- Trending TopicsView More

2K Popularity

4.7M Popularity

119.6K Popularity

77.5K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Crypto Market Sentiment: Analyzing the Emotional Pulse

###The Emotional Pulse of Crypto Markets

In the dynamic world of cryptocurrencies, understanding market sentiment is crucial for navigating the volatile landscape. The Crypto Fear & Greed Index serves as a barometer, measuring the emotional state of investors and traders. Currently standing at 47, the index reflects a neutral sentiment, a slight shift from yesterday's 48 and last week's 51.

This sentiment indicator ranges from 0 (Extreme Fear) to 100 (Extreme Greed), offering valuable insights into potential market movements. When the index dips low, it may signal overselling, while high values could warn of an impending market correction. By combining trading data and user behavior analysis, this tool provides a comprehensive overview of market sentiment.

###Ethereum's Precarious Position

Ethereum (ETH) finds itself in a critical position, teetering between euphoria and potential disaster. With a current price of $4,454.56, showing a slight 24-hour decline of 0.57%, the cryptocurrency is approaching what some analysts call the "kill zone."

Looking ahead to 2025-2026, analysts project a potential price range of $4,850-$5,000, with liquidation triggers between $4,900-$5,200 that could result in estimated liquidations of $6.8B-$7.5B. The immediate target sits at $3,300, with a possible capitulation wick between $2,700-$2,900. Ethereum Price Projection 2025-2026

Ethereum Price Projection 2025-2026

Market observers suggest that whales may be setting a bull trap, luring retail investors into euphoric long positions. For those considering strategic moves, experts identify the short setup zone between $4,800 and $4,950, with a target of $3,200 and a stop loss at $5,250. However, traders are cautioned about potential fakeouts in this volatile market.

###Geopolitical Shifts in Energy Markets

Recent geopolitical developments are reshaping the global energy landscape. The European Union has announced plans to ban certain energy imports by January 1, 2027, a year earlier than initially planned. This move aims to reduce dependency on specific energy sources and diversify suppliers.

While some sources have dismissed the impact of this decision, industry analysts point to potential beneficiaries in the global energy sector. Companies specializing in liquefied natural gas (LNG) production and distribution, particularly those based in the United States, are expected to see increased demand as Europe seeks alternative energy sources.

###Solana's Technical Analysis

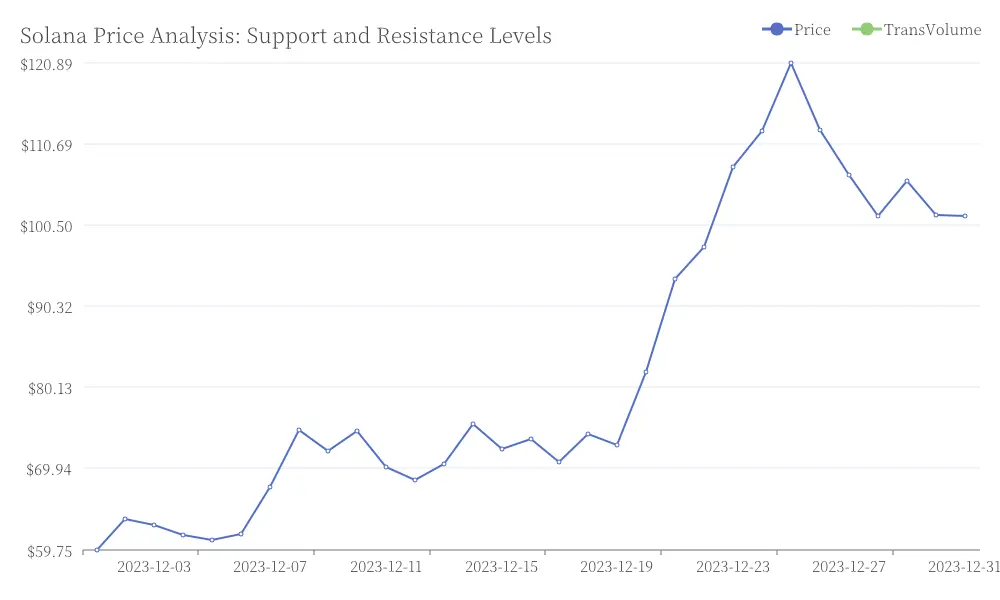

Solana (SOL) is garnering attention as its weekly chart suggests a potential significant price movement. Currently trading around $235, the cryptocurrency faces key support and resistance levels that could determine its short-term trajectory.

From a technical perspective, Solana's current price hovers around $235, which serves as a key support level, while $250 represents important resistance. Analysts see potential upside beyond $260 if bullish momentum continues, but downside risk could take prices to $220 or lower if support fails. Solana Price Analysis: Support and Resistance Levels

Solana Price Analysis: Support and Resistance Levels

Traders are advised to closely monitor volume and momentum indicators for confirmation of any breakout or breakdown. A sustained move above $235 could push SOL towards $250 and potentially beyond, while a failure to hold this level might lead to a retest of lower support areas.

As the crypto market continues to evolve, these key developments in major cryptocurrencies and global energy policies underscore the importance of staying informed and analyzing market sentiment. The interplay between technical analysis, geopolitical events, and investor psychology remains crucial for navigating the complex world of digital assets.