Gate Ventures Weekly Crypto Recap (December 8, 2025)

TL;DR

- The Bank of Japan has taken a hawkish stance, with investors pricing in a potential rate hike in December, which could lead to short-term pressure on carry trades.

- This week’s incoming data includes the U.S. FOMC interest rate decision, ADP employment change, and JOLTS job openings.

- BTC was flat at +0.04%, while ETH gained +2.27%. However, both continued to see ETF outflows, and sentiment remained in “Extreme Fear.”

- The market rebounded by +3.9% today, led by strong moves in SUI and LINK.

- SUI rose +17.7% following Grayscale’s SUI Trust filing, while LINK gained +15.2%, supported by the solid debut of Grayscale’s Chainlink ETF, signaling rising institutional interest.

- Aave and CoW launched the first intent-based flash loan product, expanding programmable DeFi.

- Galaxy expanded into institutional liquid staking through the acquisition of Alluvial.

- Grayscale launched a LINK ETF with $41M in inflows, highlighting strong appetite for regulated altcoin exposure.

Macro Overview

The Bank of Japan made a hawkish stance, the investors are pricing in a rate hike in December, which could lead to short term pressure on carry trade.

On December 1, Bank of Japan (BOJ) Governor Kazuo Ueda stated in a speech that the pros and cons of a rate hike would be considered at the December monetary policy meeting. This hawkish remark has made the December meeting a focal point for financial markets. Market expectations for a December rate hike by the BOJ rose significantly, leading to a 0.4% appreciation of the yen and a temporary decline of over 2% in Japanese stocks. The upward movement of Japan government bond yields also had a spillover effect, as US Treasury yields rose by 7 basis points on the same day. Since 2022, Japan has seen inflation levels persistently elevated. However, the BOJ did not implement its first rate hike until 2024. The recent depreciation of the yen is likely to increase inflationary pressures. An earlier rate hike by the BOJ could help mitigate the risk of inflation becoming “unanchored.”

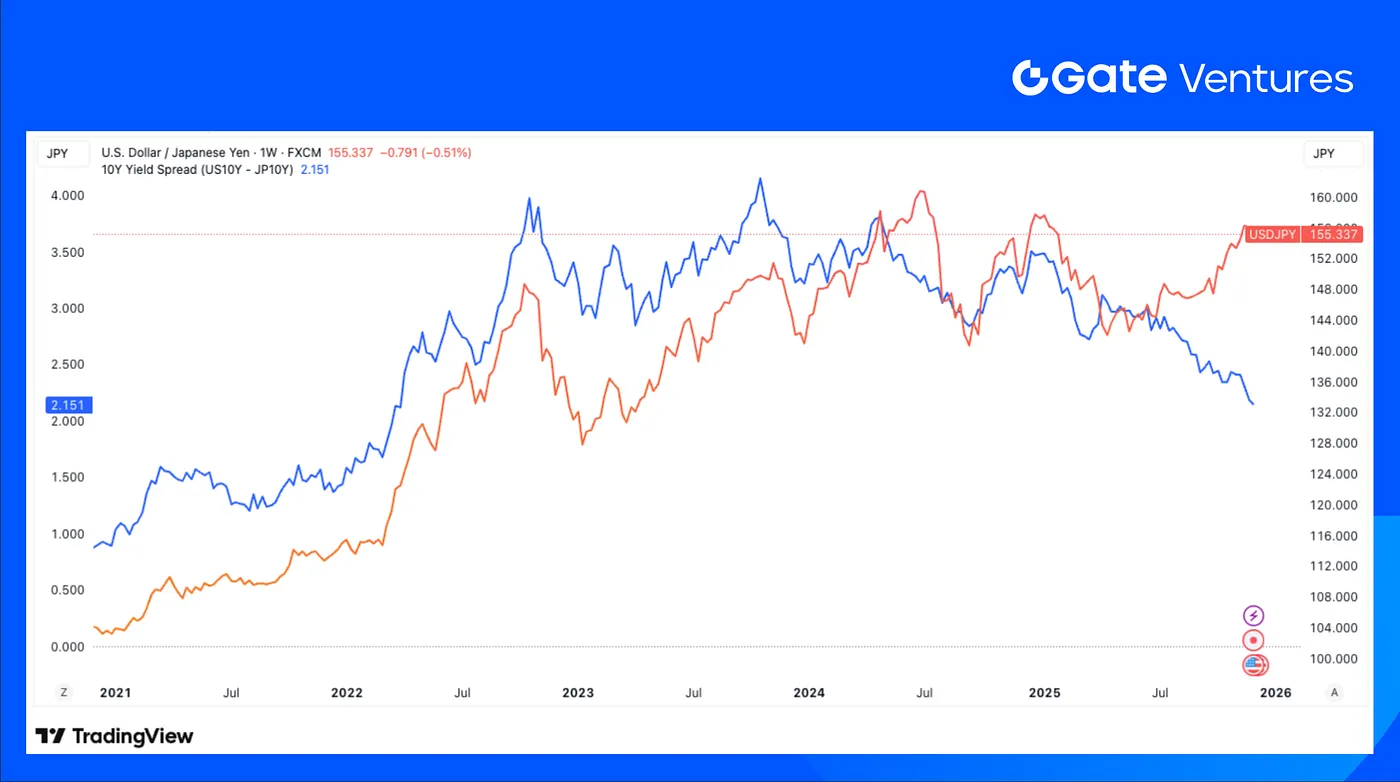

The BOJ’s hawkish stance and potential subsequent actions have created short term pressure on carry trades. There remains a significant gap between the yen’s exchange rate and the US-Japan interest rate differential, leaving room for further yen appreciation. Yen-based carry trades typically involve borrowing yen to invest in short-term government bonds or deposits denominated in G10 currencies, as well as in currencies of countries like Mexico and Brazil. During a reversal of carry trades, these currencies often face certain levels of shock. The broader carry trades include assets such as equities, bonds, and gold, meaning that a reversal of carry trades could also impact the prices of these asset classes. If the unwinding of yen carry trades continues, it could exert pressure on government bond and corporate credit markets in some countries globally.

This week’s incoming data includes the US FOMC interest rate decision, ADP employment change, JOLTs job openings, etc. Despite in November FOMC meeting the Fed Chair Jerome Powell mentioned that “a further reduction in the policy rate is not a foregone conclusion — far from it”, the market is currently pricing in a 25 bps cut in the upcoming December FOMC meeting this week. Although inflationary pressures persist, with U.S. consumer price inflation accelerating to 3.0% in September and tariffs contributing to further price increases, the lower interest rate will mainly stimulate the weak labour market. This is particularly important after the ADP payroll report signalled falling private sector jobs. (1, 2)

The deviation between the yen and the US-Japan bond yield spread has been significant

DXY

The US dollar further dropped last week as the market is forming a consensus that the Fed rate cut in Dec FOMC meeting is highly likely. The dollar index dropped below $99 level last Friday. (3)

