2025 RIF Price Prediction: Market Analysis and Future Outlook for RSK Infrastructure Framework Token

Introduction: RIF's Market Position and Investment Value

RIF Token (RIF), as a key player in blockchain infrastructure, has made significant strides since its inception in 2018. As of 2025, RIF's market capitalization has reached $56,170,000, with a circulating supply of approximately 1,000,000,000 tokens, and a price hovering around $0.05617. This asset, often referred to as the "Rootstock Infrastructure Framework," is playing an increasingly crucial role in providing integrated and user-friendly open blockchain infrastructure services.

This article will comprehensively analyze RIF's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. RIF Price History Review and Current Market Status

RIF Historical Price Evolution

- 2019: Initial launch, price reached ATL of $0.0091475 on June 12

- 2021: Bull market peak, price hit ATH of $0.455938 on April 13

- 2025: Market consolidation, price fluctuating between $0.05 and $0.06

RIF Current Market Situation

As of September 29, 2025, RIF is trading at $0.05617, with a 24-hour trading volume of $22,341.17. The token has seen a 2.63% increase in the last 24 hours, indicating short-term positive momentum. However, looking at longer timeframes, RIF has experienced a 2.88% decrease over the past week and a significant 41.08% decline over the past year.

RIF's market capitalization currently stands at $56,170,000, ranking it 641st in the overall cryptocurrency market. With a circulating supply of 1,000,000,000 RIF tokens, which is also the total and maximum supply, the project has reached full circulation.

The token's price is currently 87.67% below its all-time high, suggesting potential for recovery if market conditions improve. However, it's also trading significantly above its all-time low, demonstrating long-term value retention despite recent downtrends.

Click to view the current RIF market price

RIF Market Sentiment Indicator

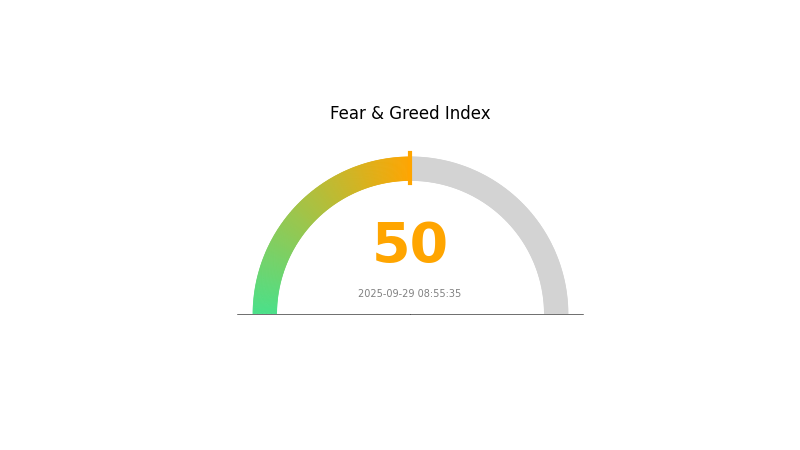

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 50, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Traders should exercise caution and conduct thorough research before making investment decisions. While the market shows stability, it's essential to stay informed about potential catalysts that could shift sentiment in either direction.

RIF Holdings Distribution

The address holdings distribution data for RIF reveals an interesting pattern in the token's ownership structure. This metric provides insights into the concentration of tokens among different addresses, which can be indicative of the overall decentralization and potential market dynamics of the cryptocurrency.

Based on the provided data, it appears that the RIF token distribution is relatively dispersed, with no single address holding a disproportionately large percentage of the total supply. This suggests a healthy level of decentralization, which is generally considered positive for the stability and fairness of the token's ecosystem. The absence of large whale addresses reduces the risk of market manipulation and sudden price swings caused by individual actors.

However, it's important to note that this distribution only represents on-chain data and may not account for off-chain holdings or multiple addresses controlled by single entities. Nevertheless, the current distribution pattern indicates a robust market structure with a reduced likelihood of centralized control, potentially contributing to more organic price movements and a more resilient network overall.

Click to view the current RIF holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing RIF's Future Price

Market Sentiment

- Investor Confidence: Investor sentiment and confidence directly impact RIF/USD price movements. Positive news about RIF's widespread adoption or significant technological breakthroughs can boost the price.

- Overall Crypto Market Mood: The general sentiment in the cryptocurrency market plays a crucial role in RIF's price fluctuations.

Technical Development and Ecosystem Building

- Rootstock Platform Development: The price trend of $RIF tokens is closely related to the development of the Rootstock platform. Advancements in the platform can positively influence RIF's value.

- Ecosystem Applications: The growth of decentralized applications (DApps) and ecosystem projects built on RIF can contribute to its price appreciation.

Macroeconomic Environment

- Market Demand: The overall demand for RIF in the market can significantly affect its price.

- Adoption Rate: The level of acceptance and adoption of RIF technology in various sectors can impact its value.

- Regulatory Changes: Changes in cryptocurrency regulations across different jurisdictions can influence RIF's price.

Trading Dynamics

- Liquidity: RIF's availability on major exchanges, including Gate.com, provides global liquidity and exposure, which can affect its price movements.

- Trading Volume: The trading activity and volume of RIF can impact its short-term price fluctuations.

III. RIF Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05282 - $0.05619

- Neutral prediction: $0.05619 - $0.06012

- Optimistic prediction: $0.06012 - $0.06406 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.05909 - $0.07402

- 2028: $0.05211 - $0.08129

- Key catalysts: Increased adoption of RIF technology, overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.07538 - $0.08669 (assuming steady market growth)

- Optimistic scenario: $0.08669 - $0.09189 (assuming strong RIF ecosystem expansion)

- Transformative scenario: $0.09800 - $0.10000 (assuming breakthrough in RIF technology adoption)

- 2030-12-31: RIF $0.09189 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06406 | 0.05619 | 0.05282 | 0 |

| 2026 | 0.06974 | 0.06012 | 0.03367 | 7 |

| 2027 | 0.07402 | 0.06493 | 0.05909 | 15 |

| 2028 | 0.08129 | 0.06948 | 0.05211 | 23 |

| 2029 | 0.098 | 0.07538 | 0.04598 | 34 |

| 2030 | 0.09189 | 0.08669 | 0.07109 | 54 |

IV. Professional Investment Strategies and Risk Management for RIF

RIF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate RIF tokens during market dips

- Set price alerts for significant support and resistance levels

- Store tokens securely in a hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify key support and resistance levels

- Use stop-loss orders to manage risk

RIF Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for RIF

RIF Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Liquidity: Lower trading volume may lead to price slippage

- Competition: Other blockchain infrastructure projects may gain market share

RIF Regulatory Risks

- Regulatory uncertainty: Changing regulations may impact RIF's adoption

- Cross-border restrictions: Different jurisdictions may have varying crypto policies

- Tax implications: Evolving tax laws may affect RIF token holders

RIF Technical Risks

- Smart contract vulnerabilities: Potential bugs in the RIF token contract

- Scalability challenges: RIF ecosystem may face scaling issues as it grows

- Integration risks: Complications in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

RIF Investment Value Assessment

RIF offers potential long-term value as a blockchain infrastructure token, but faces short-term volatility and adoption challenges. Its success depends on the growth of the RSK ecosystem and broader blockchain adoption.

RIF Investment Recommendations

✅ Beginners: Consider small, regular investments to build a position over time ✅ Experienced investors: Implement dollar-cost averaging and set clear profit targets ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large orders

RIF Trading Participation Methods

- Spot trading: Buy and sell RIF tokens on Gate.com

- Staking: Participate in RIF staking programs if available

- DeFi integration: Explore decentralized finance options within the RSK ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is a RIF coin worth?

As of September 2025, a RIF coin is worth approximately $0.05667. The coin has a market cap of $56.67M and a 24-hour trading value of $19.73K.

What is the XRP price prediction in 2025?

Based on current analysis, XRP is expected to see a slight decrease of about 1.86% by September 30, 2025. However, specific price predictions can vary widely in the volatile crypto market.

What is rif crypto?

RIF is a cryptocurrency based on the Rootstock Infrastructure Framework, enhancing Bitcoin's capabilities through decentralized protocols for smart contracts and dApps.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH). These predictions are based on current market trends and expert analysis.

Share

Content