2025 MOBILE Price Prediction: Forecasting the Future of Smartphone Costs in a Tech-Driven Market

Introduction: MOBILE's Market Position and Investment Value

Helium Mobile (MOBILE), as a decentralized wireless infrastructure provider, has been offering cellular services since its inception in 2024. As of 2025, MOBILE's market capitalization has reached $17,018,229, with a circulating supply of approximately 62,544,025,971 tokens, and a price hovering around $0.0002721. This asset, known as the "decentralized cellular network token," is playing an increasingly crucial role in the field of wireless communications and network infrastructure.

This article will comprehensively analyze MOBILE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MOBILE Price History Review and Current Market Status

MOBILE Historical Price Evolution

- 2024: MOBILE launched, reaching its all-time high of $0.006944 on March 16, 2024

- 2025: Significant market downturn, price dropped to its all-time low of $0.0002329 on October 22, 2025

MOBILE Current Market Situation

MOBILE is currently trading at $0.0002721, experiencing a 10.76% decrease in the last 24 hours. The token's market capitalization stands at $17,018,229, ranking it 969th in the cryptocurrency market. MOBILE's trading volume in the past 24 hours is $13,379, indicating moderate market activity. The token is currently trading 96.08% below its all-time high and 16.83% above its all-time low. The circulating supply of MOBILE is 62,544,025,971.39, representing 27.19% of its total supply of 230,000,000,000 tokens.

Click to view the current MOBILE market price

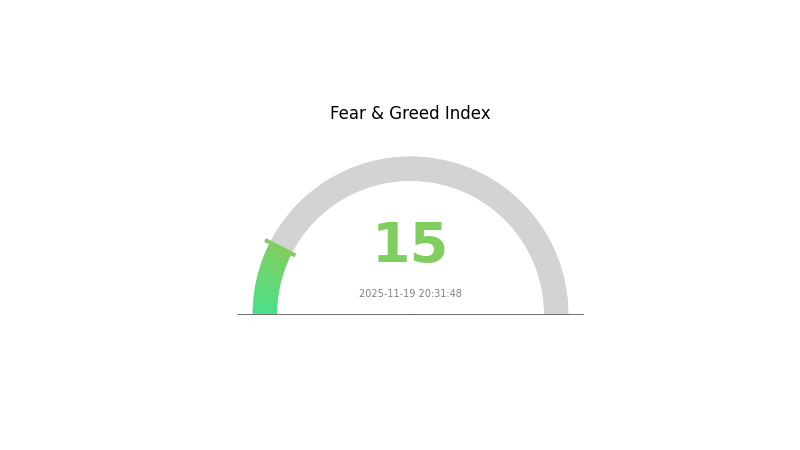

MOBILE Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 15. This level of pessimism often presents unique opportunities for savvy investors. While caution is warranted, historically, such extreme fear has preceded significant market rebounds. Traders on Gate.com are closely monitoring this indicator, as it may signal potential entry points for long-term positions. Remember, market sentiment can shift rapidly, so stay informed and consider your risk tolerance before making any investment decisions.

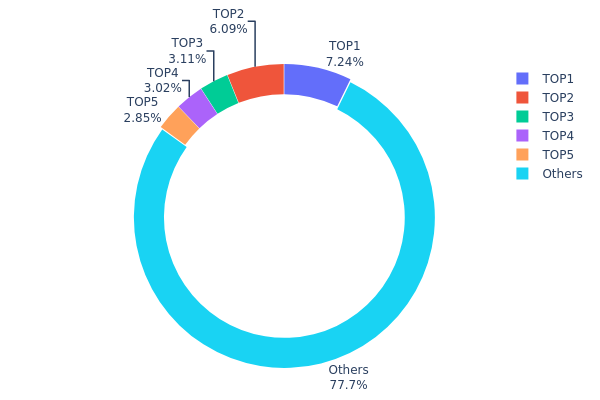

MOBILE Holdings Distribution

The address holdings distribution data for MOBILE reveals a moderate level of concentration among top holders. The top 5 addresses collectively control 22.27% of the total supply, with the largest holder possessing 7.23%. This distribution pattern suggests a relatively balanced ownership structure, as the majority of tokens (77.73%) are held by addresses outside the top 5.

While there is some concentration at the top, it does not appear to be excessive. The current distribution indicates a healthy level of decentralization, which is generally positive for market stability and resilience against potential manipulation. However, investors should note that the top holders still have significant influence and their actions could impact short-term price movements.

Overall, the MOBILE token distribution reflects a maturing market structure with a good balance between major stakeholders and a diverse base of smaller holders. This distribution pattern supports the potential for organic price discovery and reduces the risk of extreme volatility caused by individual large holders.