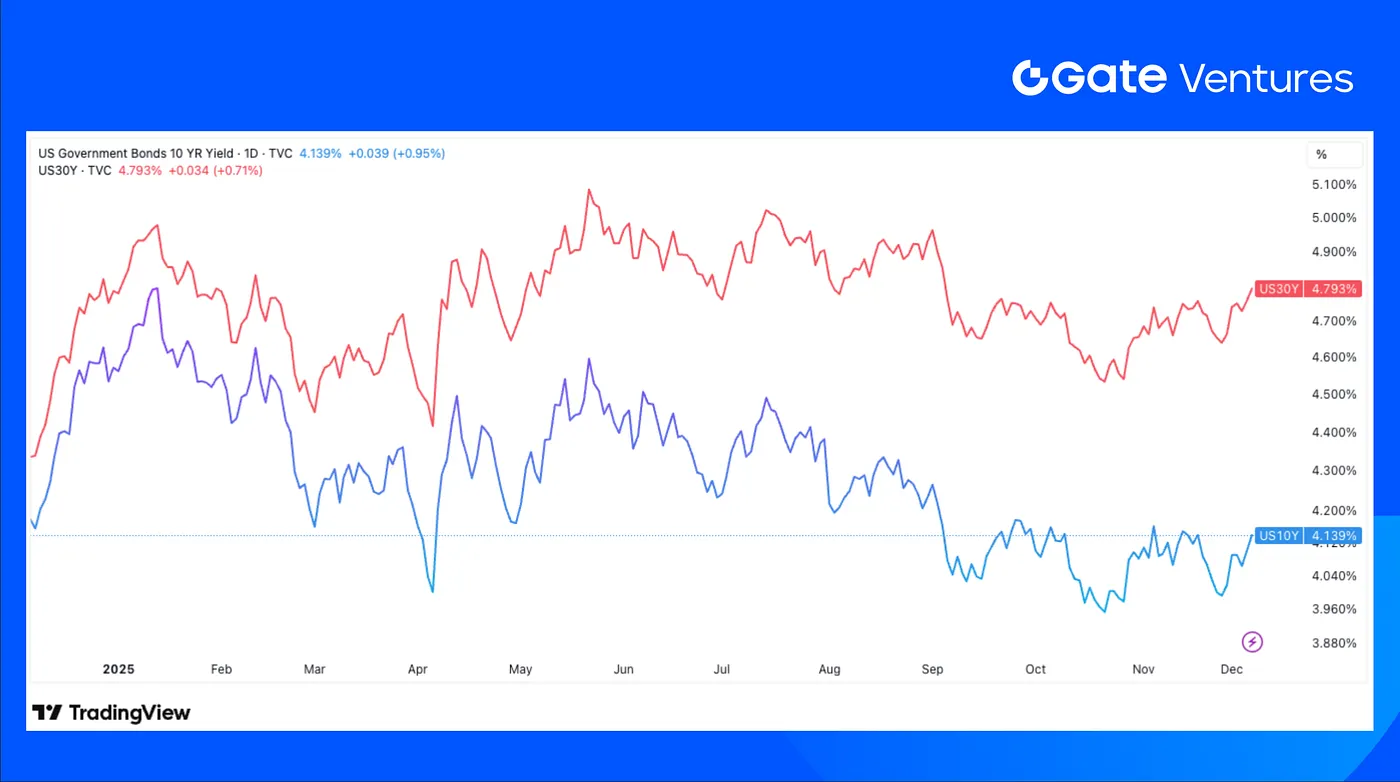

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields both traded higher last week, forming an upward trend. This was driven by the lower-than-expected PCE data, which gives the Fed green light to cut interest rates. (4)

Gold

The gold prices stayed at the high position throughout last week, trading above the $4,150 level. The gold price further gained momentum on the Fed rate cut optimism. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC held steady with only a marginal +0.04% move, while ETH outperformed with a +2.27% gain last week.

ETF flows remained negative, BTC ETFs saw $87.7M of net outflows last week, and ETH ETFs recorded $65.59M in outflows. (6)

Despite ETH’s relative strength, with the ETH/BTC ratio rising 2.3% to 0.034, overall sentiment remains weak: the Fear & Greed Index is still deep in the “Extreme Fear” zone at 20. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

Total market cap was essentially flat at -0.02%, but weakness remained under the surface.

Excluding BTC and ETH, the market fell 1.1%, and the broader altcoin segment (excluding the top 10) dropped a steeper -3.88%, highlighting that liquidity in altcoin assets continued to deteriorate last week.

