Why did I bet on MNT after the market crash?

I can’t offer thoughts on perp market mechanisms, because it is not my specialty

What I can offer, is my market thoughts - and I believe there is a structural trend shift.

Firstly, the entirety of 2025 was propelled by a DEX vs CEX through the birth of Hyperliquid and on-chain capital markets - both of which had their own reasons for existing. On-chain capital markets offered low float, low FDV pumps (numba go up) which made them very attractive, as you needed less marginal bid, and had no dumpers that got in at earlier entries

Perp DEXes thrived on the back of the fact that Binance was seemingly losing its grip on its traders because none of the coins were going up - many of the new listings (NXPC, Zerebro, Perp markets) were down only on listing, and with that kind of PA, it drove many traders away from Binance, believing that it was antagonistic and not a venue to make money on.

I myself talked about these two trends when it was happening. I remember saying something along the lines of how Binance Dynasty was slowly eroding with all the new listings that went down only.

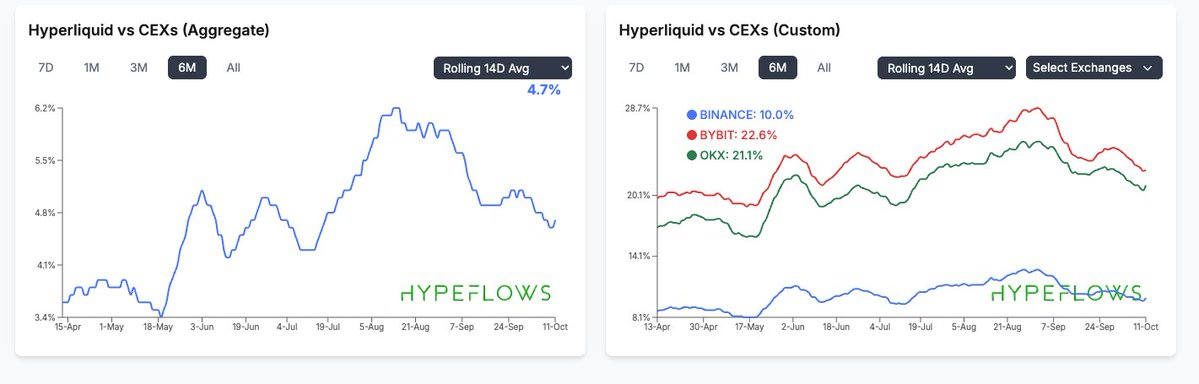

However, I believe that this DEX vs CEX narrative will no longer be a big driver, moving forward. In fact, looking at the aggregate, it topped out a month or two ago, and has been coming down ever since

This doesn’t mean I’m bearish DEXes or Perp DEXes or Hyperliquid. What I mean to say is that this was the asymmetric narrative for most of the year, but now that asymmetry isn’t clear to me anymore. For starters:

1) The emergence of many highly competitive and capable perp dexes is incredibly mercenary to each other (Lighter, et al) in a space that isn’t that big to begin with (and now, after 20+ bn liquidated, is ever so smaller)

2) Combined with many, many events that transpired across perp dexes and DEXes in general in the past few months - mainly, being the favourite venue for insiders and criminals to trade on.

Countless of such incidents: white house insider, north korean wash trading, on-chain scams by celebrities, Milei token, Trump token, etc. DEXes died first, but Perp DEXes saw their fair share of morally ambiguous events

The transparency of Perp DEXes seems to work against in its favor in all of these occassions - whales did not like being hunted (Launchcoin, Jelly Jelly), clear insider depositing, and what is not talked about is the transparency of losses. In most CEXes, leaderboards only show the top winners, but the transparency of Perp DEXes also show the top losers.

This may not be important for now, but imagine if Citadel were to onboard, and everyone could see that they were on a losing streak. TradFi values privacy.

Anyways, none of these events had insane outcomes unlike TRUMP (which created the death of Onchain DEX), but slowly, and over time, they have added up

3) And obviously, what happened in the past few days was basically, the equivalent of TRUMP in terms of impact in the markets.

Combining all of these, it seems to me that Perp DEXes no longer are an asymmetric outcome. Again, it is important that you understand the nature of what I’m saying.

I am quite bullish perps as a product, as a whole. But as a general trader, and someone whose edge has always laid in spotting asymmetric outcomes, I will say that the general Perp DEX space does not seem incredibly enticing for me to allocate into.

