyperliquid. Cadangan bakal dikelola State Street dan VanEck, verifikasi cadangan oleh Chaos Labs. Kelompok ini juga menyiapkan minimal $10 juta likuiditas di hari pertama melalui mitra seperti Cross River dan Customers Bank. Proposalnya menawarkan model institusional teruji dengan satu janji utama: seluruh pendapatan bersih dari cadangan USDH akan dikembalikan ke ekosistem Hyperliquid. Dengan demikian, pertumbuhan stablecoin akan langsung menopang imbal hasil bagi pemegang HYPE. Keunggulan proposal ini meliputi kredibilitas institusi, kekuatan modal, dan kemampuan distribusi yang luas. Namun, ketergantungan pada bank dan kustodian berpotensi menghadirkan kembali hambatan off-chain yang ingin dihindari USDH.

Stripe, melalui akuisisi Bridge senilai $1,1 miliar, mengajukan proposal agar USDH menjadi tulang punggung jaringan pembayaran stablecoin global. Infrastruktur Bridge sudah mendukung bisnis dalam menerima dan menyelesaikan pembayaran stablecoin seperti USDC di lebih dari 100 negara dengan biaya rendah dan settlement instan. Integrasi ke Stripe membawa kredibilitas regulasi, arsitektur API ramah developer, dan konektivitas pembayaran/kartu yang seamless. Stripe juga tengah meluncurkan stablecoin fiat-nya sendiri, USDB, di ekosistem Bridge—dirancang untuk menghindari biaya blockchain eksternal dan memperkuat pertahanan ekosistem. Keuntungannya jelas: skala, reputasi, dan kekuatan distribusi Stripe berpotensi membawa USDH ke arus utama perdagangan global. Risikonya: potensi dominasi strategis—fintech terintegrasi vertikal dengan chain (Tempo) dan wallet (Privy) sendiri bisa menguasai lapisan moneter inti Hyperliquid.

Kandidat lain memilih strategi berbeda. Paxos, perusahaan trust teregulasi yang berbasis di New York, menawarkan pendekatan paling konservatif: prioritas utama pada kepatuhan. Paxos berkomitmen menyalurkan 95% bunga cadangan USDH langsung ke pembelian kembali HYPE. Paxos juga berjanji listing HYPE di seluruh jaringan mereka—termasuk PayPal, Venmo, dan MercadoLibre—saluran distribusi institusional yang tak dimiliki kandidat lain. Iklim regulasi AS yang makin ramah di bawah pemerintahan Trump tak menggoyahkan Paxos sebagai pilihan utama bagi pihak yang mengutamakan legitimasi dan daya tahan jangka panjang USDH. Sisi lemah proposal ini terletak pada ketergantungan penuh pada fiat custody serta paparan risiko perbankan dan regulasi AS—faktor yang pernah meruntuhkan BUSD.

Lain halnya, Frax Finance menawarkan proposal DeFi-native. Berasal dari ekosistem kripto, Frax menitikberatkan mekanisme on-chain, tata kelola komunitas, dan strategi pembagian hasil yang menarik bagi penganut crypto purist. Proposal Frax memasang taruhan pada visi USDH yang terdesentralisasi dan berbasis komunitas. Desainnya menjamin dukungan 1:1 antara USDH dan frxUSD serta Treasury yang dikelola BlackRock, serta redemption seamless ke USDC, USDT, frxUSD, dan fiat. Frax juga berkomitmen menyalurkan 100% yield kepada pengguna Hyperliquid, dengan tata kelola sepenuhnya di tangan validator. Keunggulannya adalah model komunitas yang teruji, imbal hasil tinggi, dan selaras dengan prinsip crypto. Kekurangannya: ketergantungan pada frxUSD dan Treasury off-chain berpotensi membawa risiko eksternal dan membatasi adopsi dibanding stablecoin fiat.

