BITBOARD vs FIL: A Comparative Analysis of Blockchain Storage Solutions

Introduction: Investment Comparison of BITBOARD vs FIL

In the cryptocurrency market, the comparison between BITBOARD vs FIL has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset landscape.

BITBOARD (BITBOARD): Since its launch, it has gained market recognition for its ranking chart where users can vote for their favorite stars.

Filecoin (FIL): Introduced in 2020, it has been hailed as a decentralized storage network, becoming one of the cryptocurrencies with significant global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between BITBOARD vs FIL, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?"

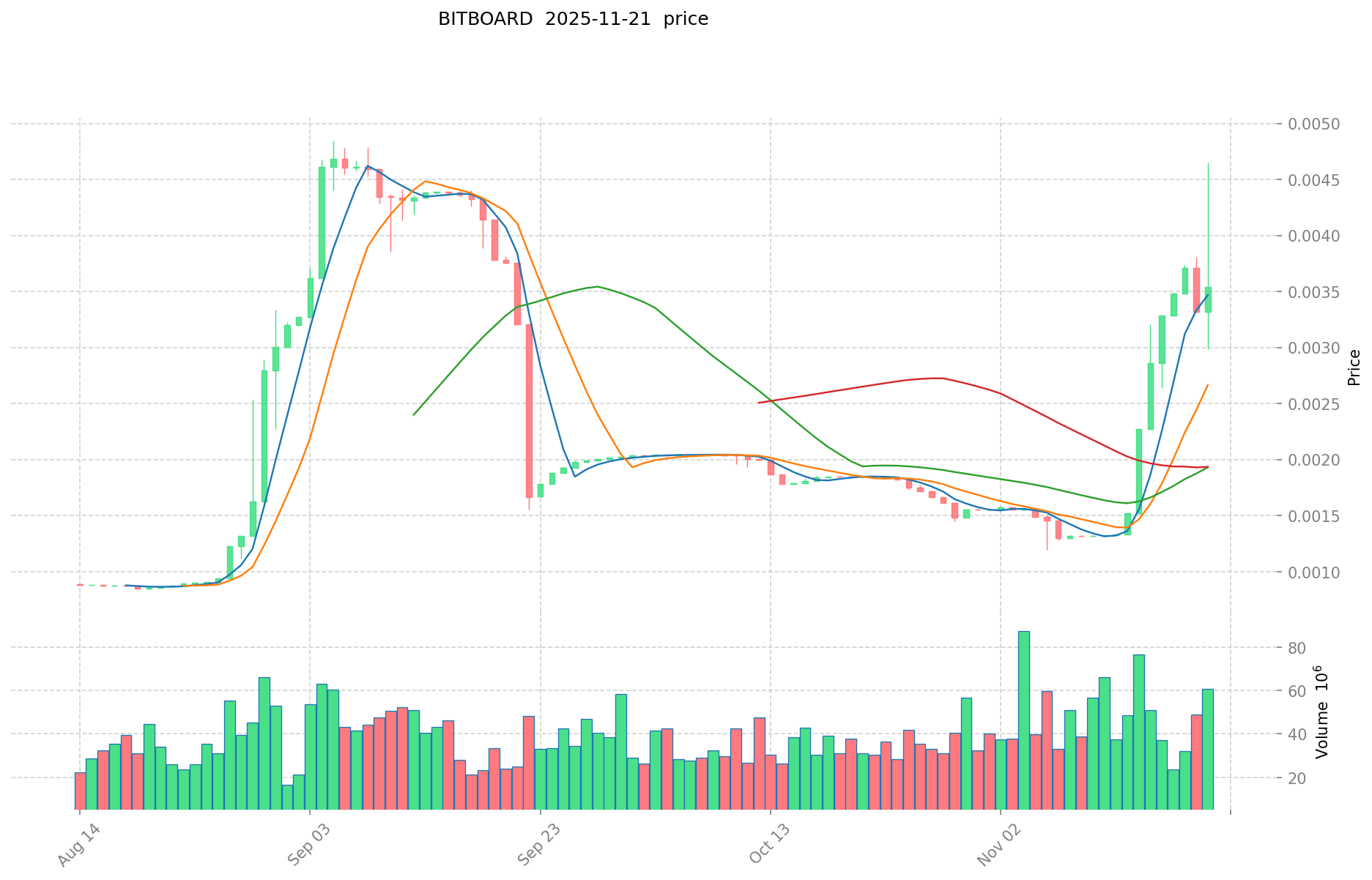

I. Price History Comparison and Current Market Status

BITBOARD (Coin A) and FIL (Coin B) Historical Price Trends

-

2024: BITBOARD reached its all-time high of $0.27 on December 7, 2024.

-

2025: BITBOARD hit its all-time low of $0.0000655 on March 13, 2025.

-

2021: FIL reached its all-time high of $236.84 on April 1, 2021.

-

2025: FIL hit its all-time low of $0.848008 on October 11, 2025.

-

Comparative Analysis: Over the past year, BITBOARD has experienced a significant decline of 95.42% from its peak, while FIL has also seen a substantial drop of 58.65% during the same period.

Current Market Situation (2025-11-21)

- BITBOARD current price: $0.0026975

- FIL current price: $1.756

- 24-hour trading volume: BITBOARD $241,476.08 vs FIL $3,022,194.54

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

Click to view real-time prices:

- View BITBOARD current price Market Price

- View FIL current price Market Price

II. Core Factors Influencing Investment Value of BITBOARD vs FIL

Supply Mechanism Comparison (Tokenomics)

- BITBOARD: Not specified in the provided information

- FIL: Not specified in the provided information

- 📌 Historical Pattern: Information about how supply mechanisms drive price cycle changes is not available in the provided context.

Institutional Adoption and Market Applications

- Institutional Holdings: Information about institutional preference between these assets is not provided in the context.

- Enterprise Adoption: Data comparing BITBOARD/FIL in cross-border payments, settlements, and investment portfolios is not available.

- National Policies: Information about regulatory attitudes toward these assets across different countries is not provided.

Technical Development and Ecosystem Building

- BITBOARD Technical Upgrades: No information provided in the context.

- FIL Technical Development: No information provided in the context.

- Ecosystem Comparison: No data available on DeFi, NFT, payment, or smart contract implementation.

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: Information about which asset has better anti-inflation properties is not provided.

- Macroeconomic Monetary Policy: No information on how interest rates or the USD index affect these assets.

- Geopolitical Factors: No data available on cross-border transaction demands or international situations affecting these assets.

III. 2025-2030 Price Prediction: BITBOARD vs FIL

Short-term Prediction (2025)

- BITBOARD: Conservative $0.001946 - $0.00278 | Optimistic $0.00278 - $0.0036696

- FIL: Conservative $1.4048 - $1.756 | Optimistic $1.756 - $1.82624

Mid-term Prediction (2027)

- BITBOARD may enter a growth phase, with estimated prices ranging from $0.00275897764 to $0.00404131936

- FIL may enter a consolidation phase, with estimated prices ranging from $1.150973712 to $2.323261752

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- BITBOARD: Base scenario $0.00519826360332 - $0.006029985779851 | Optimistic scenario $0.006029985779851+

- FIL: Base scenario $3.2475836957718 - $3.474914554475826 | Optimistic scenario $3.474914554475826+

Disclaimer: This analysis is based on historical data and market projections. Cryptocurrency markets are highly volatile and unpredictable. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

BITBOARD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0036696 | 0.00278 | 0.001946 | 3 |

| 2026 | 0.004546968 | 0.0032248 | 0.002805576 | 19 |

| 2027 | 0.00404131936 | 0.003885884 | 0.00275897764 | 44 |

| 2028 | 0.0057075864192 | 0.00396360168 | 0.0022196169408 | 46 |

| 2029 | 0.00556093315704 | 0.0048355940496 | 0.003723407418192 | 79 |

| 2030 | 0.006029985779851 | 0.00519826360332 | 0.003378871342158 | 92 |

FIL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.82624 | 1.756 | 1.4048 | 0 |

| 2026 | 2.4717456 | 1.79112 | 0.9492936 | 2 |

| 2027 | 2.323261752 | 2.1314328 | 1.150973712 | 21 |

| 2028 | 3.14055965916 | 2.227347276 | 1.7818778208 | 26 |

| 2029 | 3.8112139239636 | 2.68395346758 | 1.9056069619818 | 52 |

| 2030 | 3.474914554475826 | 3.2475836957718 | 2.078453565293952 | 84 |

IV. Investment Strategy Comparison: BITBOARD vs FIL

Long-term vs Short-term Investment Strategy

- BITBOARD: Suitable for investors focused on niche market potential and community-driven projects

- FIL: Suitable for investors interested in decentralized storage solutions and broader ecosystem applications

Risk Management and Asset Allocation

- Conservative investors: BITBOARD: 10% vs FIL: 90%

- Aggressive investors: BITBOARD: 30% vs FIL: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- BITBOARD: Higher volatility due to lower market cap and trading volume

- FIL: Susceptible to broader crypto market trends and competition in the decentralized storage space

Technical Risk

- BITBOARD: Scalability, network stability

- FIL: Mining power concentration, security vulnerabilities

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BITBOARD advantages: Niche market potential, community-driven project

- FIL advantages: Established decentralized storage network, higher market cap and liquidity

✅ Investment Advice:

- New investors: Consider a small allocation to FIL as part of a diversified crypto portfolio

- Experienced investors: Explore both BITBOARD and FIL, with a higher allocation to FIL

- Institutional investors: Focus primarily on FIL due to its higher liquidity and established use case

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between BITBOARD and FIL? A: BITBOARD is known for its ranking chart where users can vote for favorite stars, while FIL is a decentralized storage network. FIL has a higher market cap, trading volume, and liquidity compared to BITBOARD.

Q2: Which cryptocurrency has performed better in terms of price history? A: Based on the provided data, FIL has shown better price performance. While BITBOARD has declined 95.42% from its peak over the past year, FIL has seen a less severe drop of 58.65% during the same period.

Q3: What are the current prices of BITBOARD and FIL? A: As of 2025-11-21, BITBOARD's current price is $0.0026975, while FIL's current price is $1.756.

Q4: How do the short-term price predictions for 2025 compare between BITBOARD and FIL? A: For BITBOARD, the conservative estimate is $0.001946 - $0.00278, and the optimistic estimate is $0.00278 - $0.0036696. For FIL, the conservative estimate is $1.4048 - $1.756, and the optimistic estimate is $1.756 - $1.82624.

Q5: What are the long-term price predictions for BITBOARD and FIL in 2030? A: For BITBOARD, the base scenario is $0.00519826360332 - $0.006029985779851, with an optimistic scenario of $0.006029985779851+. For FIL, the base scenario is $3.2475836957718 - $3.474914554475826, with an optimistic scenario of $3.474914554475826+.

Q6: How should investors allocate their assets between BITBOARD and FIL? A: For conservative investors, a suggested allocation is 10% BITBOARD and 90% FIL. For aggressive investors, the suggested allocation is 30% BITBOARD and 70% FIL.

Q7: Which cryptocurrency is considered a better buy for different types of investors? A: For new investors, a small allocation to FIL as part of a diversified crypto portfolio is recommended. Experienced investors may explore both BITBOARD and FIL, with a higher allocation to FIL. Institutional investors are advised to focus primarily on FIL due to its higher liquidity and established use case.

Share

Content