2025 SOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Landscape

Introduction: SOLO's Market Position and Investment Value

Sologenic (SOLO) as a token that bridges cryptocurrency with traditional financial assets, has made significant strides since its inception in 2019. As of 2025, Sologenic's market capitalization has reached $109,863,478, with a circulating supply of approximately 399,198,717 tokens, and a price hovering around $0.27521. This asset, often referred to as a "bridge between crypto and traditional markets," is playing an increasingly crucial role in facilitating transactions between cryptocurrencies and non-blockchain assets such as stocks and ETFs.

This article will provide a comprehensive analysis of Sologenic's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SOLO Price History Review and Current Market Status

SOLO Historical Price Evolution

- 2021: SOLO reached its all-time high of $6.55 on December 3rd

- 2021: SOLO hit its all-time low of $0.061723 on October 29th

- 2025: SOLO price has shown significant volatility, currently trading at $0.27521

SOLO Current Market Situation

As of September 26, 2025, SOLO is trading at $0.27521, with a market cap of $109,863,478.90. The token has experienced a 2.09% decrease in the last 24 hours and a more substantial 9.39% decline over the past week. Despite these short-term downtrends, SOLO has shown remarkable growth over the past year, with a 216.62% increase.

The current circulating supply of SOLO is 399,198,717 tokens, which is 99.79% of its maximum supply of 400,000,000. This high circulation ratio suggests that the token distribution is nearly complete.

SOLO's 24-hour trading volume stands at $548,354.05, indicating moderate market activity. The token's fully diluted valuation is $110,084,000, which is very close to its current market cap, reflecting the high circulation ratio.

Click to view the current SOLO market price

SOLO Market Sentiment Indicator

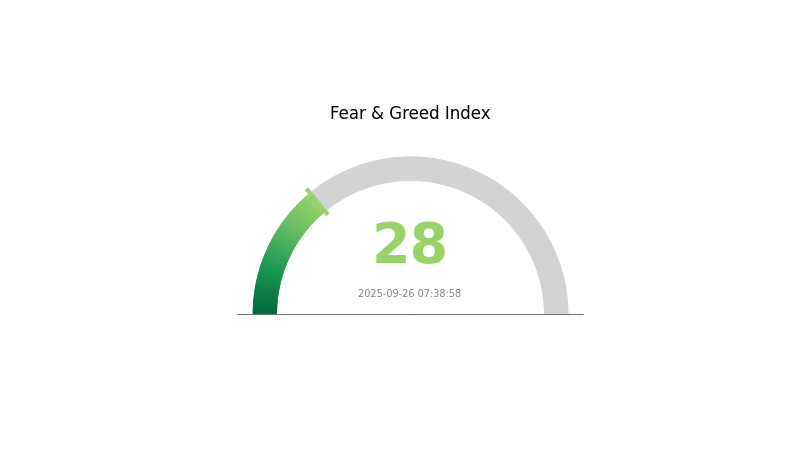

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 28, indicating a state of fear. This suggests investors are hesitant and risk-averse, potentially creating buying opportunities for contrarian traders. However, it's crucial to conduct thorough research and exercise caution in such market conditions. Remember, market sentiment can shift quickly, and it's essential to stay informed about broader economic factors and crypto-specific developments before making investment decisions.

SOLO Holdings Distribution

The address holdings distribution data for SOLO reveals a relatively decentralized ownership structure. With no individual address holding a significant percentage of the total supply, the risk of market manipulation by large holders appears minimal. This distribution pattern suggests a healthy level of decentralization, which is generally viewed positively in the cryptocurrency space.

The absence of heavily concentrated holdings indicates that SOLO's market structure is likely more resilient to sudden price shocks that could be caused by large sell-offs from major holders. This distributed ownership may contribute to more stable price action and potentially lower volatility in the long term. Furthermore, the current address distribution reflects a diverse user base, which could be indicative of organic adoption and a more sustainable ecosystem for SOLO.