3. Top 30 Crypto Assets Performance

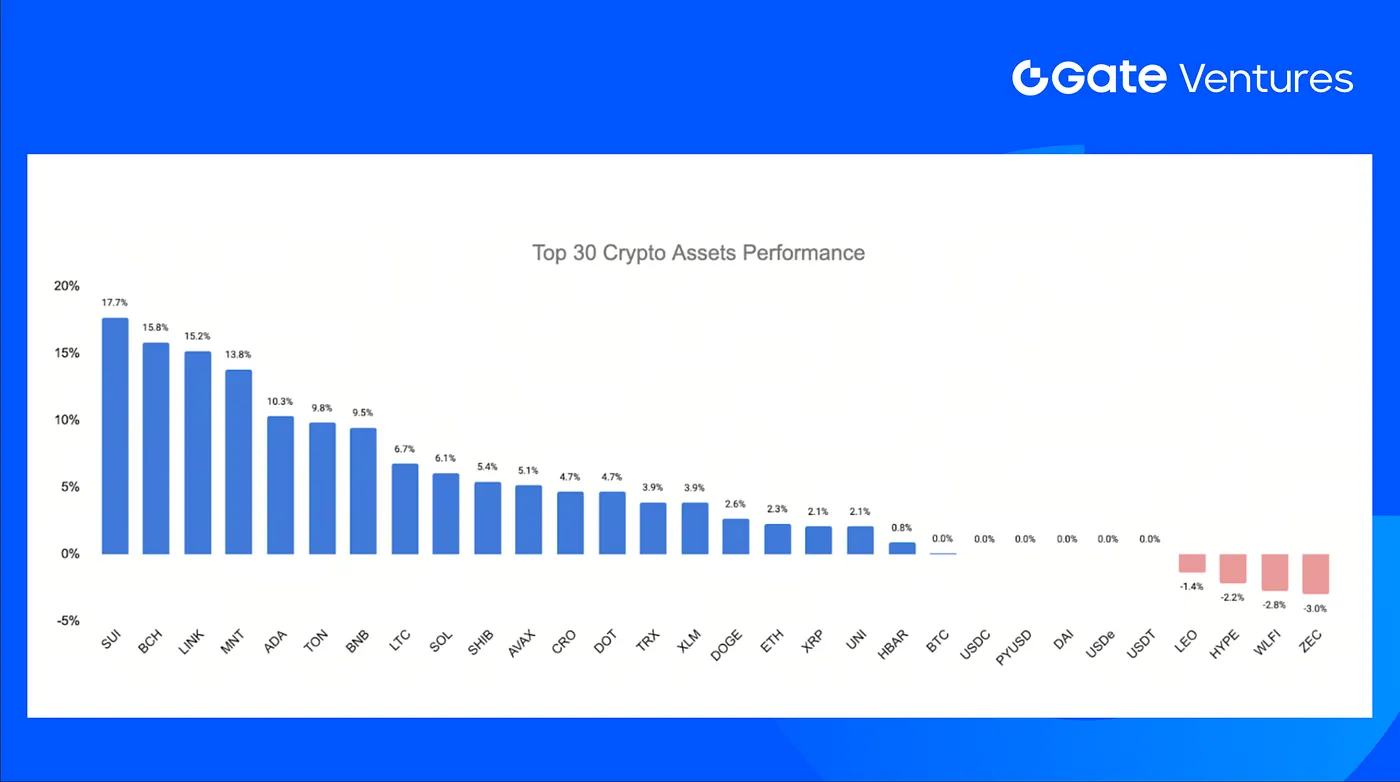

Source: Coinmarketcap and Gate Ventures, as of Dec 8th 2025

The market rebounded early today with an average gain of 3.9%, led by SUI, BCH, and LINK.

SUI outperformed with a +17.7% surge, driven largely by Grayscale’s filing for a SUI trust, which follows 21Shares’ recent SUI ETP launch on Nasdaq. The back-to-back filings signal rising institutional interest and growing confidence in Sui as a leading Layer-1 heading into 2025. (8)

LINK rallied 15.2%, supported by the strong debut of Grayscale’s new US spot Chainlink ETF. The fund opened with $41M in net inflows and $13M in day-one volume, outperforming Solana’s ETF launch and signaling that investor appetite for regulated altcoin exposure remains intact despite recent market softness. (9)

The Key Crypto Highlights

1. Aave and CoW launch first intent-based flash loan product to expand programmable DeFi

Aave Labs expanded its partnership with CoW Swap by routing all swap, collateral swap, debt swap and repayment functions on Aave.com through CoW Protocol’s MEV-protected solver network. The move consolidates loan lifecycle management into a single interface while lowering gas costs and shielding users from frontrunning. The collaboration also debuts an intent-based flash loan product, enabling more efficient arbitrage, refinancing and automation. With CoW processing over $10B in monthly volume, Aave plans to extend the integration into a broader suite of intent-driven execution tools. (1)

2. Galaxy expands into institutional liquid staking with Alluvial acquisition

Galaxy acquired Alluvial Finance, becoming the Development Company behind Liquid Collective as institutional liquid staking demand accelerates. Liquid Collective, which tripled its assets to roughly $1B in 2025, offers enterprise-grade liquid staking for ETH and SOL and provides tokens usable across trading, collateral management and onchain strategies. The deal brings Alluvial’s engineering team and staking integration tools under Galaxy, enhancing its institutional infrastructure across trading, custody and staking. Liquid Collective will continue operating independently under The Liquid Foundation’s governance model. (2)

