#GoldandSilverHitNewHighs Gold and Silver Hit New Highs — January 19, 2026 Market Insight

On January 19, 2026, global financial markets witnessed a strong shift toward precious metals as gold and silver surged to all-time or near-record highs. This movement reflects growing uncertainty across global markets, where investors are increasingly prioritizing capital protection over risk exposure. While traditional safe-haven assets strengthened, risk-based markets such as cryptocurrencies showed contrasting behavior.

Record Highs in Gold & Silver

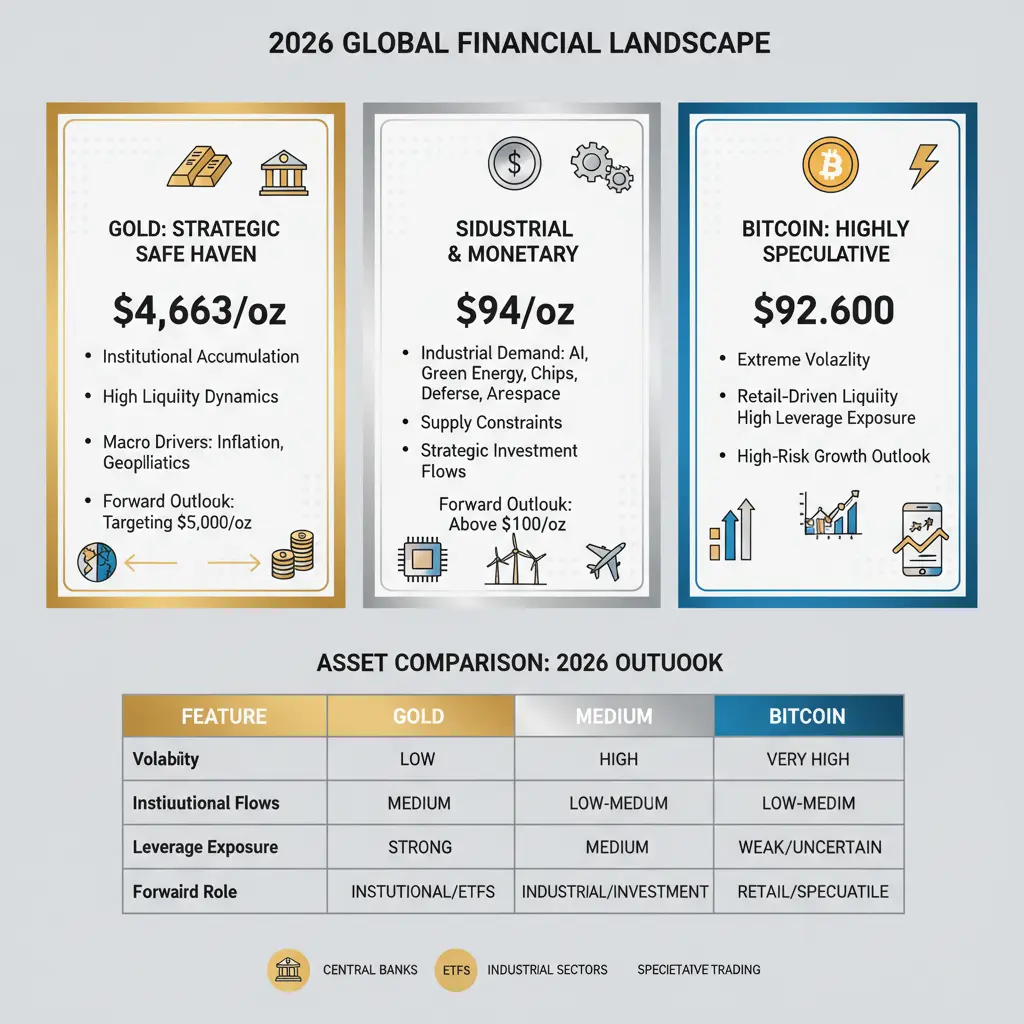

Gold climbed to around $4,660–$4,680 per ounce, marking historic levels, while silver surged near $93–$94 per ounce, also approaching record territory. These price levels are extremely elevated compared to historical averages and highlight the intensity of safe-haven demand currently dominating markets.

In Pakistan’s local market, prices adjusted sharply due to global strength and currency factors:

• Gold per tola: approximately Rs 480,000+

• Gold per 10 grams: approximately Rs 413,000+

• Silver per tola: approximately Rs 9,400+

These local prices reflect both international momentum and domestic currency pressure.