However, I believe that instead we will see a CEX vs CEX narrative. And you might think this is quite hypocritical, considering that the events in the past 2 days also involved CEXes.

But that works in my favour. Let me explain my thoughts.

The broader narrative at play is simple. Over the past few months, there have been a few criteria when looking at tokens:

They have to have aligned holders, i.e preferably no VCs that continuously unlock and dump. This is a spectrum, and it can go from fully diluted, to fully supply controlled

They have to have a growing product and revenue

Priority of tokenholders - i.e the token has to have some sort of utility or focus, unlike many tokens that may have 1) & 2) but not give a crap about their token at all

They have to have some sort of incremental bid

Combining these metrics, with my thoughts of the past two days - that in crypto, there’s really only 3 broadly investable sectors:

Provenance, Exchanges, & Stablecoins.

Combining these 3, and the criterias I have above, the investable tokens come out to something like:

Provenance - BTC / ETH

Exchanges - BNB / HYPE / MNT / ASTER

Stablecoins - Unfortunately many DeFi protocols don’t sustain the 3 criteria above. In fact, I would argue the best way to express the Stablecoin bet is in Equity - CRCL, or better yet, Tether equity.

The events over the past 2 days have cemented to my head the importance of looking at this criteria. I am seriously not interested in 99% of tokens where I have to rely on CT, who not only lost alot of money in the past week, but also has no incremental new flows (retail is betting on memestocks)

BTC & ETH is obvious, they have perma tradfi bid, and they dont need revenue. Their narratives stand on their own.

But tokens in altcoin land, 99% fail the test. The really only area I am interested in, is thus exchanges.

Now back to the whole CEX vs CEX thing. What do I mean? Well, first I explained about Perp DEXes and how the entire year was shifting against them, into the flash crash which in my opinion, has basically shifted the trend.

But the second effect of the black swan event also lies on Binance - namely, how they handled the crisis. I will not go into all the details about it (mostly because I don’t trust myself with the specifics as I’m not an expert), but I do want to leave some examples:

The biggest being the fact that USDe depegged alot more on Binance vs Bybit which caused quite a lot of pain for Binance users

I’m not going to bet against Binance, because clearly, they have once again trumped against the CEX vs DEX narratives - bringing BSC season back, BNB going to >$1000, etc. Binance is also a fantastic product, that serves millions of users worldwide

BUT - I will say that I believe this may be the start of an emerging CEX to take a larger % of the market share. Just like how Lighter and friends are coming up against Hyperliquid, I believe that there is space for a CEX to grow.

And obviously, my bet is simple. Bybit has time and again showed professionalism and the knowledge of how to do things right.

Bybit to me is also more of a growth oriented exchange than anyone else - they, as far as I know, are the only large exchange to experiment so much - they have stocks, and their launch of Byreal (DEX on Solana), and the ability to trade forex, commodities, etc.

They kind of remind me of Robinhood (?) Cracked founder, constantly shipping, and constantly iterating - in the arena vibes. And most importantly, their token is in quite an asymmetric spot, fulfilling all the criteria:

Exchange tokens have the largest demand sinks out of all token mechanisms. Billion dollar exchanges requiring their VIP traders to buy MNT for fee discounts is an evergreen demand sink that constantly nets new buyers and doesn’t rely on “flavor of the week” or “come and go” liquidity - this is CONSTANT buying pressure

They have aligned holders (themselves), and since they make revenue, they don’t rely on dumping the token for $ - in fact, quite the opposite. Also no VCs, blah blah.

Growing product and revenue. Of course.

Priority to tokenholders - now MNT gives you access to launchpool (i.e new tokens launched)

Overall, where MNT stands price wise is also asymmetric to me. I mean, by FDV, these are the tokens “valued” more than it:

WLFI, CRO, SUI, ADA,

and by MC: SHIB, LTC, LINK, etc.

I would like to remind you guys that BNB is 4th across all tokens. BTC, ETH, Tether, BNB

Mantle is 34th, for fuck’s sake. Anyways, most importantly, I am going to re-iterate that really, this past few days hammered home that most tokens are toxic waste, and this is the last bastion of hope for me.

I am naturally a hodler, and I dislike trading flavor of the weeks (I suck); my edge has always been something akin to swing trading. And so, I present to you, the only real coin that I’m holding now.

gMNT.

(The article for the full pitch I wrote will be in the replies below)

Disclaimer:

- This article is reprinted from [0xkyle__]. All copyrights belong to the original author [**]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?