2025 AQT Price Prediction: Bullish Trends and Key Factors Shaping AQT's Future Value

Introduction: AQT's Market Position and Investment Value

Alpha Quark (AQT), as a service provider for purchasing and trading digital intangible assets such as intellectual property rights, has made significant strides since its inception in 2021. As of 2025, Alpha Quark's market capitalization has reached $16,190,945, with a circulating supply of approximately 26,806,201 tokens, and a price hovering around $0.604. This asset, often referred to as the "IP trading facilitator," is playing an increasingly crucial role in the field of digital asset management and intellectual property transactions.

This article will comprehensively analyze Alpha Quark's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AQT Price History Review and Current Market Status

AQT Historical Price Evolution

- 2021: AQT reached its all-time high of $15.37 on February 26, marking a significant milestone in its price history.

- 2025: The market entered a bearish cycle, with AQT price declining to its all-time low of $0.582847 on November 5.

AQT Current Market Situation

As of November 20, 2025, AQT is trading at $0.604, showing a slight recovery from its recent all-time low. The token has experienced mixed performance across different timeframes:

- In the past hour, AQT has seen a positive movement with a 1.19% increase.

- Over the last 24 hours, there has been a minor decline of 0.34%.

- The 7-day trend shows a significant drop of 17.04%, indicating short-term bearish pressure.

- Looking at the 30-day period, AQT has declined by 25.16%, suggesting a continued downward trend.

- The yearly performance reflects a substantial decrease of 47.23%, highlighting the overall bearish sentiment in the longer term.

The current market capitalization stands at $16,190,945.404, with a circulating supply of 26,806,201 AQT tokens. The fully diluted valuation is $18,120,000, and the token's market dominance is relatively low at 0.00055%.

Trading volume in the past 24 hours amounts to $17,246.859482, indicating moderate market activity for AQT.

Click to view the current AQT market price

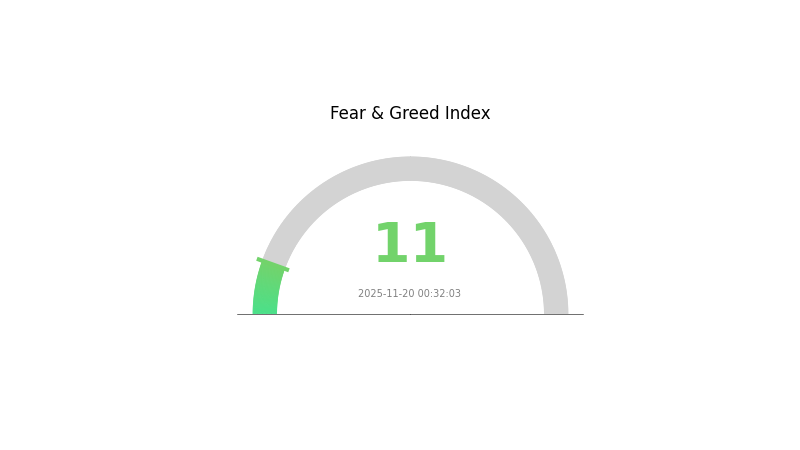

AQT Market Sentiment Indicator

2025-11-20 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often presents unique opportunities for contrarian investors. While caution is warranted, historically, such extreme fear has preceded significant market rebounds. Savvy traders on Gate.com may consider this a potential entry point, but remember to conduct thorough research and manage risks carefully. As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful."

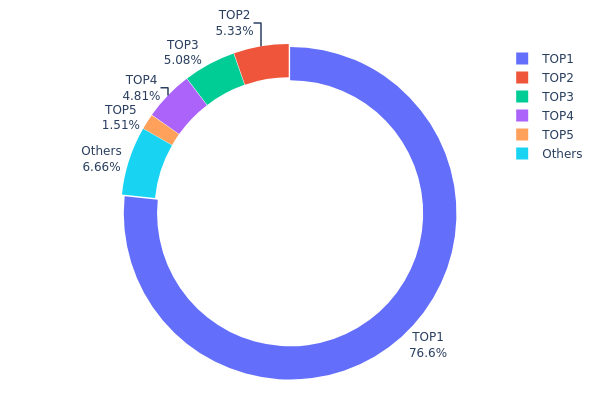

AQT Holdings Distribution

The address holdings distribution data for AQT reveals a highly concentrated ownership structure. The top address holds a staggering 76.62% of the total supply, equivalent to 23,005.16K AQT tokens. This level of concentration raises significant concerns about centralization and potential market manipulation. The next four largest holders collectively account for an additional 16.69% of the supply, leaving only 6.69% distributed among all other addresses.

