What is OpenEden (EDEN) ?

What Is OpenEden?

(Source: OpenEden_X)

As Real-World Assets (RWA) emerge as the new focus in DeFi, OpenEden leads the market with its innovative tokenized U.S. Treasury solutions. OpenEden enables 24/7 on-chain access to Treasury assets. This gives Web3 CFOs, DAO treasury managers, and institutional investors a safer and more flexible way to manage crypto assets.

Since launching in early 2023, OpenEden has become the largest issuer of tokenized U.S. Treasuries across Asia and Europe, and is the first tokenized asset issuer to earn Moody’s “A-bf” rating. Moody’s “A-bf” rating validates OpenEden’s product structure and marks a milestone, as traditional finance recognizes the value of DeFi and tokenized assets.

OpenEden’s Mission and Vision

OpenEden’s core mission is to bring real-world assets into DeFi and unlock trillions of dollars in value. The team believes that as digital currencies become mainstream, real-world assets will be accessible to everyone, helping to build a more inclusive, permissionless, and freely flowing global economy.

While Bitcoin started the digital currency era, OpenEden is developing the infrastructure for DeFi-based RWA, combining traditional finance’s low-risk yield products with the composability and liquidity of on-chain assets, enabling Web3 users to access the U.S. Treasury market.

Core Products

1. TBILL Vault

OpenEden’s flagship product, TBILL Vault, is a smart contract-powered vault that lets investors mint TBILL tokens using USDC and earn yields linked to short-term U.S. Treasuries.

- 1:1 Asset Backing: Every TBILL token is backed by an equal value of short-term U.S. Treasuries (T-Bills) and a portion of U.S. dollar cash.

- Regulatory Compliance: A professional fund registered in the British Virgin Islands (BVI) and regulated by the local financial authority issues TBILL, ensuring transparency and compliance.

- Professional Management: BNY Mellon Investment Management manages the assets, which are held by regulated, qualified custodians.

- Investment Returns: TBILL holders receive yields in line with short-term U.S. Treasury rates, accessing low-risk investments directly without traditional bank channels.

For Web3 investors, this gives them a new way to use on-chain assets to access one of the world’s most stable investment options.

Why Choose On-Chain U.S. Treasuries?

Over the past two years, as the Federal Reserve sharply raised interest rates, short-term U.S. Treasury yields surpassed 5%, making them a top choice for capital preservation. Yet, many high-yield farming models in DeFi lack long-term sustainability, leaving investors searching for reliable decentralized products with stable returns. OpenEden’s TBILL Vault addresses this gap:

- Low Risk: Backed by U.S. Treasuries, nearly equivalent to the Risk-Free Rate.

- High Liquidity: Daily trading volumes exceed $100 billion, ensuring assets are always liquid.

- Short Duration: The weighted average maturity (WAM) of the portfolio is less than three months, minimizing interest rate volatility risk.

- Instant Settlement: On-chain smart contracts enable 24/7 minting and redemption, significantly faster than the traditional two-day settlement cycle.

- Self-Custody: Investors can store TBILL tokens in their own wallets, eliminating the need for third-party custodians.

For DAOs or institutions holding large amounts of USDC, this offers a safer, more transparent, and instant solution for asset management.

2. USDO

In addition to TBILL, OpenEden has introduced USDO—a yield-generating stablecoin pegged to the U.S. dollar.

- Stable Value: Pegged to $1, providing users with stable payment and transactional utility.

- Yield Distribution: USDO rebases daily, passing on yields from U.S. Treasuries and repurchase agreements (repos) to holders.

- Earn by Holding: Unlike traditional stablecoins, USDO is not only a value storage tool but also a low-risk yield-generating asset.

Users can enjoy the convenience of stablecoins and earn steady returns from traditional financial markets.

Tokenomics

OpenEden’s native token, EDEN, serves as the ecosystem’s core coordination mechanism—driving platform governance, incentivizing community participation, and ensuring long-term protocol sustainability.

Token Utility

- Governance: Holders participate in protocol proposals and voting, shaping fund allocation, partnership strategy, and future roadmaps.

- Security: EDEN may be staked to enhance protocol security.

- Incentives: Allocated to early adopters, contributors, and partners to drive protocol growth.

- Ecosystem Growth: Fuels new product development, marketing, and cross-chain expansion.

Token Allocation

EDEN has a capped total supply, and its allocation model emphasizes fairness, incentives, and sustainable development:

- Ecosystem Development (38.5%)

For protocol promotion, technology R&D, and partnership building, ensuring continuous growth of the OpenEden ecosystem. - Fund Support (10%)

For professional funds and financial operations, supporting compliance and asset management needs. - Airdrop (7.5%)

Distributed to early supporters and community participants, encouraging decentralized ownership and strengthening community cohesion. - Advisors and Strategic Partnerships (20%)

Allocated to long-term advisors and strategic investors, ensuring ongoing professional and resource input. - Early Adopters (6%)

Rewards for protocol participants and supporters in the early stages, promoting community activity. - Institutional Investors (18%)

Allocated to compliant, strategically valuable institutions, accelerating protocol expansion and global reach.

By balancing community-driven growth, professional support, and institutional participation, this allocation builds a strong foundation for OpenEden’s long-term success.

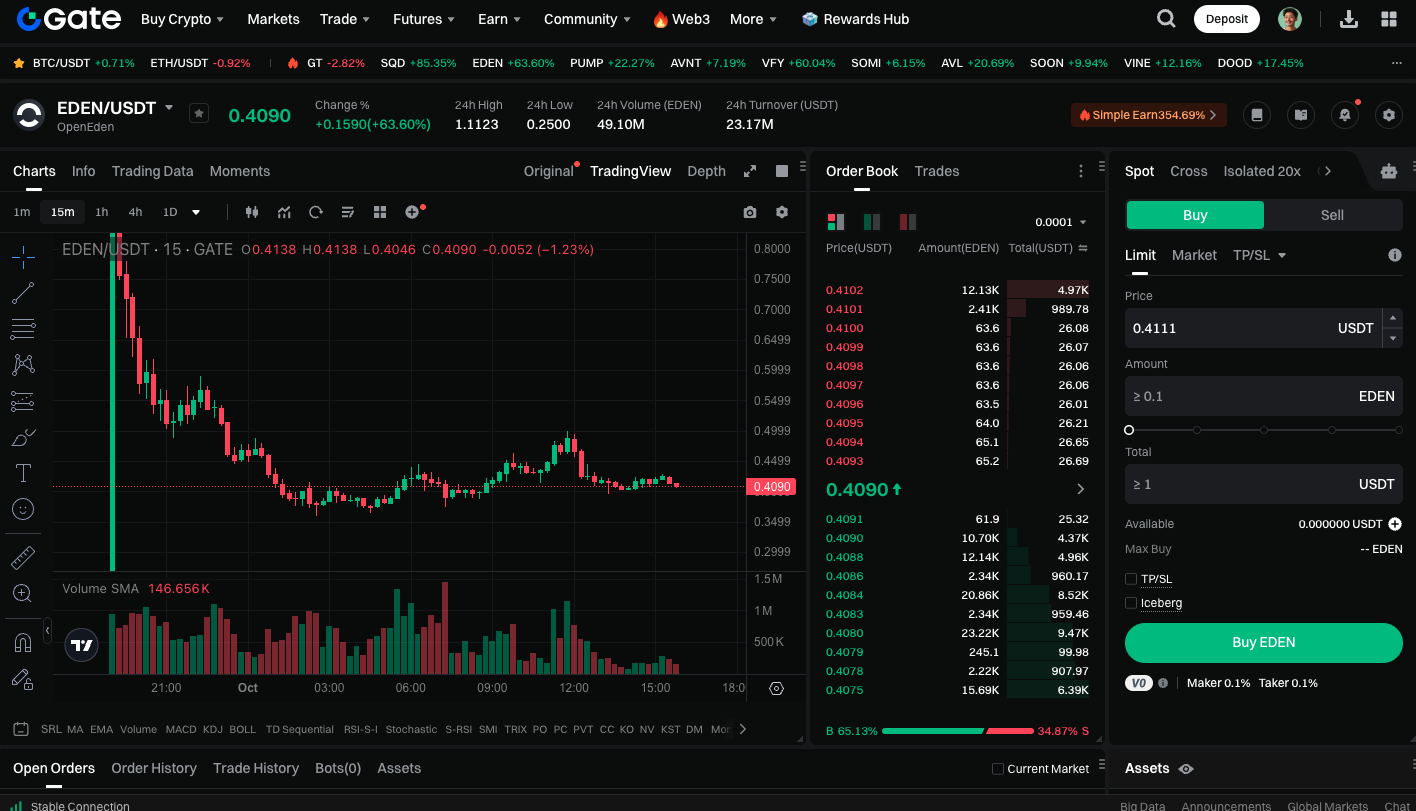

Start trading EDEN spot now: https://www.gate.com/trade/EDEN_USDT

Conclusion

OpenEden (EDEN) is much more than another RWA project—it represents a deep fusion of traditional finance and Web3. Through TBILL and USDO, OpenEden offers investors secure, transparent, and compliant on-chain, low-risk yield options, opening new possibilities for asset management for DAOs, institutions, and individuals. As global demand for RWA accelerates, OpenEden is poised to become a key infrastructure provider in this space, helping make the vision of real-world assets in DeFi a reality.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality