When Stablecoins Start Building Chains, Does Ethereum Still Have a Chance?

In recent years, stablecoins have quietly become one of the most important—and fastest-growing—drivers in the crypto market. Powering everything from cross-border payments and settlement to compliance pilots, they’re now critical infrastructure for the movement of digital assets.

This year marks a true milestone: leading stablecoin issuers are no longer satisfied simply operating on existing blockchains—they’re building their own. In August, Circle unveiled Arc, followed closely by Stripe’s announcement of Tempo. The fact that two of the sector’s biggest heavyweights made this move simultaneously hints at deeper strategic logic.

Why do stablecoins need their own dedicated blockchains? Is there still room for retail users in what’s increasingly a business-focused environment? And as stablecoin networks take control of payment rails, what does this mean for general-purpose chains like Ethereum and Solana?

This article explores four key topics:

- What are stablecoin blockchains, and how do they differ from legacy public blockchains?

- How do representative projects approach design and architecture?

- Could stablecoin blockchains threaten Ethereum?

- Where might ordinary users find opportunities?

Stablecoin Blockchains: The New Settlement Layer

Where blockchains like Ethereum and Solana focus on decentralized applications, stablecoin blockchains are engineered for settlement and payments.

They share several defining traits:

- Stablecoin-native Gas: Transactions fees are stable and predictable, so there’s no need to hold volatile assets just to pay fees.

- Purpose-built for payments and settlement: These chains aren’t aiming for universality, but for reliability and everyday usability.

- Embedded compliance modules: Direct integration with banks and payment institutions, reducing regulatory ambiguity and friction.

- Financial-first design: Cross-currency settlement, FX matching, unified accounting units—mirroring real-world settlement systems.

Put simply, stablecoin blockchains reflect a vertically integrated model—from issuance and clearing, all the way to applications. These blockchains bring every crucial step under the issuer’s control. The initial “cold start” is a challenge, but long term, scale and influence are the rewards.

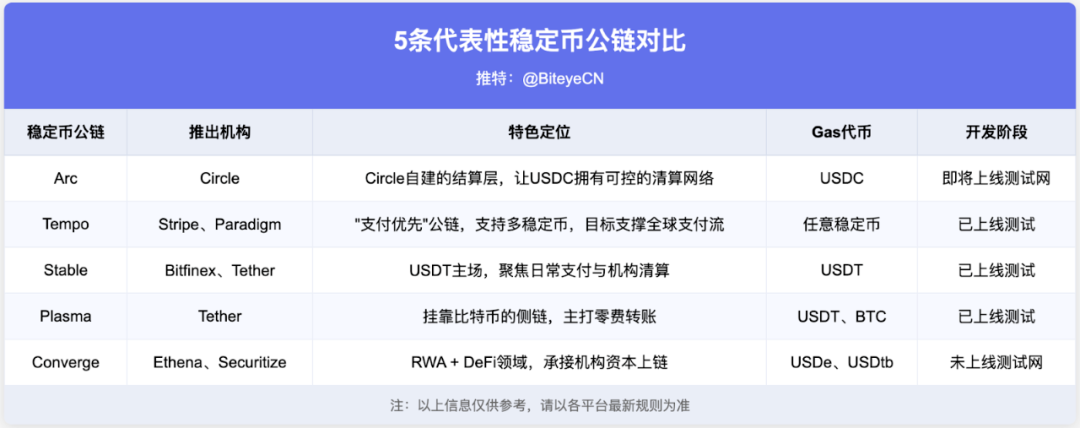

Five Flagship Projects, Five Distinct Paths

1. Arc @arc: Circle’s Debut Blockchain

As the world’s second-largest stablecoin issuer, Circle’s launch of Arc comes as no surprise. USDC is massive, but transaction fees are beholden to volatility on Ethereum and competing chains. Arc is Circle’s vision for a purpose-built “settlement layer.”

Arc stands out for three core features:

- USDC as Gas: Fees are transparent, with no FX risk.

- Ultra-fast and reliable settlement: 1-second transaction confirmation, ideal for cross-border payments and big-ticket clearing.

- Optional privacy: Enterprise-grade privacy for accounting, with regulatory compliance baked in.

Arc is more than just a technical product—it’s Circle’s next leap toward becoming a backbone for global financial infrastructure.

