2025 THE Price Prediction: Analyzing Market Trends and Factors Shaping Crypto's Future Value

Introduction: THE's Market Position and Investment Value

Thena (THE), as a trading hub and liquidity layer built on BNB Chain and opBNB, has established itself as a comprehensive ecosystem since its inception. As of 2025, Thena's market capitalization has reached $17,315,114, with a circulating supply of approximately 118,434,432 tokens, and a price hovering around $0.1462. This asset, often referred to as the "DEX innovator," is playing an increasingly crucial role in decentralized finance and trading.

This article will provide a comprehensive analysis of Thena's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. THE Price History Review and Current Market Status

THE Historical Price Evolution Trajectory

- 2024: THE reached its all-time high of $4.2 on November 27, marking a significant milestone for the project.

- 2025: The market experienced a sharp downturn, with THE hitting its all-time low of $0.0748 on October 10.

THE Current Market Situation

As of November 20, 2025, THE is trading at $0.1462, showing a 7.7% decrease in the last 24 hours. The token has experienced significant volatility over the past year, with a 16.11% decrease from its price one year ago. In the short term, THE has seen a 15.15% decline over the past week and a substantial 44.93% drop over the last 30 days.

The current market capitalization of THE stands at $17,315,114, ranking it at 959th position in the global cryptocurrency market. With a circulating supply of 118,434,432.70 THE tokens, representing 36.32% of the total supply, the project has a fully diluted valuation of $39,331,825.

Trading volume in the last 24 hours has reached $94,603, indicating moderate market activity. The token's price is currently closer to its recent all-time low than its all-time high, suggesting a challenging market environment for THE.

Click to view the current THE market price

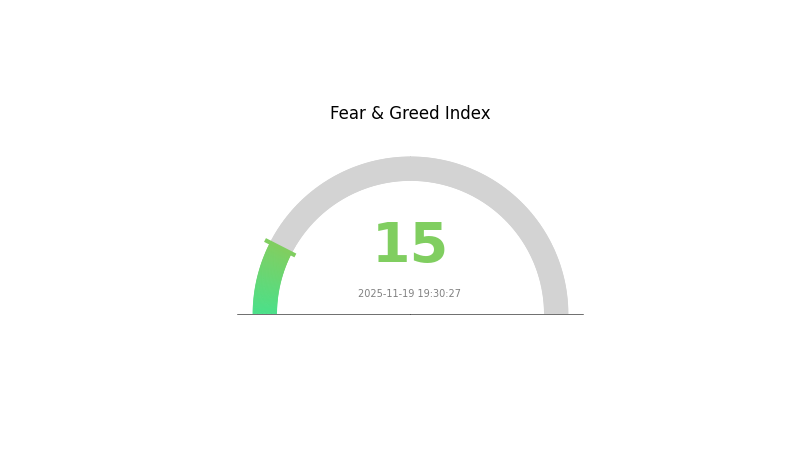

THE Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the Fear and Greed Index plummeting to 15. This low reading suggests that investors are extremely cautious and hesitant to enter the market. Such extreme fear often precedes potential buying opportunities, as assets may be undervalued. However, traders should exercise caution and conduct thorough research before making any investment decisions. It's crucial to remember that market sentiment can shift rapidly in the volatile crypto space.

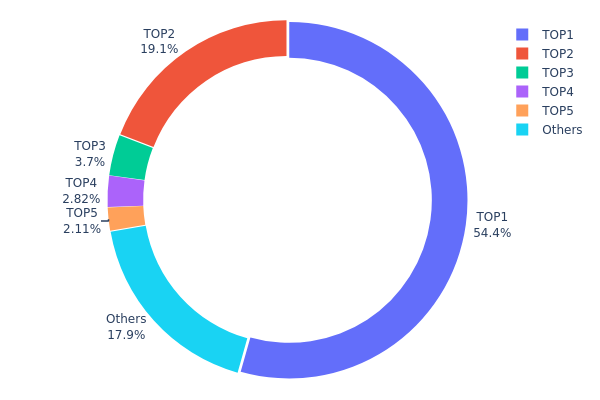

THE Holdings Distribution

The address holdings distribution data for THE token reveals a highly concentrated ownership structure. The top address holds a substantial 54.39% of the total supply, equivalent to 150,589.16K tokens. This is followed by the second-largest holder with 19.12% (52,945.42K tokens), creating a combined ownership of 73.51% between just two addresses. The top five addresses collectively control 82.12% of the total supply, leaving only 17.88% distributed among all other holders.

This level of concentration raises concerns about centralization and potential market manipulation. With such a significant portion of tokens held by a few addresses, there is an increased risk of price volatility and susceptibility to large-scale sell-offs or accumulations. The high concentration also suggests that THE's market structure may be less resilient to external shocks, as decisions made by these major holders could have outsized impacts on the token's price and liquidity.

From a broader perspective, this distribution pattern indicates a low degree of decentralization in THE's ecosystem. While blockchain technology aims to promote distributed ownership and control, the current state of THE holdings suggests a divergence from this ideal. This concentration may impact governance decisions if THE implements any on-chain voting mechanisms, potentially compromising the democratic nature of decentralized systems.

