2025 MOBILE Price Prediction: Analyzing Future Trends and Market Dynamics in the Smartphone Industry

Introduction: MOBILE's Market Position and Investment Value

Helium Mobile (MOBILE), as a decentralized wireless infrastructure provider, has been playing an increasingly crucial role in cellular services since its inception. As of 2025, MOBILE's market capitalization has reached $17,205,861, with a circulating supply of approximately 62,544,025,971 tokens, and a price hovering around $0.0002751. This asset, known as the "decentralized cellular network token," is making significant strides in revolutionizing wireless connectivity and infrastructure.

This article will provide a comprehensive analysis of MOBILE's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. MOBILE Price History Review and Current Market Status

MOBILE Historical Price Evolution

- 2024: MOBILE reached its all-time high of $0.006944 on March 16, marking a significant milestone for the project.

- 2025: The token experienced a sharp decline, hitting its all-time low of $0.0002329 on October 22, reflecting a challenging market period.

MOBILE Current Market Situation

As of November 20, 2025, MOBILE is trading at $0.0002751, representing a 24-hour decrease of 9.29%. The token's market capitalization stands at $17,205,861, ranking it 971st in the global cryptocurrency market. MOBILE has a circulating supply of 62,544,025,971 tokens out of a total supply of 230,000,000,000.

In the past 24 hours, MOBILE has traded between a low of $0.0002629 and a high of $0.0003088. The token's trading volume over this period was $13,387, indicating moderate market activity.

While MOBILE has seen a slight recovery of 2.87% in the last hour, its performance over longer periods remains mixed. The token has declined by 11.20% over the past week but shows an 8.21% increase over the last 30 days. However, MOBILE has experienced a significant 62.9% decrease in value over the past year.

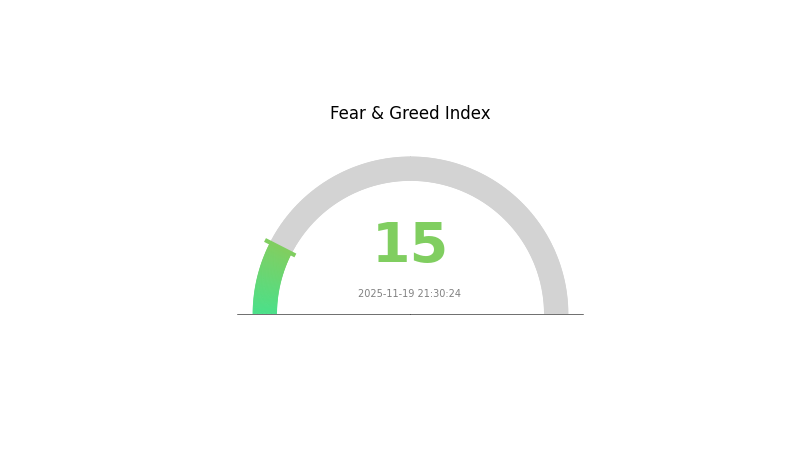

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX index of 15, suggesting a cautious and risk-averse environment among investors.

Click to view the current MOBILE market price

MOBILE Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 15. This suggests a significant level of pessimism among investors. Such extreme fear often indicates a potential buying opportunity, as markets may be oversold. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

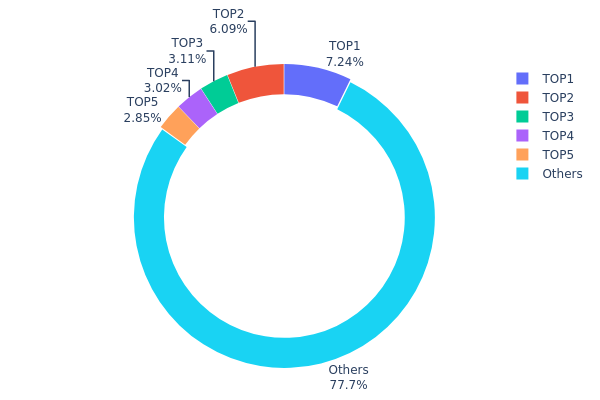

MOBILE Holdings Distribution

The address holdings distribution data for MOBILE reveals a relatively balanced ownership structure. The top five addresses collectively hold 22.27% of the total supply, with the largest single address controlling 7.23%. This distribution suggests a moderate level of concentration, but not to an extent that raises immediate concerns about centralization.

The majority of MOBILE tokens (77.73%) are distributed among numerous smaller holders, indicating a broad base of ownership. This diversification is generally positive for market stability and resistance to manipulation. However, the presence of a few large holders, particularly the top two addresses with over 6% each, warrants monitoring as they could potentially influence market dynamics if they decide to make significant moves.

Overall, the current holdings distribution of MOBILE reflects a reasonably decentralized structure. While there is some concentration at the top, the wide distribution among other holders suggests a healthy ecosystem with reduced risk of market manipulation by a single entity. This structure potentially contributes to more organic price discovery and market stability for MOBILE.

