# JapanBondMarketSellOff

7.63K

MrFlower_XingChen

#JapanBondMarketSell-Off A Silent Macro Shift With Global Consequences

The recent surge in Japanese government bond yields — particularly the sharp move of over 25 basis points in 30-year and 40-year maturities — has emerged as one of the most underappreciated macro developments of early 2026. What may appear on the surface as a domestic policy reaction is increasingly being interpreted by global investors as a possible turning point in one of the world’s most important financial anchors.

For decades, Japan has operated under an ultra-low-yield framework that shaped global liquidity behavior.

The recent surge in Japanese government bond yields — particularly the sharp move of over 25 basis points in 30-year and 40-year maturities — has emerged as one of the most underappreciated macro developments of early 2026. What may appear on the surface as a domestic policy reaction is increasingly being interpreted by global investors as a possible turning point in one of the world’s most important financial anchors.

For decades, Japan has operated under an ultra-low-yield framework that shaped global liquidity behavior.

- Reward

- 25

- 195

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off — A Silent Macro Shift With Global Consequences

The recent surge in Japanese government bond yields has quietly emerged as one of the most significant yet underappreciated macro developments of early 2026. Long-dated maturities, particularly the 30-year and 40-year bonds, have climbed more than 25 basis points in a short span — a move that may appear technical on the surface but carries deep implications for the global financial system.

For decades, Japan functioned as one of the world’s most stable financial anchors. Its ultra-low-yield environment shaped global capit

The recent surge in Japanese government bond yields has quietly emerged as one of the most significant yet underappreciated macro developments of early 2026. Long-dated maturities, particularly the 30-year and 40-year bonds, have climbed more than 25 basis points in a short span — a move that may appear technical on the surface but carries deep implications for the global financial system.

For decades, Japan functioned as one of the world’s most stable financial anchors. Its ultra-low-yield environment shaped global capit

- Reward

- 13

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#JapanBondMarketSell-Off Japan Bond Market Sell-Off: Quiet Shockwaves in Global Finance

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

- Reward

- 10

- 3

- Repost

- Share

HeavenSlayerFaithful :

:

Buy financial management 💎View More

#JapanBondMarketSell-Off JapanBondMarketSellOff The recent surge in Japanese government bond yields, particularly the sharp rise of more than 25 basis points in 30-year and 40-year maturities, represents one of the most underappreciated macro shifts of early 2026 and may signal a deeper transition in the global financial landscape rather than a simple domestic adjustment. For decades, Japan’s ultra-low-yield policy anchored global liquidity behavior, encouraging capital to flow outward into U.S. Treasuries, global equities, emerging markets, and alternative assets, effectively suppressing glob

- Reward

- 2

- 3

- Repost

- Share

Yunna :

:

2026 gogoView More

#JapanBondMarketSell-Off Japan Bond Market Sell-Off: Quiet Shockwaves in Global Finance

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

- Reward

- 1

- Comment

- Repost

- Share

#JapanBondMarketSell-Off #JapanBondMarketSellOff

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

BTC2.34%

- Reward

- 12

- 12

- Repost

- Share

Yunna :

:

2026 gogoView More

#JapanBondMarketSellOff 🇯🇵📉 | A Macro Shock With Global Implications

The *Japanese bond market is experiencing a notable sell-off* drawing global attention as yields move higher and long-standing market dynamics begin to shift. Given Japan’s critical role in global liquidity and carry trades, developments in JGBs (Japanese Government Bonds) are increasingly relevant for *FX, equities, and crypto markets*

*What’s Driving the Sell-Off?*

Several structural and policy-related factors are converging:

🔹 *Rising Yields:*

Bond prices are falling as yields rise, signaling reduced demand for ultra-

The *Japanese bond market is experiencing a notable sell-off* drawing global attention as yields move higher and long-standing market dynamics begin to shift. Given Japan’s critical role in global liquidity and carry trades, developments in JGBs (Japanese Government Bonds) are increasingly relevant for *FX, equities, and crypto markets*

*What’s Driving the Sell-Off?*

Several structural and policy-related factors are converging:

🔹 *Rising Yields:*

Bond prices are falling as yields rise, signaling reduced demand for ultra-

- Reward

- 2

- 6

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off #JapanBondMarketSellOff

If you think Japan’s bond market sell‑off is “just another macro headline,” stop reading now. You’re not ready for this market.

