2025 SHELL Price Prediction: Navigating the Future of Energy Markets and Sustainable Investments

Introduction: SHELL's Market Position and Investment Value

MyShell (SHELL), as an AI consumer application platform, has been enabling everyone to create, share, and own AI agents since its inception in 2023. As of 2025, MyShell's market capitalization has reached $20,309,400, with a circulating supply of approximately 270,000,000 tokens, and a price hovering around $0.07522. This asset, hailed as the "AI-Blockchain Bridge," is playing an increasingly crucial role in bridging cutting-edge AI technology with blockchain applications.

This article will comprehensively analyze SHELL's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SHELL Price History Review and Current Market Status

SHELL Historical Price Evolution

- 2025: Project launched, price started at $0.022

- February 2025: Reached all-time high of $0.7023

- October 2025: Hit all-time low of $0.03524

SHELL Current Market Situation

As of November 19, 2025, SHELL is trading at $0.07522. The token has seen a 0.51% increase in the past 24 hours, with a trading volume of $323,074.54. However, SHELL has experienced significant declines over longer periods, with a 26.39% decrease in the past week and a 20.66% drop over the last month. The most striking decline is observed in the yearly performance, with SHELL down 89.59% compared to a year ago.

SHELL's market capitalization currently stands at $20,309,400, ranking it 908th among all cryptocurrencies. The circulating supply is 270,000,000 SHELL, which represents 27% of the total supply of 1,000,000,000 tokens. The fully diluted valuation of the project is $75,220,000.

The token's 24-hour trading range is between $0.07364 and $0.07858, indicating some volatility within the day. Despite the recent positive movement, the overall market sentiment for SHELL appears bearish, given the substantial declines over longer time frames.

Click to view the current SHELL market price

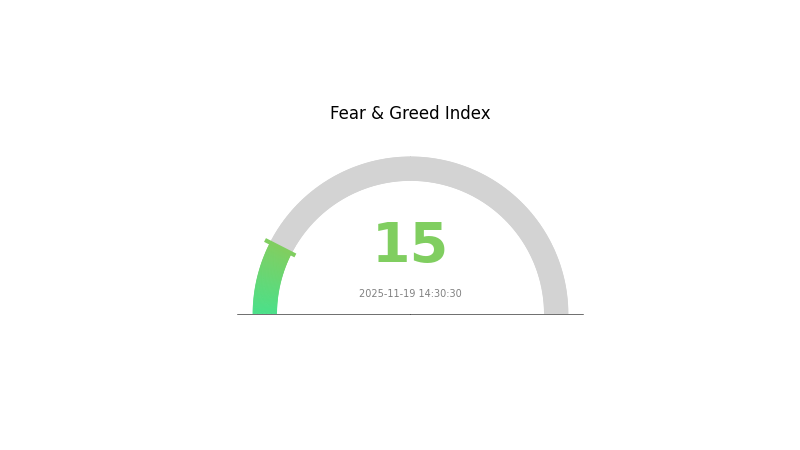

SHELL Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 15. This level of pessimism often precedes potential buying opportunities, as historically, extreme fear has signaled market bottoms. However, investors should exercise caution and conduct thorough research before making any decisions. Remember, while fear can create opportunities, it's crucial to manage risks and avoid impulsive actions. Stay informed and consider diversifying your portfolio to navigate these uncertain times.

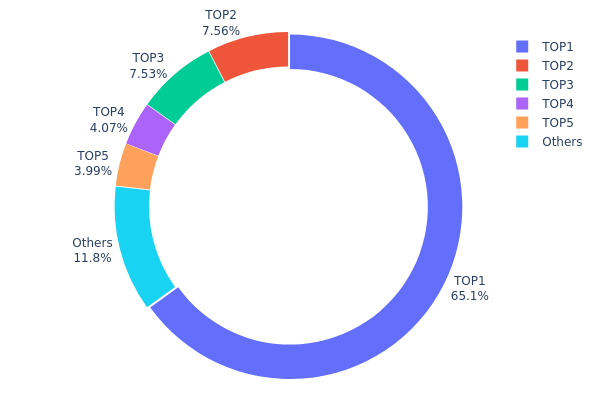

SHELL Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for SHELL tokens. The top address holds a staggering 65.06% of the total supply, equivalent to 320,000,000 SHELL tokens. This level of concentration raises concerns about potential market manipulation and centralized control. The next four largest holders collectively account for an additional 23.12% of the supply, leaving only 11.82% distributed among all other addresses.

Such a concentrated distribution pattern could lead to significant market volatility and price instability. The dominant address has the potential to exert substantial influence over the token's price movements and overall market dynamics. This centralization also contradicts the principles of decentralization often associated with blockchain projects, potentially impacting the token's perceived value and adoption among users seeking more distributed systems.

From a market structure perspective, this high concentration suggests a relatively illiquid market for SHELL tokens, with a small number of addresses controlling the majority of the supply. This scenario may deter new investors and could pose challenges for the project's long-term sustainability and growth prospects.

Click to view the current SHELL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb760...f96b0c | 320000.00K | 65.06% |

| 2 | 0xc3b9...c7da6f | 37205.95K | 7.56% |

| 3 | 0xc336...e6cf58 | 37029.69K | 7.52% |

| 4 | 0xf977...41acec | 20000.00K | 4.06% |

| 5 | 0xffa8...44cd54 | 19622.73K | 3.98% |

| - | Others | 57966.69K | 11.82% |

II. Key Factors Affecting SHELL's Future Price

Supply Mechanism

- Oil and Gas Price Fluctuations: SHELL's future operations are significantly influenced by volatile crude oil and natural gas prices.

- Current Impact: In the first half of 2025, falling oil prices have been dragging down SHELL's profitability.

Institutional and Major Holder Dynamics

- Corporate Adoption: Shell is transitioning towards becoming a provider of net-zero emission energy products and services, catering to customer-related business growth.

Macroeconomic Environment

- Monetary Policy Impact: Central bank interest rates and inflation policies affect SHELL's financing costs and investment sentiment.

- Geopolitical Factors: International conflicts, trade frictions, and global economic instability impact the oil and gas market, as well as SHELL's operations and stock price.

Technological Development and Ecosystem Building

- Net-Zero Emissions Strategy: Shell has announced its "Powering Progress" global strategy, aiming to create shareholder value, achieve net-zero emissions, empower lives, and respect nature.

- Ecosystem Applications: Shell is exploring low-carbon development possibilities through innovation, collaborating with customers and partners to contribute to China's low-carbon future.

III. SHELL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05469 - $0.07492

- Neutral prediction: $0.07492 - $0.09178

- Optimistic prediction: $0.09178 - $0.10863 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.06574 - $0.15075

- 2028: $0.07527 - $0.15581

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.14393 - $0.16768 (assuming steady market growth and adoption)

- Optimistic scenario: $0.16768 - $0.19143 (given strong ecosystem development and market penetration)

- Transformative scenario: $0.19143 - $0.20792 (with breakthrough use cases and mainstream integration)

- 2030-12-31: SHELL $0.20792 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10863 | 0.07492 | 0.05469 | 0 |

| 2026 | 0.13491 | 0.09178 | 0.04864 | 22 |

| 2027 | 0.15075 | 0.11334 | 0.06574 | 50 |

| 2028 | 0.15581 | 0.13205 | 0.07527 | 75 |

| 2029 | 0.19143 | 0.14393 | 0.0878 | 91 |

| 2030 | 0.20792 | 0.16768 | 0.14588 | 122 |

IV. SHELL Professional Investment Strategy and Risk Management

SHELL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and AI technology enthusiasts

- Operation suggestions:

- Accumulate SHELL tokens during market dips

- Monitor MyShell's AI technology advancements and adoption rates

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Implement strict stop-loss orders to manage risk

SHELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official MyShell wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SHELL

SHELL Market Risks

- High volatility: AI token market subject to rapid price swings

- Competition: Emergence of rival AI platforms could impact SHELL's value

- Market sentiment: Shifts in overall crypto market can affect SHELL price

SHELL Regulatory Risks

- AI regulation: Potential government restrictions on AI development

- Cryptocurrency regulations: Changes in global crypto policies may impact SHELL

- Data privacy concerns: Stricter data protection laws could affect MyShell's operations

SHELL Technical Risks

- Smart contract vulnerabilities: Potential security issues in token contract

- AI model limitations: Challenges in scaling or improving AI capabilities

- Network congestion: High transaction fees during peak usage periods

VI. Conclusion and Action Recommendations

SHELL Investment Value Assessment

SHELL presents a unique opportunity in the AI-blockchain intersection but carries significant risks due to market volatility and regulatory uncertainties. Long-term potential is tied to MyShell's AI technology advancements and user adoption.

SHELL Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence on MyShell's technology and growth metrics

SHELL Trading Participation Methods

- Spot trading: Purchase SHELL tokens on Gate.com

- Staking: Participate in SHELL staking programs if available

- AI agent creation: Engage with MyShell platform to potentially earn SHELL tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Shell stock expected to rise?

Yes, Shell stock is expected to rise steadily over the coming years. Current forecasts indicate a positive trend based on recent market analysis.

What will Shell stock price be in 2030?

Shell stock price is projected to reach between $107 and $137 by 2030, based on current market analysis and trends.

What is the long term outlook for Shell?

Shell's long-term outlook appears bearish, with forecasts predicting a decline to $69.87 by 2026, followed by a modest recovery to $81.00 by 2030.

Is it worth keeping Shell shares?

Shell shares have shown strong long-term gains, but are near all-time highs. Consider current market conditions and your investment goals before deciding to hold or sell.

Share

Content