Post content & earn content mining yield

placeholder

WOWMY NEXT CALL TOMORROW WILL RUN THIS WAY. IF YOU MISSED $PENGUIN, DONT MISS MY NEXT CALL!

PENGUIN17.66%

- Reward

- like

- Comment

- Repost

- Share

Rotating into the real $LOCKIN and rotating out poverty.

- Reward

- like

- Comment

- Repost

- Share

龙

龙腾盛世

Created By@ComeWealth,ComeWealth

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinFallsBehindGold Global financial markets are quietly signaling a shift: the hierarchy of safe-haven assets is evolving. Recent price behavior highlights a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tensions, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

BTC1.01%

- Reward

- 2

- 6

- Repost

- Share

Discovery :

:

1000x VIbes 🤑View More

January 28th Jing Yi Morning Gold Review

Multiple positive factors boost gold prices to new highs, as the US government shutdown probability rises to 80%, and the US dollar declines for the third consecutive day, losing the 97 level; the Federal Reserve interest rate meeting is approaching, with bets on rate cuts intensifying. Tensions in the Middle East are high, risk aversion sentiment is at its peak, and gold bulls are strongly motivated.

Technically, the hourly gold chart broke through 5100 and surged to 5190+ to hit a new all-time high, with the MACD red histogram expanding, moving av

View OriginalMultiple positive factors boost gold prices to new highs, as the US government shutdown probability rises to 80%, and the US dollar declines for the third consecutive day, losing the 97 level; the Federal Reserve interest rate meeting is approaching, with bets on rate cuts intensifying. Tensions in the Middle East are high, risk aversion sentiment is at its peak, and gold bulls are strongly motivated.

Technically, the hourly gold chart broke through 5100 and surged to 5190+ to hit a new all-time high, with the MACD red histogram expanding, moving av

- Reward

- like

- Comment

- Repost

- Share

$METCIt got rejected at $28.46-fibo50. That level is also the neckline. Right now it’s below the correction band, but what matters is how it closes the week

- Reward

- like

- Comment

- Repost

- Share

If okay can I hold 3330? #8clock I proceed

- Reward

- like

- Comment

- Repost

- Share

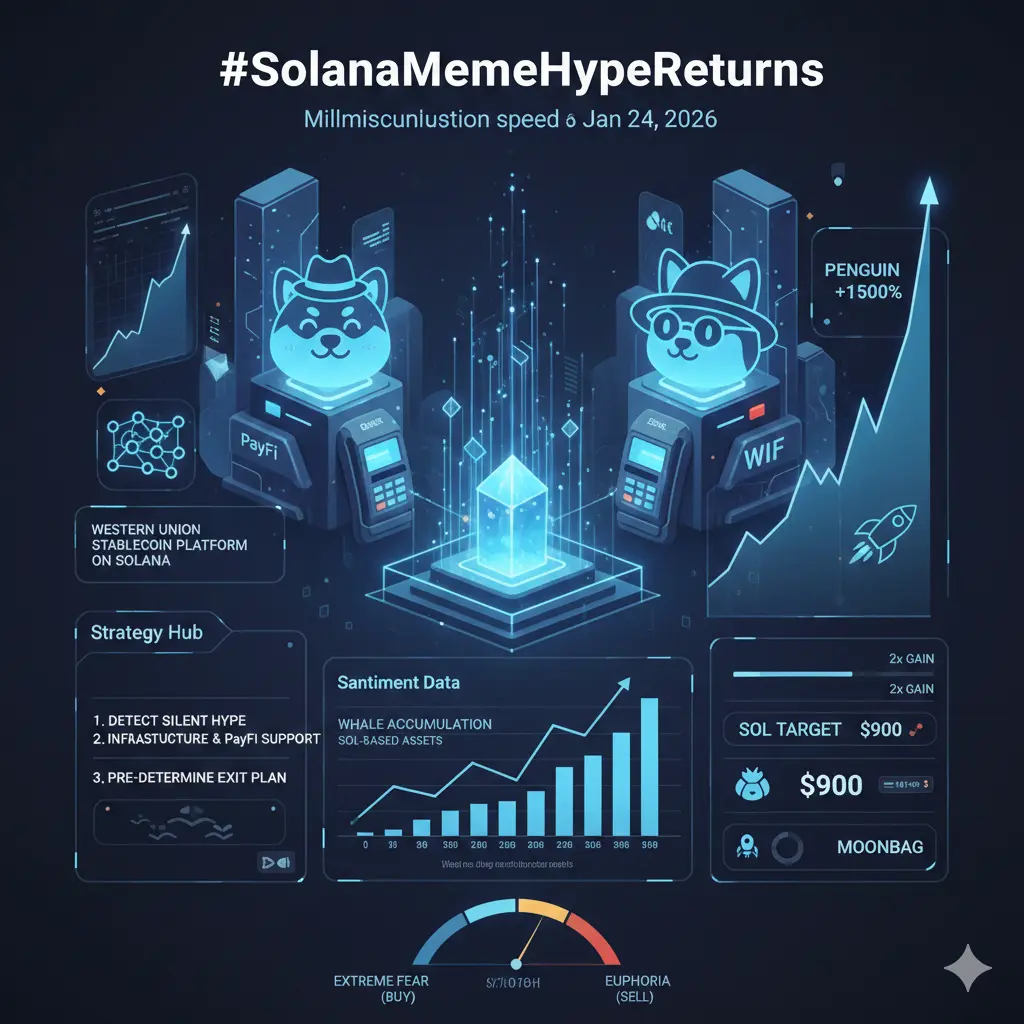

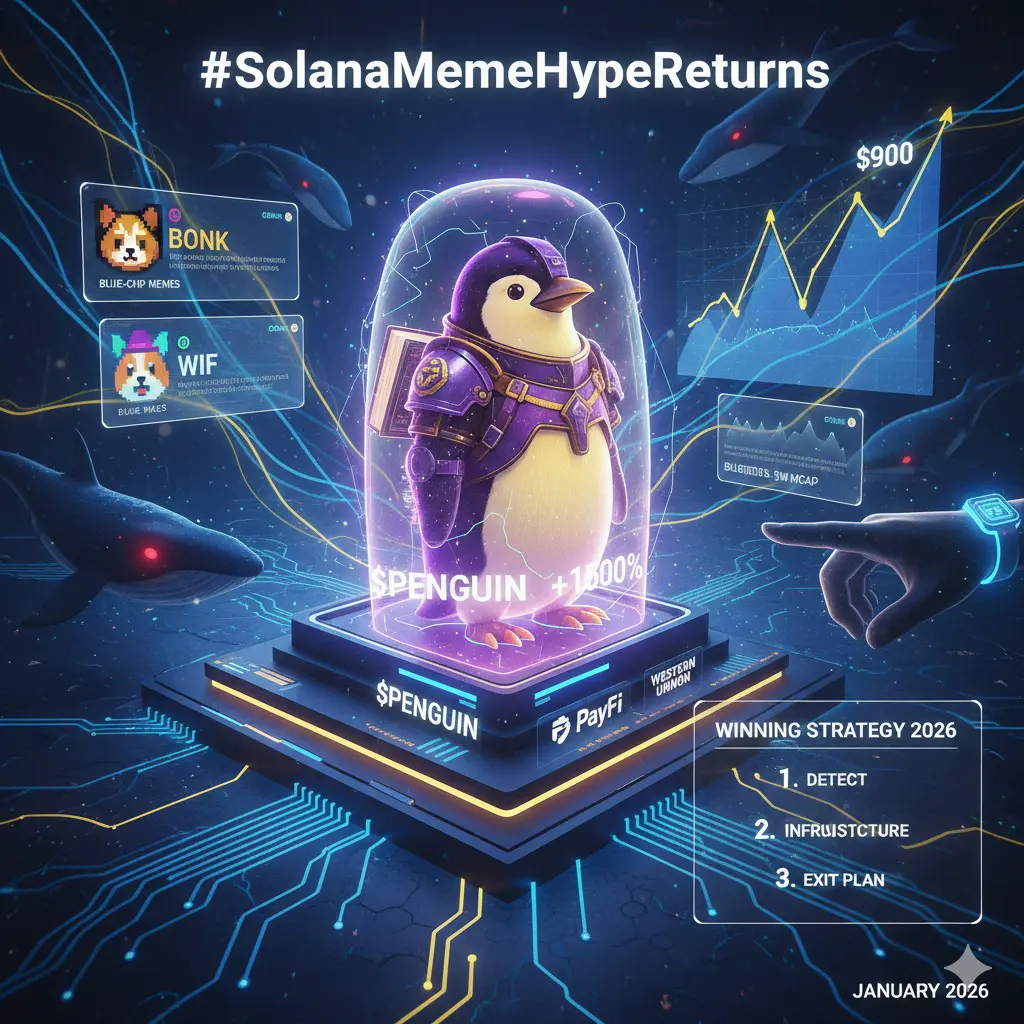

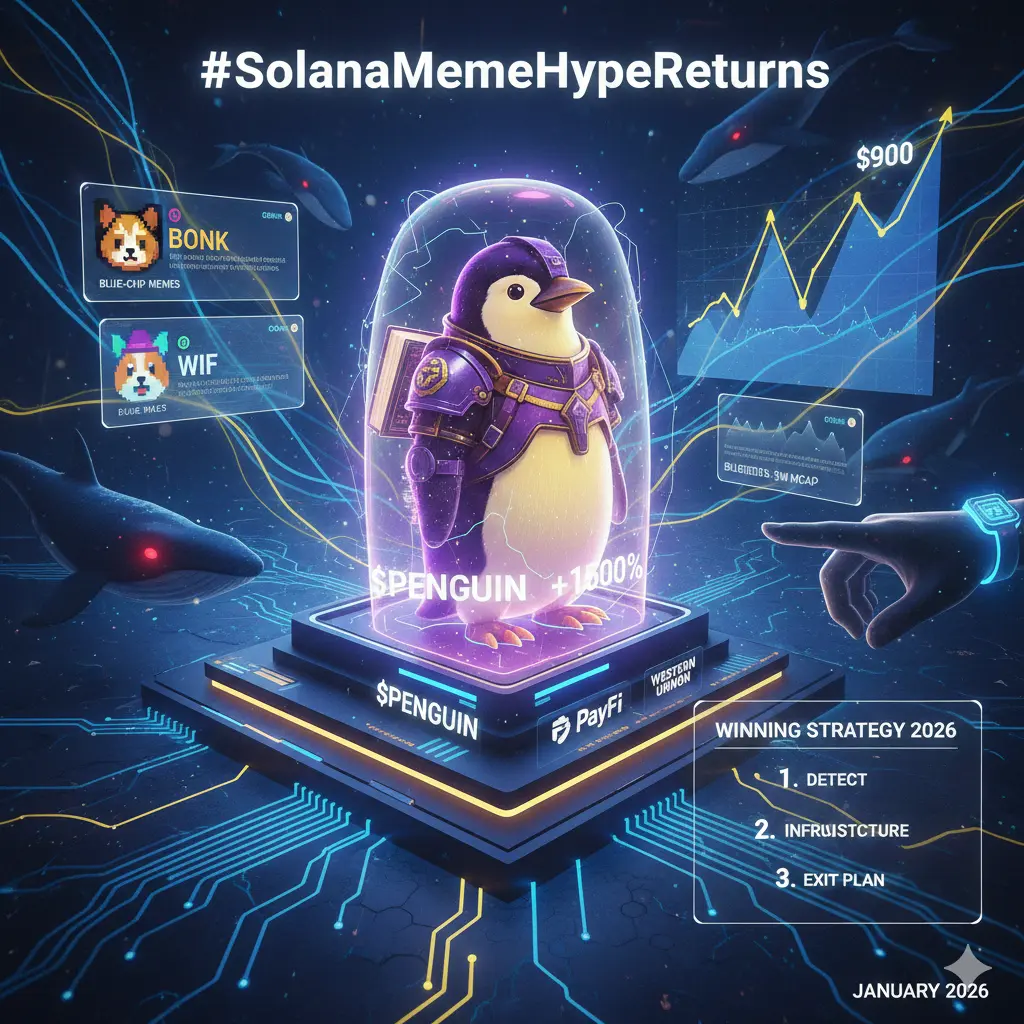

#SolanaMemeHypeReturns As 2026 unfolds, the cryptocurrency market is witnessing a fundamental transformation in how meme assets are perceived and valued. What once existed primarily as short-lived speculation is evolving into a cultural and structural phenomenon, with Solana emerging as the central network driving this shift. The meme coin narrative is no longer built purely on chance, but on the convergence of community strength, network performance, and expanding on-chain utility.

The early months of 2026 have positioned Solana at the forefront of this renaissance. Major protocol upgrades ha

The early months of 2026 have positioned Solana at the forefront of this renaissance. Major protocol upgrades ha

- Reward

- 2

- 6

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$39.89K

Create My Token

The all-new MBH is back, and the English version is only to go further!

2026 MBH accompanies you forward

View Original2026 MBH accompanies you forward

[The user has shared his/her trading data. Go to the App to view more.]

MC:$7.69KHolders:17

18.73%

- Reward

- like

- Comment

- Repost

- Share

$BTC 1.28 Bitcoin Price Today: The overall market structure is clear (W-X-Y), but the operability is extremely low. The mid-term X wave is oscillating, and its internal structure has multiple possible paths. It is currently impossible to confirm whether it has ended, is constructing the B wave, or is part of a more complex sub-wave, making it unusable for guiding trades. On a smaller scale, the five-wave decline from $98,000 has ended, and the market is currently in a rebound phase, but whether a reversal trend will form remains uncertain. The only technical level to reference is the small-

BTC1.01%

- Reward

- like

- Comment

- Repost

- Share

A watch that can mine bitcoin. This is some futuristic shit. 👀

BTC1.01%

- Reward

- like

- Comment

- Repost

- Share

Quant just sent me this

- Reward

- like

- Comment

- Repost

- Share

#内容挖矿焕新公测开启 $Laozi “Everyone is a VIP” All income (live mining + trading fees)) converges on one point: focusing on token repurchase. This reduces circulating supply and continuously injects market capital, strongly driving value growth. $ChineseCoin Everyone is a VIP, buy and hold, wait for listing. The earlier you buy, the sooner you enjoy; the later you buy, the higher the price.

老子4.78%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#CryptoRegulationNewProgress

If you're having a bad day today 😫

Remember that someone bought #NFT which was a picture of the very first tweet ever posted in history

The crazy one bought it for 2.9 million dollars

And now its value is 10 dollars😅🤦♂️

View OriginalIf you're having a bad day today 😫

Remember that someone bought #NFT which was a picture of the very first tweet ever posted in history

The crazy one bought it for 2.9 million dollars

And now its value is 10 dollars😅🤦♂️

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More56.09K Popularity

19.2K Popularity

14.73K Popularity

6.43K Popularity

5.21K Popularity

News

View MoreData: If BTC drops below $84,830, the total long liquidation strength of mainstream CEXs will reach $1.593 billion.

1 m

Data: If ETH drops below $2,872, the total long liquidation strength on mainstream CEXs will reach $1.368 billion.

1 m

ETH large whale sells 10,000 stETH, profit of $1,039,000

1 m

Today, the Fear & Greed Index remains at 29, and the market is in a "fear" state.

2 m

SoftBank is in talks to invest up to $30 billion more in OpenAI

4 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889