2025 UXLINK Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Blockchain Protocol

Introduction: UXLINK's Market Position and Investment Value

UXLINK (UXLINK) has established itself as the largest Web3 social platform and infrastructure globally since its inception. As of 2025, UXLINK's market capitalization has reached $15,946,092, with a circulating supply of approximately 607,470,193 tokens, and a price hovering around $0.02625. This asset, often referred to as the "social liquidity layer," is playing an increasingly crucial role in facilitating socialized discovery, distribution, and trading of crypto assets.

This article will provide a comprehensive analysis of UXLINK's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. UXLINK Price History Review and Current Market Status

UXLINK Historical Price Evolution

- 2024: UXLINK reached its all-time high of $3.832 on December 25, 2024

- 2025: The project experienced a significant downturn, with the price dropping to its all-time low of $0.0202 on November 17, 2025

UXLINK Current Market Situation

As of November 20, 2025, UXLINK is trading at $0.02625, representing a 20.69% decrease in the last 24 hours. The token's market capitalization stands at $15,946,092.57, ranking it 1008th in the global cryptocurrency market. UXLINK has a circulating supply of 607,470,193 tokens, which is 60.75% of its total supply of 1,000,000,000 tokens.

The token has experienced significant volatility, with a 24-hour trading range between $0.02514 and $0.03417. Over the past week, UXLINK has seen an 18.02% decline, while the 30-day and 1-year price changes show decreases of 24.81% and 95.38%, respectively.

Despite the recent downtrend, UXLINK has shown a slight recovery in the past hour, with a 1.58% increase. However, the current price remains substantially below its all-time high, indicating a challenging market environment for the token.

Click to view the current UXLINK market price

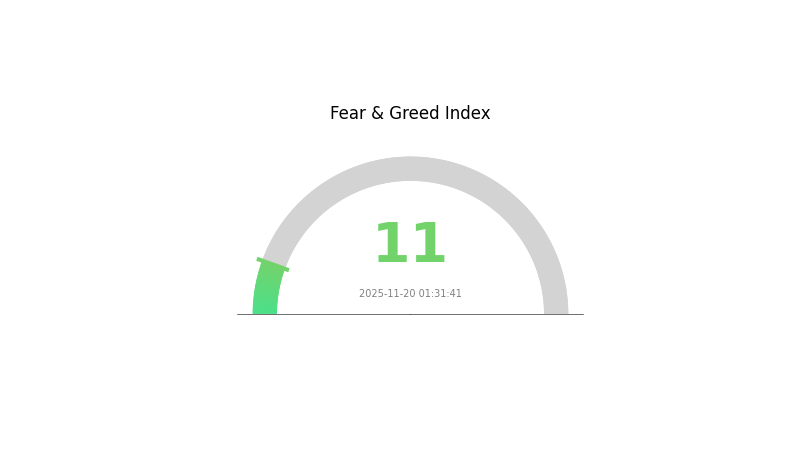

UXLINK Market Sentiment Indicator

2025-11-20 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com are closely monitoring key support levels and market indicators for signs of a potential trend reversal. Remember, while fear can create opportunities, it's crucial to manage risks and conduct thorough research before making investment decisions.

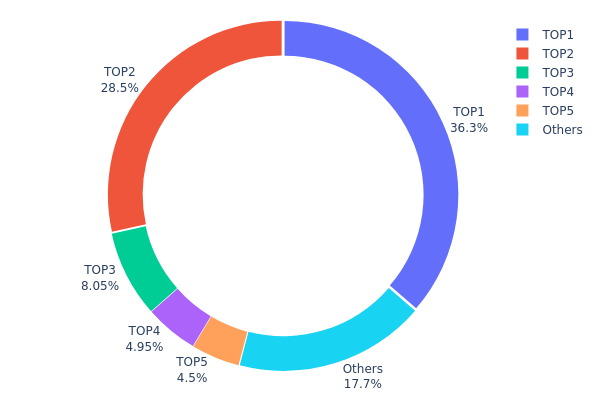

UXLINK Holdings Distribution

The address holdings distribution data for UXLINK reveals a highly concentrated token ownership structure. The top five addresses collectively hold 82.25% of the total supply, with the largest holder possessing 36.32% of all tokens. This level of concentration raises concerns about potential market manipulation and centralized control.

Such a distribution pattern could lead to increased price volatility, as large holders have the capacity to significantly impact market dynamics through substantial buy or sell orders. Moreover, the high concentration in a few addresses may undermine the project's claims of decentralization and could pose risks to the overall stability of the UXLINK ecosystem.

While it's common for newer projects to have a more concentrated token distribution, the current state of UXLINK's holdings suggests a need for broader distribution to enhance market resilience and reduce the risk of price manipulation. Investors should closely monitor any changes in this distribution pattern as it could significantly influence the token's future performance and adoption.

Click to view the current UXLINK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x985c...e6d9ad | 363267.10K | 36.32% |

| 2 | 0x14b6...b74b89 | 284529.81K | 28.45% |

| 3 | 0x659d...bbbd9e | 80451.88K | 8.04% |

| 4 | 0x91d4...c8debe | 49494.77K | 4.94% |

| 5 | 0x800b...b7d4d1 | 45000.00K | 4.50% |

| - | Others | 177256.45K | 17.75% |

II. Key Factors Influencing UXLINK's Future Price

Supply Mechanism

- Historical Patterns: Past supply changes have shown significant impact on UXLINK's price volatility.

- Current Impact: The upcoming supply changes are expected to influence market dynamics and potentially affect the price.

Institutional and Whale Dynamics

- Enterprise Adoption: UXLINK aims to establish itself as the largest social platform within the Web3 ecosystem, which could attract enterprise interest.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, UXLINK may be viewed as a potential hedge against inflation in certain economic conditions.

Technological Development and Ecosystem Building

- Social Chain Development: UXLINK plans to build its own specialized social chain in the future, enhancing ecosystem synergy and user experience.

- Ecosystem Applications: The platform focuses on creating authentic connections within the Web3 ecosystem, which could lead to various DApps and ecosystem projects.

III. UXLINK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02243 - $0.0267

- Neutral prediction: $0.0267 - $0.03

- Optimistic prediction: $0.03 - $0.03231 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.02095 - $0.03481

- 2027: $0.03055 - $0.04438

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.03827 - $0.04888 (assuming steady market growth)

- Optimistic scenario: $0.04888 - $0.05664 (assuming strong market performance)

- Transformative scenario: $0.05664 - $0.05572 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: UXLINK $0.04888 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03231 | 0.0267 | 0.02243 | 1 |

| 2026 | 0.03481 | 0.0295 | 0.02095 | 12 |

| 2027 | 0.04438 | 0.03216 | 0.03055 | 22 |

| 2028 | 0.05664 | 0.03827 | 0.02755 | 45 |

| 2029 | 0.0503 | 0.04745 | 0.03796 | 80 |

| 2030 | 0.05572 | 0.04888 | 0.02688 | 86 |

IV. UXLINK Professional Investment Strategy and Risk Management

UXLINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate UXLINK tokens during market dips

- Stake tokens to participate in governance and earn rewards

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

UXLINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Option strategies: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for UXLINK

UXLINK Market Risks

- High volatility: UXLINK price may experience significant fluctuations

- Liquidity risk: Limited trading volume may impact ability to enter/exit positions

- Competition: Emerging Web3 social platforms may challenge UXLINK's market position

UXLINK Regulatory Risks

- Unclear regulations: Evolving crypto regulations may impact UXLINK's operations

- Cross-border compliance: Varying international regulations may limit global expansion

- Token classification: Potential for UXLINK to be classified as a security in some jurisdictions

UXLINK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Ability to handle increased user adoption and transaction volume

- Interoperability issues: Compatibility with other blockchain networks and protocols

VI. Conclusion and Action Recommendations

UXLINK Investment Value Assessment

UXLINK presents a unique value proposition in the Web3 social space, but faces significant short-term volatility and regulatory uncertainties. Long-term potential is promising, contingent on successful platform adoption and ecosystem growth.

UXLINK Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the technology and ecosystem ✅ Experienced investors: Consider dollar-cost averaging and staking for long-term exposure ✅ Institutional investors: Conduct thorough due diligence and explore strategic partnerships

UXLINK Trading Participation Methods

- Spot trading: Buy and sell UXLINK tokens on Gate.com

- Staking: Participate in UXLINK's governance and earn rewards

- Social trading: Engage with the UXLINK community to identify trading opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price forecast for Uxlink?

Based on current trends, Uxlink's price is expected to range between $0.00949 and $0.0337 in the next 24 hours, with a predicted price of $0.0235 for tomorrow.

What will be the price of link in 2025?

Based on current predictions, the price of Chainlink (LINK) is expected to reach approximately $14.16 by November 2025. This forecast assumes positive market conditions and correlation with major cryptocurrencies.

What is the all time high for Uxlink coin?

The all-time high for Uxlink coin is $3.68, which was reached on its launch date.

Can Chainlink reach $1000 dollars?

It's highly unlikely for Chainlink to reach $1000. Current market trends and competition don't support such a significant price increase. Historical performance suggests this target is improbable.

Share

Content