2025 DOLO Price Prediction: Bullish Outlook as Adoption Soars and Market Matures

Introduction: DOLO's Market Position and Investment Value

Dolomite (DOLO), as a modular money market integrated with DEX functionality, has made significant strides since its inception. As of 2025, Dolomite's market capitalization has reached $16,858,700, with a circulating supply of approximately 361,000,000 tokens, and a price hovering around $0.0467. This asset, often referred to as a "capital efficiency enhancer," is playing an increasingly crucial role in the DeFi ecosystem.

This article will provide a comprehensive analysis of Dolomite's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. DOLO Price History Review and Current Market Status

DOLO Historical Price Evolution

- 2025 June: DOLO reached its all-time low of $0.02897

- 2025 August: DOLO hit its all-time high of $0.4, marking a significant milestone

- 2025 November: Price declined from the peak, currently trading at $0.0467

DOLO Current Market Situation

DOLO is currently trading at $0.0467, experiencing a 5.06% decrease in the last 24 hours. The token's market cap stands at $16,858,700, ranking it 980th in the cryptocurrency market. DOLO has seen significant volatility, with a 21.05% decrease over the past week and a 42.97% decline in the last 30 days. The trading volume in the past 24 hours is $301,315.50. Despite recent downward trends, DOLO has shown a positive 3.62% increase in the last hour, indicating potential short-term recovery signals.

Click to view the current DOLO market price

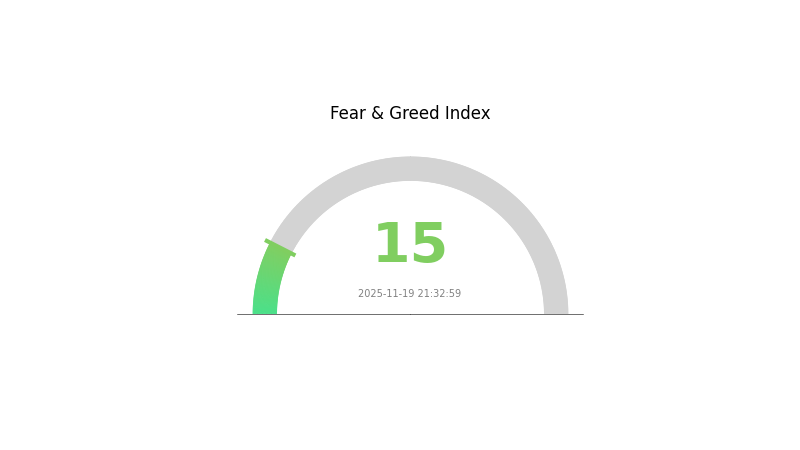

DOLO Market Sentiment Index

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the DOLO index plummeting to 15. This significant drop signals a potential buying opportunity for contrarian investors. However, caution is advised as market sentiment remains fragile. Traders should closely monitor key support levels and potential catalysts that could shift the market direction. While fear dominates, it's crucial to remember that market cycles often present opportunities for those who can navigate volatility wisely. Stay informed and consider your risk tolerance before making any investment decisions.

DOLO Holdings Distribution

The address holdings distribution chart provides insights into the concentration of DOLO tokens among different addresses. Based on the provided data, it appears that there are currently no significant holders of DOLO tokens, as the table is empty.

This lack of large holders suggests a highly decentralized distribution of DOLO tokens. The absence of dominant addresses indicates that no single entity or small group of entities has a disproportionate influence over the token supply. This decentralized structure potentially reduces the risk of market manipulation and promotes a more stable price dynamic.

From a market perspective, this distribution pattern may contribute to reduced volatility and a more organic price discovery process. The absence of "whales" or large token holders minimizes the potential for sudden, large-scale sell-offs that could negatively impact the token's value. Overall, the current address distribution reflects a high degree of decentralization and on-chain structural stability for DOLO.

Click to view the current DOLO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing DOLO's Future Price

Technical Development and Ecosystem Building

-

Ecosystem Integration: Expanding integration with wallets, DeFi aggregators, and custody services can potentially increase user coverage, trading volume, and Total Value Locked (TVL), providing strong support for DOLO token price.

-

DeFi Innovation: Dolomite's exploration in the DeFi sector indicates a trend towards protocols that not only offer better yields but also emphasize users' complete control over their assets, aligning with the core principles of the crypto world.

-

Ecosystem Applications: The DOLO token serves as the foundation ERC20 token for transactions and exchange trading within the ecosystem. Additionally, users can lock DOLO tokens to obtain veDOLO, the core governance token, with longer lock-up periods resulting in more tokens received.

III. DOLO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.03707 - $0.04753

- Neutral forecast: $0.04753 - $0.05846

- Optimistic forecast: $0.05846 - $0.06939 (requires sustained market growth and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range prediction:

- 2027: $0.05279 - $0.07856

- 2028: $0.04949 - $0.07636

- Key catalysts: Technological advancements, expanding use cases, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.07353 - $0.0853 (assuming steady market growth and adoption)

- Optimistic scenario: $0.09706 - $0.11856 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.11856+ (under extremely favorable conditions and breakthrough developments)

- 2030-12-31: DOLO $0.0853 (potential for significant growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06939 | 0.04753 | 0.03707 | 1 |

| 2026 | 0.06723 | 0.05846 | 0.05437 | 25 |

| 2027 | 0.07856 | 0.06285 | 0.05279 | 34 |

| 2028 | 0.07636 | 0.0707 | 0.04949 | 51 |

| 2029 | 0.09706 | 0.07353 | 0.07132 | 57 |

| 2030 | 0.11856 | 0.0853 | 0.04862 | 82 |

IV. Professional Investment Strategies and Risk Management for DOLO

DOLO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate DOLO during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Use stop-loss orders to manage risk

DOLO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Never share private keys, use 2FA, regularly update software

V. Potential Risks and Challenges for DOLO

DOLO Market Risks

- High volatility: Price fluctuations can be extreme

- Liquidity risk: Limited trading volume may affect price stability

- Competition: Other DeFi projects may capture market share

DOLO Regulatory Risks

- Uncertain regulations: Potential for stricter DeFi regulations

- Legal status: Unclear classification of DOLO tokens in some jurisdictions

- Compliance challenges: Adapting to evolving regulatory requirements

DOLO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High gas fees on underlying blockchain

- Scalability issues: Limitations in transaction processing capacity

VI. Conclusion and Action Recommendations

DOLO Investment Value Assessment

DOLO presents a high-risk, high-potential opportunity in the DeFi space. Long-term value proposition lies in its innovative features, but short-term volatility and regulatory uncertainties pose significant risks.

DOLO Investment Recommendations

✅ Beginners: Limited exposure, focus on learning DeFi concepts ✅ Experienced investors: Consider as part of a diversified DeFi portfolio ✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

DOLO Trading Participation Methods

- Spot trading: Purchase DOLO tokens on Gate.com

- DeFi interactions: Engage with Dolomite protocol for lending/borrowing

- Staking: Participate in yield-generating opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Dolo a good investment?

Based on current projections, Dolo may not be a promising investment. Analysts predict limited growth potential, with a maximum price of $0.05 expected by the end of 2025.

Will Doge hit $10?

While unlikely, Doge could potentially reach $10 if it gains significant real-world adoption and market capitalization growth by 2025.

Who is the owner of Dolo coin?

Corey Caplan, the Co-Founder and President of Dolomite, is the owner of Dolo coin.

What will Doge be worth in 2025?

Based on current trends, Dogecoin (DOGE) is projected to reach an average price of $0.1 by the end of 2025, showing potential growth from its current $0.15 value.

Share

Content