Click to view the current MOBILE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 22Wnk8...h7zkBa | 4266258.18K | 7.23% |

| 2 | 8dzcoH...G5Ry4J | 3590186.88K | 6.08% |

| 3 | V8MgBK...3C5cDF | 1831758.14K | 3.10% |

| 4 | 8Ndq7B...xJZw49 | 1780401.69K | 3.01% |

| 5 | 47T8Gb...o3pKy8 | 1681707.30K | 2.85% |

| - | Others | 45807434.64K | 77.73% |

II. Key Factors Affecting MOBILE's Future Price

Supply Mechanism

- DRAM Price Increase: The sharp rise in DRAM (Dynamic Random Access Memory) prices has become a core factor driving up costs in the smartphone sector. In Q4 2025, DRAM contract prices have surged over 75% compared to the same period last year.

- Current Impact: This significant increase in DRAM prices is expected to have a substantial impact on smartphone production costs and potentially on retail prices.

Institutional and Whale Dynamics

- Enterprise Adoption: Major tech companies are increasingly integrating mobile technologies into their products and services, potentially influencing demand and price.

- Government Policies: National-level policies related to mobile technology and the telecommunications sector may impact the industry's development and pricing strategies.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions are likely to influence consumer spending power and investment in the mobile technology sector.

- Geopolitical Factors: International relations and trade policies may affect the global supply chain and pricing of mobile devices.

Technological Development and Ecosystem Building

- 5G Technology: The ongoing rollout and adoption of 5G technology is a significant driver for mobile device upgrades and pricing.

- AI Integration: Advancements in artificial intelligence and its integration into mobile devices are becoming key differentiators in the market.

- Ecosystem Applications: The development of mobile-based applications and services, particularly in areas like IoT and smart home technologies, is expanding the mobile ecosystem and potentially influencing device pricing.

III. MOBILE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00022 - $0.00025

- Neutral prediction: $0.00025 - $0.00029

- Optimistic prediction: $0.00029 - $0.0004 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00018 - $0.00047

- 2027: $0.00024 - $0.00046

- Key catalysts: Increased adoption and technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.00043 - $0.00056 (assuming steady market growth)

- Optimistic scenario: $0.00056 - $0.00063 (assuming strong market performance)

- Transformative scenario: $0.00063+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: MOBILE $0.00063 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0004 | 0.00027 | 0.00022 | 0 |

| 2026 | 0.00047 | 0.00034 | 0.00018 | 24 |

| 2027 | 0.00046 | 0.0004 | 0.00024 | 47 |

| 2028 | 0.00055 | 0.00043 | 0.00026 | 58 |

| 2029 | 0.00062 | 0.00049 | 0.00039 | 80 |

| 2030 | 0.00063 | 0.00056 | 0.00039 | 104 |

IV. Professional MOBILE Investment Strategies and Risk Management

MOBILE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in decentralized wireless infrastructure

- Operation suggestions:

- Accumulate MOBILE tokens during market dips

- Participate in network governance to increase potential rewards

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor Helium Mobile network adoption and growth metrics

- Stay informed about partnerships and technological advancements

MOBILE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MOBILE with other crypto assets and traditional investments

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MOBILE

MOBILE Market Risks

- High volatility: MOBILE price may experience significant fluctuations

- Competition: Other decentralized wireless projects may emerge

- Adoption risk: Slow user acquisition could impact token value

MOBILE Regulatory Risks

- Uncertain regulatory landscape: Potential changes in telecom regulations

- Data privacy concerns: Increased scrutiny on decentralized networks

- Compliance requirements: Possible need for licensing in various jurisdictions

MOBILE Technical Risks

- Network scalability: Challenges in expanding coverage and capacity

- Security vulnerabilities: Potential exploits in the decentralized infrastructure

- Technological obsolescence: Rapid advancements in wireless technology

VI. Conclusion and Action Recommendations

MOBILE Investment Value Assessment

MOBILE presents a unique opportunity in the decentralized wireless space, with potential long-term value driven by network growth. However, short-term volatility and adoption challenges pose significant risks.

MOBILE Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy and actively participate in governance ✅ Institutional investors: Conduct comprehensive due diligence and consider strategic partnerships

MOBILE Trading Participation Methods

- Spot trading: Purchase MOBILE tokens on Gate.com

- Staking: Participate in network validation for potential rewards

- Governance: Engage in MOBILE subDAO decision-making processes

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will helium mobile reach 1 cent?

Based on current projections, it's unlikely Helium Mobile will reach 1 cent by 2025. However, long-term forecasts suggest it could reach $0.00065 by 2030, showing potential for growth.

What is the price prediction for mobile token in 2030?

Based on current trends and market analysis, the price of MOBILE token is predicted to reach approximately $0.16 by 2030, showing potential for moderate growth over the next few years.

How much is a helium mobile to $1?

As of 2025, 1 Helium Mobile (MOBILE) is worth approximately $0.000306. Conversely, $1 can buy about 3,265 MOBILE tokens.

How much will helium mobile cost in 2040?

Based on current forecasts, Helium Mobile (MOBILE) is expected to cost between $0.0332 and $0.0880 by 2040, showing potential for moderate growth over the long term.

Share

Content