Click to view the current SOLO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting SOLO's Future Price

Supply Mechanism

- Price volatility: SOLO's price is highly volatile, similar to many emerging cryptocurrencies. The demand in the market, the development of the Sologenic ecosystem, and the overall trend of the crypto market may all affect SOLO's price.

Institutional and Whale Dynamics

- Corporate adoption: The adoption of SOLO by well-known enterprises could significantly impact its price.

Macroeconomic Environment

- Inflation hedging properties: SOLO's performance in an inflationary environment could affect its price.

- Geopolitical factors: International situations may influence SOLO's price.

Technical Development and Ecosystem Building

- Ecosystem applications: The development of major DApps and ecosystem projects on the Sologenic platform could drive SOLO's price.

III. SOLO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.20921 - $0.25000

- Neutral prediction: $0.25000 - $0.27527

- Optimistic prediction: $0.27527 - $0.29729 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.27483 - $0.45003

- 2028: $0.32933 - $0.46027

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.36206 - $0.50995 (assuming steady market growth)

- Optimistic scenario: $0.50995 - $0.63744 (assuming strong market performance)

- Transformative scenario: $0.63744 - $0.70000 (assuming breakthrough innovations)

- 2030-12-31: SOLO $0.50995 (85% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.29729 | 0.27527 | 0.20921 | 0 |

| 2026 | 0.40079 | 0.28628 | 0.22616 | 4 |

| 2027 | 0.45003 | 0.34354 | 0.27483 | 24 |

| 2028 | 0.46027 | 0.39679 | 0.32933 | 44 |

| 2029 | 0.59137 | 0.42853 | 0.29568 | 55 |

| 2030 | 0.63744 | 0.50995 | 0.36206 | 85 |

IV. Professional Investment Strategies and Risk Management for SOLO

SOLO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Sologenic ecosystem

- Operation suggestions:

- Accumulate SOLO tokens during market dips

- Stake SOLO tokens to earn passive income

- Store tokens in a secure XRP-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps in identifying overbought/oversold conditions

- Key points for swing trading:

- Monitor SOLO's correlation with XRP price movements

- Pay attention to Sologenic ecosystem developments and announcements

SOLO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Official Sologenic wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SOLO

SOLO Market Risks

- Volatility: High price fluctuations due to market sentiment

- Liquidity: Potential challenges in trading large volumes

- Correlation: Strong dependence on XRP market performance

SOLO Regulatory Risks

- XRP Legal Issues: Ongoing Ripple lawsuit may impact SOLO

- Global Crypto Regulations: Changing regulatory landscape could affect adoption

- Securities Classification: Risk of being classified as a security token

SOLO Technical Risks

- Smart Contract Vulnerabilities: Potential flaws in the token's code

- Scalability Issues: Challenges in handling increased transaction volumes

- Interoperability: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

SOLO Investment Value Assessment

SOLO presents a unique value proposition by bridging traditional financial assets with cryptocurrencies. However, it faces short-term risks due to regulatory uncertainties and market volatility.

SOLO Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the Sologenic ecosystem ✅ Experienced Investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional Investors: Conduct thorough due diligence and consider SOLO as part of a diversified crypto portfolio

SOLO Trading Participation Methods

- Spot Trading: Buy and sell SOLO on Gate.com

- Staking: Participate in SOLO staking programs for passive income

- Ecosystem Participation: Engage with Sologenic's tokenized asset offerings

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Solo stock have a future?

Yes, Solo has potential. Forecasts predict a price of $0.5008 by 2025, indicating growth prospects. However, market conditions can change rapidly.

How much will Solana be worth in 2025?

Based on expert predictions, Solana's price in 2025 is expected to range from $220 to $1,000, with an average forecast of $425.

Will Sol get to $1000?

While possible, SOL reaching $1000 is uncertain. Market trends and expert opinions vary, making long-term price predictions speculative.

How high can sol realistically go?

Solana could realistically reach $500-$800 during a peak bull market, based on historical performance and market projections.

Share

Content