Post content & earn content mining yield

placeholder

$RLS is reacting after a hard liquidity sweep and failed continuation, and I’m watching how price behaves at this compression zone.

Reason / Market read

I’m looking at this move as post-distribution stabilization. Price ran liquidity toward 0.0062, trapped late buyers, and then rotated lower with controlled selling. That flush toward 0.0050 cleaned weak hands, and now we’re seeing price slow down — not accelerating lower. That matters.

Structure & context

I’m seeing range compression after expansion. Momentum faded after the rejection, and now price is holding a tight zone near prior demand

Reason / Market read

I’m looking at this move as post-distribution stabilization. Price ran liquidity toward 0.0062, trapped late buyers, and then rotated lower with controlled selling. That flush toward 0.0050 cleaned weak hands, and now we’re seeing price slow down — not accelerating lower. That matters.

Structure & context

I’m seeing range compression after expansion. Momentum faded after the rejection, and now price is holding a tight zone near prior demand

RLS-1.73%

- Reward

- 1

- Comment

- Repost

- Share

For a long time, DeFi protocols have faced a fundamental contradiction: products are becoming increasingly specialized, but the user base remains confined to a small circle. Complex strategy combinations and frequent operational requirements have kept most ordinary users on the outside. The emergence of @Hypercroc_xyz has pioneered a new path for on-chain asset management products to advance simultaneously toward professionalism and mass adoption. Through an intelligent Vault system, multi-strategy operations that previously required manual execution are now integrated into automated processes

View Original

- Reward

- like

- Comment

- Repost

- Share

NAINAI

NAI

Created By@LandRacetrack

Listing Progress

0.00%

MC:

$0.1

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$AAVE — BULLISH: Higher-low reclaim, buyers defending 112 support.

Direction: Long

Entry: 112.0 – 113.2

Stop: 109.8

Targets:

• TP1: 114.8

• TP2: 116.4

• TP3: 118.8

Thesis:

Momentum/structure: reclaiming after pullback from 116.4

Expectation: continuation upside while 111–110 holds

Trade here ⬇️ $AAVE

Direction: Long

Entry: 112.0 – 113.2

Stop: 109.8

Targets:

• TP1: 114.8

• TP2: 116.4

• TP3: 118.8

Thesis:

Momentum/structure: reclaiming after pullback from 116.4

Expectation: continuation upside while 111–110 holds

Trade here ⬇️ $AAVE

AAVE4.04%

- Reward

- like

- Comment

- Repost

- Share

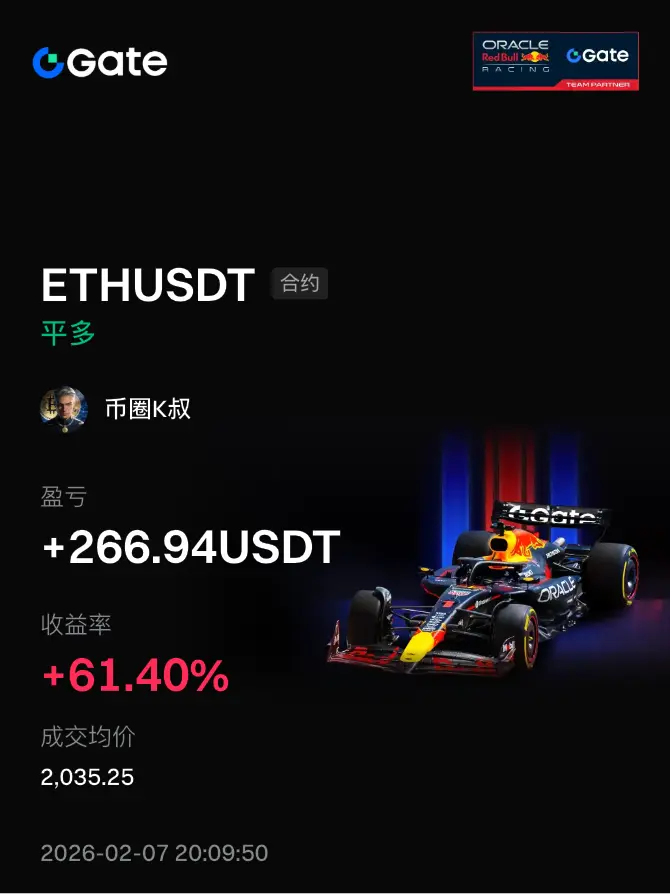

$ETH — BULLISH: Strong bounce, reclaiming 2k after pullback.

