Polymarket Expands to Solana Through Jupiter Integration in $35M JUP Deal

30m ago

Weiss Crypto Backs NIGHT Over Zcash, Citing Predictable Costs and Better Privacy Design

40m ago

Trending Topics

View More14.39K Popularity

9.53K Popularity

8.28K Popularity

3.24K Popularity

5.24K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.65KHolders:10.00%

- MC:$0.1Holders:10.00%

Polygon Rebounds as ERC-8004 Standard Expands Blockchain Utility

Polygon said Ethereum’s ERC-8004 standard is now live on its network, introducing support for “trustless agents” on Polygon. In an X post, the network stated that ERC-8004 is designed to make identity and reputation portable for agents, to enable agent interactions across layer-2 environments without relying on closed systems. POL price action steadied as the update circulated. The token held above $0.1100 on Tuesday after rebounding from the $0.1000 psychological level, following an 11% rise on Monday. The move came after a broader slide over recent weeks, with a 21% decline across the prior three-week stretch.

Ethereum’s trustless agents are live on Polygon.

ERC-8004 makes identity and reputation portable, unlocking agentic interactions across L2s orgs without the walled gardens.

The result: a scalable, permissionless agent economy pic.twitter.com/VZ9cwLI2I6

— Polygon | POL (@0xPolygon) February 2, 2026

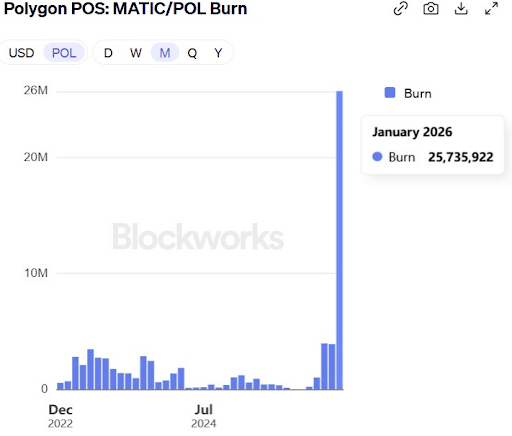

Onchain data pointed to stronger cross-chain flows and higher stablecoin balances over the past 24 hours. Artemis data showed Polygon recorded $13.6 million in bridged net inflows during that period. It also reported a $29 million increase in the network’s stablecoin supply over the same window. Most recently, Polygon expanded enterprise use cases by serving as the settlement layer for Toku’s global stablecoin payroll service. We reported that the integration is designed to support compliant payroll payments in more than 100 countries. Polygon Technical Levels and Supply Data Remain in View Supply indicators were also mentioned as traders evaluated the recent situation. According to Blockworks data, 25.73 million POL tokens were burned in January, which is a significant number for the network. POL Monthly Burn Data | Source: Blockworks

Technically, the broader trend remains bearish even though the short-term movement has gone up. The 50-day, 100-day, and 200-day exponential moving averages on the daily chart were shown to be moving downward, which is an indicator of continuous bearish pressure.

This analysis pegged the 50-day EMA at approximately $0.1273 with the 100-day and 200-day EMAs at approximately $0.1422 and $0.1743, respectively, which are usually followed when recovery is being attempted.

However, momentum readings showed less selling pressure than earlier sessions. The MACD line was moving closer to the signal line while both stayed below zero, and the RSI was near 40 after lifting from oversold territory. On the downside, a move under $0.1100 could shift attention back to $0.1000, with $0.0691 as the lower area tied to the S1 pivot level.

Additionally, Polygon Labs signed definitive agreements to acquire Coinme and Sequence to build a U.S.-compliant stablecoin payments platform under the Open Money Stack. Last month, CNF reported that Coinme operates in 48 U.S. states and supports more than 50,000 fiat-to-crypto retail locations.

At the time of reporting, POL was still up 13% over the past 24 hours, trading at $0.1169. It posted a 24-hour trading volume of about $138.6 million and a market cap of $1.23 billion.

POL Monthly Burn Data | Source: Blockworks

Technically, the broader trend remains bearish even though the short-term movement has gone up. The 50-day, 100-day, and 200-day exponential moving averages on the daily chart were shown to be moving downward, which is an indicator of continuous bearish pressure.

This analysis pegged the 50-day EMA at approximately $0.1273 with the 100-day and 200-day EMAs at approximately $0.1422 and $0.1743, respectively, which are usually followed when recovery is being attempted.

However, momentum readings showed less selling pressure than earlier sessions. The MACD line was moving closer to the signal line while both stayed below zero, and the RSI was near 40 after lifting from oversold territory. On the downside, a move under $0.1100 could shift attention back to $0.1000, with $0.0691 as the lower area tied to the S1 pivot level.

Additionally, Polygon Labs signed definitive agreements to acquire Coinme and Sequence to build a U.S.-compliant stablecoin payments platform under the Open Money Stack. Last month, CNF reported that Coinme operates in 48 U.S. states and supports more than 50,000 fiat-to-crypto retail locations.

At the time of reporting, POL was still up 13% over the past 24 hours, trading at $0.1169. It posted a 24-hour trading volume of about $138.6 million and a market cap of $1.23 billion.