2025 KDA Price Prediction: Analyzing Growth Patterns and Market Potential in the Evolving Blockchain Ecosystem

Introduction: KDA's Market Position and Investment Value

Kadena (KDA), as a leader in distributed digital ledgers, has made significant strides in the blockchain industry since its inception. As of 2025, Kadena's market capitalization has reached $110,601,222, with a circulating supply of approximately 331,836,852 KDA tokens, and a price hovering around $0.3333. This asset, often referred to as a "secure and scalable blockchain platform," is playing an increasingly crucial role in improving efficiency for various institutions through its blockchain technology.

This article will provide a comprehensive analysis of Kadena's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. KDA Price History Review and Current Market Status

KDA Historical Price Evolution

- 2020: Initial launch, price fluctuated around $0.065811 (all-time low)

- 2021: Bull market peak, price reached all-time high of $27.64 on November 11

- 2022-2025: Bearish trend, price declined to current level of $0.3333

KDA Current Market Situation

As of September 26, 2025, KDA is trading at $0.3333, with a market cap of $110,601,222.88. The 24-hour trading volume stands at $358,397.89. KDA has experienced a 2.14% decrease in the last 24 hours and a significant 14.43% drop over the past week. The current price represents a 98.79% decline from its all-time high and a 406.45% increase from its all-time low. With a circulating supply of 331,836,852.34915 KDA and a total supply of 331,933,811.34765 KDA, the project has a max supply cap of 1,000,000,000 KDA. The fully diluted market cap is $333,300,000.00, and KDA's market dominance is 0.0027%.

Click to view the current KDA market price

KDA Market Sentiment Indicator

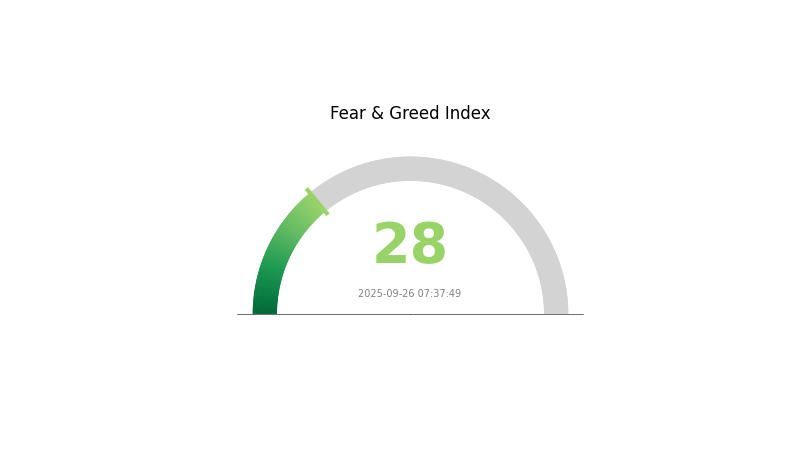

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index standing at 28. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade wisely on Gate.com.

KDA Holdings Distribution

The address holdings distribution data for KDA is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific information on top holders and their respective percentages, it's challenging to assess the level of decentralization or potential market impact.

In the absence of this data, we can only speculate that KDA's distribution might follow patterns typical of many cryptocurrencies, where a small number of addresses often hold a significant portion of the total supply. However, this assumption cannot be confirmed without concrete figures.

The lack of publicly available holdings data could be interpreted in various ways. It might indicate a desire for privacy among large holders, or it could suggest that the project's transparency regarding token distribution is limited. This situation underscores the importance of ongoing research and the need for more detailed information to accurately evaluate KDA's market structure and potential volatility factors.

Click to view the current KDA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing KDA's Future Price

Supply Mechanism

- Chainweb Consensus: Kadena's architecture is based on the Chainweb consensus, a network of 20 interconnected chains powering the Kadena blockchain. This forms the foundation of Kadena's Layer 1 network.

Institutional and Whale Dynamics

- Enterprise Adoption: Kadena emphasizes enterprise-grade solutions, attracting developers and institutional investors with its smart contract capabilities and compatibility with the Pact language.