Japan isn’t selling bonds because it wants to.

It’s selling because the system is cracking under its own weight.

For decades, Japan ran the greatest experiment in financial repression the world has ever seen:

Zero yields. Infinite liquidity. A central bank that became the market itself.

It worked—until it didn’t.

Now yields are rising, and that’s not a small detail.

That’s gravity returning.

When Japanese government bon

If you think Japan’s bond market sell‑off is “just another macro headline,” stop reading now. You’re not ready for this market.

Japan isn’t selling bonds because it wants to.

It’s selling because the system is cracking under its own weight.

For decades, Japan ran the greatest experiment in financial repression the world has ever seen:

Zero yields. Infinite liquidity. A central bank that became the market itself.

It worked—until it didn’t.

Now yields are rising, and that’s not a small detail.

That’s gravity returning.

When Japanese government bon

BTC2.34%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#JapanBondMarketSellOff 🚨 | Macro Inflection or Prelude to Global Realignment?

What began as a subtle shift in Japanese government bond (JGB) yields has quickly evolved into one of the most consequential macro developments of 2026. The sharp rise—over 25bps in 30‑yr & 40‑yr maturities—is signaling potential structural change in Japan’s role in global finance.

💡 Why it matters globally:

For two decades, Japan’s ultra-low yields fueled global liquidity, encouraging capital to flow into U.S. Treasuries, EM debt, equities, real estate, and alternative assets.

Signals from Tokyo suggest fiscal ea

What began as a subtle shift in Japanese government bond (JGB) yields has quickly evolved into one of the most consequential macro developments of 2026. The sharp rise—over 25bps in 30‑yr & 40‑yr maturities—is signaling potential structural change in Japan’s role in global finance.

💡 Why it matters globally:

For two decades, Japan’s ultra-low yields fueled global liquidity, encouraging capital to flow into U.S. Treasuries, EM debt, equities, real estate, and alternative assets.

