Avantis Building the Next Generation of On Chain Multi Asset Leverage Trading

The Genesis and Positioning of Avantis

(Source: avantisfi)

As DeFi continues to advance, single-asset perpetual contract trading is no longer sufficient for professional investors. Avantis is a decentralized leverage platform specializing in crypto assets, foreign exchange, and commodities. Its unified interface enables users to manage multiple asset classes simultaneously, delivering both fairness and efficiency through decentralized trading.

The project is led by the Avantis Foundation. The team comprises professionals from investment banking, engineering and R&D, venture capital, product design, and the crypto sector, bringing a combined 20+ years of industry experience. This expertise fosters professional protocol planning and sustainable development.

A Global On-Chain, Cross-Market Leverage Exchange

Setting itself apart from traditional DeFi protocols, Avantis expands beyond the confines of the crypto market to create an on-chain leverage ecosystem spanning multiple asset classes. Users can trade Bitcoin, forex pairs, gold, and other assets simultaneously—enabling comprehensive execution of macro trading strategies. Key platform features include:

- Synthetic Leverage: Centered on a USDC-based liquidity pool, the platform offers leverage up to 500x.

- LP Risk Tranching: Liquidity providers choose their preferred risk tier for greater flexibility.

- Composability: Developers can build new application modules using the leverage engine.

Innovative Design Mechanisms

To optimize the trading experience, Avantis incorporates several unique mechanisms:

- Loss Rebate: In certain scenarios, traders who incur losses receive partial fund rebates, balancing market open interest.

- Positive Slippage: Trades contributing to market equilibrium may qualify for better execution prices.

- On-Chain Multi-Asset Support: Beyond crypto, the platform integrates forex and gold, creating a truly global on-chain market.

- Zero-Fee Leverage: In some cases, traders pay fees only when realizing profits.

- LP Risk Management Innovation: Departing from standard DeFi market maker models, LPs actively choose risk exposures based on tranching and duration preferences.

Core Trading Engine

The Avantis liquidity pool is anchored by the USDC Vault, which acts as the counterparty for all trades:

- Profitable trades are paid out from the Vault.

- Losses are absorbed into the Vault and distributed to liquidity providers.

The Vault features a dual-layer structure:

- Senior Tranche: Low risk, responsible for 35% of profits and losses.

- Junior Tranche: High risk, responsible for 65% of profits and losses.

This system allows LPs to select risk exposure according to their preferences, similar to Uniswap V3’s price range model but designed for leveraged trading.

Revenue and Fee Model

Avantis revenue primarily consists of two streams:

- Trading Fees: Including opening, closing, and margin fees.

- Vault Deposit/Withdrawal Fees: Assessed by protocol status and lock-up duration.

Protocol revenues are allocated as follows:

- 60% to LPs, rewarding their risk assumption and contribution.

- 40% to the protocol treasury, supporting ongoing development, trading competitions, and ecosystem incentives.

AVNT Tokenomics

AVNT is Avantis’s core token, delivering utility, governance, and security functions:

- Governance: Token holders participate in protocol decisions and parameter updates.

- Incentives: Used for airdrops, rewards, and marketing.

- Security: Staking strengthens protocol robustness.

- Ecosystem: Funds developers and supports community growth.

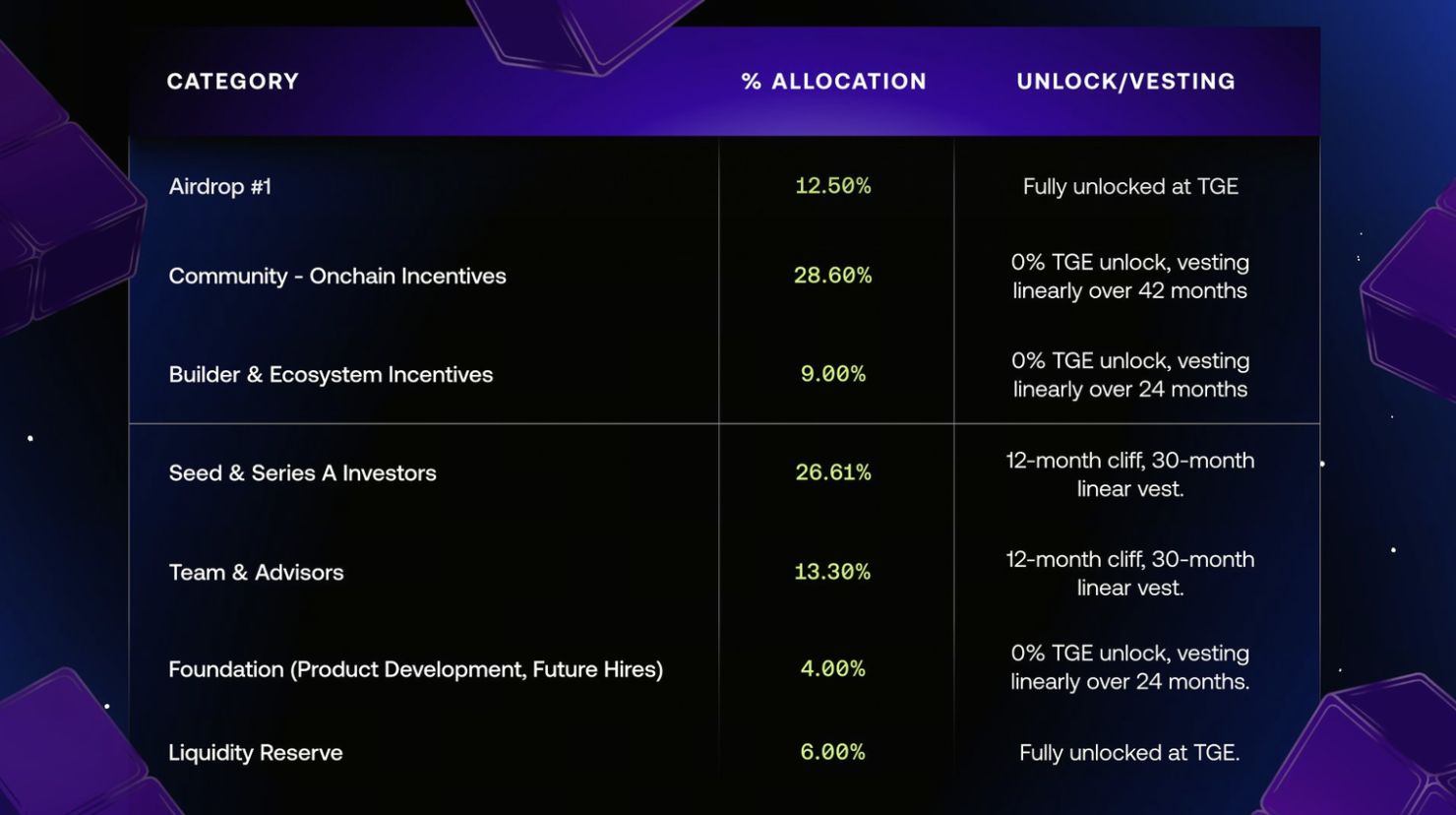

Token Distribution

- Initial Airdrop: 12.5%, fully unlocked at TGE.

- Community Incentives: 28.6%, linearly released over 42 months.

- Builder & Ecosystem Rewards: 9%, linearly released over 24 months.

- Seed & Series A Investors: 26.61%, 12-month cliff, then linearly released over 30 months.

- Team & Advisors: 13.3%, 12-month cliff, then linearly released over 30 months.

- Foundation: 4%, linearly released over 24 months.

- Liquidity Reserve: 6%, fully unlocked at TGE.

(Source: docs.avantisfi)

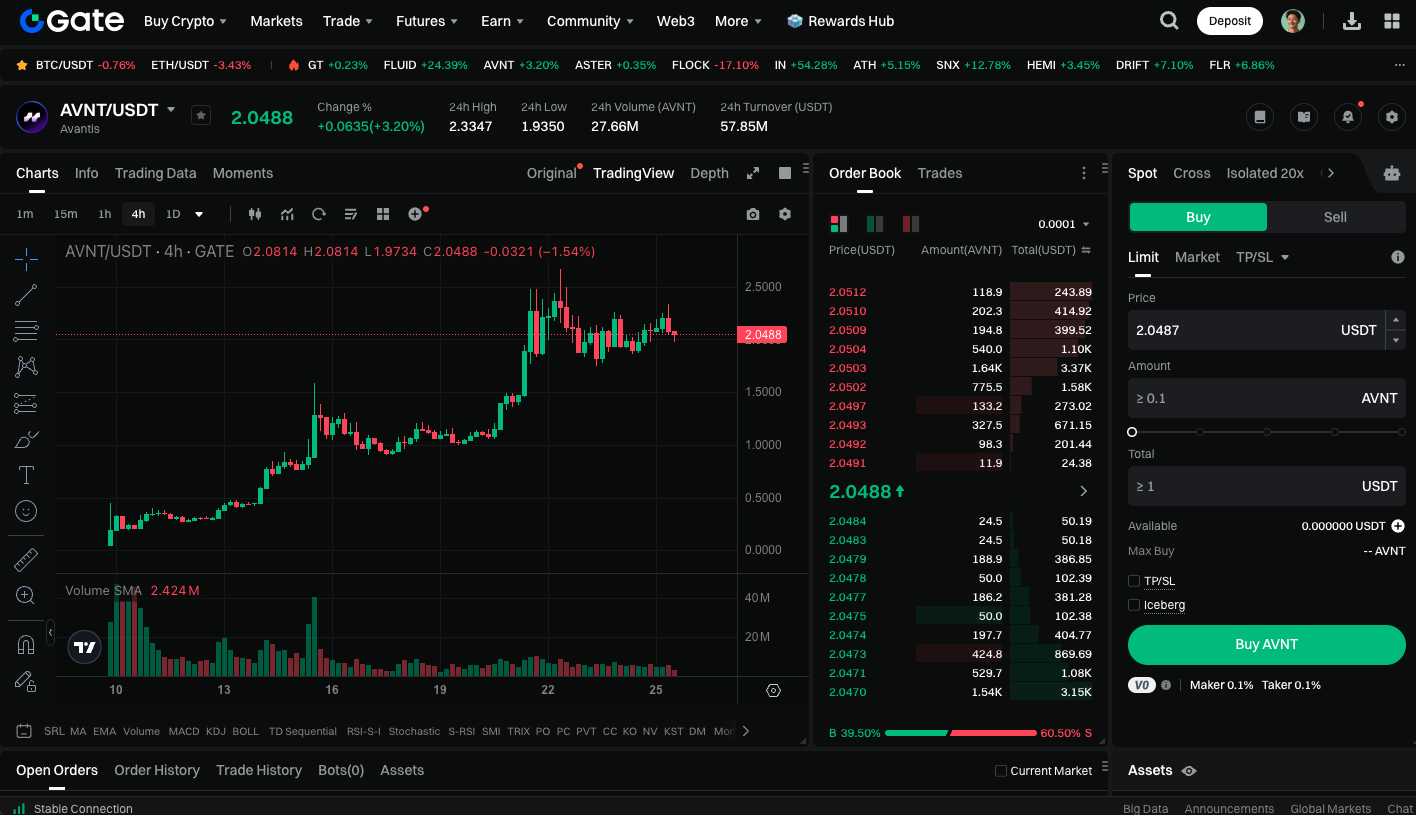

Start trading AVNT spot now: https://www.gate.com/trade/AVNT_USDT

Conclusion

Avantis is more than an on-chain leverage platform; it is decentralized infrastructure for cross-asset trading. Its innovative risk controls and multi-asset support meet the demands of sophisticated traders and attract LPs seeking portfolio diversification. As DeFi continues to mature, Avantis is positioned to become a foundational component of on-chain finance, with AVNT powering the growth of its ecosystem.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution