# BTC

37.66M

LedgerBull

What we saw in the last 24 hours was not random selling, it was a clean leverage flush. BTC slipping under 76K dragged ETH and SOL with it, funding reset fast, open interest got wiped, and volatility came back exactly where it was missing. This is the kind of move that shakes out weak positioning, not long term conviction.

Right now the market is doing what it always does before the next directional leg. It punishes impatience and rewards structure.

On portfolio strategy, this is not an all in or all out moment. I am holding dry powder while staying positioned in high conviction spots. Core ho

Right now the market is doing what it always does before the next directional leg. It punishes impatience and rewards structure.

On portfolio strategy, this is not an all in or all out moment. I am holding dry powder while staying positioned in high conviction spots. Core ho

- Reward

- like

- Comment

- Repost

- Share

What we saw in the last 24 hours was not random selling, it was a clean leverage flush. BTC slipping under 76K dragged ETH and SOL with it, funding reset fast, open interest got wiped, and volatility came back exactly where it was missing. This is the kind of move that shakes out weak positioning, not long term conviction.

Right now the market is doing what it always does before the next directional leg. It punishes impatience and rewards structure.

On portfolio strategy, this is not an all in or all out moment. I am holding dry powder while staying positioned in high conviction spots. Core ho

Right now the market is doing what it always does before the next directional leg. It punishes impatience and rewards structure.

On portfolio strategy, this is not an all in or all out moment. I am holding dry powder while staying positioned in high conviction spots. Core ho