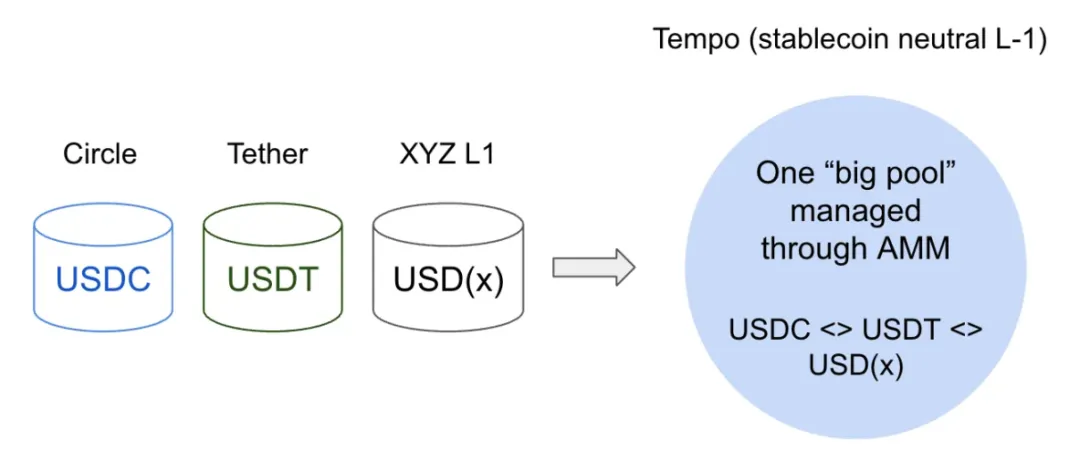

2. Tempo @tempo: Payment-First, High-Performance Blockchain

Incubated by Stripe and Paradigm, Tempo’s premise is clear: as stablecoins move mainstream, payments infrastructure must keep up. Legacy chains have unpredictable fees, scalability bottlenecks, or UX that’s “too crypto-native” for global use. Tempo aims to solve this.

Tempo delivers:

- Any stablecoin as Gas: Swapping between stablecoins via built-in AMM.

- Low, predictable fees: With features like payment channels, memos, and whitelists, it’s built for real-world systems.

- Extreme throughput: Targets 100,000 TPS and sub-second confirmations, suitable for payroll, remittances, and micropayments.

- EVM-compatible (Reth implementation): Making developer migration easy.

Its notable industry partners include Visa, Deutsche Bank, Shopify, and OpenAI—positioning Tempo as an open payment network for dollars, not just an add-on for any single stablecoin. If successful, Tempo could pioneer the “on-chain payroll” model.

Tempo’s focus on payments has raised questions about decentralization. For now, it’s closer to a consortium chain than a fully public chain, with restricted node participation and weaker decentralization.

3. Stable @stable: USDT’s Purpose-Built Chain

Stable, created by Bitfinex and USDT0, is designed specifically for USDT payments, facilitating smoother, more efficient daily financial flows.

Key design features:

- Native USDT Gas: Fees paid in USDT; peer-to-peer transfers are completely gas-free.

- Instant confirmation: Suitable for both micro-payments and sizable transactions.

- Enterprise tools: Bulk transfer aggregation and privacy-preserving, compliant transfers.

- End-user experience: Wallet integrations with cards and merchant settlement.

- Developer support: EVM-compatible with comprehensive SDKs.

The focus is on real-world adoption—facilitating frictionless USDT transactions for cross-border payments, merchant settlement, and institutional clearing.

4. Plasma @PlasmaFDN: Bitcoin-Powered Sidechain

Plasma charts a different course. As a Bitcoin sidechain, it leans on BTC’s security but is focused on stablecoin payments.

Distinct features include:

- Native BTC bridge: Trustless cross-chain BTC moves into EVM environments for direct stablecoin ecosystem access.

- Zero-fee USDT transfers: Completely free USDT transactions—Plasma’s top selling point.

- Customizable Gas tokens: Developers can select stablecoin or ecosystem token payment.

- Optional privacy: Supports payroll and institutional clearing use cases.

- EVM-compatible (Reth implementation): Simplifies developer migration.

Plasma’s July public sale for $XPL raised over $373 million, with demand outstripping supply 7-to-1—a significant boost for early adoption.

5. Converge @convergeonchain: Where RWA Meets DeFi

While other chains focus on stablecoin-powered payments and settlement, Converge aims to bring real-world assets (RWA) and DeFi together on a single chain.

Core priorities:

- High performance: Sub-100ms block times, pushing speed through partnerships with Arbitrum and Celestia.

