Gate Launchpad Phase 5 Launches Kodiak (KDK): USDT & GUSD Dual-Channel Subscription with 100% Unlock Distribution Explained

What Is Gate Launchpad

Gate Launchpad is a new token subscription platform from Gate, designed for early-stage blockchain projects. It provides users with a fair and open way to participate in token distributions at the start of a project. Unlike traditional private placements or high-barrier entry methods, Gate Launchpad sets comparatively low participation thresholds and uses standardized allocation rules, making it accessible to both everyday users and newcomers.

With Gate Launchpad, users take part by locking designated assets. The platform then allocates tokens based on the average locked amount over the subscription period, which prevents “fast clickers” from claiming the entire allocation at once.

Gate Launchpad Phase 5 Project Overview: Kodiak (KDK)

Image: https://www.gate.com/launchpad/2362

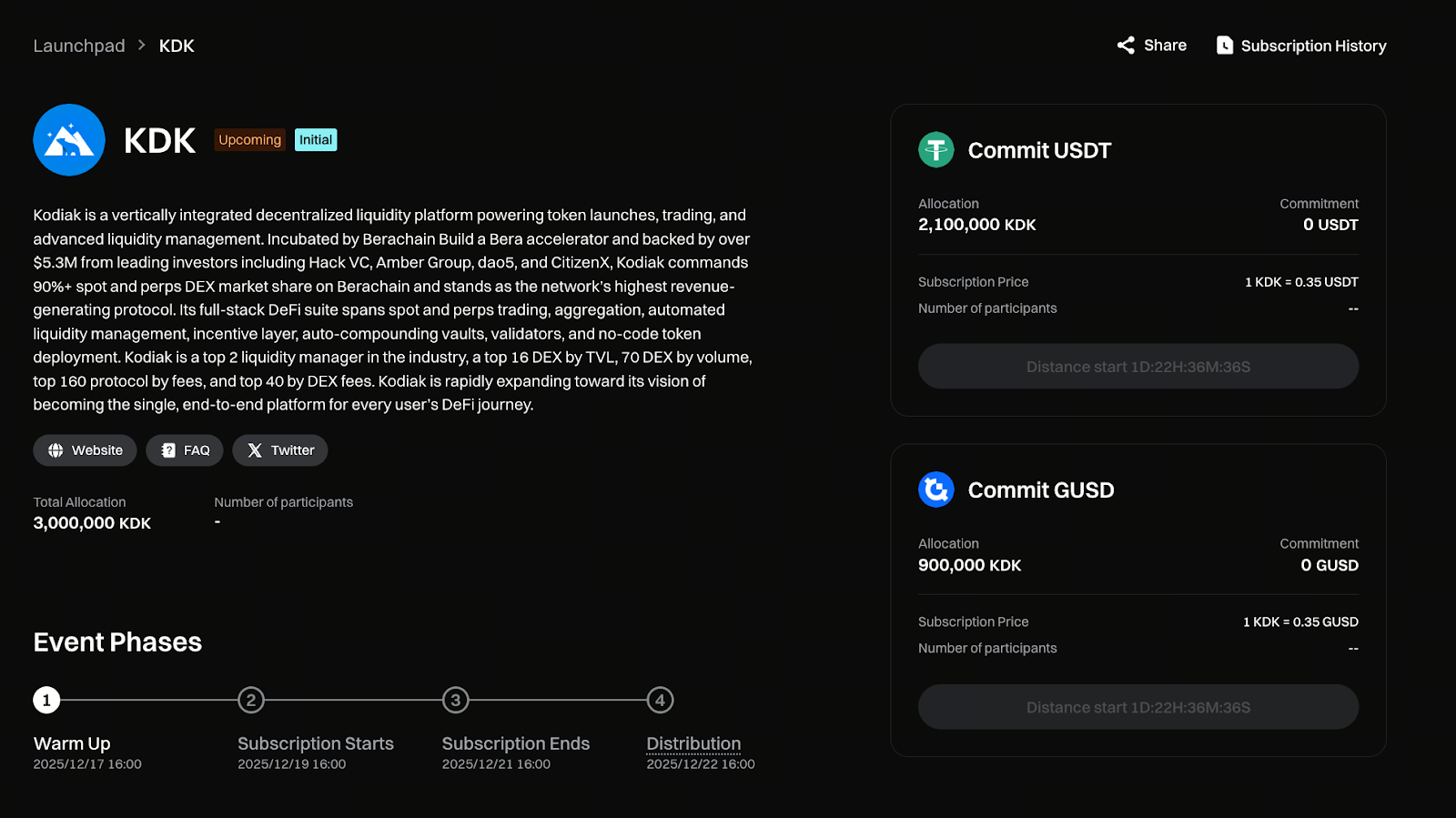

This round of Gate Launchpad features Kodiak (KDK), a decentralized liquidity protocol. The total subscription amount is 3,000,000 KDK, with 70% allocated to the USDT pool and 30% to the GUSD pool. All tokens are distributed with 100% immediate unlocking, eliminating uncertainties related to phased releases.

KDK is priced at 1 KDK = 0.35 USDT or GUSD. Each participant can receive up to 30,000 KDK, ensuring a fair opportunity for both smaller and larger investors.

Why Gate Launchpad Uses Dual-Token Subscription with USDT and GUSD

A standout feature of this Gate Launchpad round is support for both USDT and GUSD. USDT is a leading stablecoin with strong liquidity and broad adoption. GUSD is a yield-bearing stable asset backed by government bond RWAs, providing steady returns while held.

This allows users to maintain asset stability and earn passive yield through GUSD while joining Gate Launchpad, lowering idle capital costs during the subscription process. It marks a significant product upgrade for Gate Launchpad.

Kodiak (KDK) Core Project Highlights

Kodiak is a vertically integrated decentralized liquidity platform that spans spot trading, perpetual contracts, liquidity aggregation, automated management, and no-code token deployment. The project was incubated by the Berachain “Build a Bera” accelerator and has secured over $5.3 million in investment from Hack VC, Amber Group, dao5, and other institutional investors.

