2025 MOVR Price Prediction: Analyzing Market Trends and Growth Potential in the Moonriver Ecosystem

Introduction: MOVR's Market Position and Investment Value

Moonriver (MOVR), as an EVM-compatible blockchain running on the Kusama network, has achieved significant milestones since its inception in 2021. As of 2025, Moonriver's market capitalization has reached $55,065,411, with a circulating supply of approximately 10,028,303 tokens, and a price hovering around $5.491. This asset, often referred to as the "Kusama's Ethereum Bridge," is playing an increasingly crucial role in facilitating interoperability between Ethereum-based applications and the Kusama ecosystem.

This article will provide a comprehensive analysis of Moonriver's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. MOVR Price History Review and Current Market Status

MOVR Historical Price Evolution

- 2021: Moonriver launched, price reached all-time high of $494.26 on September 11

- 2023: Market downturn, price hit all-time low of $3.62 on October 20

- 2025: Price recovery and stabilization, currently trading at $5.491

MOVR Current Market Situation

As of September 29, 2025, MOVR is trading at $5.491. The token has shown a 3.7% increase in the past 24 hours, with a trading volume of $137,021. MOVR's market capitalization stands at $55,065,411, ranking it 647th in the global cryptocurrency market. The circulating supply is 10,028,303 MOVR, which represents 92.31% of the total supply. Despite a 51.27% decrease in price over the past year, MOVR has shown signs of recovery in recent months, with a 0.96% increase over the last 7 days.

Click to view the current MOVR market price

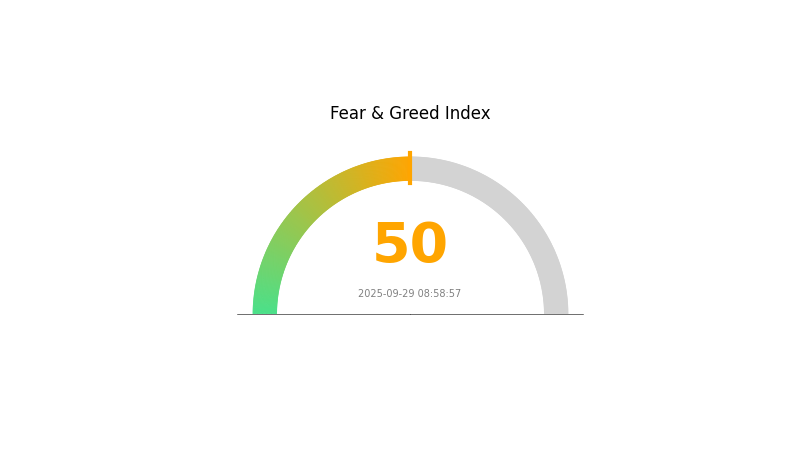

MOVR Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment for MOVR remains balanced today, with the Fear and Greed Index at 50, indicating a neutral stance. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about MOVR's prospects. Such a neutral reading often presents a good opportunity for traders to reassess their strategies and conduct thorough market analysis before making any significant moves. As always, it's crucial to stay informed and exercise caution in the volatile crypto market.

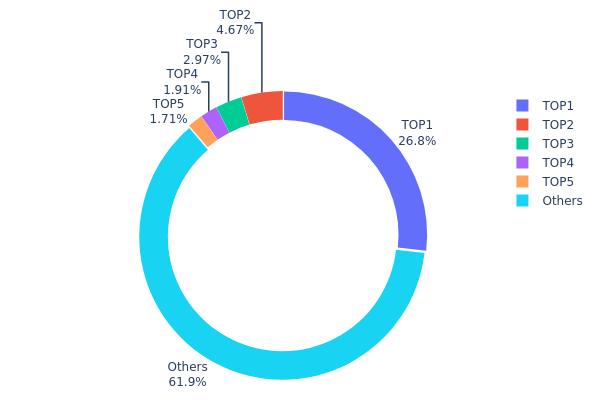

MOVR Holdings Distribution

The address holdings distribution data for MOVR reveals a significant concentration of tokens in a few top addresses. The largest holder controls 26.81% of the total supply, with 3,248,500 MOVR tokens. The top 5 addresses collectively hold 38.04% of all MOVR tokens, while the remaining 61.96% is distributed among other addresses.

This concentration pattern suggests a relatively high level of centralization in MOVR token ownership. The presence of a single address holding over a quarter of the total supply raises concerns about potential market manipulation and price volatility. Such a large position could significantly impact market dynamics if liquidated or moved suddenly. Additionally, the top 5 addresses controlling nearly 40% of the supply further accentuates the centralized nature of MOVR's current distribution.

While some level of concentration is common in many cryptocurrencies, MOVR's distribution indicates a lower degree of decentralization compared to more established assets. This structure may lead to increased price sensitivity to large holders' actions and could potentially affect the overall stability of the MOVR ecosystem.

Click to view the current MOVR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 3248.50K | 26.81% |

| 2 | 0x5a04...4020a3 | 565.76K | 4.66% |

| 3 | 0xb0a3...7e4411 | 359.83K | 2.96% |

| 4 | 0x381d...a362a7 | 232.01K | 1.91% |

| 5 | 0x14d7...632bcc | 207.19K | 1.70% |

| - | Others | 7503.33K | 61.96% |

II. Key Factors Influencing MOVR's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Institutional investors have shown increasing interest in MOVR, contributing to its price growth in 2025.

- Corporate Adoption: The explosive growth of the Web3 Movement ecosystem has attracted more enterprises to adopt MOVR.

Macroeconomic Environment

- Inflation Hedge Properties: As a cryptocurrency, MOVR may be viewed as a potential hedge against inflation in the current economic climate.

- Geopolitical Factors: International political situations continue to impact the broader crypto market, including MOVR.

Technological Development and Ecosystem Building

- Cross-chain Interoperability: Future opportunities for MOVR lie in enhancing cross-chain interoperability and multi-chain ecosystem development.

- Ecosystem Applications: The growth of DApps and ecosystem projects on Moonriver is crucial for MOVR's value proposition.

III. MOVR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3.40 - $5.49

- Neutral prediction: $5.49 - $6.50

- Optimistic prediction: $6.50 - $7.52 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $6.08 - $8.06

- 2028: $6.18 - $9.08

- Key catalysts: Ecosystem expansion, technological improvements, and broader market trends

2030 Long-term Outlook

- Base scenario: $7.93 - $9.26 (assuming steady growth and adoption)

- Optimistic scenario: $9.26 - $11.94 (with significant ecosystem expansion and market penetration)

- Transformative scenario: Above $11.94 (with breakthrough innovations and mass adoption)

- 2030-12-31: MOVR $9.26 (potential average price based on projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 7.52541 | 5.493 | 3.40566 | 0 |

| 2026 | 7.16013 | 6.50921 | 4.23098 | 18 |

| 2027 | 8.0649 | 6.83467 | 6.08285 | 24 |

| 2028 | 9.08874 | 7.44979 | 6.18332 | 35 |

| 2029 | 10.25388 | 8.26926 | 7.93849 | 50 |

| 2030 | 11.94743 | 9.26157 | 5.18648 | 68 |

IV. MOVR Professional Investment Strategies and Risk Management

MOVR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term horizon

- Operational suggestions:

- Accumulate MOVR during market dips

- Stake MOVR to earn rewards and participate in network security

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor Kusama ecosystem developments and parachain auctions

- Track MOVR/ETH and MOVR/BTC pairs for relative strength

MOVR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MOVR with other crypto assets and traditional investments

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and backup private keys

V. Potential Risks and Challenges for MOVR

MOVR Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Potential challenges in trading large volumes

- Competition: Other EVM-compatible chains may gain market share

MOVR Regulatory Risks

- Uncertain regulations: Changing crypto policies may impact MOVR's adoption

- Cross-border compliance: Varying regulations across jurisdictions

- Taxation: Evolving tax treatments for crypto assets and staking rewards

MOVR Technical Risks

- Smart contract vulnerabilities: Potential exploits in DApps built on Moonriver

- Network congestion: Scalability challenges during high-demand periods

- Interoperability issues: Risks associated with cross-chain bridges and integrations

VI. Conclusion and Action Recommendations

MOVR Investment Value Assessment

MOVR offers long-term potential as part of the Kusama and Polkadot ecosystem, but faces short-term volatility and competitive pressures from other EVM-compatible chains.

MOVR Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time ✅ Experienced investors: Explore staking and liquidity provision opportunities ✅ Institutional investors: Monitor Moonriver's ecosystem growth and consider strategic allocations

MOVR Participation Methods

- Spot trading: Purchase MOVR on Gate.com

- Staking: Participate in network security and earn rewards

- DeFi: Explore decentralized applications built on Moonriver

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is advisable to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Does Moonriver have a future?

Yes, Moonriver has a promising future. Its price is expected to experience a bull trend, with positive growth anticipated in the market.

What is the move coin prediction for 2030?

Based on analysis of recent price data, the MOVE coin is predicted to reach $2.29 by 2030, representing a 17.06x increase from its current price.

What meme coin will explode in 2025 price prediction?

Dogecoin (DOGE) is expected to lead, with PEPE and Shiba Inu showing potential. Mog Coin's maximum price is projected at €0.0000005719 in 2025.

What are the risks of investing in Moonriver?

Risks include high volatility, limited history, potential regulatory changes, and market competition, which can impact MOVR's value and adoption.

Share

Content