Direction: Long

Entry: 2,000 – 2,040

Stop: 1,950

Targets:

• TP1: 2,080

• TP2: 2,120

• TP3: 2,155

Thesis:

Momentum/structure: reclaiming after drop from 2,119

Expectation: continuation upside while 1,980–2,000 holds

Trade here ⬇️ $ETH

Direction: Long

Entry: 2,000 – 2,040

Stop: 1,950

Targets:

• TP1: 2,080

• TP2: 2,120

• TP3: 2,155

Thesis:

Momentum/structure: reclaiming after drop from 2,119

Expectation: continuation upside while 1,980–2,000 holds

Trade here ⬇️ $ETH

ETH4.2%

- Reward

- like

- Comment

- Repost

- Share

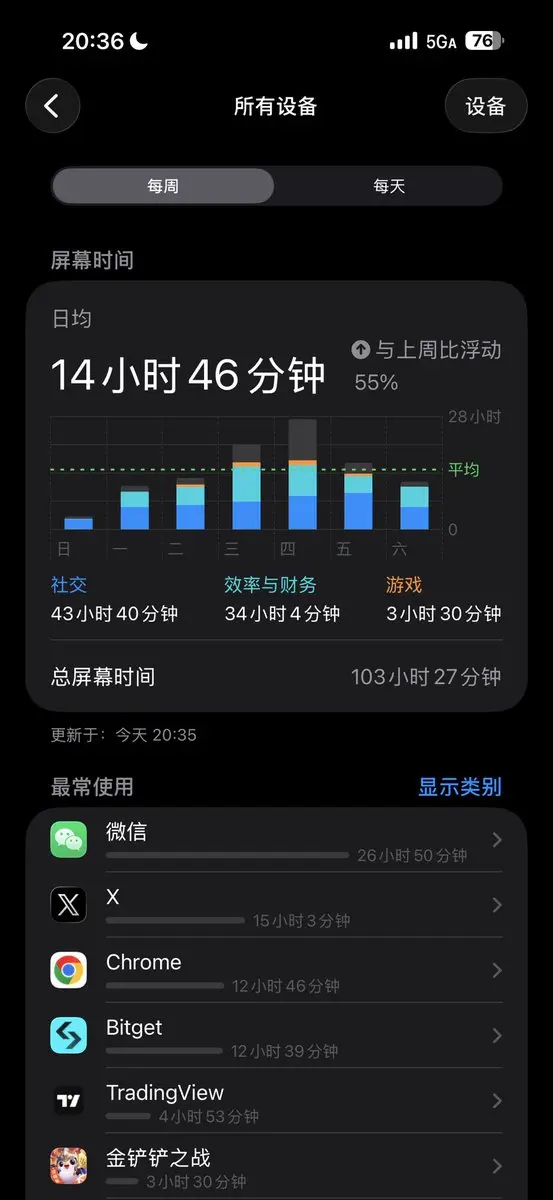

Next week, excel in screen time by working hard on both long and short trading strategies.

View Original

- Reward

- like

- Comment

- Repost

- Share

Bought the dip: Sold the bottom:

- Reward

- like

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF

Bitwise Files for Uniswap (UNI) Spot ETF: A Milestone for DeFi and Institutional Crypto Adoption

Bitwise Asset Management, a leading provider of cryptocurrency investment products, has officially filed for a spot exchange-traded fund (ETF) tracking Uniswap (UNI). This move represents a significant step forward in bridging decentralized finance (DeFi) with traditional capital markets. By offering a regulated investment vehicle tied directly to UNI, Bitwise is signaling growing institutional interest in DeFi protocols and setting the stage for wider adoption of digita

Bitwise Files for Uniswap (UNI) Spot ETF: A Milestone for DeFi and Institutional Crypto Adoption

Bitwise Asset Management, a leading provider of cryptocurrency investment products, has officially filed for a spot exchange-traded fund (ETF) tracking Uniswap (UNI). This move represents a significant step forward in bridging decentralized finance (DeFi) with traditional capital markets. By offering a regulated investment vehicle tied directly to UNI, Bitwise is signaling growing institutional interest in DeFi protocols and setting the stage for wider adoption of digita

UNI3%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

马尔福

马尔福

Created By@0xd1b5...a733

Listing Progress

0.00%

MC:

