# aave

826.38K

BeautifulDay

#GrayscaleEyesAVESpotETFConversion

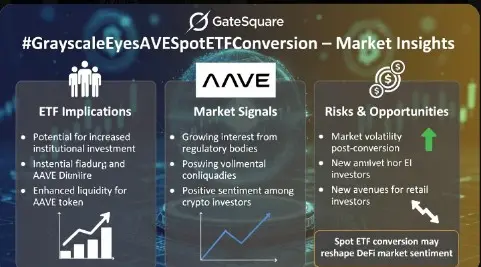

Grayscale has announced that it is considering converting AAVE into a spot ETF, signaling a potentially significant shift for the crypto market. Here are the key insights:

1️⃣ ETF Implications:

Approval of a spot ETF would increase AAVE’s liquidity and market accessibility. Institutional investors would find it easier to enter, potentially driving price appreciation.

2️⃣ Market Signals:

News of the ETF conversion may trigger short-term volatility as both retail and institutional investors react. This creates an opportunity for strategic positioning.

3️⃣ Risk

Grayscale has announced that it is considering converting AAVE into a spot ETF, signaling a potentially significant shift for the crypto market. Here are the key insights:

1️⃣ ETF Implications:

Approval of a spot ETF would increase AAVE’s liquidity and market accessibility. Institutional investors would find it easier to enter, potentially driving price appreciation.

2️⃣ Market Signals:

News of the ETF conversion may trigger short-term volatility as both retail and institutional investors react. This creates an opportunity for strategic positioning.

3️⃣ Risk

AAVE5.19%

- Reward

- 3

- 4

- Repost

- Share

BeautifulDay :

:

To The Moon 🌕View More

#GrayscaleEyesAVESpotETFConversion GrayscaleEyesAVESpotETFConversion

Headline: 👻 DEFI GOES WALL STREET: The Race for $GAVE is On! 🏛️🚀

It’s Feb 21st, and the "Institutional DeFi" narrative is officially exploding. #GrayscaleEyesAVESpotETFConversion is the biggest signal yet that the world’s largest asset managers want a piece of the lending king, AAVE.

Why the "GAVE" ETF is a Game-Changer:

🏦 TradFi Bridge: It allows pension funds and Boomers to bet on decentralized lending without ever touching a MetaMask wallet.

🔥 Supply Burn? With a 2.5% fee paid in AAVE, the ETF itself becomes a constan

Headline: 👻 DEFI GOES WALL STREET: The Race for $GAVE is On! 🏛️🚀

It’s Feb 21st, and the "Institutional DeFi" narrative is officially exploding. #GrayscaleEyesAVESpotETFConversion is the biggest signal yet that the world’s largest asset managers want a piece of the lending king, AAVE.

Why the "GAVE" ETF is a Game-Changer:

🏦 TradFi Bridge: It allows pension funds and Boomers to bet on decentralized lending without ever touching a MetaMask wallet.

🔥 Supply Burn? With a 2.5% fee paid in AAVE, the ETF itself becomes a constan

- Reward

- 10

- 13

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

🚀 Big move in crypto finance!

Grayscale Investments is exploring the conversion of its AAVE product into a spot ETF, signaling growing institutional confidence in the Aave ecosystem and DeFi as a whole.

If approved, this step could: • Expand mainstream access to AAVE through traditional markets

• Boost transparency and regulatory alignment

• Strengthen the bridge between DeFi innovation and institutional capital

The momentum around crypto ETFs keeps building — and this development could be another major milestone for decentralized finance adoption.

#GrayscaleEyesAVESpotETFConversion #AAVE #Cr

Grayscale Investments is exploring the conversion of its AAVE product into a spot ETF, signaling growing institutional confidence in the Aave ecosystem and DeFi as a whole.

If approved, this step could: • Expand mainstream access to AAVE through traditional markets

• Boost transparency and regulatory alignment

• Strengthen the bridge between DeFi innovation and institutional capital

The momentum around crypto ETFs keeps building — and this development could be another major milestone for decentralized finance adoption.

#GrayscaleEyesAVESpotETFConversion #AAVE #Cr

AAVE5.19%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕#GrayscaleEyesAVESpotETFConversion #GrayscaleEyesAVESpotETFConversion 🚀📊

The institutional wave into DeFi might be getting stronger!

Grayscale Investments is reportedly considering converting its AAVE product into a Spot ETF — a move that could significantly boost mainstream exposure to Aave.

If this happens, it could mean:

🔹 Greater institutional access to DeFi assets

🔹 Increased liquidity for AAVE

🔹 Stronger regulatory integration of decentralized finance

🔹 Another milestone in crypto’s journey toward traditional finance adoption

After Bitcoin and Ethereum ETFs, attention is now shifti

The institutional wave into DeFi might be getting stronger!

Grayscale Investments is reportedly considering converting its AAVE product into a Spot ETF — a move that could significantly boost mainstream exposure to Aave.

If this happens, it could mean:

🔹 Greater institutional access to DeFi assets

🔹 Increased liquidity for AAVE

🔹 Stronger regulatory integration of decentralized finance

🔹 Another milestone in crypto’s journey toward traditional finance adoption

After Bitcoin and Ethereum ETFs, attention is now shifti

- Reward

- 6

- 7

- Repost

- Share

Yunna :

:

thank you for information about cryptoView More

# GrayscaleEyesAVESpotETFConversion

Institutional interest in crypto is expanding once again—this time into

decentralized finance (DeFi). Grayscale

Investments has officially filed with the U.S. Securities and Exchange

Commission to convert its existing AAVE trust into a spot exchange-traded fund

(ETF), signaling a deeper push toward regulated altcoin investment products.

🚨 What’s Happening?

The proposed ETF would transform the closed-end

trust into a publicly traded vehicle, allowing investors to gain exposure to

the AAVE token through traditional markets rather than private structures.

Institutional interest in crypto is expanding once again—this time into

decentralized finance (DeFi). Grayscale

Investments has officially filed with the U.S. Securities and Exchange

Commission to convert its existing AAVE trust into a spot exchange-traded fund

(ETF), signaling a deeper push toward regulated altcoin investment products.

🚨 What’s Happening?

The proposed ETF would transform the closed-end

trust into a publicly traded vehicle, allowing investors to gain exposure to

the AAVE token through traditional markets rather than private structures.

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕#GrayscaleEyesAVESpotETFConversion

📈💼

📊🤖 #GrayscaleEyesAVESpotETFConversion

Grayscale has filed to convert its Aave Trust into a spot ETF, which would directly hold AAVE tokens and potentially list on a regulated exchange.

This is part of a broader trend of institutional crypto products moving into regulated ETFs, making DeFi projects more visible in traditional markets.

Key points:

• Provides a regulated framework for exposure to AAVE

• Bridges DeFi and traditional finance

• Highlights institutional interest in decentralized protocols

This update is informational only, showing the evolv

📈💼

📊🤖 #GrayscaleEyesAVESpotETFConversion

Grayscale has filed to convert its Aave Trust into a spot ETF, which would directly hold AAVE tokens and potentially list on a regulated exchange.

This is part of a broader trend of institutional crypto products moving into regulated ETFs, making DeFi projects more visible in traditional markets.

Key points:

• Provides a regulated framework for exposure to AAVE

• Bridges DeFi and traditional finance

• Highlights institutional interest in decentralized protocols

This update is informational only, showing the evolv

- Reward

- 3

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

As institutional adoption continues reshaping the crypto landscape, the market is paying close attention to discussions surrounding a potential spot ETF conversion involving Grayscale Investments and the growing relevance of Aave. The narrative reflects a broader shift in how asset managers and regulators view high-utility DeFi assets — moving them closer to mainstream financial consideration. Unlike purely speculative tokens, AAVE’s role in decentralized lending, strong on-chain activity, and transparent governance model position it as a protocol with measurable financial utility, which align

AAVE5.19%

- Reward

- 11

- 14

- Repost

- Share

ybaser :

:

Good luck and prosperity 🧧View More

- Reward

- like

- Comment

- Repost

- Share

$AAVE is building pressure around 158.16, and this level is giving a clean setup for a continuation leg if the push arrives.

Entry Zone: 157.52 – 158.16

TP 1: 159.95

TP 2: 161.00

TP 3: 162.50

Stop Loss: 156.64

Decent momentum window here...just track the reaction around entry.

#AAVE #Rmj-Trades

Entry Zone: 157.52 – 158.16

TP 1: 159.95

TP 2: 161.00

TP 3: 162.50

Stop Loss: 156.64

Decent momentum window here...just track the reaction around entry.

#AAVE #Rmj-Trades

AAVE5.19%

- Reward

- like

- Comment

- Repost

- Share

JUST IN: Senate Committee "Greenlights" DeFi Yields While Blocking CEX Rewards.

The Senate Agriculture Committee has just handed decentralized finance its biggest win of 2026. The finalized markup of the crypto market structure bill effectively bans centralized exchanges from offering "passive yield" on stablecoins but explicitly exempts non-custodial DeFi protocols.

This is a massive capital funnel.

The market is instantly repricing governance tokens. Investors are realizing that if Coinbase and Binance can't offer yield, the trillion-dollar stablecoin economy will be forced to migrate on-cha

The Senate Agriculture Committee has just handed decentralized finance its biggest win of 2026. The finalized markup of the crypto market structure bill effectively bans centralized exchanges from offering "passive yield" on stablecoins but explicitly exempts non-custodial DeFi protocols.

This is a massive capital funnel.

The market is instantly repricing governance tokens. Investors are realizing that if Coinbase and Binance can't offer yield, the trillion-dollar stablecoin economy will be forced to migrate on-cha

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

306.64K Popularity

96.72K Popularity

416.67K Popularity

114.18K Popularity

20.56K Popularity

312.17K Popularity

68.51K Popularity

624.06K Popularity

36.11K Popularity

34.29K Popularity

35.93K Popularity

30.43K Popularity

33.78K Popularity

62.19K Popularity

News

View MoreData: If BTC drops below $65,082, the total long liquidation strength on major CEXs will reach $1.121 billion.

20 m

Data: If ETH drops below $1,890, the total long liquidation strength on major CEXs will reach $749 million.

21 m

Data: Over the past 24 hours, the entire network has liquidated $102 million, with long positions liquidated at $27.504 million and short positions at $74.1143 million.

2 h

Trump: Raise global tariffs from 10% to 15%

2 h

Punch increased by 51.89% after launching Alpha, current price is 0.0386119409101489 USDT

2 h

Pin