2025 OORT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: OORT's Market Position and Investment Value

OORT (OORT), as a decentralized AI infrastructure for data privacy and cost savings, has been empowering trustworthy AI applications since its inception. As of 2025, OORT's market capitalization has reached $17,263,337, with a circulating supply of approximately 646,082,988 tokens, and a price hovering around $0.02672. This asset, known as the "AI privacy protector," is playing an increasingly crucial role in the field of decentralized artificial intelligence and data protection.

This article will provide a comprehensive analysis of OORT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. OORT Price History Review and Current Market Status

OORT Historical Price Evolution Trajectory

- 2024: OORT reached its all-time high of $1.22 on January 15, 2024

- 2025: OORT hit its all-time low of $0.02133 on August 6, 2025

- 2025: Current market cycle, price has rebounded from the low point to $0.02672

OORT Current Market Situation

OORT is currently trading at $0.02672, showing a significant 18.96% increase in the last 24 hours. The token has a market capitalization of $17,263,337, ranking it at 959th position in the overall cryptocurrency market. OORT's trading volume in the past 24 hours stands at $297,308, indicating moderate market activity.

The token has shown mixed performance across different timeframes. While it has gained 13.08% over the past week, it has experienced a substantial decline of 29.48% in the last 30 days. The long-term trend appears bearish, with a 73.54% decrease over the past year.

OORT's current price is significantly below its all-time high of $1.22, suggesting potential for growth if market conditions improve. However, it's also trading above its all-time low of $0.02133, indicating some level of price support.

The token's circulating supply is 646,082,988 OORT, which represents 32.3% of its total supply of 1,998,899,999 OORT. This relatively low circulation ratio could impact liquidity and price volatility.

Click to view the current OORT market price

OORT Market Sentiment Indicator

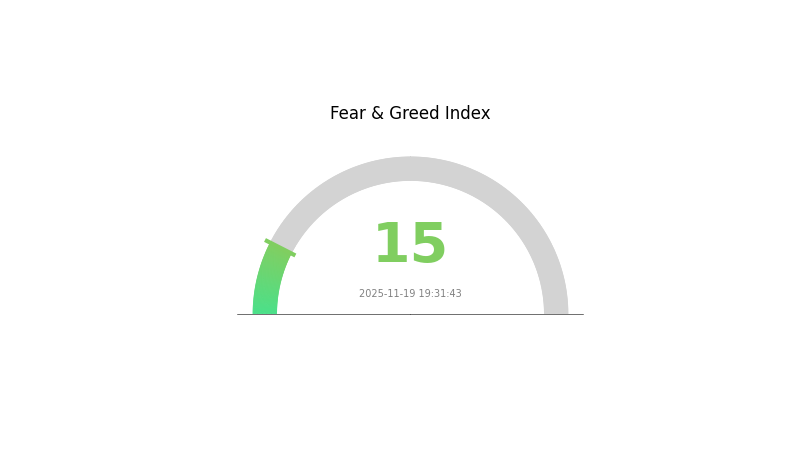

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index hitting a low of 15. This indicates a significant level of anxiety among investors, potentially signaling oversold conditions. Historical data suggests that such extreme fear often precedes market bottoms, presenting potential buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders should closely monitor market developments and adjust their strategies accordingly, while maintaining a balanced portfolio approach.

OORT Holdings Distribution

The address holdings distribution data for OORT reveals an interesting pattern in token concentration. This metric provides insight into how OORT tokens are distributed among different addresses, offering a glimpse into the project's decentralization and potential market dynamics.

Based on the provided data, it appears that OORT's token distribution is relatively balanced, with no single address holding an overwhelming percentage of the total supply. This distribution suggests a healthy level of decentralization, which is generally favorable for the project's long-term stability and resistance to market manipulation.

The absence of extremely large holders reduces the risk of sudden price fluctuations caused by individual actors. This balanced distribution may contribute to more organic price movements and potentially lower volatility in the OORT market, enhancing its appeal to investors seeking stable crypto assets.

Click to view the current OORT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting OORT's Future Price

Supply Mechanism

- Mining Rewards: The reduction in mining rewards will directly impact future earnings of OORT.

- Current Impact: According to the function, the rise and fall of OORT Token prices do not have a decisive impact on earnings.

Institutional and Whale Dynamics

- Enterprise Adoption: OORT has established one of the world's largest decentralized cloud infrastructures, with network nodes covering over 100 countries.

Macroeconomic Environment

- Inflation Hedging Properties: AI's ability to analyze large amounts of market data, including past trading volumes, price trends, and economic indicators, may help identify future market behavior trends and patterns in inflationary environments.

Technological Development and Ecosystem Building

- Core Technology: OORT's core technology has been published in top global academic journals and has obtained US patents.

- Node Infrastructure: OORT implements a unique 3-layer node service provider to achieve enterprise-level product experience: 1. Backup nodes 2. Edge nodes 3. Super nodes.

- Ecosystem Applications: OORT optimizes idle computing power and increases miner revenue (aggregating multiple resources).

III. OORT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02388 - $0.02683

- Neutral prediction: $0.02683 - $0.02924

- Optimistic prediction: $0.02924 - $0.03280 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.02312 - $0.04411

- 2028: $0.02273 - $0.05105

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.04416 - $0.04703 (assuming steady market growth)

- Optimistic scenario: $0.04990 - $0.05644 (assuming strong market performance)

- Transformative scenario: $0.05644 - $0.06000 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: OORT $0.05644 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02924 | 0.02683 | 0.02388 | 0 |

| 2026 | 0.0328 | 0.02804 | 0.01963 | 4 |

| 2027 | 0.04411 | 0.03042 | 0.02312 | 13 |

| 2028 | 0.05105 | 0.03727 | 0.02273 | 39 |

| 2029 | 0.0499 | 0.04416 | 0.02605 | 65 |

| 2030 | 0.05644 | 0.04703 | 0.02869 | 76 |

IV. Professional Investment Strategies and Risk Management for OORT

OORT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate OORT tokens during market dips

- Set price targets and regularly review investment thesis

- Store tokens securely in a hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential support/resistance levels

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined levels based on technical analysis

OORT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk profile

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Cold storage solution: Use air-gapped devices for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for OORT

OORT Market Risks

- High volatility: OORT's price may experience significant fluctuations

- Competition: Other AI infrastructure projects may gain market share

- Liquidity risk: Limited trading volume could impact price stability

OORT Regulatory Risks

- Uncertain regulatory landscape: AI and blockchain regulations may impact OORT's operations

- Data privacy concerns: Stricter data protection laws could affect OORT's business model

- Cross-border restrictions: International regulations may limit OORT's global expansion

OORT Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the OORT protocol

- Scalability challenges: The network may face issues handling increased demand

- Technological obsolescence: Rapid advancements in AI could outpace OORT's development

VI. Conclusion and Action Recommendations

OORT Investment Value Assessment

OORT presents a compelling long-term value proposition in the AI infrastructure space, but investors should be prepared for short-term volatility and potential regulatory challenges.

OORT Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time

✅ Experienced investors: Implement a balanced approach with defined entry and exit points

✅ Institutional investors: Conduct thorough due diligence and consider OORT as part of a diversified AI and blockchain portfolio

OORT Trading Participation Methods

- Spot trading: Purchase OORT tokens on Gate.com

- Staking: Participate in OORT staking programs if available

- DeFi integration: Explore decentralized finance options involving OORT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Trumpcoin go?

Trumpcoin could reach $300 by 2025 and potentially $500 by 2030, based on optimistic analyst projections.

Can toncoin reach 100?

Yes, Toncoin could potentially reach $100 in the long term, given its strong technology and growing adoption in the Web3 ecosystem.

What is an Oort token?

An Oort token is a decentralized AI ecosystem token with a deflationary model, supporting operations and governance. It's crucial for decentralized AI applications and incentivizes long-term holding.

Would hamster kombat coin reach $1?

It's possible for Hamster Kombat coin to reach $1, but it depends on market conditions and investor interest. While the coin shows potential, its future price remains speculative and uncertain.

Share

Content