Konelia merupakan peserta kecil dan minim publikasi yang ikut lelang USDH bersama para pemain besar. Rencana mereka menonjolkan penerbitan sesuai regulasi, pengelolaan cadangan, dan keselarasan ekosistem untuk Layer 1 Hyperliquid. Berbeda dari kandidat utama, proposal Konelia belum banyak dipublikasikan dan masih terbatas perhatian dari komunitas. Meski telah diakui secara resmi sebagai kandidat, Konelia tetap dipandang sebagai peserta pinggiran dibanding rival yang lebih mapan. Kelebihannya ada pada kelayakan resmi dan kecocokan dengan Layer 1 Hyperliquid, namun kekurangan pada detail, pengenalan merek, dan minimnya dukungan komunitas membuat peluangnya tipis.

Terakhir, xDFi, tim veteran DeFi dari SushiSwap dan LayerZero, mengajukan proposal USDH sebagai stablecoin crypto-collateralized omnichain yang mendukung 23 EVM chain sejak hari pertama. Stabilitasnya dijamin oleh aset seperti ETH, BTC, USDC, dan AVAX, dengan saldo tersinkronisasi native di berbagai chain via infrastruktur xD tanpa perlu jembatan atau fragmentasi. Model ini menyalurkan 69% yield ke governance $HYPE, 30% ke validator, dan 1% ke maintenance protokol, menjadikan USDH milik komunitas tanpa keterlibatan bank maupun kustodian. Keunggulannya adalah desain tahan sensor dan murni crypto yang memperkuat posisi Hyperliquid sebagai liquidity hub utama. Risikonya: stabilitas sangat bergantung pada volatilitas aset kripto dan tidak ada perlindungan regulasi untuk adopsi arus utama.

Curve menawarkan opsi berbeda, memposisikan diri sebagai mitra. Berdasarkan mekanisme crvUSD LLAMMA, Curve mengajukan skema dua stablecoin: USDH teregulasi (oleh Paxos atau Agora) plus dUSDH terdesentralisasi yang didukung HYPE dan HLP serta dijalankan pada infrastruktur CDP Curve di bawah tata kelola Hyperliquid. Pendekatan ini membuka strategi leverage, looping, dan yield serta menciptakan mekanisme penguatan nilai secara berkelanjutan untuk HYPE dan HLP. Curve menonjolkan ketahanan dan stabilitas crvUSD dalam gejolak pasar, menawarkan lisensi fleksibel, dan model CDP yang telah menghasilkan $2,5–10 juta per tahun pada skala $100 juta. Kelebihannya adalah pendekatan “best of both worlds”—perlindungan regulasi plus opsi DeFi-native. Kekurangannya berupa risiko fragmentasi likuiditas dan merek antara dua stablecoin, serta penggunaan aset Hyperliquid sebagai kolateral.

Mandat Terdesentralisasi

Validator Hyperliquid akan mengambil keputusan akhir melalui voting on-chain. Untuk memastikan hasil yang adil dan berpusat komunitas, Hyperliquid Foundation telah menyatakan tidak akan ikut voting.

Dengan berjanji mengikuti suara mayoritas, foundation mengambil sikap netral—menghilangkan kekhawatiran sentralisasi dan menegaskan keputusan mutlak di tangan para pemangku kepentingan.

14 September akan menjadi lebih dari sekadar pemungutan suara—ini adalah momentum ujian sejauh mana tata kelola DeFi telah berkembang, dari diskusi fee-switch simbolik menuju penentuan kontrak bernilai miliaran dolar melalui voting komunitas.

Disclaimer:

- Artikel ini merupakan reprint dari [Tristero Research]. Hak cipta sepenuhnya milik penulis asli [@tristero">Tristero Research]. Jika ada keberatan atas reprint ini, silakan hubungi tim Gate Learn untuk penanganan segera.

- Disclaimer: Semua pendapat dan pandangan di artikel ini sepenuhnya milik penulis dan tidak menjadi saran investasi.

- Penerjemahan artikel ke dalam bahasa lain dilakukan oleh tim Gate Learn. Kecuali disebutkan, dilarang menyalin, mendistribusikan, atau melakukan plagiasi terhadap artikel terjemahan.

Artikel Terkait

Apa itu Tronscan dan Bagaimana Anda Dapat Menggunakannya pada Tahun 2025?

Apa itu USDC?

Apa Itu Narasi Kripto? Narasi Teratas untuk 2025 (DIPERBARUI)

Apa itu Stablecoin?

Penggunaan Bitcoin (BTC) di El Salvador - Analisis Keadaan Saat Ini