Signals from Tokyo suggest fiscal ea

- Reward

- 1

- Comment

- Repost

- Share

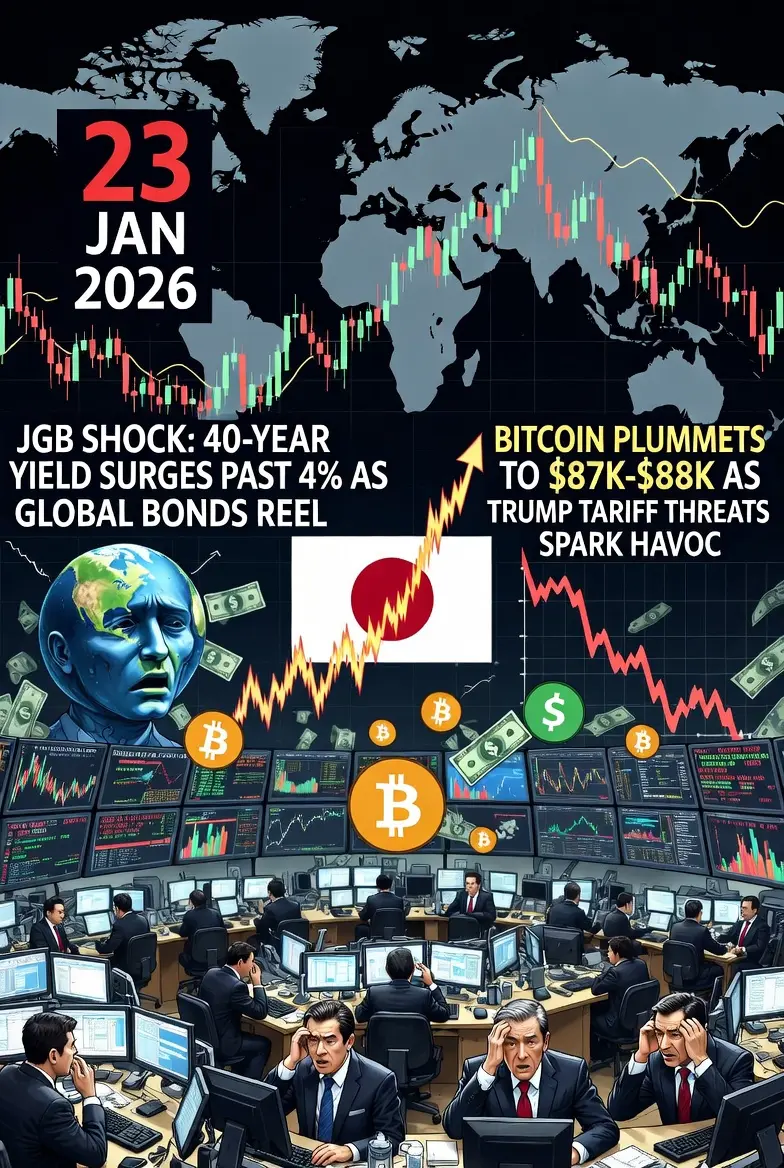

#JapanBondMarketSell-Off

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

- Reward

- 32

- 28

- Repost

- Share

GateUser-fb813ea7 :

:

Good morning, remember to have a good breakfast and start a energetic day!View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

8.46K Popularity

70.87K Popularity

27.37K Popularity

9.58K Popularity

9.38K Popularity

8.31K Popularity

7.84K Popularity

7.69K Popularity

74.06K Popularity

20.59K Popularity

81.18K Popularity

23.22K Popularity

49.51K Popularity

43.47K Popularity

178.47K Popularity

News

View MoreBitwise Report: By Q4 2025, corporate Bitcoin holdings will reach 1.1 million coins, with 19 new publicly listed companies buying in

5 m

Former Revolut project leader Bleap completes $6 million seed funding round

11 m

1inch denies team and treasury selling tokens, plans to review the tokenomics model this year

24 m

BTC breaks through 90,000 USDT

24 m

Kimi K2.5 tops the global open-source chart within 24 hours of release

34 m

Pin

𝙏𝙤𝙠𝙚𝙣𝙞𝙯𝙚𝙙 𝙍𝙒𝘼𝙨 𝙟𝙪𝙨𝙩 𝙘𝙧𝙤𝙨𝙨𝙚𝙙 $21𝘽 𝙞𝙣 𝙏𝙑𝙇.

-

Long-term forecasts vary — $2–4T by McKinsey, up to $16T per Boston Consulting Group, but directionally, the slope is clear.

© Cryptorank🚨😵💫💥 The $85K Floor: Can Bitcoin Hold Support Amid Sustained ETF Exits ⁉️

While early January 2026 saw a brief "clean slate" recovery, the latest figures suggest institutional caution is back in the driver's seat

📉 What’s happening ⁉️

⚡️Persistent Outflows: Following a massive $1.73 billion weekly exit in late January, the trend remains shaky. Even brief "green" days (like the $6.8M inflow on Jan 26) are pale compared to the billions lost in late 2025

⚡️Price Pressure: Outflows often act as a "sell signal" for the broader market, as they represent institutional de-risking

🔍 What does thThe U.S. crypto market has witnessed a significant internal rift as of late January 2026, with industry giants Ripple and Coinbase taking opposing stances on the newly amended CLARITY Act.

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 DGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/post