Such an extreme concentration of tokens in a single address poses substantial risks to the AQT ecosystem. It could lead to increased price volatility, as any large-scale movement of tokens from the top address could dramatically impact market supply and demand dynamics. Furthermore, this concentration potentially undermines the principle of decentralization, which is fundamental to many cryptocurrency projects. It also raises questions about the fairness of token distribution and the long-term stability of the AQT network.

Given this distribution, investors and stakeholders should be aware of the increased susceptibility to market manipulation and the potential for sudden, significant price movements. The high concentration also suggests that the on-chain governance structure, if implemented, could be heavily influenced by a small number of large token holders, potentially compromising the democratic decision-making processes typically associated with decentralized networks.

Click to view the current AQT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0f93...380fbe | 23005.16K | 76.62% |

| 2 | 0x53dd...6fa489 | 1600.00K | 5.32% |

| 3 | 0xdbda...289250 | 1523.80K | 5.07% |

| 4 | 0xef35...9f0d50 | 1443.20K | 4.80% |

| 5 | 0x92e9...3d736f | 451.98K | 1.50% |

| - | Others | 1998.90K | 6.69% |

II. Key Factors Influencing AQT's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are showing increased interest in AQT, potentially due to its growing adoption in NFT and metaverse projects.

- Enterprise Adoption: Companies in the NFT and metaverse sectors are increasingly integrating AQT into their platforms and ecosystems.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and global economic conditions will continue to influence the broader cryptocurrency market, including AQT.

- Geopolitical Factors: International events and regulatory changes in key markets can significantly impact AQT's price trajectory.

Technological Development and Ecosystem Building

- NFT and Metaverse Integration: AQT's growing role in NFT and metaverse projects is a key driver for its future value and adoption.

- Ecosystem Applications: The development of DApps and projects utilizing AQT within its ecosystem will be crucial for long-term growth and sustainability.

III. AQT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.3926 - $0.5000

- Neutral forecast: $0.5000 - $0.6500

- Optimistic forecast: $0.6500 - $0.77312 (requires favorable market conditions and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.7108 - $1.04709

- 2028: $0.6521 - $1.33138

- Key catalysts: Project expansion, partnerships, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.95076 - $1.23598 (assuming steady growth and adoption)

- Optimistic scenario: $1.23598 - $1.58206 (assuming strong market performance and project success)

- Transformative scenario: $1.58206+ (extreme favorable conditions and breakthrough innovations)

- 2030-12-31: AQT $1.23598 (projected average price, indicating significant growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.77312 | 0.604 | 0.3926 | 0 |

| 2026 | 0.84004 | 0.68856 | 0.63348 | 14 |

| 2027 | 1.04709 | 0.7643 | 0.7108 | 26 |

| 2028 | 1.33138 | 0.9057 | 0.6521 | 49 |

| 2029 | 1.35343 | 1.11854 | 0.95076 | 85 |

| 2030 | 1.58206 | 1.23598 | 0.79103 | 104 |

IV. Professional Investment Strategies and Risk Management for AQT

AQT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate AQT during market dips

- Set price targets for partial profit-taking

- Store AQT in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for breakouts from consolidation patterns

- Use stop-loss orders to manage risk

AQT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Alpha Quark wallet (if available)

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for AQT

AQT Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Liquidity: AQT may have lower liquidity compared to major cryptocurrencies

- Competition: Other projects in the intellectual property space may gain market share

AQT Regulatory Risks

- Unclear regulations: Intellectual property tokenization may face regulatory scrutiny

- Compliance challenges: Changes in regulations could impact AQT's business model

- Cross-border issues: Differences in IP laws across jurisdictions may pose challenges

AQT Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token's smart contract

- Scalability: The platform may face challenges as it grows

- Blockchain interoperability: Limited compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

AQT Investment Value Assessment

AQT presents an innovative approach to intellectual property management on the blockchain. While it offers long-term potential in the growing digital asset space, short-term volatility and adoption challenges pose significant risks.

AQT Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate AQT as part of a diversified crypto portfolio, focusing on its potential in the IP sector

AQT Trading Participation Methods

- Spot trading: Buy and hold AQT on Gate.com

- Staking: Participate in AQT staking programs if available

- DeFi integration: Explore decentralized finance options involving AQT tokens

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 QNT be worth in 2030?

By 2030, 1 QNT is projected to be worth between $550 and $900, based on current forecasting models and market trends.

Would hamster kombat coin reach $1?

Hamster Kombat coin has potential to reach $1, but it's speculative. Current market trends and community growth suggest it could happen, though predictions aren't guaranteed.

Does API3 have a future?

Yes, API3 shows promise. Analysts project a price of $8-$15 by 2030, depending on adoption. While facing competition, it remains an interesting long-term investment prospect.

Which coin will reach $1 in 2030?

Based on current projections, no specific coin is guaranteed to reach $1 by 2030. PEPE Coin is forecasted to be worth $0.0002733 in 2030, far below $1.

Share

Content