Macroeconomic Environment

- Inflation Hedging Properties: As a decentralized cryptocurrency, KDA may be viewed as a potential hedge against inflation and currency devaluation, similar to other digital assets.

Technological Development and Ecosystem Building

- Chainweb Architecture: KDA's unique Chainweb consensus mechanism enables parallel multi-chain architecture, achieving thousands of transactions per second while maintaining low latency and high security.

- Smart Contract Platform: Kadena focuses on building a scalable decentralized application platform, supporting smart contract development and DeFi applications.

- Ecosystem Applications: The Kadena ecosystem supports DeFi and NFT applications, with users able to participate in network governance and access various decentralized services using KDA tokens.

III. KDA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.22 - $0.30

- Neutral prediction: $0.30 - $0.35

- Optimistic prediction: $0.35 - $0.41 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.37 - $0.60

- 2028: $0.46 - $0.54

- Key catalysts: Technological advancements, increased utility, and broader market recovery

2030 Long-term Outlook

- Base scenario: $0.59 - $0.70 (assuming steady growth and adoption)

- Optimistic scenario: $0.70 - $0.88 (assuming strong ecosystem expansion and market leadership)

- Transformative scenario: $0.88 - $1.00 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: KDA $0.88669 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.41388 | 0.3311 | 0.22184 | 0 |

| 2026 | 0.51776 | 0.37249 | 0.20114 | 11 |

| 2027 | 0.60537 | 0.44512 | 0.3739 | 33 |

| 2028 | 0.541 | 0.52524 | 0.46222 | 57 |

| 2029 | 0.69839 | 0.53312 | 0.42117 | 59 |

| 2030 | 0.88669 | 0.61576 | 0.59728 | 84 |

IV. KDA Professional Investment Strategies and Risk Management

KDA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate KDA during market dips and price corrections

- Set price targets and regularly review investment thesis

- Store KDA in secure hardware wallets or reputable custodial solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

KDA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, and regularly update software

V. KDA Potential Risks and Challenges

KDA Market Risks

- High volatility: Significant price fluctuations can lead to substantial losses

- Limited liquidity: May impact ability to enter or exit positions efficiently

- Correlation with broader crypto market: Susceptible to overall market sentiment

KDA Regulatory Risks

- Uncertain regulatory landscape: Potential for unfavorable regulations in key markets

- Compliance challenges: Evolving AML/KYC requirements may impact adoption

- Tax implications: Unclear or changing tax treatment of KDA transactions

KDA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: May face issues as network usage increases

- Competition from other blockchain platforms: Risk of losing market share

VI. Conclusion and Action Recommendations

KDA Investment Value Assessment

Kadena offers a unique value proposition with its scalable proof-of-work blockchain and simple smart contract language. However, investors should be aware of the project's relatively small market cap and potential for high volatility.

KDA Investment Recommendations

✅ Beginners: Start with small positions and focus on education about Kadena's technology ✅ Experienced investors: Consider KDA as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

KDA Trading Participation Methods

- Spot trading: Buy and sell KDA on Gate.com's spot market

- Staking: Participate in KDA staking programs for passive income

- DeFi integration: Explore Kadena-based DeFi protocols for additional yield opportunities

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future potential of Kadena?

Kadena's future potential is strong, with expected growth in adoption and value. Its scalable blockchain solutions aim to disrupt traditional infrastructure. Analysts predict significant price increases based on its innovative approach.

Is kadena a good crypto?

Kadena (KDA) offers fast, low-cost transactions and scalable blockchain solutions. Its innovative technology and growing ecosystem make it a promising crypto asset with potential for future growth.

Will Kadena go up again?

Kadena's price may rise again. Current forecasts suggest potential growth, with a predicted average of $0.38 by 2029. However, market sentiment remains mixed.

Is Kadena a good project?

Yes, Kadena is a promising blockchain project with unique scalability features and strong development team, making it a good investment option.

Share

Content