Why On-Chain Gold is a Trap

Tokenized gold has successfully onboarded many crypto users into the real-world asset (RWA) space. But at what cost?

Binance PAXG price vs Spot Gold price

Here’s a simple price chart overlaying PAXG (in blue), one of the two leading tokenized gold solutions, with spot gold (in yellow). Each token represents one ounce of spot gold. Yet, in the time period displayed, almost every PAXG buyer ended up paying above the spot price.

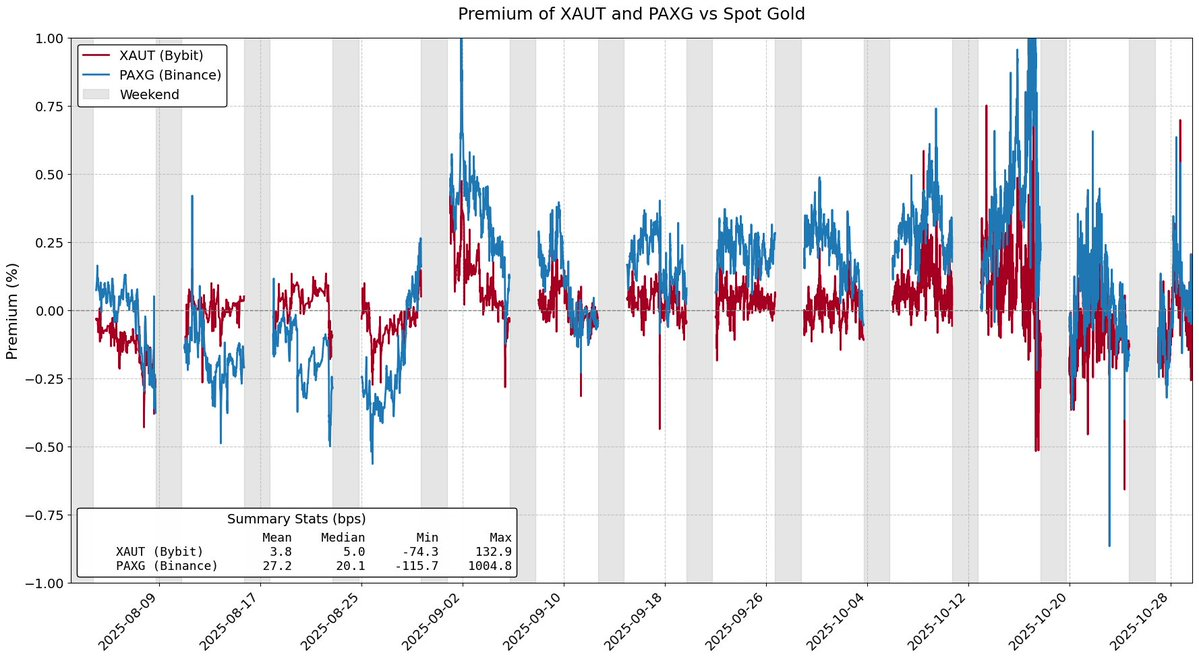

Premium on pricing of PAXG and XAUT over spot Gold

Tokenized RWAs are meant to make access to real assets more cost efficient. Yet tokenized gold, which makes up ~84% of the total tokenized commodity market capitalization, has struggled to meet that goal. The premium in tokenized gold can easily be mistaken to be driven by demand. In reality, it stems from the structural frictions embedded in these tokens’ issuance model design.

Minting and redemption fees

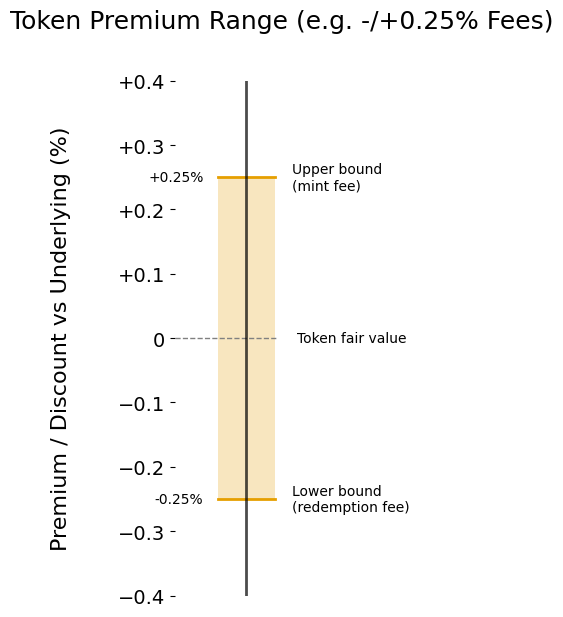

A big driver of the premium of any tokenized product relative to its underlying asset is the fee to mint and redeem. The minting and redemption fee effectively establishes a “premium range” the tokenized product can reasonably trade in relative to the value of the underlying asset.

Consider yourself a market maker of XAUt and PAXG. Gold has been on a strong rally and, as a result, there have been strong inflows in tokenized gold. At what price would you be willing to sell XAUt or PAXG? Just to breakeven, you would have to sell the tokens at a price that is at least what you acquired the tokens for as inventory. This is defined by the token’s minting fee and effectively sets a soft upper bound for the token’s price.

Following the same logic, tokenized gold can also trade at a discount. Consider tokenized gold now experiences outflows. You, as an MM, would only buy XAUt or PAXG at a price that is lower than what you would receive from Tether or Paxos in redeeming the tokens. Just as the mint fee caps the upside, the redemption fee caps the downside.

Premium range driven by mint/redemption fee

The higher the fees, the wider the premium range and the more the token can deviate from its fair value. As of writing, Tether charges a 0.25% fee on XAUt mints and redemptions, while Paxos uses a fee schedule with mint and redemption sizes of 2-25 PAXG incurring a 1% fee and sizes greater than 800 tokens incurring 0.125%.

Given the overhead and operational costs involved in tokenizing physical gold, some may argue that the mint and redemption fees charged by Paxos and Tether are justified. But it is clear that lower minting and redemption fees would reduce the tracking error of tokenized RWAs and ultimately improve cost efficiency for end investors.

Structural frictions

Minting and redemption fees only set “soft” upper and lower bounds for the tokenized gold price. Other frictions related to the token’s primary issuance model can also meaningfully contribute to the tokenized gold price’s premium range.

For example, Tether Gold imposes a minimum size of 50 XAUt (~$200k) for mints and 430 XAUt (~$1.7mln) for redemptions. This size limitation is a significant barrier for market makers, leaving them warehousing inventory for extended periods and incurring significant opportunity cost.

Another hurdle in the current tokenized gold landscape is the settlement delay involved in mints and redemptions. In the redemption of PAXG, Paxos says it can take up to several business days for users’ account balance to update, posing as a substantial opportunity cost as capital is tied up.

Together, these frictions dissuade market makers from stepping in unless there is sufficient money to be made. This ultimately enables the price of these tokenized gold assets to drift from its fair value more dramatically, even beyond the caps set by mint and redemption fees.

Tokenized gold has shown that RWAs can attract capital but also exposed the limits of today’s tokenization model. On-chain gold trades at a premium with slow redemption periods. These barriers act as an indirect tax. If tokenized assets are to scale, users should not be punished for choosing on-chain rails.

Liquidity, redemption, and price alignment must reinforce one another, not come as trade-offs. This has to change.

Disclaimer:

- This article is reprinted from [ballsyalchemist]. All copyrights belong to the original author [ballsyalchemist]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

What is Plume Network

ONDO, a Project Favored by BlackRock

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)

Real World Assets - All assets will move on-chain