Market Summary: Bullish or Bearish?

1. Recent Momentum

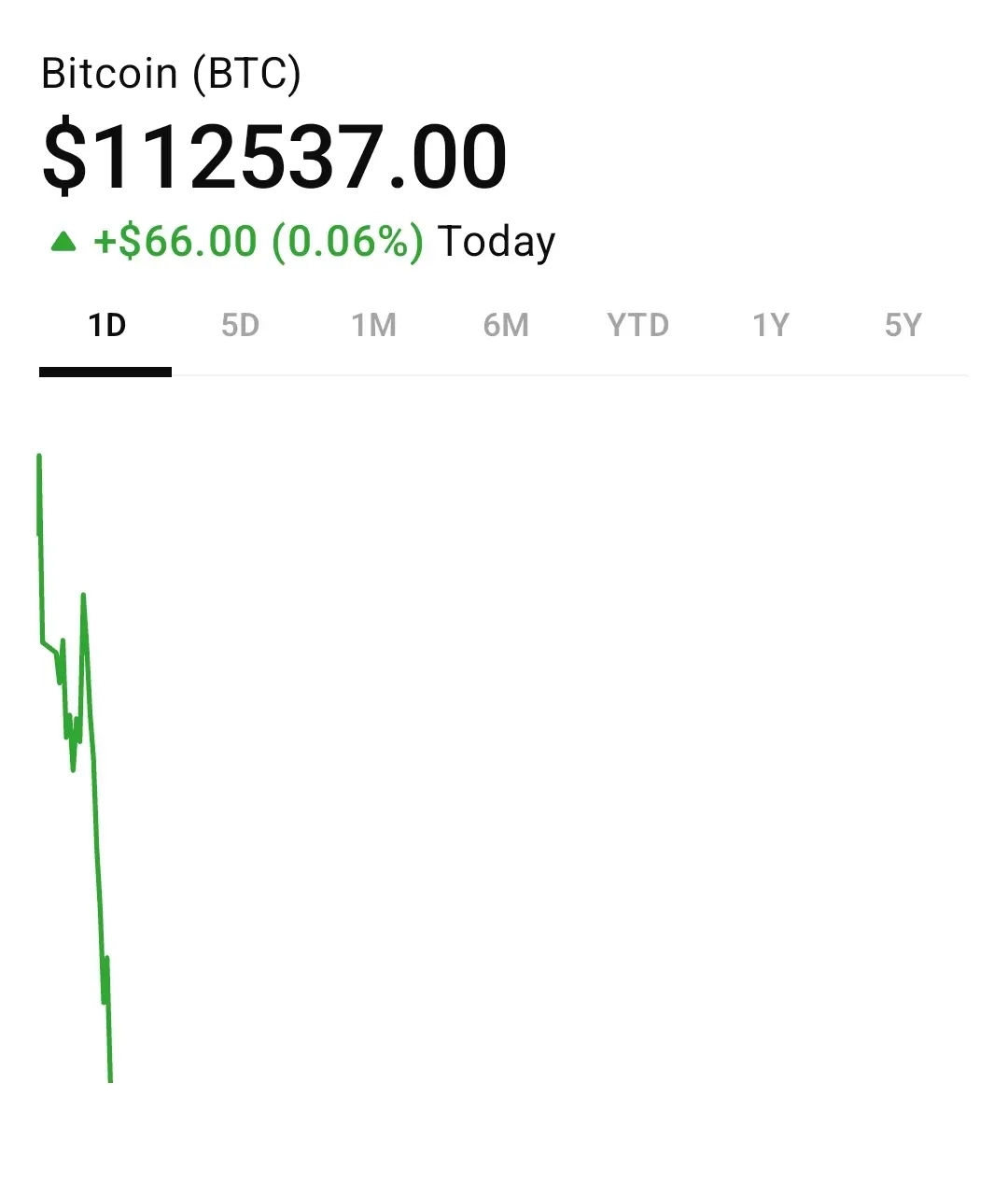

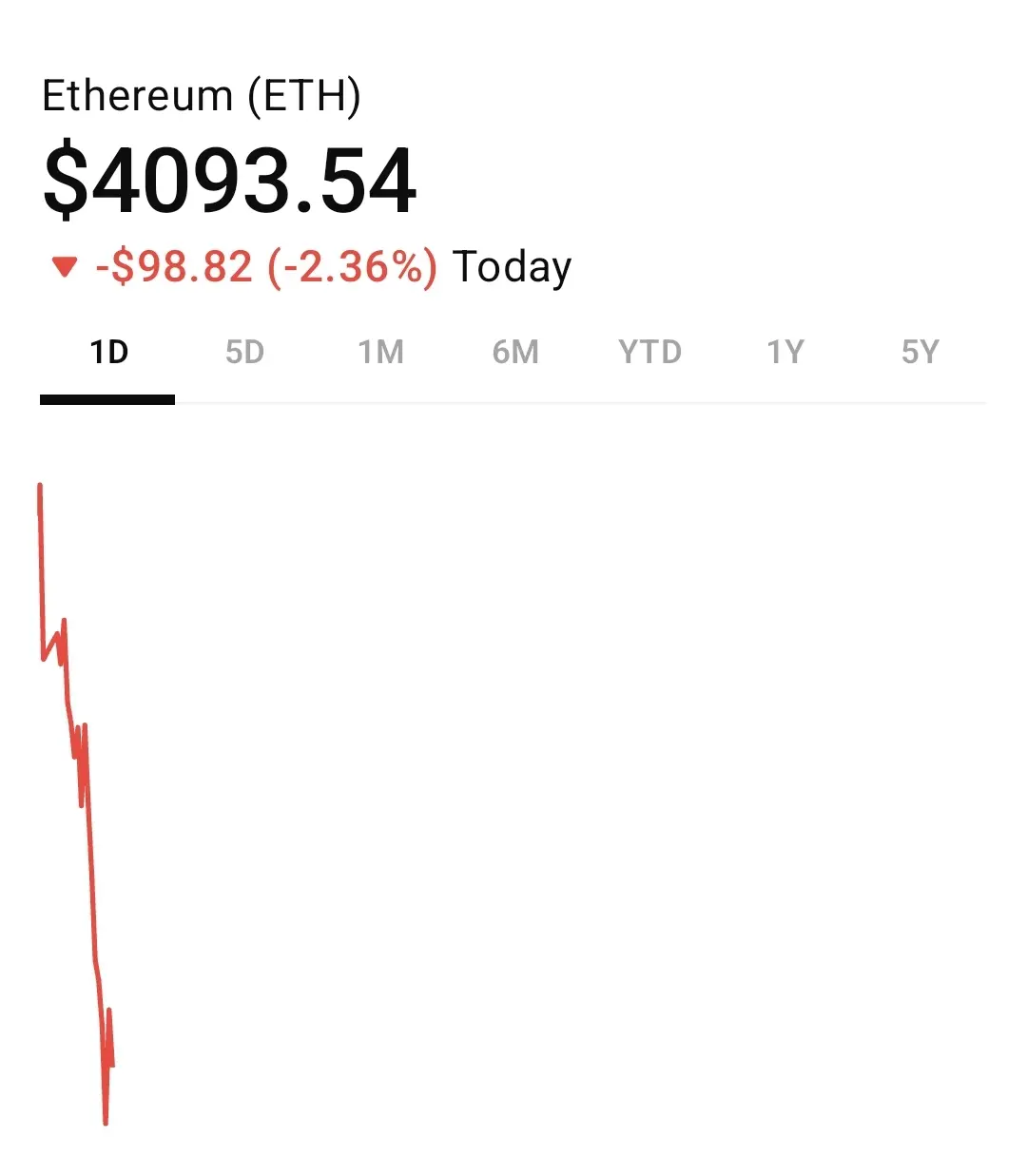

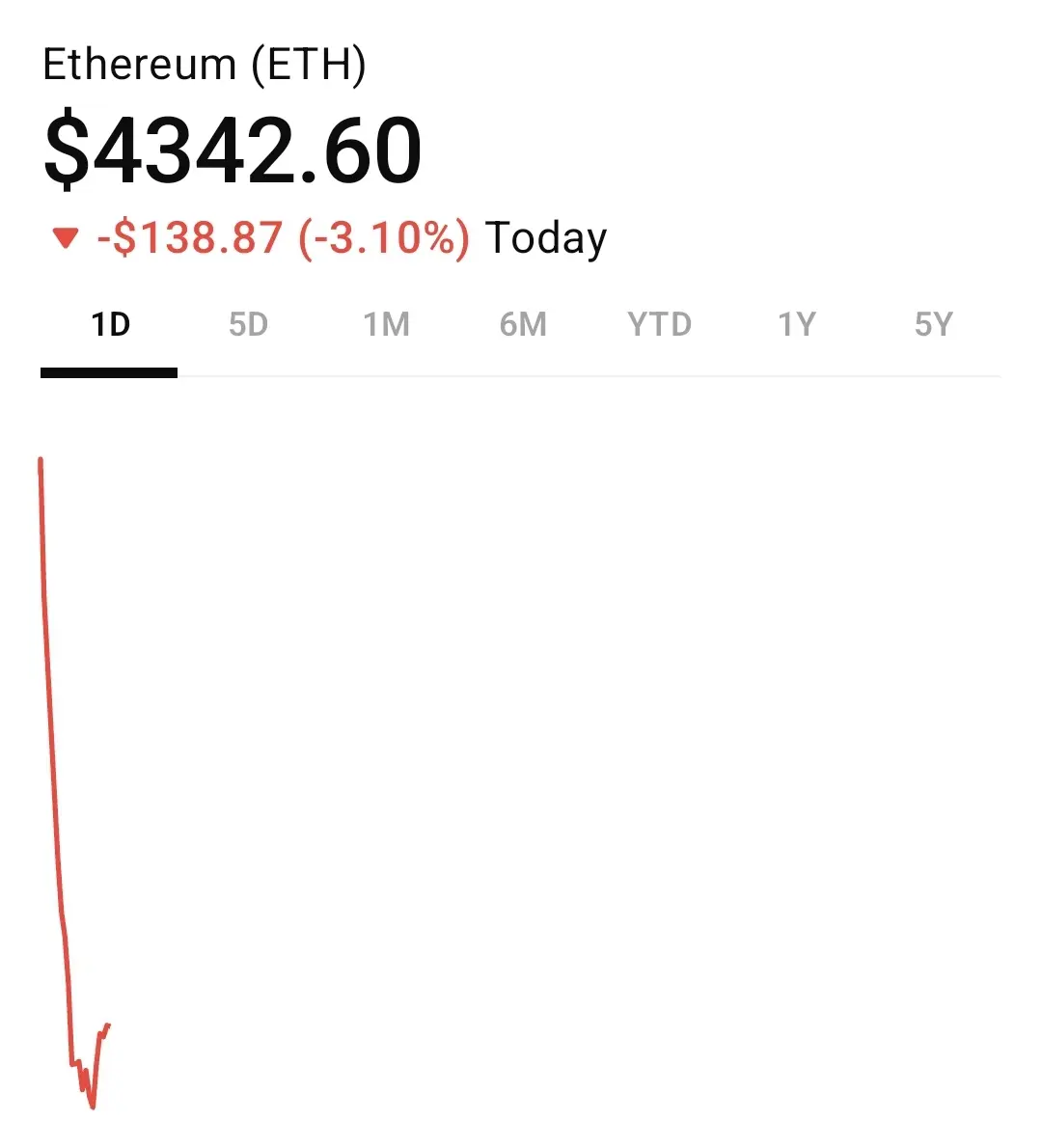

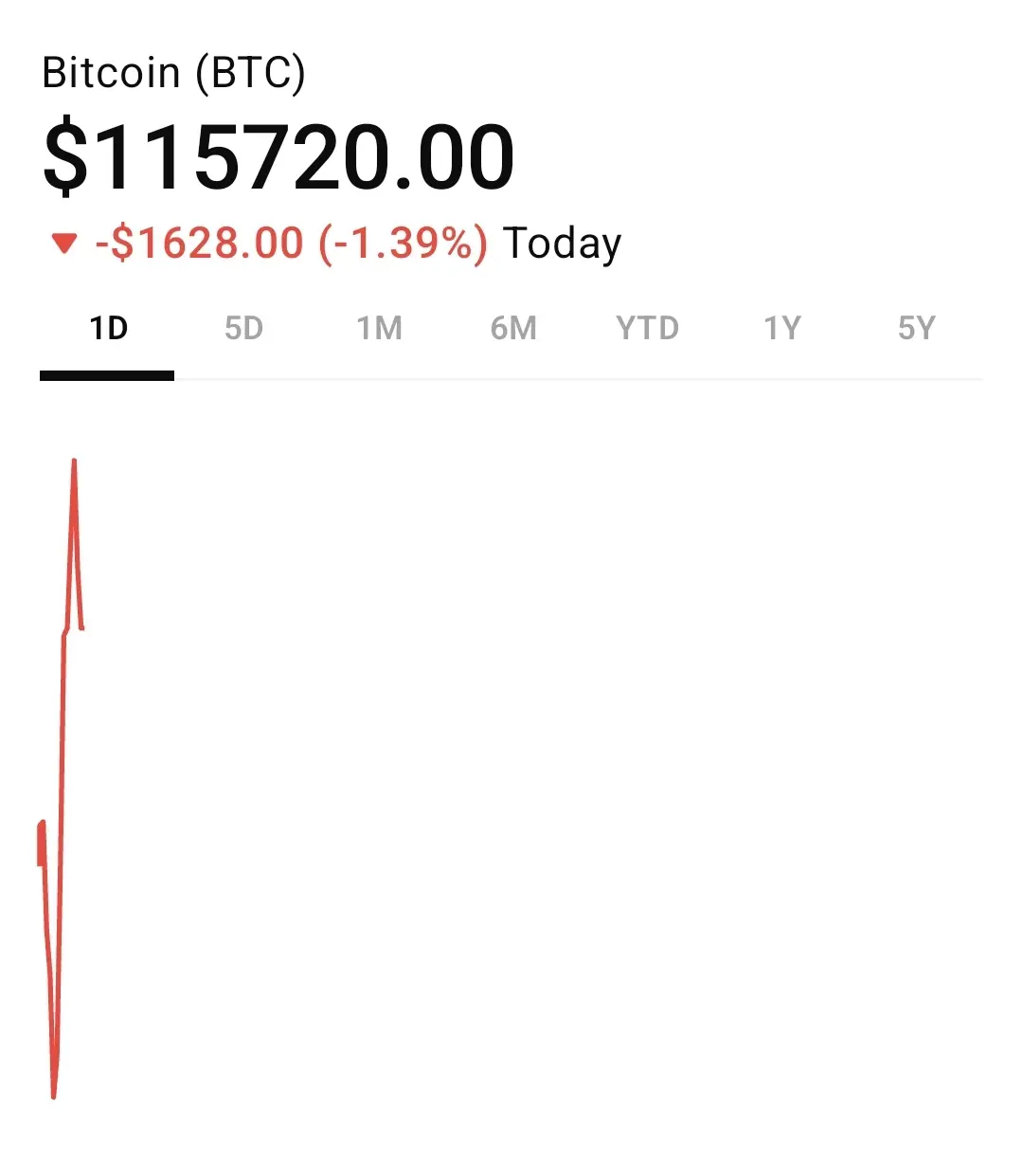

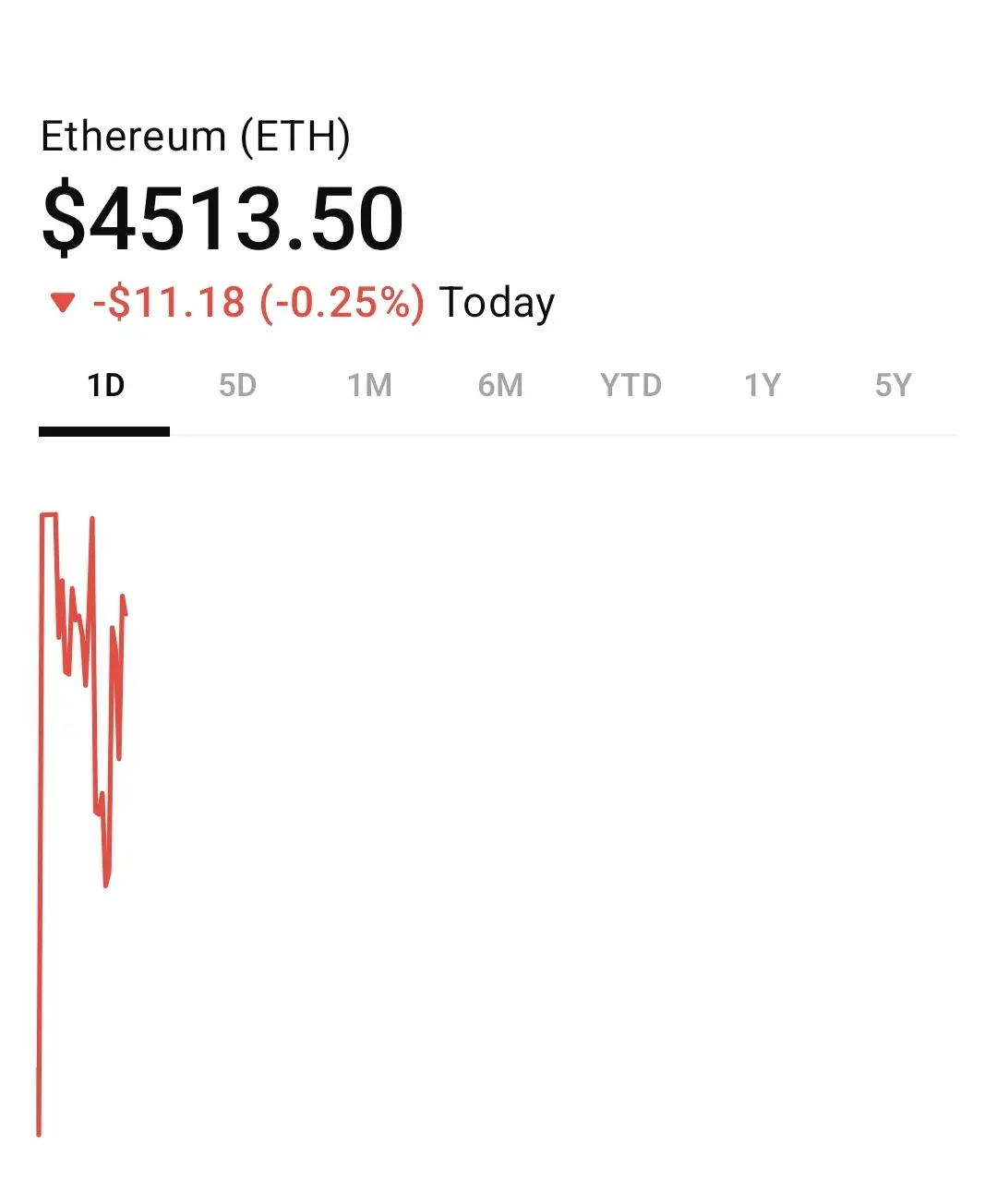

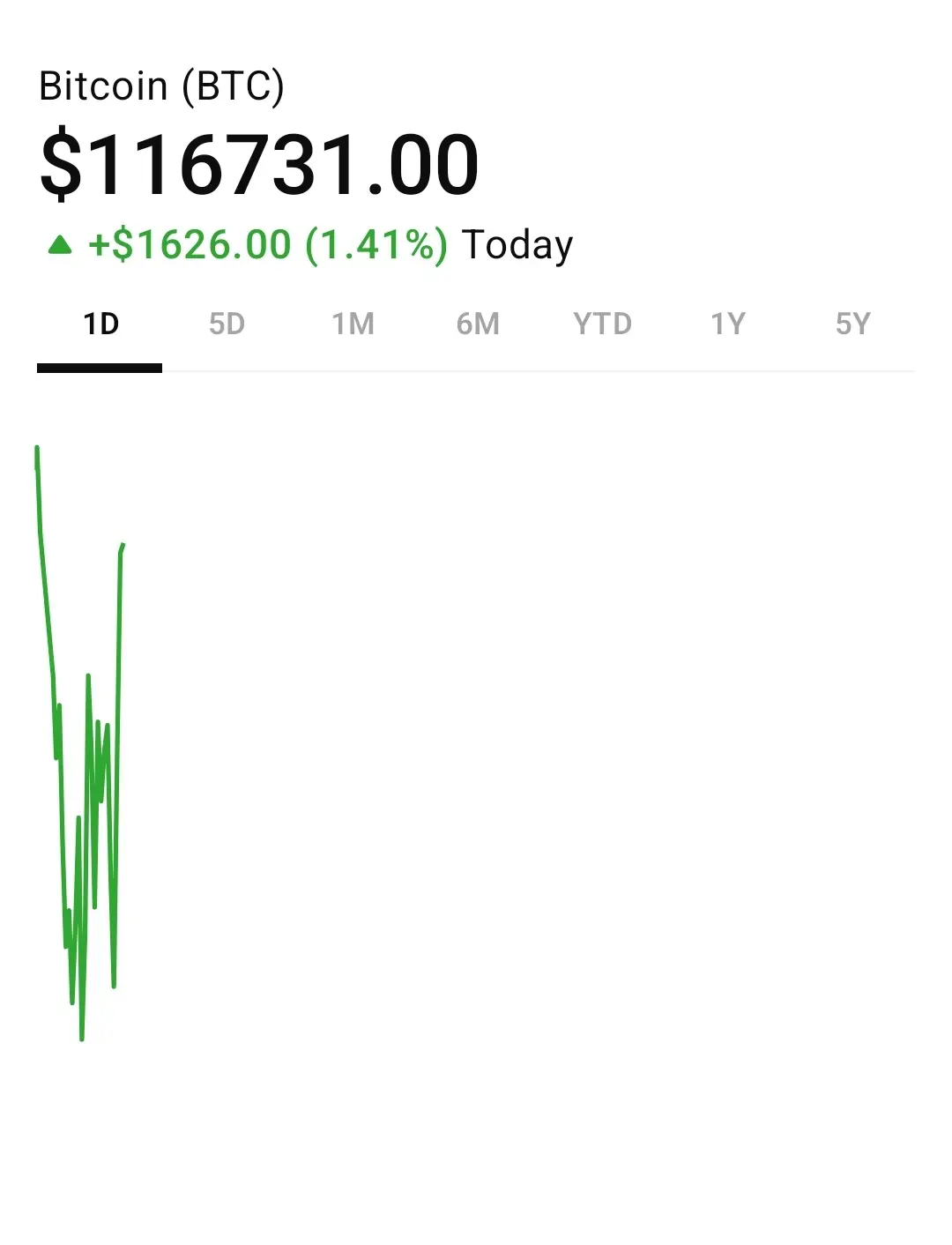

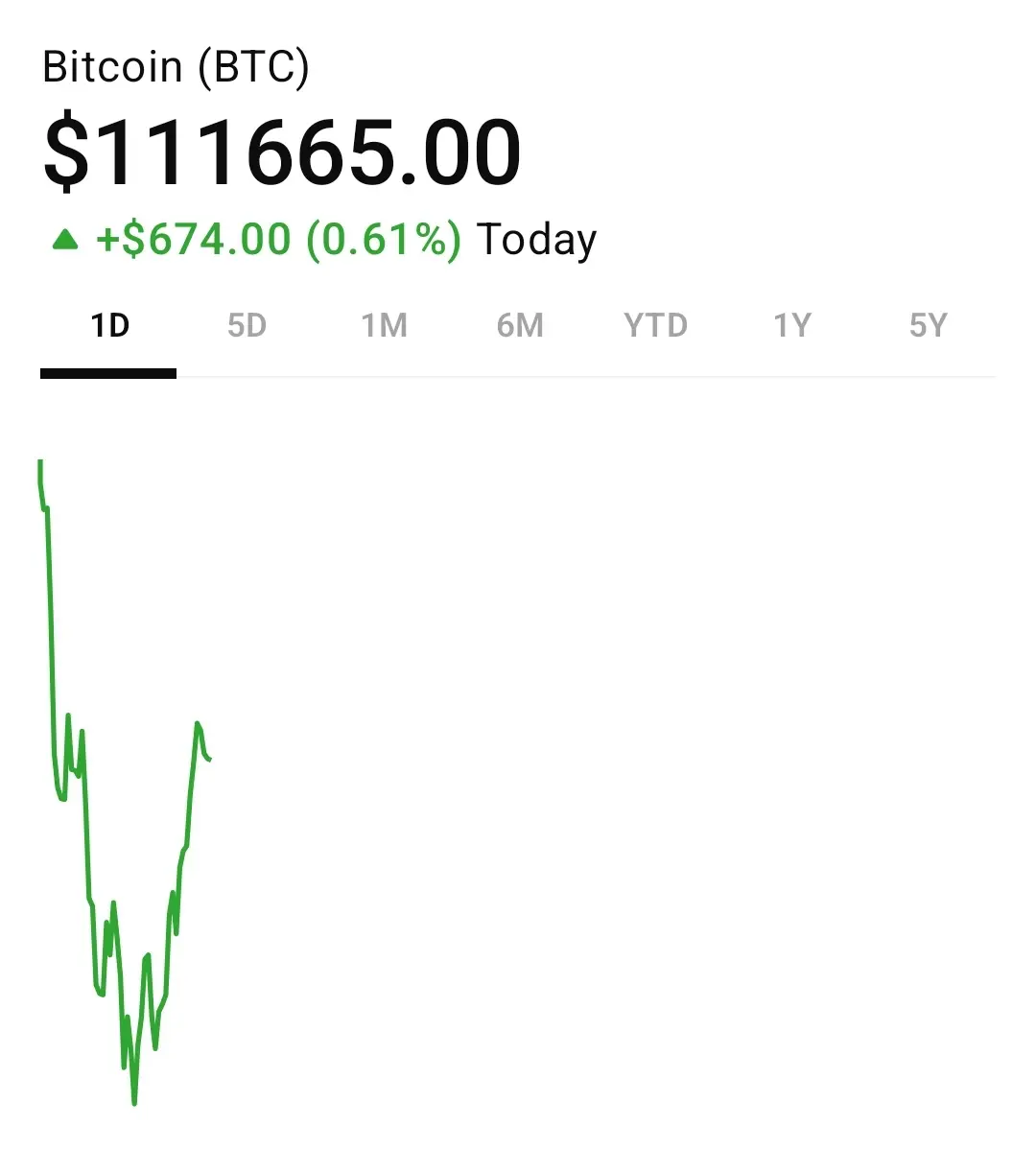

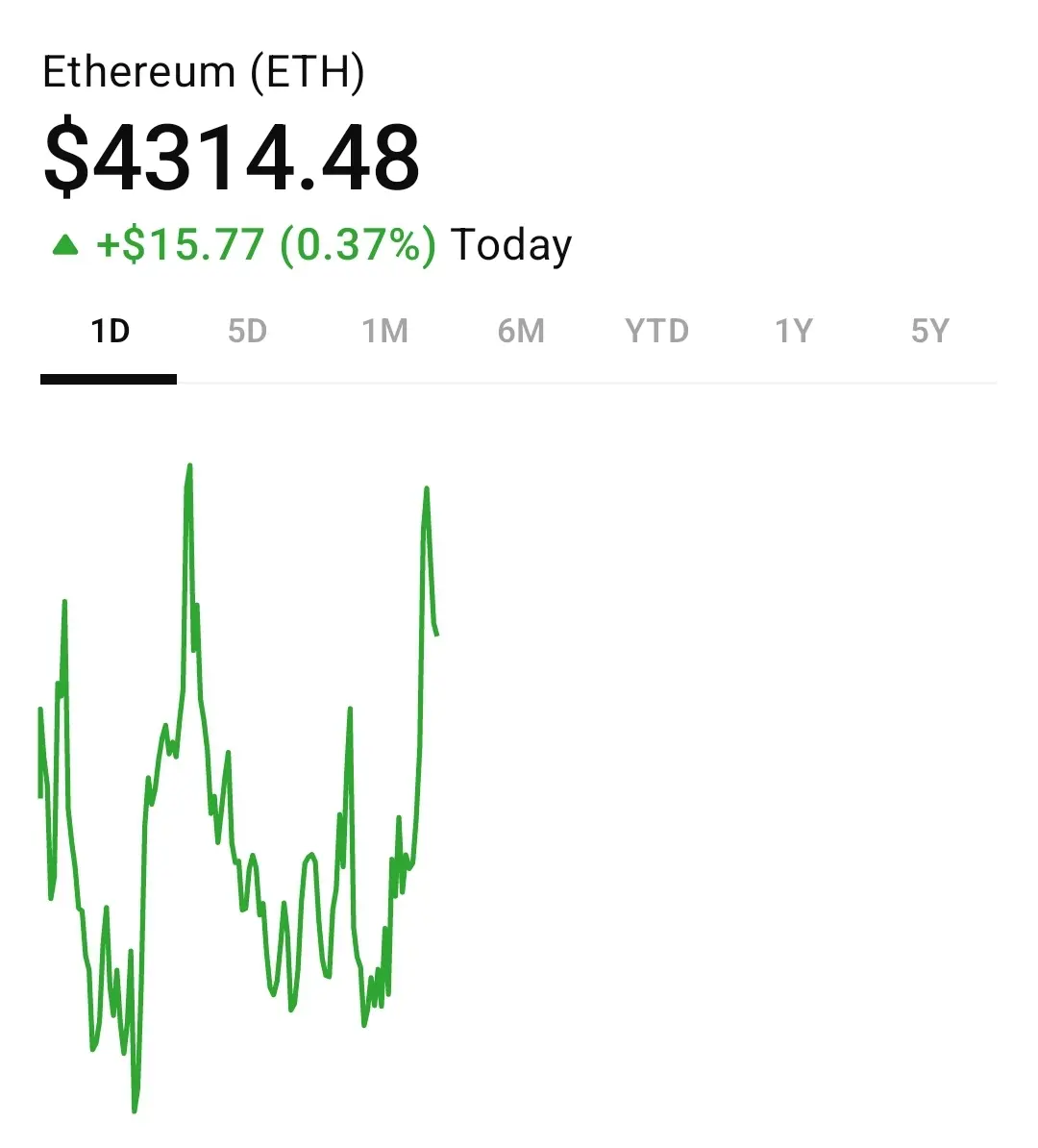

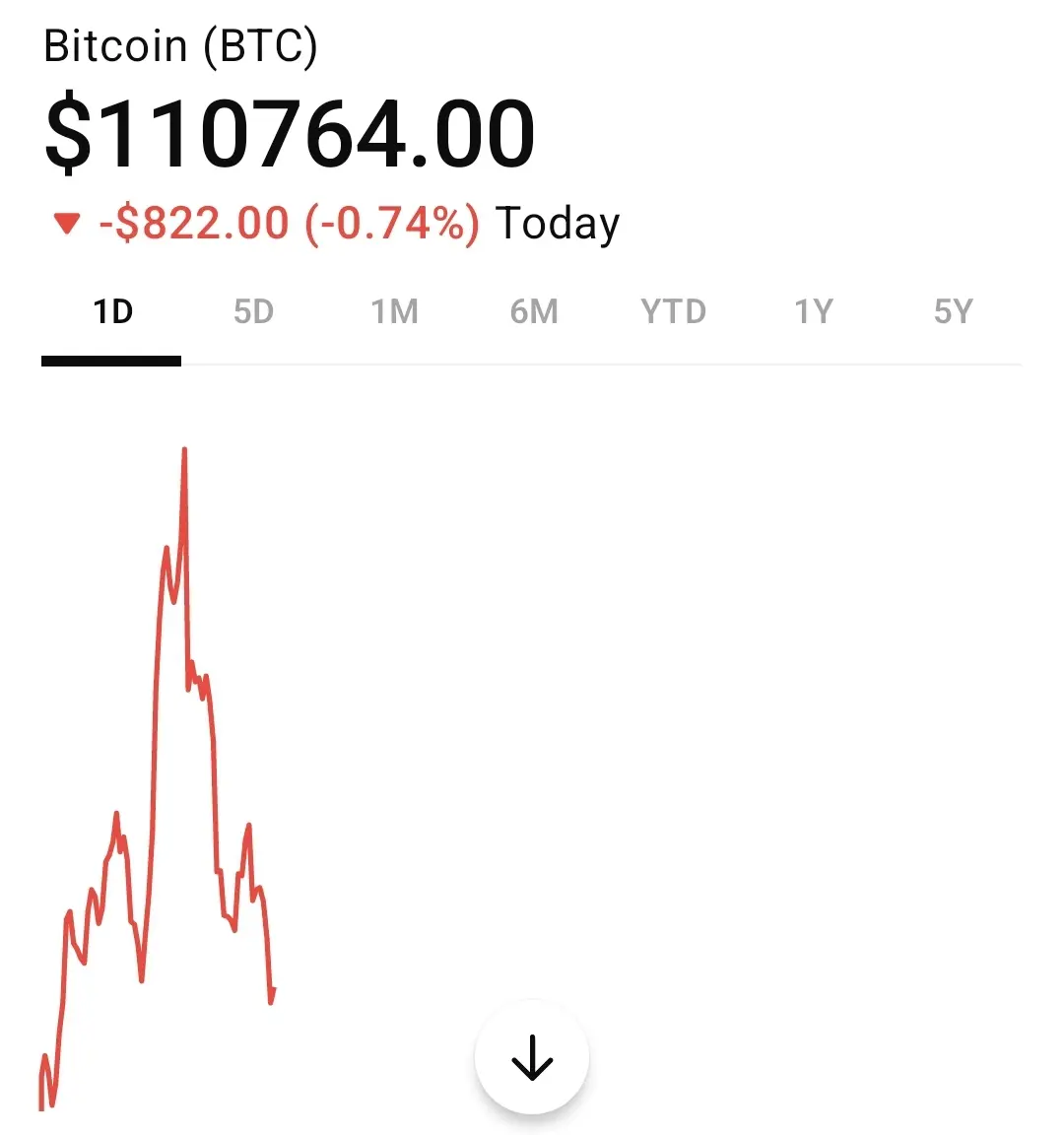

Bitcoin is hovering around $112K, and Ethereum is near $4.3K. These levels show relative stability, with Bitcoin consolidating around key resistance zones.