$0.1

Create My Token

$BLACKSWAN is about to breakout 🦢⚫

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

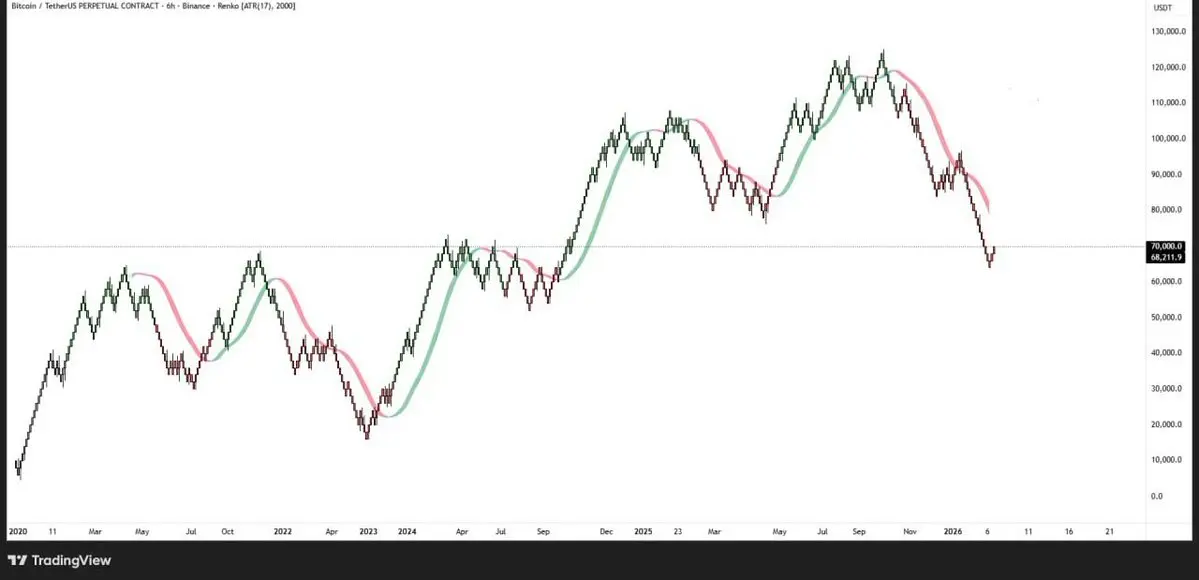

The price of Bitcoin rose $10k , and the fear and greed index dropped from 9 to 6. I would be scared to have a 9 to 5 job 🤣

BTC2.47%

- Reward

- like

- Comment

- Repost

- Share

$ARB is showing early bullish momentum after a strong bounce from recent lows, with buyers stepping in as selling pressure weakens.

Price is forming higher lows on lower timeframes, suggesting recovery strength.

A break above nearby resistance could fuel further upside continuation.

Momentum building.

#Trading #Gate

Price is forming higher lows on lower timeframes, suggesting recovery strength.

A break above nearby resistance could fuel further upside continuation.

Momentum building.

#Trading #Gate

ARB5.68%

- Reward

- 1

- Comment

- Repost

- Share

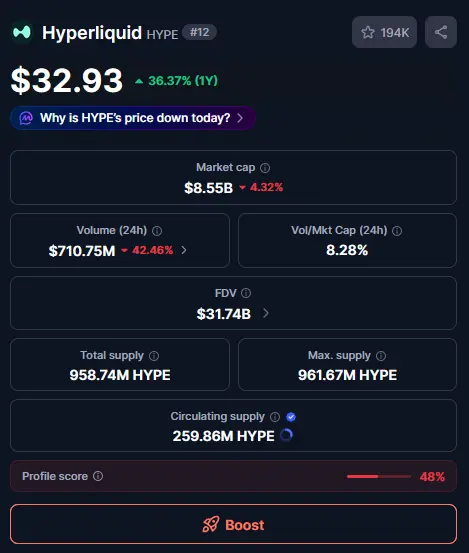

The HYPE Futures Trading Challenge is now live on Gate. Check in daily and share 50,000 USDT in total rewards. Simple trading, exciting airdrops – don't miss out. https://www.gate.com/campaigns/4003?ref=VVBDU19YCQ&ref_type=132

- Reward

- 2

- 7

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

High Volatility in BYC,ETH,SOL - Washout or trend reversal

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

CRYPTO ANALYSIS 722 TWO

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More131.79K Popularity

29.47K Popularity

391.33K Popularity

11.95K Popularity

10.9K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$2.4KHolders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.42KHolders:20.14%

- MC:$0.1Holders:10.00%

News

View MoreEthereum treasury company Bit Digital disclosed that at the end of January, ETH holdings exceeded 155,000, valued at over $380 million.

1 m

Opinion: This round of the crypto bear market was not caused by a single factor; instead, a combination of 15 major factors collectively drove the market downturn.

6 m

Whale 0x3952 Shifts from Profit to Loss, Deposits $50M ETH to Exchanges

32 m

MetYa has completed the first round of MY quarterly burn in 2026, permanently destroying approximately 5,756,710 MY tokens.

38 m

Bitcoin short-term trend opinions divided: some traders eye $84,000, but bear market risk still exists

1 h

Pin