Post content & earn content mining yield

placeholder

AylaShinex

#CMEGroupPlansCMEToken 💥 | Institutional Crypto Update

CME Group, one of the world’s largest derivatives exchanges, is planning to launch its own CME Token.

This move could:

• Bridge traditional finance with crypto

• Offer new trading and hedging opportunities

• Attract institutional investors to tokenized markets

A big step showing how legacy finance is increasingly entering the crypto space.

#CryptoNews #InstitutionalCrypto #CME #BTC 🚀

CME Group, one of the world’s largest derivatives exchanges, is planning to launch its own CME Token.

This move could:

• Bridge traditional finance with crypto

• Offer new trading and hedging opportunities

• Attract institutional investors to tokenized markets

A big step showing how legacy finance is increasingly entering the crypto space.

#CryptoNews #InstitutionalCrypto #CME #BTC 🚀

BTC2.11%

- Reward

- 3

- 2

- Repost

- Share

MoonGirl :

:

Buy To Earn 💎View More

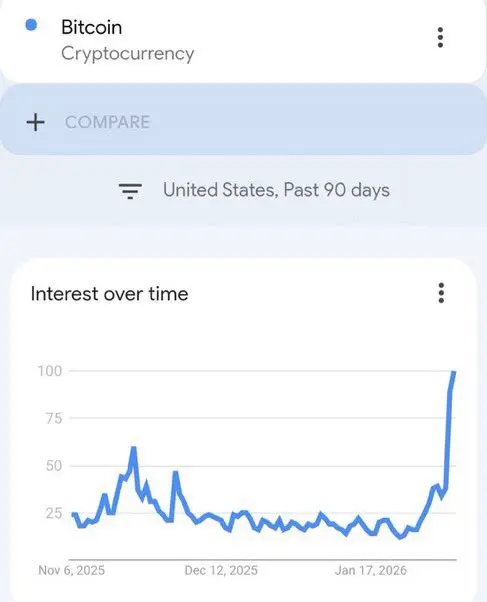

Bitcoin's sharp rise in Google search trends! From November 2025 to early February 2026, the interest index skyrocketed from a low of 25-50 to 100. What does this usually indicate? Historically, Bitcoin's Google search peaks are often associated with bull markets, such as the big rallies in 2017 and 2021. But if the peak is too high, it could also signal a market top (a pullback after the peak). Do you think this might mean that scattered funds are flowing back in, potentially driving Bitcoin prices higher? Or is it a top signal?

BTC2.11%

- Reward

- like

- Comment

- Repost

- Share

Banks Rush Into Blockchain as Regulators Watch Closely - - #asx #ibm #ict

- Reward

- like

- Comment

- Repost

- Share

星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$2.16K

Create My Token

#当前行情抄底还是观望?

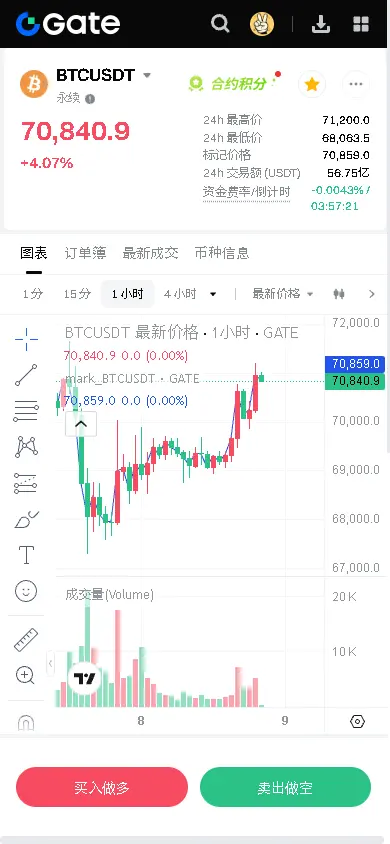

February 8【Price Trend Analysis】Long and Short Entry Points#加密市场回调

1. Candlestick Pattern:

- Recent candlesticks show significant volatility. After a long bearish candle on February 5, the price gradually rebounded, but the overall trend remains downward.

- Consecutive three days of bullish closes from February 6 to 8 indicate a short-term rebound demand, but overhead resistance is strong.

2. Technical Indicators:

- MACD: DIF and DEA are both negative, and the MACD histogram remains below zero, indicating a bearish dominance. However, the green bars are shortening, suggesting

View OriginalFebruary 8【Price Trend Analysis】Long and Short Entry Points#加密市场回调

1. Candlestick Pattern:

- Recent candlesticks show significant volatility. After a long bearish candle on February 5, the price gradually rebounded, but the overall trend remains downward.

- Consecutive three days of bullish closes from February 6 to 8 indicate a short-term rebound demand, but overhead resistance is strong.

2. Technical Indicators:

- MACD: DIF and DEA are both negative, and the MACD histogram remains below zero, indicating a bearish dominance. However, the green bars are shortening, suggesting

- Reward

- like

- Comment

- Repost

- Share

【$BTC Signal】Long | Breakout Pullback Confirmation

After a volume breakout on the 4H timeframe, the price consolidates tightly above the previous high area. This is a typical healthy reset after a breakout, not a top sell-off.

🎯 Direction: Long

🎯 Entry: 70800 - 71000

🛑 Stop Loss: 69400 $BTC Rigid Stop Loss (

🚀 Target 1: 72800

🚀 Target 2: 74500

Hardcore Logic: The last candle on the 4H chart shows a volume surge with upward movement, dominated by taker buy orders, but open interest remains stable, indicating genuine buying pressure rather than short covering. After the breakout, the price

View OriginalAfter a volume breakout on the 4H timeframe, the price consolidates tightly above the previous high area. This is a typical healthy reset after a breakout, not a top sell-off.

🎯 Direction: Long

🎯 Entry: 70800 - 71000

🛑 Stop Loss: 69400 $BTC Rigid Stop Loss (

🚀 Target 1: 72800

🚀 Target 2: 74500

Hardcore Logic: The last candle on the 4H chart shows a volume surge with upward movement, dominated by taker buy orders, but open interest remains stable, indicating genuine buying pressure rather than short covering. After the breakout, the price

- Reward

- like

- Comment

- Repost

- Share

The HYPE Futures Trading Challenge is now live on Gate. Check in daily and share 50,000 USDT in total rewards. Simple trading, exciting airdrops – don't miss out. https://www.gate.com/campaigns/4003?ref_type=132

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

Buy To Earn 💎#WhyAreGoldStocksandBTCFallingTogether?

Recently, investors have noticed that gold stocks and Bitcoin (BTC) are falling at the same time, which seems unusual since gold is traditionally seen as a safe-haven asset while Bitcoin is often treated as a speculative risk asset. Here’s why this is happening:

1️⃣ Rising Real Yields and Interest Rates

When real interest rates (interest rates minus inflation) rise, both gold and gold miners tend to fall because the opportunity cost of holding non-yielding assets increases.

Bitcoin, despite being digital, also reacts negatively to rising yields since hi

Recently, investors have noticed that gold stocks and Bitcoin (BTC) are falling at the same time, which seems unusual since gold is traditionally seen as a safe-haven asset while Bitcoin is often treated as a speculative risk asset. Here’s why this is happening:

1️⃣ Rising Real Yields and Interest Rates

When real interest rates (interest rates minus inflation) rise, both gold and gold miners tend to fall because the opportunity cost of holding non-yielding assets increases.

Bitcoin, despite being digital, also reacts negatively to rising yields since hi

BTC2.11%

- Reward

- 9

- 15

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Shrimp friends, going all-in on ETH and going long.

Recently created accounts, some well-known scam kingpins,

relying on copying scams to turn things around, focusing on winning battles, playing with heavy positions and aggressive moves. Currently, some say they are in the red, but they will turn things around this year.

Recently created accounts, some well-known scam kingpins,

relying on copying scams to turn things around, focusing on winning battles, playing with heavy positions and aggressive moves. Currently, some say they are in the red, but they will turn things around this year.

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

#EthereumL2Outlook

Scaling the Future of Ethereum

Ethereum’s long-term vision has always been clear: become the global settlement layer for decentralized finance, Web3 applications, and on-chain innovation. However, as adoption has grown, so have the challenges most notably high gas fees and network congestion. This is where Layer 2 (L2) solutions step in, playing a critical role in Ethereum’s scalability roadmap and shaping its future.

Layer 2 networks operate on top of Ethereum’s mainnet, processing transactions off-chain while still inheriting Ethereum’s security. Technologies such as Op

Scaling the Future of Ethereum

Ethereum’s long-term vision has always been clear: become the global settlement layer for decentralized finance, Web3 applications, and on-chain innovation. However, as adoption has grown, so have the challenges most notably high gas fees and network congestion. This is where Layer 2 (L2) solutions step in, playing a critical role in Ethereum’s scalability roadmap and shaping its future.

Layer 2 networks operate on top of Ethereum’s mainnet, processing transactions off-chain while still inheriting Ethereum’s security. Technologies such as Op

- Reward

- like

- Comment

- Repost

- Share

BTC forecast and market analysis

- Reward

- 4

- 6

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- 3

- 2

- Repost

- Share

LittleGodOfWealthPlutus :

:

2026 get rich get rich 😘View More

GDEX

GateDex

Created By@0xd1b5...a733

Listing Progress

0.00%

MC:

$2.43K

Create My Token

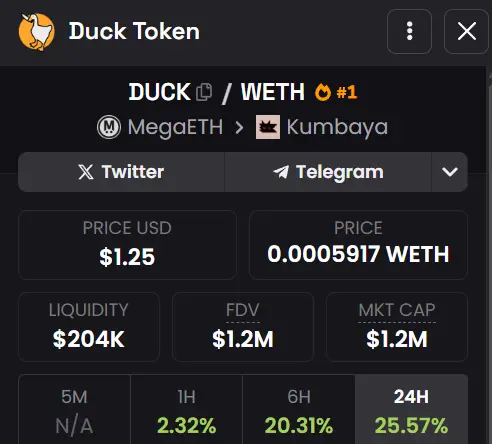

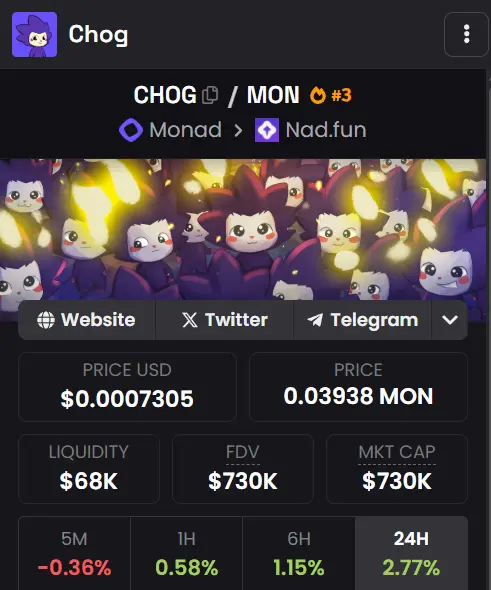

MegaETH has higher mcap shitcoins pre mainnet than Monad has post mainnet

- Reward

- like

- Comment

- Repost

- Share

$BNB bullish recovery is building strength

I’m starting with the reason first: I’m seeing a clear rejection from the lower range after a liquidity sweep. Price dipped, grabbed stops, and immediately found buyers. The bounce wasn’t aggressive hype — it was controlled, which tells me accumulation is happening rather than short-term speculation.

Market read

I’m reading this as a bullish base formation. The sell-off stalled near strong demand, structure stopped making lower lows, and price reclaimed the mid-range. Sellers pushed once more and failed. That failure matters because it usually opens t

I’m starting with the reason first: I’m seeing a clear rejection from the lower range after a liquidity sweep. Price dipped, grabbed stops, and immediately found buyers. The bounce wasn’t aggressive hype — it was controlled, which tells me accumulation is happening rather than short-term speculation.

Market read

I’m reading this as a bullish base formation. The sell-off stalled near strong demand, structure stopped making lower lows, and price reclaimed the mid-range. Sellers pushed once more and failed. That failure matters because it usually opens t

BNB0.42%

- Reward

- like

- Comment

- Repost

- Share

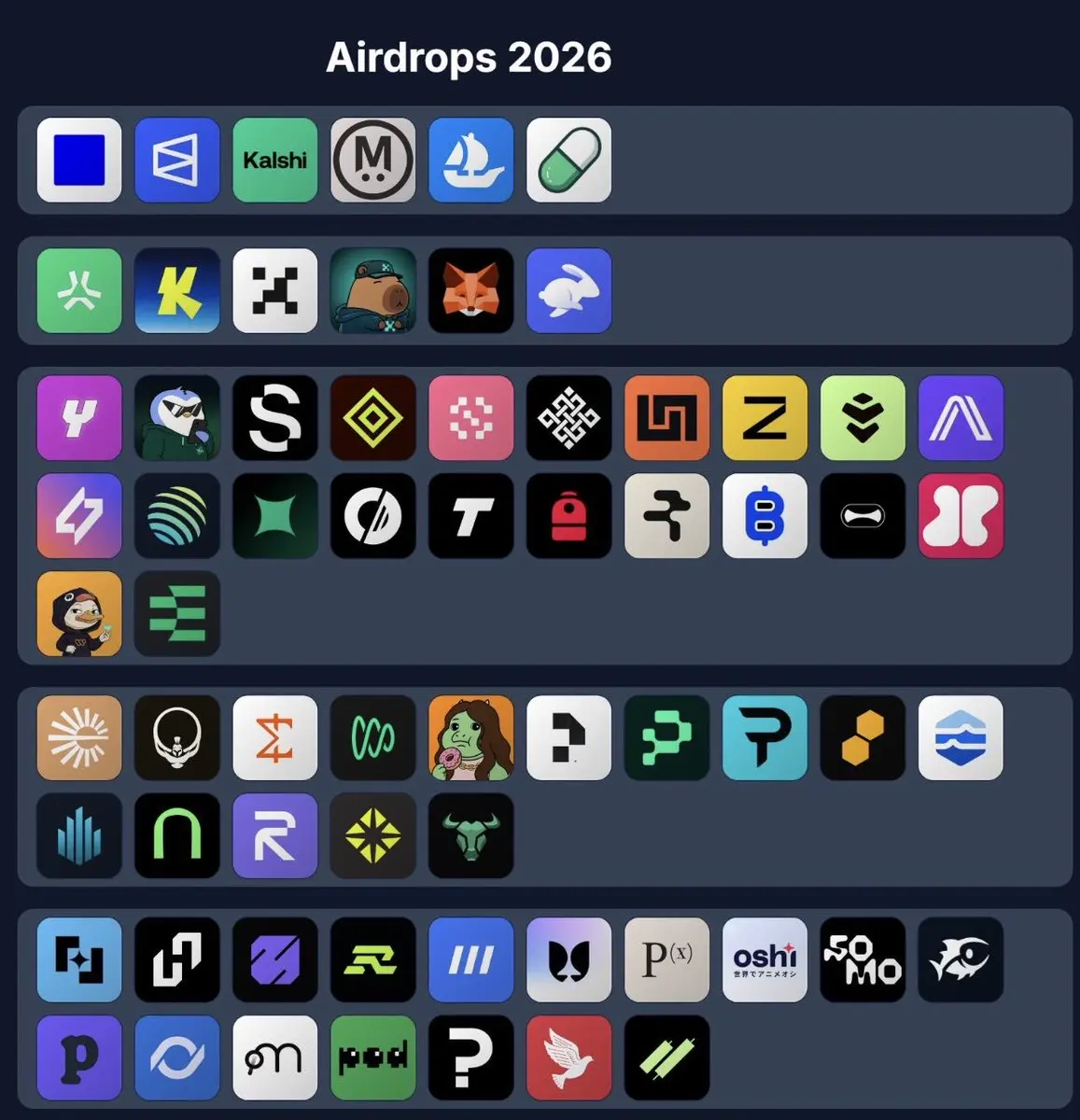

Hey @grok, please remove from this image any icons that you believe are associated with anti-revenue projects.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#TopCoinsRisingAgainsttheTrend – Feb 2026 | Market Spotlight

The crypto market may be facing sideways pressure or a mild pullback, but not every coin is following the crowd. Some projects are showing exceptional strength, delivering big gains despite broader market hesitation. Here’s a closer look at today’s top performers:

🐧 PENGUIN +60.26% (0.02803)

The biggest mover of the day! PENGUIN is showing serious momentum, possibly fueled by community engagement and positive sentiment on social channels. This breakout proves that even in sideways markets, strong fundamentals and hype cycles can dr

The crypto market may be facing sideways pressure or a mild pullback, but not every coin is following the crowd. Some projects are showing exceptional strength, delivering big gains despite broader market hesitation. Here’s a closer look at today’s top performers:

🐧 PENGUIN +60.26% (0.02803)

The biggest mover of the day! PENGUIN is showing serious momentum, possibly fueled by community engagement and positive sentiment on social channels. This breakout proves that even in sideways markets, strong fundamentals and hype cycles can dr

- Reward

- 3

- 3

- Repost

- Share

MoonGirl :

:

Buy To Earn 💎View More

Speak these 5 affirmations every morning

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More156.91K Popularity

15.03K Popularity

394.69K Popularity

4.6K Popularity

16.54K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.4KHolders:10.00%

- MC:$2.41KHolders:10.00%

- MC:$2.43KHolders:00.00%

News

View MoreData: Tokens such as CONX, AVAX, and APT will experience large unlocks next week, with CONX unlocking worth approximately $15.6 million.

13 m

Analyst: Despite the silver plunge, retail investors continue to double down

23 m

CoinShares: The risk of quantum vulnerability in Bitcoin is manageable, no need to panic at the moment

41 m

Over the past hour, the entire network has experienced liquidations exceeding $30 million, mainly short positions.

1 h

BTC Breaks Through 71,000 USDT

1 h

Pin