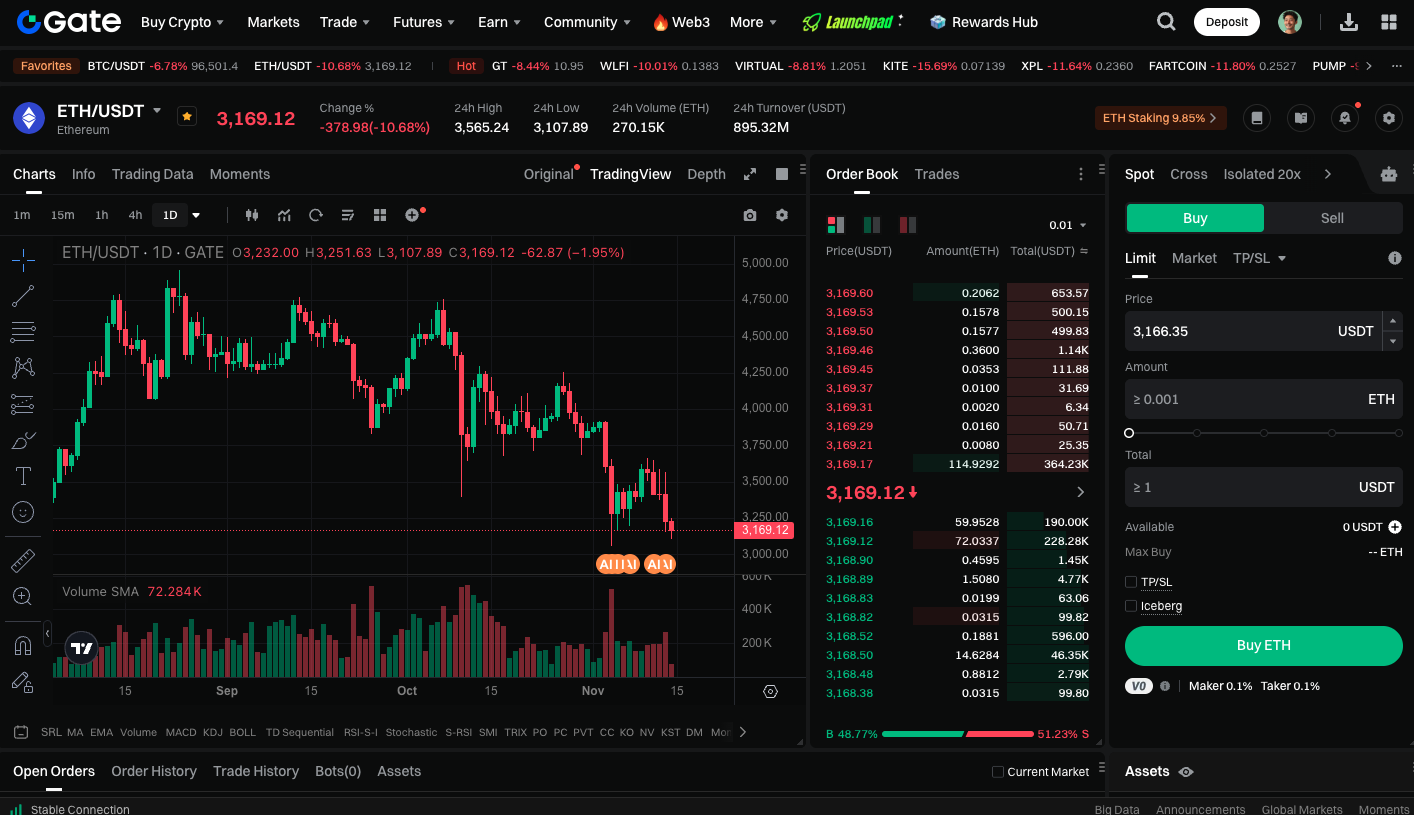

Ethereum Price Prediction: ETH Faces Multiple Hurdles Before Reclaiming $4,000

ETH Decline: Causes and Market Trends

Investors primarily hold ETH for staking rewards and its utility as a computational resource for data processing. Recently, blockchain network activity has slowed, which has put downward pressure on prices. Previous increases in activity, driven by meme coins and speculative trading, were unsustainable, limiting ETH’s potential.

Over the past 30 days, Ethereum trading volume dropped 23%, and active addresses fell by 3%. In comparison, Tron and BNB Chain saw trading volumes rise by at least 34%, while Solana’s active addresses increased by 15%. Competitors with higher centralization now offer lower fees and a smoother user experience, creating additional competitive pressure for ETH.

Ethereum ETF and Institutional Capital Flows

The US introduced spot Ethereum ETFs in mid-2024, outpacing other major altcoins by roughly 16 months. Capital inflows into the ETH ETF drove prices up 140% within 100 days, peaking at $4,200. As XRP, BNB, and Cardano entered the ETF market, institutional capital competition intensified, weakening ETH’s bullish momentum.

Meanwhile, Ethereum network fees have fallen 88% from the late-2024 weekly high of $70 million, putting pressure on staking returns. The market has limited transparency, and investors continue to seek clarity regarding the upcoming Fusaka upgrade and its expected yield improvements.

DApp Revenue and Network Activity Challenges

Ethereum maintains a strong lead in total value locked (TVL) and layer-2 adoption rates. However, traders question whether these advantages translate into higher DApp revenue. Solana is now competitive in DApp income, and new projects like Hyperliquid also challenge the ETH ecosystem. Although Base’s expansion adds value, the relationship between Base and Coinbase through native integration is not sufficient to represent the entire layer-2 ecosystem.

Key Drivers for a Return to $4,000

For Ether to reclaim the $4,000 mark, the following factors are critical:

- Increase on-chain activity to boost trading volumes and DApp engagement

- Recovery in network fees to support staking returns

- Clear, tangible benefits from the Fusaka upgrade to strengthen investor confidence

- Renewed inflows from entities holding ETH reserves to drive prices higher

Ultimately, ETH’s recovery depends on several factors. In the short term, it’s essential to watch whether on-chain activity and institutional inflows improve in tandem.

You can trade ETH spot at: https://www.gate.com/trade/ETH_USDT

Conclusion

In summary, for ETH to reach $4,000, on-chain activity, network fees, institutional capital, and technical upgrades must all recover together. Current market conditions show that Ethereum remains competitive, but it is in a phase of rebuilding momentum. If the Fusaka upgrade delivers real improvements and ETF fund inflows resume, user activity could rebound. ETH may gradually recover from its current weakness and regain a strong market position.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data