#PreciousMetalsPullBack As of late January 30, 2026, precious metals are undergoing a sharp but structurally healthy correction after one of the strongest rallies in modern financial history. This move reflects profit-taking, leverage flushing, and technical cooling — not a trend reversal. The long-term bull structure remains intact.

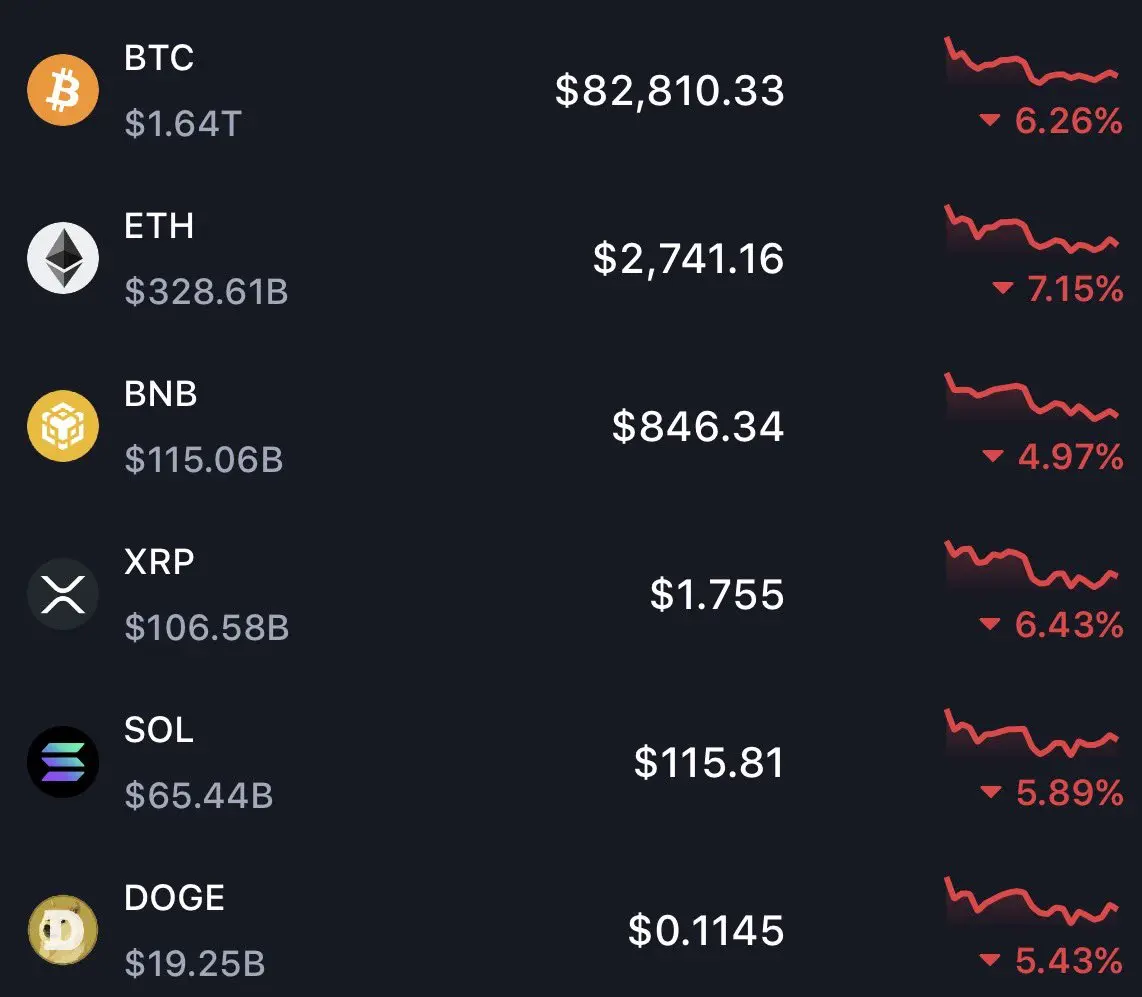

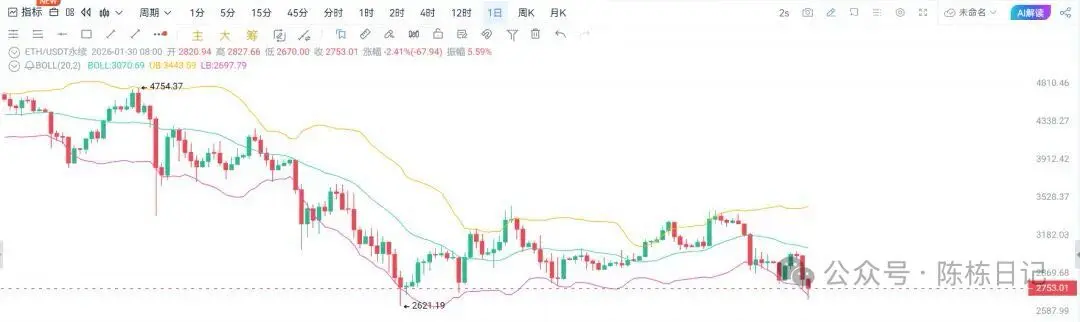

Current Price Snapshot — Jan 30, 2026

Gold (XAUT = $5,060)

Gold surged to record highs near $5,600–$5,608, then corrected toward the $5,050–$5,200 support zone.

Despite the pullback, gold remains +18–22% in January and +80–90% year-over-year, confirming the broader uptrend remains intact.

Silver (XAG = $99)

Silver peaked near $120–$121.64 before pulling back into the $95–$105 demand zone.

Even after the correction, silver holds +45–60% monthly gains and +230–290% yearly growth, supported by supply deficits and strong industrial demand from solar, EVs, AI hardware, and electrification.

Platinum & Palladium Outlook

Platinum remains elevated after rallying above $2,700–$2,900, driven by hydrogen energy expansion and industrial catalysts.

Palladium remains volatile but supported by tight supply and automotive demand.

Gold/Silver Ratio Compression — A Key Signal

The Gold/Silver Ratio has dropped to ~45–51, reflecting silver’s extreme outperformance. Historically, this often leads to short-term silver cooling and capital rotation back toward gold stability.

Why the Pullback Happened

Parabolic price expansion triggered profit-taking.

Momentum indicators showed extreme overbought conditions.

Futures margin hikes flushed leveraged positions.

Short-term macro cooling reduced safe-haven urgency.

Institutional warnings flagged speculative excess.

Why This Is Not a Trend Reversal

Central banks continue record gold accumulation.

Global debt growth and currency debasement favor hard assets.

Industrial demand for silver and platinum continues to accelerate.

Mining supply constraints remain unresolved.

Geopolitical and trade fragmentation support long-term safe-haven demand.

Forward Outlook

Gold medium-term target: $6,000–$6,500

Gold bull-case target: $7,000–$8,000+

Silver bullish range: $130–$150

Silver extreme deficit target: $160–$170+

Key Support Levels

Gold: $5,050–$5,200

Silver: $95–$105

Final Take

This pullback represents market digestion, not market failure. It is a necessary reset inside a powerful secular bull market. Long-term structural forces remain bullish, and disciplined investors may benefit from volatility.