Within the Berachain ecosystem, Kodiak commands over 90% of the spot and perpetual DEX market share and is among the network’s top-earning protocols. By metrics such as TVL, trading volume, and fees, Kodiak is now a leading DeFi liquidity protocol, which is a major reason for its selection by Gate Launchpad.

Gate Launchpad Subscription Rules and Allocation Mechanism Explained

Gate Launchpad uses “hourly average locked amount” as its core allocation metric. The earlier and longer you participate and lock assets, the higher your average locked amount and the greater your share of token allocation.

This approach encourages long-term, rational participation instead of short-term spikes. After the subscription ends, the system deducts the actual allocated funds, and any unused balance is automatically refunded to your spot account, improving capital flexibility.

How Beginners Can Participate in Gate Launchpad’s KDK Subscription

The process for beginners to join Gate Launchpad is clear and straightforward:

- Register a Gate account and complete identity verification;

- Prepare USDT or GUSD (GUSD can be minted, purchased, or deposited);

- Go to the [Wealth Management] page, select Gate Launchpad, locate the Kodiak (KDK) project, and enter your subscription amount;

- Once you confirm, the system will automatically lock your assets and include you in the allocation.

No complex steps are required, so even newcomers can get started quickly.

Gate Launchpad Risk Warning and Participation Recommendations

While Gate Launchpad screens promising projects for users, new tokens remain high-risk assets. Early-stage projects may face technical, market, or regulatory uncertainties, and price volatility is often substantial.

For beginners, it’s wise to manage investment size, avoid concentrating funds in a single project, and participate only after thoroughly understanding Gate Launchpad rules and the project background.

Summary: Why Gate Launchpad Remains a Key Channel for New Token Participation

Gate Launchpad gives users a practical way to access early-stage projects through transparent rules, standardized allocation, and low entry barriers. In this round, Kodiak (KDK) stands out for its project fundamentals, distribution model, and the dual-channel design of USDT and GUSD.

For newcomers looking to systematically learn about new token subscription mechanisms and gradually enter the crypto market, Gate Launchpad remains a vital platform worth following.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution