AI is all the rage, but cryptocurrencies are ignored

Written by: Patrick Collins

Translated by: Chopper, Foresight News

In 2025, venture capital firms like Sequoia, A16z, Lightspeed, and Y Combinator are heavily investing in AI companies, with funds flowing from the crypto space into AI, not to mention the recent sharp decline in overall cryptocurrency prices.

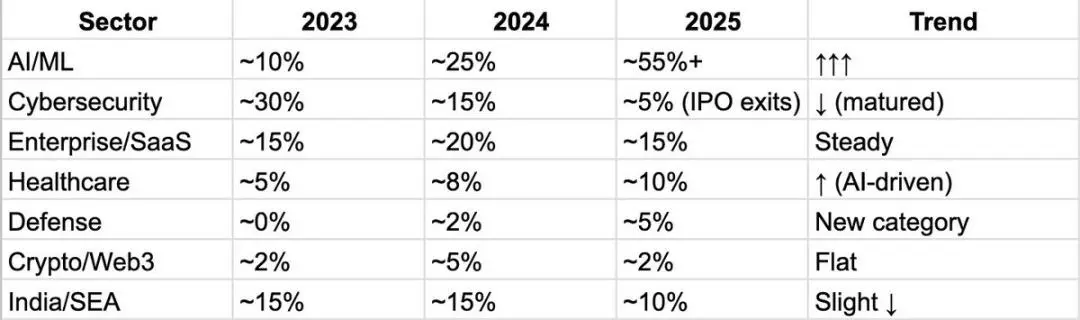

Sequoia Capital Investment Trends Over the Past Three Years

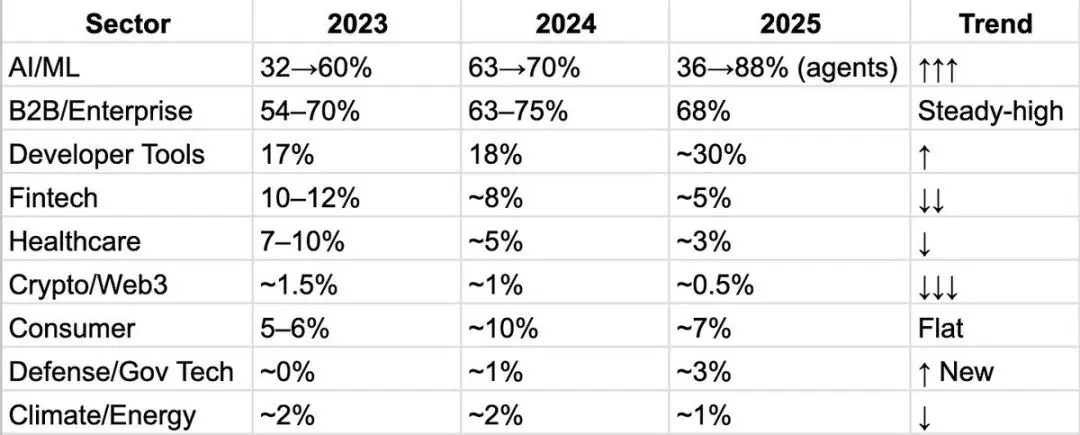

A16z Investment Trends Over the Past Three Years

Lightspeed Investment Trends Over the Past Three Years

Y Combinator Investment Trends Over the Past Three Years

I’ve seen many people who entered Web3 in 2019/2020 start to leave, moving to AI companies or prediction markets. As someone fully dedicated to blockchain and decentralized finance, I believe there are several different mindsets people can adopt in this situation.

Stay the course, no goodbyes—they never had faith to begin with

It’s a bit like a bad breakup: once someone leaves, they start criticizing. “Now only the true builders remain, everything will be better.” I think this mindset and approach are wrong. We need talent to enter this industry, even if they don’t fully agree with our underlying philosophy.

As long as we have a vision, we always need people to turn that vision into reality. Many people just want a good life, not necessarily to change the world, and I think that’s perfectly fine.

There are two types of people in the world: those with extreme passion; and those with less passion but willing to work hard, improve themselves, and do the right thing. To me, this is somewhat like the difference between a “rock star” and a “superstar.”

Crypto is dead, move quickly to AI

This is the key topic I want to discuss, and the one I want to embed in your mind: ultimately, the world’s financial system will be entirely driven by cryptocurrencies. That’s inevitable.

Really think about this statement. Once you accept this, shifting to AI seems pointless.

Yes, AI is exploding, AI is great, but AI is just a tool used to build other things. And among these “other things” is the future of finance.

Of course, you can make the choice that benefits you most. The AI field might be offering a fast-moving opportunity right now, and you can hop on that train. But I believe you might be missing a bigger opportunity.

Why is blockchain inevitable?

The reason is the same as why gold has a market cap of $35 trillion today. I’ve explained countless times what “money” is, especially in the context of stablecoins. Money has three main functions: store of value, medium of exchange, and unit of account.

Throughout human history, finding a trustworthy, neutral, and convenient form of currency has been nearly impossible—until recently. Gold has been recognized as “trustworthy and neutral,” but it’s very inconvenient to carry and use. Cryptocurrencies are the solution.

The crushing advantages of blockchain

This alone is enough to attract people, but when combined with smart contracts, the explosive potential is astronomical. Take the stock market as an example: the NYSE’s daily trading volume is about $80 billion, while Uniswap might only handle $20 billion—up to 40 times less. But look at operational costs: the NYSE’s parent company employs around 12,000 people; whereas Uniswap, in theory, only needs liquidity providers to operate, with about 200 staff.

Operational costs are directly reduced by 60 times! From a cost perspective alone, running a decentralized exchange is overwhelmingly advantageous.

Not to mention the core benefits of censorship resistance and trustworthiness—that’s the true significance of this technology. I won’t go into why trustworthy, neutral financial products are the future; just look at the data: DeFi’s operating costs are extremely low, and it’s more equitable.

Many people dismiss the logic of “trustworthy neutrality,” so I’ll skip that part here. Most of these people come from developed countries and will never understand how important this technology is for developing nations. But I still believe this is the core reason why crypto technology will inevitably succeed.

Many people, upon seeing the huge costs of the current financial system, start asking: “Why do I have to pay such high fees? Why does it take two days to settle a stock?”

Summary

You’re free to leave if you want, but I think you’ll miss the large-scale adoption that’s happening right now—and the opportunities here are bigger than ever before.

Historically, many so-called “opportunities” in crypto have been scams to some extent. NFTs, liquidity mining, meme coins—these products have all exploited people’s ignorance of new technology to harvest traffic. We’ve already gone through that phase; we all know those things are foolish.

Now, we can truly enable institutions and ordinary users to access products that improve their lives: Aave, Uniswap, zero-knowledge privacy protocols, stablecoins… They provide financial services worldwide at extremely low costs and with lower barriers to censorship.

In the future, the entire world will operate on this infrastructure. And I will continue to do my best to make that day come sooner.

Related Articles

Uniswap Price News: UNI surges 40% in two hours then pulls back, BUIDL integration and ETF news fail to ease selling pressure

BlackRock "bets" on UNI: Breaking down the business logic of its partnership with Uniswap

BlackRock Brings $2.1B Tokenized Treasury Fund to Uniswap for DeFi

The "Shanzhai Air Force Leader" shorted over 20 tokens with a monthly profit of 6.7 million, continuing to take profits on PUMP and UNI short positions today.

BlackRock partners with Uniswap! Opens tokenized fund BUIDL for on-chain trading, UNI surges 20% at one point