# GOLD

233.37K

AylaShinex

#MiddleEastTensionsEscalate 🌍

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

- Reward

- 4

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

The Unstoppable Surge in Precious Metals

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

- Reward

- 9

- 9

- Repost

- Share

EagleEye :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

Gold and Silver have surged to fresh record highs, signaling strong momentum in the precious metals market. This rally is being driven by a mix of global economic uncertainty, expectations of interest rate cuts, a softer US dollar, and rising geopolitical risks.

Gold continues to reinforce its role as a safe-haven asset, attracting institutional and long-term investors seeking stability against inflation and currency volatility. Meanwhile, Silver is outperforming on the back of both investment demand and its growing industrial use, particularly in renewable energy and

Gold and Silver have surged to fresh record highs, signaling strong momentum in the precious metals market. This rally is being driven by a mix of global economic uncertainty, expectations of interest rate cuts, a softer US dollar, and rising geopolitical risks.

Gold continues to reinforce its role as a safe-haven asset, attracting institutional and long-term investors seeking stability against inflation and currency volatility. Meanwhile, Silver is outperforming on the back of both investment demand and its growing industrial use, particularly in renewable energy and

- Reward

- 6

- 6

- Repost

- Share

楚老魔 :

:

🌱 "Growth mindset activated! Learned a lot from these posts."View More

#GoldandSilverHitNewHighs

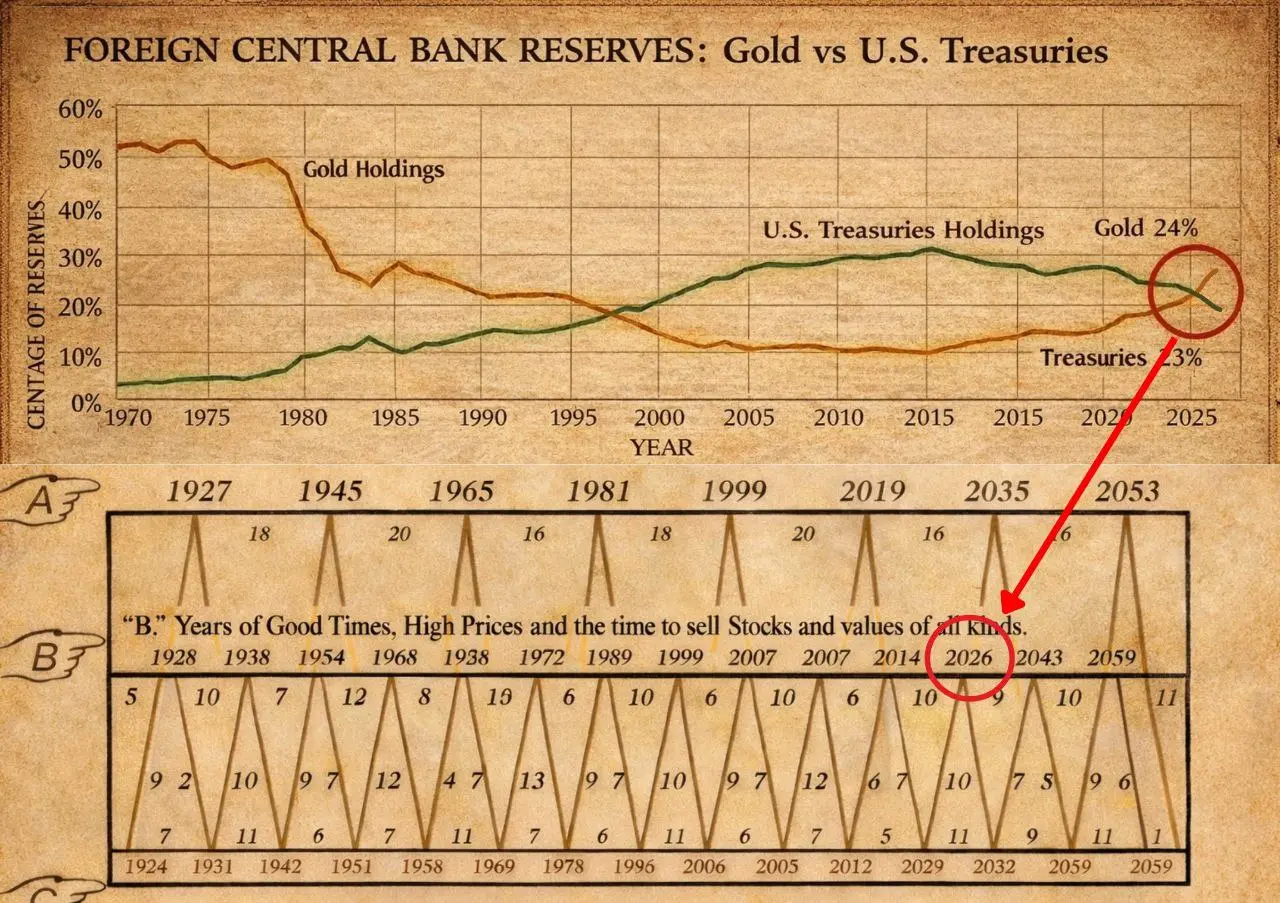

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 8

- 9

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

BTC0,66%

- Reward

- 4

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Sony will postpone the release of the PS6 to 2029 due to a shortage of RAM, the price will become much higher, - media.⚠️ US Government Shutdown Risk Spikes to 81%

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

BTC0,66%

- Reward

- 1

- Comment

- Repost

- Share

# GoldandSilverHitNewHighs

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

BTC0,66%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

44.43K Popularity

6.3K Popularity

5.64K Popularity

3.26K Popularity

2.71K Popularity

2.83K Popularity

2.4K Popularity

2.48K Popularity

68.89K Popularity

111.05K Popularity

77.3K Popularity

19.55K Popularity

44.82K Popularity

37.23K Popularity

193.24K Popularity

News

View MoreU.S. stocks open, Dow Jones down 0.6%, S&P 500 up 0.27%

2 m

Data: 309.78 BTC transferred from an anonymous address, then routed through a relay and flowed into Ledn

2 m

Asset tokenization startup Tenbin Labs completes $7 million seed funding round, led by Galaxy Ventures

18 m

Data: If ETH drops below $2,767, the total long liquidation strength on mainstream CEXs will reach $1.325 billion.

34 m

ZetaChain 2.0 officially launched, Anuma creates a new AI × privacy platform

35 m

Pin