Click to view the current MOBILE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 22Wnk8...h7zkBa | 4266258.18K | 7.23% |

| 2 | 8dzcoH...G5Ry4J | 3590186.88K | 6.08% |

| 3 | V8MgBK...3C5cDF | 1831758.14K | 3.10% |

| 4 | 8Ndq7B...xJZw49 | 1780401.69K | 3.01% |

| 5 | 47T8Gb...o3pKy8 | 1681707.30K | 2.85% |

| - | Others | 45807434.64K | 77.73% |

II. Key Factors Affecting MOBILE's Future Price

Supply Mechanism

- DRAM Price: The sharp rise in DRAM prices has become a core factor driving up costs in the smartphone sector. In Q4 2025, DRAM contract prices surged over 75% compared to the same period last year.

- Historical Pattern: Historically, increases in component costs like DRAM have led to higher smartphone prices.

- Current Impact: The current DRAM price surge is expected to push smartphone prices higher in the coming quarters.

Institutional and Major Player Dynamics

- Corporate Adoption: Major companies like vivo, Huawei, Xiaomi, and OPPO are leading the high-end smartphone market in China, showing strong momentum in technological upgrades and brand premiumization strategies.

Macroeconomic Environment

- Inflation Hedging Properties: During economic downturns, consumer purchasing power declines, leading manufacturers to adopt price reduction strategies to attract customers. Conversely, during economic recovery periods, consumer confidence rebounds, allowing manufacturers to appropriately increase prices.

- Geopolitical Factors: International situations and geopolitical tensions can impact global supply chains and production costs, potentially affecting smartphone pricing.

Technological Development and Ecosystem Building

- 5G Technology: The transition from 4G to 5G has significantly impacted smartphone pricing and consumer preferences.

- AI Integration: The integration of AI technologies in smartphones is becoming a key differentiator in the high-end market.

- Ecosystem Applications: Cross-device interconnectivity and smart home integration are becoming increasingly important factors in consumer decision-making.

III. MOBILE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00018 - $0.00025

- Neutral prediction: $0.00025 - $0.00030

- Optimistic prediction: $0.00030 - $0.00033 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.00021 - $0.00038

- 2028: $0.00023 - $0.00041

- Key catalysts: Technological advancements, broader market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00030 - $0.00042 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00042 - $0.00050 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00050 - $0.00057 (assuming breakthrough use cases and widespread adoption)

- 2030-12-31: MOBILE $0.00057 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00033 | 0.00028 | 0.00018 | 1 |

| 2026 | 0.00032 | 0.0003 | 0.00016 | 10 |

| 2027 | 0.00038 | 0.00031 | 0.00021 | 13 |

| 2028 | 0.00041 | 0.00034 | 0.00023 | 25 |

| 2029 | 0.00046 | 0.00038 | 0.0003 | 36 |

| 2030 | 0.00057 | 0.00042 | 0.00025 | 51 |

IV. MOBILE Professional Investment Strategies and Risk Management

MOBILE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate MOBILE tokens during market dips

- Stake tokens to participate in network governance

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

MOBILE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. MOBILE Potential Risks and Challenges

MOBILE Market Risks

- High volatility: MOBILE price can experience significant fluctuations

- Limited adoption: Helium Mobile network may face challenges in user acquisition

- Competition: Other decentralized wireless projects may emerge

MOBILE Regulatory Risks

- Uncertain regulatory environment: Cryptocurrency regulations may impact MOBILE

- Potential classification as a security: Could affect token trading and distribution

- Cross-border compliance: International regulations may vary

MOBILE Technical Risks

- Network scalability: Helium Mobile may face challenges in expanding coverage

- Smart contract vulnerabilities: Potential for exploits in the token contract

- Interoperability issues: Integration with other blockchain networks may be complex

VI. Conclusion and Action Recommendations

MOBILE Investment Value Assessment

MOBILE presents a unique opportunity in the decentralized wireless infrastructure space. While it offers long-term potential for growth, short-term volatility and adoption challenges pose significant risks.

MOBILE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the technology ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider long-term potential

MOBILE Trading Participation Methods

- Spot trading: Buy and sell MOBILE tokens on Gate.com

- Staking: Participate in network governance and earn rewards

- Providing cellular coverage: Contribute to the network and earn MOBILE tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will helium mobile reach 1 cent?

Based on current projections, it's unlikely Helium Mobile will reach 1 cent by 2025. However, long-term forecasts suggest it could reach $0.00065 by 2030, showing potential for growth.

What is the price prediction for mobile token in 2030?

Based on current trends and market analysis, the price of MOBILE token is predicted to reach approximately $0.16 by 2030, showing potential for moderate growth over the next few years.

How much is a helium mobile to $1?

As of 2025-11-19, 1 Helium Mobile (MOBILE) is worth approximately $0.000306. Conversely, $1 can buy about 3,265 MOBILE tokens.

How much will helium mobile cost in 2040?

Based on current forecasts, Helium Mobile (MOBILE) is expected to cost between $0.0332 and $0.0880 by 2040, showing potential for moderate growth over the long term.

Share

Content