3. Grayscale launches LINK ETF with $41M inflows, showing appetite for regulated altcoin exposure

Grayscale’s Chainlink ETF launched with $41M in first-day inflows and $13M in trading volume, a solid debut that highlights continued institutional interest in regulated altcoin exposure. Analysts noted that, while the ETF now holds $64M in assets, the launch was strong but not a “blockbuster,” particularly as LINK remains down 39% over the past year despite a recent rebound. The debut reinforces that long-tail assets such as Chainlink can find traction in ETF form as investors seek compliant access to decentralized oracle infrastructure. (3)

Key Ventures Deals

1. Pantera leads $17M Seed for Fin’s cross-border stablecoin transfer platform

Fin raised a $17M Seed round led by Pantera Capital with Sequoia, Samsung Next and other investors to develop a stablecoin-powered app for instant, high-value cross-border transfers. Designed to remove the friction of traditional wires and app payment limits, Fin targets businesses moving large sums at lower cost. As stablecoins gain regulatory clarity and institutional adoption, the round reflects demand for simpler, globally accessible payment rails built natively on digital dollar infrastructure. (4)

2. Ostium secures $20M Series A to scale RWA and crypto perpetuals trading

Ostium raised a $20M Series A led by General Catalyst and Jump Crypto with Coinbase Ventures, Wintermute, GSR and other investors to scale its decentralized exchange offering perpetuals on stocks, metals, energy and crypto assets. Positioned as a brokerage-style platform rather than a pure crypto DEX, Ostium aims to serve non-U.S. retail users seeking access to U.S. markets. As demand grows for global, high-leverage RWA derivatives, the round reflects interest in perps as a next-generation retail trading gateway. (5)

3. Digital Asset raises $50M Strategic Round to scale the Canton Network

Digital Asset secured a $50M Strategic Round led by BNY, iCapital, Nasdaq and S&P Global with other investors to accelerate the expansion of the Canton Network, a permissionless L1 built for regulated financial markets. Supporting trillions in tokenized RWAs and over 600 institutional participants, Canton focuses on compliance and configurable privacy. As traditional finance moves toward interoperable, regulated blockchain rails, the round highlights rising demand for institutional-grade settlement infrastructure. (6)

Ventures Market Metrics

The number of deals closed in the previous week was 23, with DeFi having 11 deals, representing 48% of the total number of deals. Meanwhile, Infra had 8 (35%) and Social had 1 (4%).

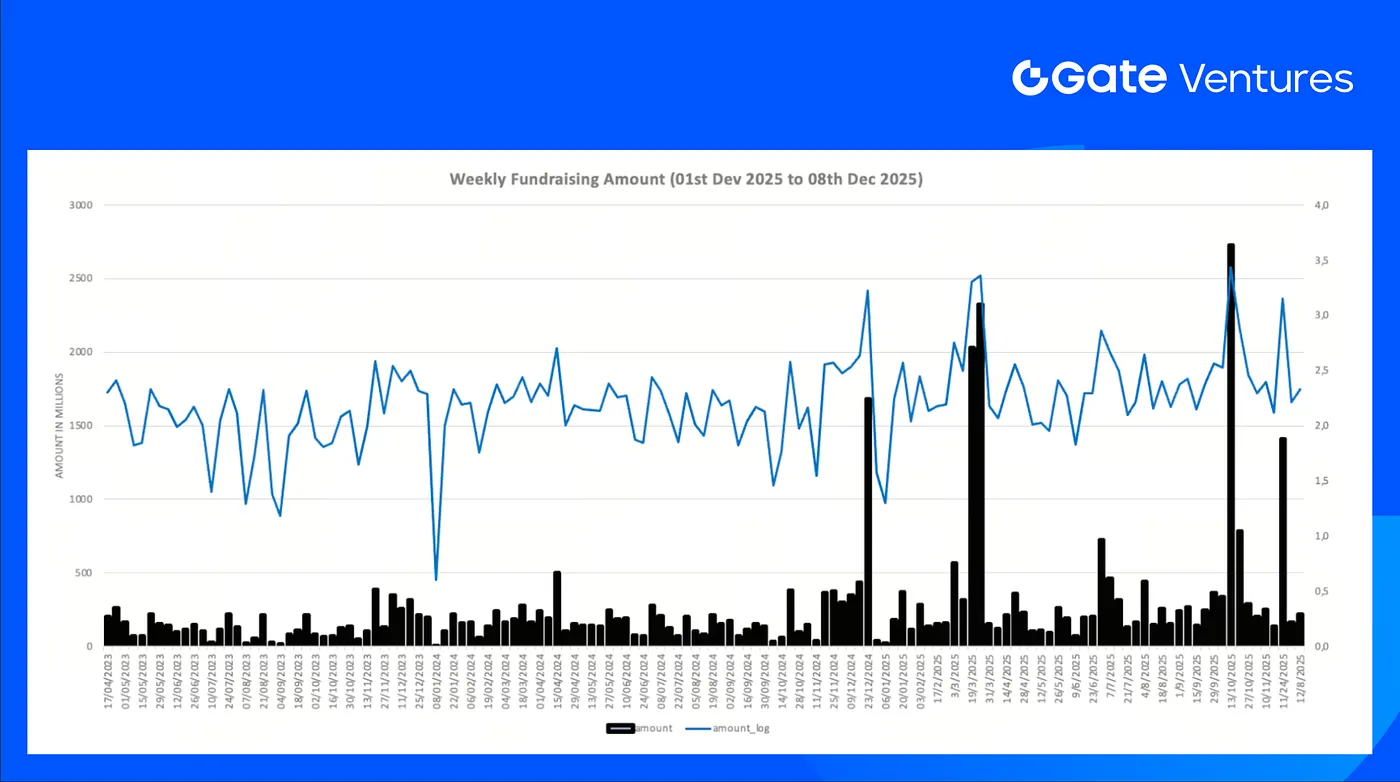

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 08th Dec 2025

The total amount of disclosed funding raised in the previous week was $215M, 21% (5/23) deals in the previous week didn’t public the raised amount. The top funding came from Infra sector with $124M. Most funded deals: Gonka $50M, Canto Network $25M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 08th Dec 2025

Total weekly fundraising rose to $215M for the 1st week of Dec-2025, an increase of 31% compared to the week prior. Weekly fundraising in the previous week was up 63% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation*. **You should always seek independent professional advice before making any investment decisions.** Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.*

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-8-december-2025.html

- The deviation between the yen and the US-Japan government bond yield spread, TradingView, https://www.tradingview.com/chart/QOz7i3JC/

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Sui Grayscale ETF Filing, https://coincentral.com/grayscale-files-s-1-for-new-sui-etf-after-21shares-launches-first-fund/

- LINK Grayscale ETF Debut, https://www.davispolk.com/experience/grayscale-chainlink-trust-etf-launches-first-us-chainlink-etf

- Aave and CoW launch first intent-based flash loan product to expand programmable DeFi,

- https://www.theblock.co/post/381336/aave-cow-mev-protected-swaps-intent-based-flash-loans

- Galaxy expands into institutional liquid staking with Alluvial acquisition, https://investor.galaxy.com/news/news-details/2025/Galaxy-Expands-into-Liquid-Staking-as-Development-Company-for-Liquid-Collective/default.aspx

- Grayscale launches LINK ETF with $41M inflows, showing appetite for regulated altcoin exposure, https://www.theblock.co/post/380978/chainlink-first-etf-grayscales-glnk-set-begin-trading

- Pantera leads $17M Seed for Fin’s cross-border stablecoin transfer platform, https://fortune.com/2025/12/03/former-citadel-employees-raise-17-million-for-fin/

- Ostium secures $20M Series A to scale RWA and crypto perpetuals trading, https://fortune.com/2025/12/03/ostium-series-a-fundraise-perpetuals-perps-crypto/

- Digital Asset raises $50M Strategic Round to scale the Canton Network, https://cointelegraph.com/news/digital-asset-canton-network-bny-nasdaq-sp-global-funding

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)