- Stablecoin-native Gas: USDe and USDtb as fee currencies.

- Institutional-grade security: Extra protection via the ENA network (CVN).

Converge is tackling “how major capital can enter crypto securely and efficiently.” Its partners include Aave, Pendle, Morpho, and RWA platforms like Securitize.

Different Approaches, Shared Goals

From Arc, Tempo, Stable, and Plasma to Converge, each focuses on how stablecoins can become part of everyday finance. Arc and Stable emphasize control over their own assets; Tempo and Plasma are neutral, supporting multiple coins; Converge is tailor-made for institutions and RWA. Each takes a different route, but all aim to make payments reliable, liquidity smooth, and compliance seamless.

These trends are driving the future of stablecoin blockchains:

- Compliance and institutionalization: Stablecoin blockchains will make settlement certainty and regulatory integration a top priority. Arc and Stable are moving to act as direct clearing layers for banks and payment firms.

- Challenge to legacy payment rails: Chains like Tempo, with multi-currency neutrality and global reach, pressure Visa and Mastercard with lower costs and new capabilities.

- Market structure shakeup: Circle and Tether control nearly 90% of stablecoin volume—a de facto duopoly. Neutral chains like Tempo are breaking this stranglehold, paving the way for a more competitive, multi-polar market.

How Stablecoin Chains Are Shaping the Future of Public Blockchains

The emergence of issuer-native chains poses a direct challenge to general-purpose blockchains like Ethereum and Solana.

Stablecoin blockchains are purpose-built for payments, making them ideal for high-frequency, low-risk uses such as global payroll and remittances—far more efficient than Ethereum or Solana. The impact could be most acute for TRON, which derives over 99% of its stablecoin activity from USDT and currently leads in USDT issuance volume. If Tether’s Stable chain proves successful, TRON’s edge could erode rapidly.

However, some argue these “payment-specialized chains” aren’t full-fledged blockchains. True decentralization would invite a flood of unrelated projects and tokens, causing congestion and lag; conversely, limiting access to payments makes them minimally functional like Bitcoin (for transfers only) or partially centralized, with just a handful of institutional node operators. Balancing “decentralization” and “payment efficiency” is a fundamental dilemma.

That’s why Ethereum and Solana’s roles remain secure. Ethereum boasts security and composability, anchoring an unmatched developer ecosystem. Solana shines in speed and user experience. Most likely, stablecoin chains will own settlement certainty, while ETH/SOL remain hubs for open financial innovation.

Retail Users: What Are the Entry Points?

Stablecoin blockchains are less focused on direct retail reward, and more on serving businesses, payments, clearing, and custody systems.

Experienced individual users still have avenues to participate:

Ecosystem incentives: New chains frequently launch bounty campaigns, developer grants, and trading rewards. Watch for future announcements.

Node staking: Technical users can explore validator and node staking opportunities. For example, Converge requires ENA staking.

Testnets: Early testnet users are often rewarded with airdrops. ARC may debut its public testnet this fall. Stable, Plasma, and Tempo testnets are already live.

Long-term positioning: If you support the stablecoin blockchain concept, consider allocating for the long haul—tracking stocks like Circle and Coinbase, for example.

Plasma is especially noteworthy: In July, its public sale saw $XPL oversubscribed 7x, raising $370+ million. A subsequent Binance airdrop was claimed out in an hour. Even in an institutional-heavy sector, early retail participants still stand to benefit.

Conclusion

Stablecoin blockchains won’t overhaul the crypto landscape overnight. Their impact is felt behind the scenes—shorter settlement times, steadier fees, and more frictionless regulatory integration.

On the surface, the narrative may seem less flashy, but at the infrastructure level, these chains are laying the foundation for stablecoins—like the “utilities” of the digital economy. Refocusing from “token price” to “how money moves” unveils the true logic:

- Who can guarantee settlement certainty?

- Who can provide robust, cross-currency liquidity?

- Who can enable real-world payment adoption?

Stablecoin blockchains are poised to become the most compelling story of the next bull market. If any project delivers on all three, it will be more than just a blockchain—it could become the backbone of next-generation crypto finance.

Statement:

- This article is republished from [Biteye Core Contributor Viee], with copyright retained by the original author [Biteye Core Contributor Viee]. For any questions regarding republication, please contact the Gate Learn team, and your request will be addressed promptly according to established protocol.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Except where Gate is referenced, translation, distribution, or copying of these articles is strictly prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.