- Reward

- like

- Comment

- Repost

- Share

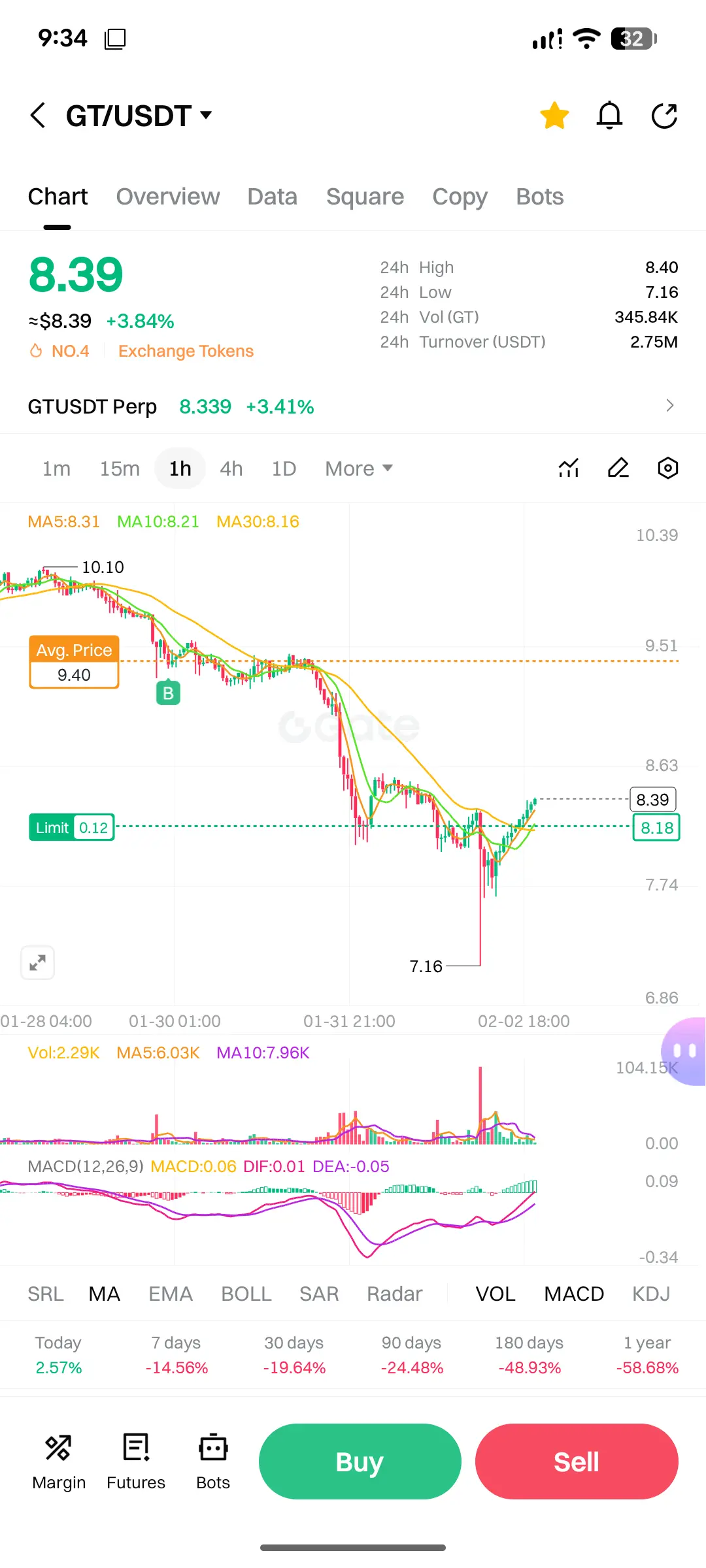

GT/USDT is showing early signs of a short-term trend shift after a prolonged bearish phase. On the 1H chart, price rebounded strongly from the 7.16 support zone, forming a higher low and reclaiming the 8.18–8.30 area. This bounce is supported by improving volume and a clear bullish crossover on MACD, with histogram turning positive, suggesting momentum is gradually shifting to buyers.

Moving averages are beginning to compress, with price pushing above the short-term MA5 and MA10, while MA30 still acts as overhead resistance. This structure often signals a relief rally or the early stage of a t

Moving averages are beginning to compress, with price pushing above the short-term MA5 and MA10, while MA30 still acts as overhead resistance. This structure often signals a relief rally or the early stage of a t

- Reward

- 1

- 2

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

📉MARKET CORRECTION DEEP DIVE: ETF Outflows, Liquidations & Big Moves

🇺🇸 ETF FLOWS (Last Week)

🟢 Net Inflow:

🪙#XRP +$52.26M

🔴 Net Outflows:

💰#BTC -$1.49B

🔹#ETH -$326.93M

🪙#SOL -$2.45M

😈 LIVE PRICES😈

💰$BTC: $76,360.43

🔹$ETH: $2,220.00

🪙$SOL: $100.49

🪙$XRP: $1.57

📊 MARKET HEALTH CHECK

✅ CMC20 Index: $157.3

😱 Fear & Greed: 15 (Extreme Fear)

⚡️Altcoin Season Index: 30/100

📍 Total Market Cap: $2.56T

🔥 THIS WEEK'S BIG MOVES🔥

👉 BitMine reports $6.7B loss on holdings (-43%).

👉Grant Cardone doubles down, buys more at $76K.

👉 MicroStrategy faces $900M+ in unrealized losses on #BTC

🇺🇸 ETF FLOWS (Last Week)

🟢 Net Inflow:

🪙#XRP +$52.26M

🔴 Net Outflows:

💰#BTC -$1.49B

🔹#ETH -$326.93M

🪙#SOL -$2.45M

😈 LIVE PRICES😈

💰$BTC: $76,360.43

🔹$ETH: $2,220.00

🪙$SOL: $100.49

🪙$XRP: $1.57

📊 MARKET HEALTH CHECK

✅ CMC20 Index: $157.3

😱 Fear & Greed: 15 (Extreme Fear)

⚡️Altcoin Season Index: 30/100

📍 Total Market Cap: $2.56T

🔥 THIS WEEK'S BIG MOVES🔥

👉 BitMine reports $6.7B loss on holdings (-43%).

👉Grant Cardone doubles down, buys more at $76K.

👉 MicroStrategy faces $900M+ in unrealized losses on #BTC

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback

💭 I think the real deciding factor right now is macro — not rumors.

Government shutdown headlines and noise can shake sentiment, but what truly moves this market is liquidity and Fed direction.

If rate cuts get delayed, risk assets stay under pressure.

If liquidity improves, crypto rebounds fast.

Right now BTC below $76K isn’t panic — it’s positioning.

Smart traders watch policy, not drama.

What’s your view? Macro shift or just temporary fear? 👇

#MarketUpdate #BTC #MacroImpact

💭 I think the real deciding factor right now is macro — not rumors.

Government shutdown headlines and noise can shake sentiment, but what truly moves this market is liquidity and Fed direction.

If rate cuts get delayed, risk assets stay under pressure.

If liquidity improves, crypto rebounds fast.

Right now BTC below $76K isn’t panic — it’s positioning.

Smart traders watch policy, not drama.

What’s your view? Macro shift or just temporary fear? 👇

#MarketUpdate #BTC #MacroImpact

BTC0.57%

- Reward

- 4

- 5

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

🪙 Digital Gold vs. Physical Gold: The Great Portfolio Tug-of-War! 📊

The relationship between Bitcoin (BTC) and Gold is one of the most debated topics on Wall Street and in the Crypto world. Are they partners or rivals? Let’s break down the Inverse Relationship and what it means for your portfolio! 🧵👇

1. Risk-On vs. Risk-Off Sentiment ⚖️

Traditionally, Bitcoin and Gold move in opposite directions during market shifts:

• Risk-On: When the economy looks bright, investors flock to Bitcoin for high-alpha returns.

• Risk-Off: During geopolitical tension or market crashes, capital often rota

The relationship between Bitcoin (BTC) and Gold is one of the most debated topics on Wall Street and in the Crypto world. Are they partners or rivals? Let’s break down the Inverse Relationship and what it means for your portfolio! 🧵👇

1. Risk-On vs. Risk-Off Sentiment ⚖️

Traditionally, Bitcoin and Gold move in opposite directions during market shifts:

• Risk-On: When the economy looks bright, investors flock to Bitcoin for high-alpha returns.

• Risk-Off: During geopolitical tension or market crashes, capital often rota

BTC0.57%

- Reward

- 2

- 1

- Repost

- Share

BlindCryptoMama :

:

New here. hope u can follow me. I will follow back$ETH / $BTC — Update

Price is back at a key support zone.

No chasing here — waiting for clean setups to build quality alt positions.

Patience wins.

#ETH #BTC #CryptoMarketPullback #Web3FebruaryFocus #FedLeadershipImpact

Price is back at a key support zone.

No chasing here — waiting for clean setups to build quality alt positions.

Patience wins.

#ETH #BTC #CryptoMarketPullback #Web3FebruaryFocus #FedLeadershipImpact

- Reward

- like

- Comment

- Repost

- Share

$BTC just revisited the same weekly demand that ignited the last parabolic move.

This zone isn’t random it’s where liquidity flipped from distribution to expansion.

Above it: structure stays bullish, volatility resets, trend breathes.

Below it: the market tests conviction before the next narrative forms.

Markets don’t move in straight lines. They move between patience and panic.

#BTC #Bitcoin

This zone isn’t random it’s where liquidity flipped from distribution to expansion.

Above it: structure stays bullish, volatility resets, trend breathes.

Below it: the market tests conviction before the next narrative forms.

Markets don’t move in straight lines. They move between patience and panic.

#BTC #Bitcoin

BTC0.57%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin has now closed four straight months in the red, something we haven’t seen since 2018.

Back then, it marked a period of deep fear, weak hands exiting, and quiet accumulation before the market turned. History doesn’t repeat exactly, but moments like these often show where patience gets rewarded and noise fades out.

#BTC #Bitcoin $BTC

Back then, it marked a period of deep fear, weak hands exiting, and quiet accumulation before the market turned. History doesn’t repeat exactly, but moments like these often show where patience gets rewarded and noise fades out.

#BTC #Bitcoin $BTC

BTC0.57%

- Reward

- like

- 2

- Repost

- Share

GateUser-47f5b6e6 :

:

The monthly chart will see five consecutive down days, six consecutive down days... 2026 is the year cryptocurrency ends.View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

381.59K Popularity

11.05K Popularity

10.81K Popularity

6.25K Popularity

4.42K Popularity

6.94K Popularity

4.4K Popularity

4.85K Popularity

2.27K Popularity

43 Popularity

55.1K Popularity

70.14K Popularity

20.88K Popularity

27.48K Popularity

202.04K Popularity

News

View MoreData: If ETH drops below $2,221, the total long liquidation strength on major CEXs will reach $850 million.

9 m

Bostick: If interest rates are cut, inflation is highly unlikely to drop to 2%. He explained that the current inflation rate is driven by factors that are not easily reversed by monetary policy alone, and that a significant reduction to 2% would require a much more aggressive approach or a change in underlying economic conditions. Therefore, policymakers should be cautious about expecting a quick decline in inflation just through lowering interest rates.

22 m

Bostick: A stable labor market provides the Fed with room to wait

22 m

Bostick: Bringing inflation down is especially important for low-income families

24 m

Bostick: The current policy is not highly restrictive, and a rate cut is not expected until 2026.

30 m

Pin