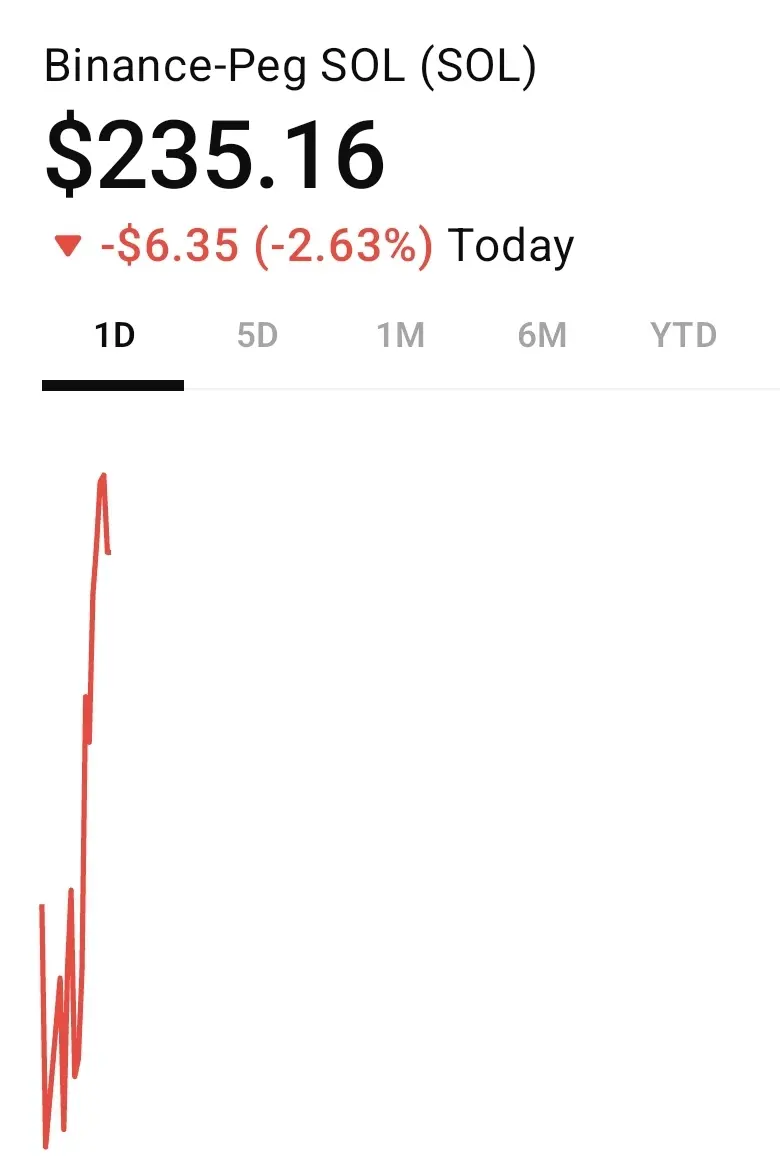

Altcoins are seeing meaningful gains: XRP (+4.1%), Solana (+3%), Dogecoin (+7.4%), and others are similarly performing well.

2. Broader Market Trends

The total crypto market cap is around $3.85–3.98 trillion, marking a modest increase of 0.2% to 1.2% over the past day.

Positive sentiment is prevalent, driven in part by soft U.S. economic data that’s raising hopes for interest rate cuts—

1. Recent Momentum

Bitcoin is hovering around $112K, and Ethereum is near $4.3K. These levels show relative stability, with Bitcoin consolidating around key resistance zones.

Altcoins are seeing meaningful gains: XRP (+4.1%), Solana (+3%), Dogecoin (+7.4%), and others are similarly performing well.

2. Broader Market Trends

The total crypto market cap is around $3.85–3.98 trillion, marking a modest increase of 0.2% to 1.2% over the past day.

Positive sentiment is prevalent, driven in part by soft U.S. economic data that’s raising hopes for interest rate cuts—