Ethereum Drops Over 30% From Yearly High — Opportunities Amid ETF Outflows and Liquidation Storm

As of mid-November 2025, Ethereum’s price is down over 30% from its peak this year. Rather than a sudden crash, this correction stems from structural shifts in capital, ETF outflows, and market liquidations working in tandem.

Why Has Ethereum Fallen More Than 30% from Its Yearly High?

Chart: https://farside.co.uk/eth/

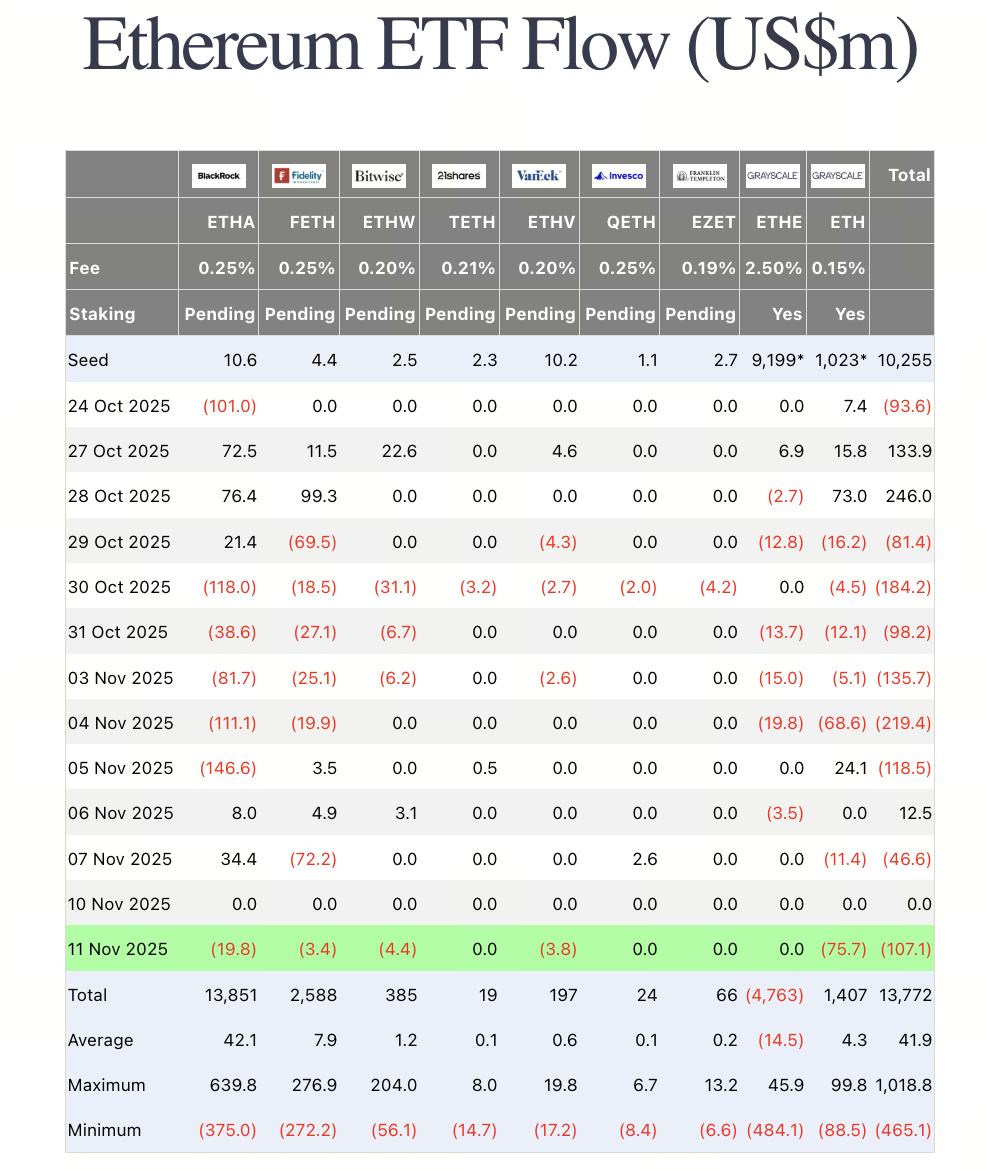

In the first half of 2025, Ethereum surged toward $4,900, driven by spot ETF approvals and broad market gains. Since September, however, ETFs have posted consecutive net outflows, while tightening macro liquidity has pressured ETH lower to roughly $3,200. Market data shows that since late October, Ethereum ETFs have seen daily net outflows totaling over $1 billion.

ETF Outflows and Forced Liquidations: Compounding Market Pressure

ETF outflows signal a temporary dip in institutional confidence. When investors redeem ETF shares, funds must sell the underlying asset, putting sustained selling pressure on spot Ethereum. Meanwhile, stop-loss triggers in leveraged trading have set off a chain of forced liquidations. Over the past week alone, ETH-related liquidations exceeded $300 million, amplifying volatility. This combination of ETF selling and liquidations has kept ETH under pressure even without any major negative headlines.

Technical Support Range Analysis

Chart: https://www.gate.com/trade/ETH_USDT

According to the current ETH/USDT chart, ETH trades at 3,455.10 USDT, down 2.66% over the past 24 hours. The 24-hour price range has been 3,405.20–3,594.42 USDT, reflecting notable volatility. The short-term moving average (MA5) is at 3,434.76 and is trending downward, indicating recent weakness.

Technically, ETH has broken below prior support at 3,500.00 USDT, with price now hovering near 3,455.10 USDT. A further breakdown below this support could open the door to lower levels. Conversely, if ETH holds and rebounds from this support, 3,500.00 USDT could become a key short-term resistance zone.

In summary, ETH faces downward pressure. Investors should watch the 3,450–3,500 support zone closely—if ETH breaks below this range, further declines could follow.

On-Chain Data Reveals Institutional “Contrarian Positioning”

Despite the pullback, on-chain data shows that large holders (whales) have consistently accumulated below $3,200. Additionally, total Ethereum staked continues to climb, indicating that long-term investors are staying put and viewing the decline as a cost-optimization opportunity.

How Should Investors Respond?

- Avoid emotional trading: A cyclical pullback does not signal a trend reversal.

- Build positions in tranches: Consider phased entry in the $3,000–$3,200 range, managing position size carefully.

- Monitor ETF flows: A shift from net outflow to net inflow is a key signal for a potential market reversal.

- Prioritize risk management: If ETH breaks below $2,650, consider implementing stop-loss orders.

In conclusion, while this Ethereum correction has created short-term headwinds, it largely reflects a shift in capital structure. For investors with a medium- to long-term view, the current price range may represent a pivotal stage for observation and strategic accumulation.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data