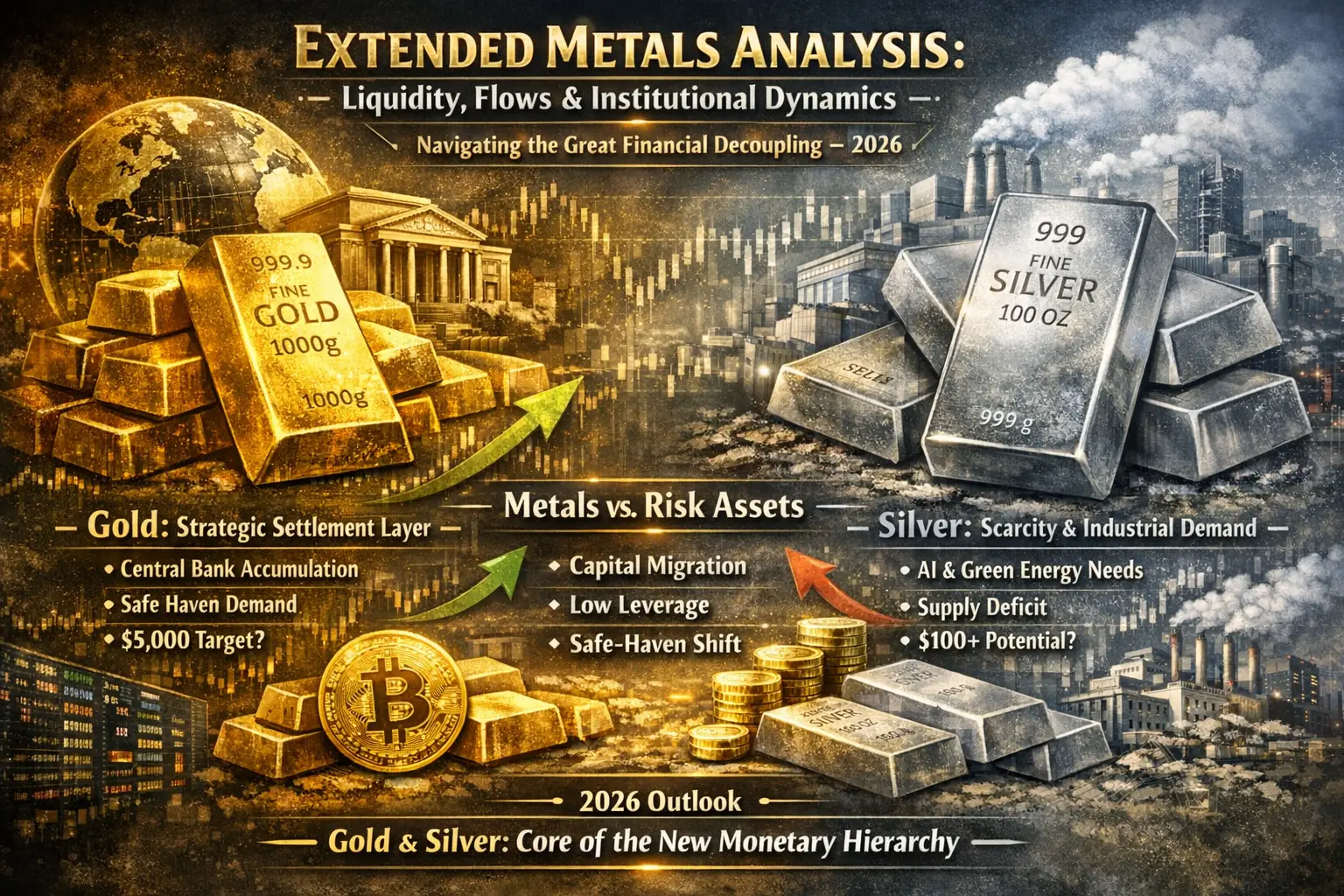

Why Gold and Silver Are Rising

The primary driver behind this surge is growing geopolitical and economic uncertainty. Trade tensions, political instability, and global policy risks have increased fear across financial markets. During such periods, investors historically move toward assets with proven value preservation.

A weaker U.S. dollar has further supported precious metals, making them more attractive globally. At the same time, inflation concerns remain persistent, encouraging investors to seek long-term hedges against declining purchasing power.

Silver has received additional support from industrial demand, particularly in electronics, renewable energy, and technology sectors, giving it both defensive and functional value.

Gold & Silver vs Bitcoin — Market Contrast

The current environment highlights a clear difference between traditional safe havens and digital assets.

Gold and silver are physical commodities with centuries of trust, lower volatility, and deep global liquidity. They typically perform well during crisis periods and are widely used for wealth preservation.

Bitcoin, while often referred to as “digital gold,” remains a high-volatility asset. In risk-off conditions, it frequently behaves more like a speculative investment, reacting to sentiment, liquidity, and leverage dynamics rather than fear-based demand.

During the current market phase, precious metals surged while Bitcoin weakened, emphasizing this behavioral divergence.