Click to view the current THE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfbbf...1c070d | 150589.16K | 54.39% |

| 2 | 0xf977...41acec | 52945.42K | 19.12% |

| 3 | 0x86e0...33739f | 10234.23K | 3.69% |

| 4 | 0x0000...00dead | 7813.41K | 2.82% |

| 5 | 0x8894...e2d4e3 | 5833.18K | 2.10% |

| - | Others | 49425.54K | 17.88% |

II. Core Factors Influencing THE's Future Price

Supply Mechanism

- Halving: THE's supply is reduced by half every four years, creating scarcity and potentially driving up prices.

- Historical Pattern: Previous halvings have led to significant price increases in the following years.

- Current Impact: The next halving is expected to further tighten supply, potentially catalyzing another bull run.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their THE holdings, signaling growing mainstream acceptance.

- Corporate Adoption: Companies like Tesla and MicroStrategy have added THE to their balance sheets, setting a precedent for corporate treasury diversification.

- National Policies: El Salvador's adoption of THE as legal tender has opened doors for other nations to consider similar moves.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative easing and low interest rates may drive investors towards THE as an inflation hedge.

- Inflation Hedging Properties: THE is increasingly viewed as "digital gold", attracting investors seeking protection against currency devaluation.

- Geopolitical Factors: Global economic uncertainties and trade tensions may boost THE's appeal as a non-sovereign store of value.

Technological Development and Ecosystem Growth

- Lightning Network: The second-layer solution is improving THE's scalability and transaction speed, enhancing its utility for everyday transactions.

- Taproot Upgrade: This upgrade has enhanced THE's smart contract capabilities and privacy features, expanding its potential use cases.

- Ecosystem Applications: The growing number of decentralized finance (DeFi) applications built on THE's network is expanding its utility and demand.

III. THE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12427 - $0.1462

- Neutral prediction: $0.1462 - $0.18

- Optimistic prediction: $0.18 - $0.21345 (requires significant market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.1612 - $0.26194

- 2028: $0.18947 - $0.3498

- Key catalysts: Increasing blockchain adoption, potential technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.25783 - $0.30376 (assuming steady market growth)

- Optimistic scenario: $0.30376 - $0.33414 (assuming strong market conditions and increased adoption)

- Transformative scenario: $0.33414 - $0.40 (assuming breakthrough innovations and mainstream acceptance)

- 2030-12-31: THE $0.30376 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.21345 | 0.1462 | 0.12427 | 0 |

| 2026 | 0.26794 | 0.17983 | 0.13127 | 23 |

| 2027 | 0.26194 | 0.22388 | 0.1612 | 53 |

| 2028 | 0.3498 | 0.24291 | 0.18947 | 66 |

| 2029 | 0.31117 | 0.29635 | 0.25783 | 102 |

| 2030 | 0.33414 | 0.30376 | 0.23997 | 107 |

IV. Professional Investment Strategies and Risk Management for THE

THE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate THE tokens during market dips

- Set price targets for partial profit-taking

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

THE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for THE

THE Market Risks

- Volatility: Extreme price fluctuations common in the crypto market

- Liquidity: Potential challenges in selling large amounts during market stress

- Competition: Emergence of rival DeFi platforms on BNB Chain and opBNB

THE Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of DeFi platforms

- Cross-border compliance: Varying regulations across different jurisdictions

- AML/KYC requirements: Possible implementation affecting user privacy

THE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the code

- Network congestion: Possibility of high fees or delayed transactions on BNB Chain

- Interoperability issues: Challenges in connecting with other blockchain networks

VI. Conclusion and Action Recommendations

THE Investment Value Assessment

THE offers potential long-term value as a comprehensive DeFi ecosystem on BNB Chain and opBNB. However, short-term volatility and regulatory uncertainties pose significant risks.

THE Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the ecosystem ✅ Experienced investors: Consider a balanced approach with both spot and perpetual trading ✅ Institutional investors: Explore strategic partnerships and liquidity provision opportunities

THE Trading Participation Methods

- Spot trading: Exchange THE tokens on Gate.com

- Yield farming: Provide liquidity to THE pools for passive income

- Perpetual trading: Engage in leveraged trading on ALPHA platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will $1 Bitcoin be worth in 2025?

Based on current projections, $1 Bitcoin could be worth around $100,000 to $150,000 in 2025, driven by increased adoption and institutional investment.

How much will $1 Bitcoin be worth in 2030?

Based on current trends, $1 Bitcoin could be worth around $1 million by 2030, though this is a speculative estimate.

Which crypto will give 1000x in 2025?

Cardano (ADA) shows strong potential for 1000x gains in 2025. Its innovative technology and growing ecosystem make it a top contender for massive growth in the crypto market.

Why is BTC going down?

BTC's price decline is due to profit-taking, market corrections, and reduced investor confidence. This reflects typical crypto market volatility.

Share

Content