Bitcoin’s Current Market Position

Bitcoin recently traded below the $92,000 level as broader risk-off sentiment dominated markets. This divergence shows that investors currently favor traditional hedges over digital ones. While Bitcoin retains strong long-term potential, short-term movements continue to depend heavily on liquidity and market confidence.

What This Means for Investors

This market phase reinforces the importance of diversification.

Precious metals serve as capital preservation tools during uncertainty. Bitcoin offers high-growth potential but comes with significantly higher volatility. Each asset plays a different role depending on market conditions and risk tolerance.

Understanding when markets favor safety versus growth is critical for managing modern portfolios.

Key Takeaways

• Gold and silver are trading at historic highs due to strong safe-haven demand

• Bitcoin is currently behaving as a risk asset, not a crisis hedge

• Precious metals provide stability; crypto provides growth potential

• Diversification across asset classes is essential

MrFlower_XingChen Observation

The strength in gold and silver is sending a clear macro signal: uncertainty remains elevated. When capital aggressively flows into physical assets, it reflects caution rather than optimism. Bitcoin’s contrasting performance highlights that digital assets still require confidence and liquidity to thrive.

Smart investors understand that no single asset performs best in every environment. Metals protect wealth during fear, while crypto rewards patience during expansion cycles. Recognizing these phases is the key to long-term success.

On January 19, 2026, global financial markets witnessed a strong shift toward precious metals as gold and silver surged to all-time or near-record highs. This movement reflects growing uncertainty across global markets, where investors are increasingly prioritizing capital protection over risk exposure. While traditional safe-haven assets strengthened, risk-based markets such as cryptocurrencies showed contrasting behavior.

Record Highs in Gold & Silver

Gold climbed to around $4,660–$4,680 per ounce, marking historic levels, while silver surged near $93–$94 per ounce, also approaching record territory. These price levels are extremely elevated compared to historical averages and highlight the intensity of safe-haven demand currently dominating markets.

In Pakistan’s local market, prices adjusted sharply due to global strength and currency factors:

• Gold per tola: approximately Rs 480,000+

• Gold per 10 grams: approximately Rs 413,000+

• Silver per tola: approximately Rs 9,400+

These local prices reflect both international momentum and domestic currency pressure.

Why Gold and Silver Are Rising

The primary driver behind this surge is growing geopolitical and economic uncertainty. Trade tensions, political instability, and global policy risks have increased fear across financial markets. During such periods, investors historically move toward assets with proven value preservation.

A weaker U.S. dollar has further supported precious metals, making them more attractive globally. At the same time, inflation concerns remain persistent, encouraging investors to seek long-term hedges against declining purchasing power.

Silver has received additional support from industrial demand, particularly in electronics, renewable energy, and technology sectors, giving it both defensive and functional value.

Gold & Silver vs Bitcoin — Market Contrast

The current environment highlights a clear difference between traditional safe havens and digital assets.

Gold and silver are physical commodities with centuries of trust, lower volatility, and deep global liquidity. They typically perform well during crisis periods and are widely used for wealth preservation.

Bitcoin, while often referred to as “digital gold,” remains a high-volatility asset. In risk-off conditions, it frequently behaves more like a speculative investment, reacting to sentiment, liquidity, and leverage dynamics rather than fear-based demand.

During the current market phase, precious metals surged while Bitcoin weakened, emphasizing this behavioral divergence.

Bitcoin’s Current Market Position

Bitcoin recently traded below the $92,000 level as broader risk-off sentiment dominated markets. This divergence shows that investors currently favor traditional hedges over digital ones. While Bitcoin retains strong long-term potential, short-term movements continue to depend heavily on liquidity and market confidence.

What This Means for Investors

This market phase reinforces the importance of diversification.

Precious metals serve as capital preservation tools during uncertainty. Bitcoin offers high-growth potential but comes with significantly higher volatility. Each asset plays a different role depending on market conditions and risk tolerance.

Understanding when markets favor safety versus growth is critical for managing modern portfolios.

Key Takeaways

• Gold and silver are trading at historic highs due to strong safe-haven demand

• Bitcoin is currently behaving as a risk asset, not a crisis hedge

• Precious metals provide stability; crypto provides growth potential

• Diversification across asset classes is essential

MrFlower_XingChen Observation

The strength in gold and silver is sending a clear macro signal: uncertainty remains elevated. When capital aggressively flows into physical assets, it reflects caution rather than optimism. Bitcoin’s contrasting performance highlights that digital assets still require confidence and liquidity to thrive.

Smart investors understand that no single asset performs best in every environment. Metals protect wealth during fear, while crypto rewards patience during expansion cycles. Recognizing these phases is the key to long-term success.