Bitcoin Price Prediction: BTC Could Retest $100K Without Fresh Catalysts

Preface

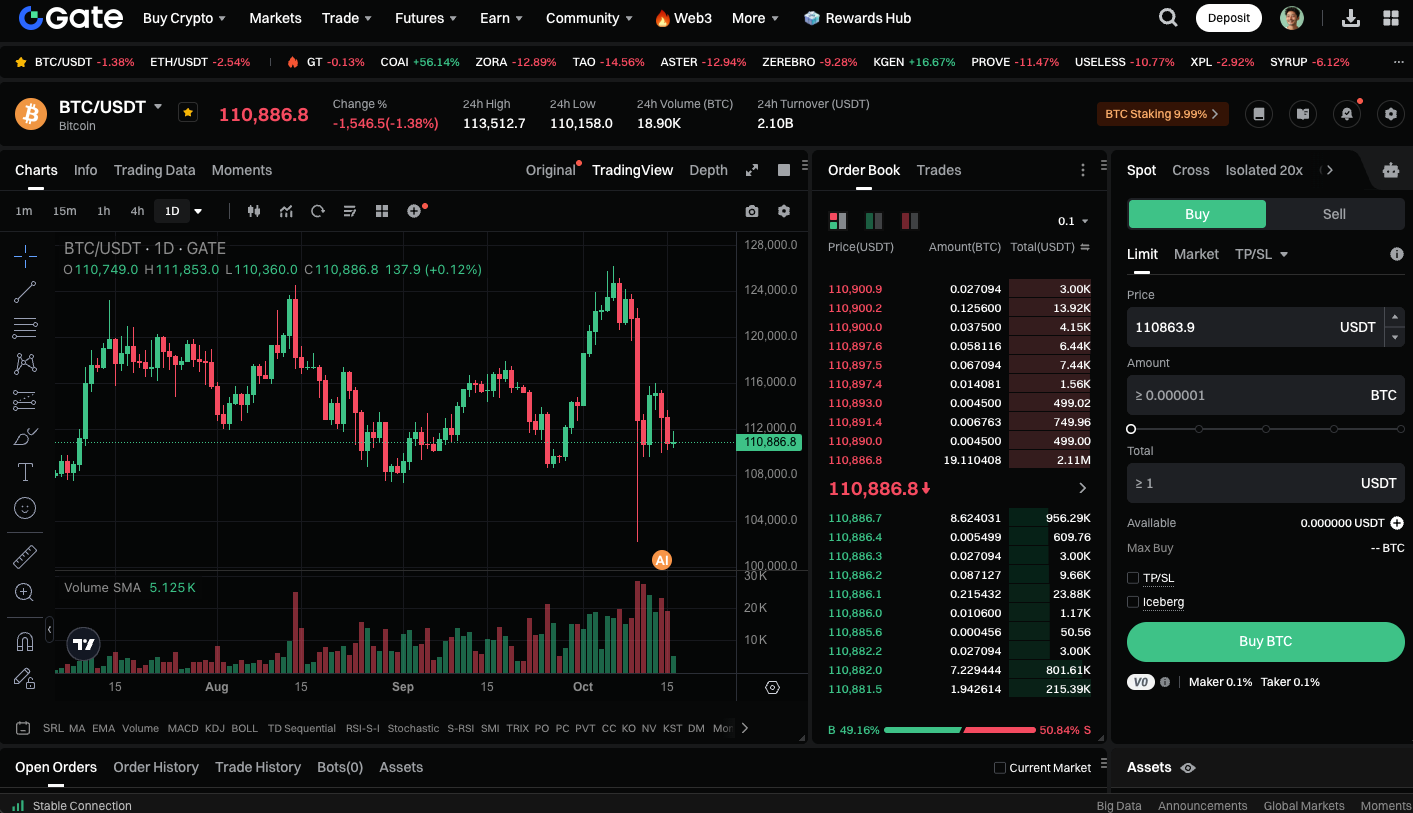

Bitcoin’s recent price action has remained flat. According to market analytics firm Glassnode, unless new catalysts emerge to reignite market momentum, BTC’s upward trajectory may falter, with the possibility of another decline toward the $100,000 level.

Bitcoin Lacks Catalysts

Glassnode’s latest report notes that unless Bitcoin reclaims the $117,100 mark, further market contraction is likely. At the time of writing, BTC traded near $110,850—about 5% below this key resistance. The report highlights a recent surge in profit-taking by long-term holders, signaling potential demand weakness. Historically, similar patterns have led to medium- to long-term corrections.

Divergent Market Views

Hyblock Capital CEO Shubh Varma commented that October could bring significant volatility, with BTC likely to range between $116,000 and $120,000. He added that, following the recent sharp decline, price consolidation is most likely. Still, overall liquidity and spot market trading volumes remain robust, supporting prospects for a medium-term rebound. The US spot Bitcoin ETF recorded nine straight days of inflows, totaling nearly $6 billion—demonstrating continued institutional engagement.

Fed Rate Cut Could Be a Key Catalyst

The market broadly expects the US Federal Reserve (Fed) to cut rates again on October 29. The CME FedWatch Tool places the odds of a rate cut at 95.7%. If the Fed enacts a rate cut, lower yields on traditional bonds and fixed deposits will likely drive more capital into higher-risk assets such as cryptocurrencies, potentially spurring renewed BTC buying.

Structural Demand Fuels Upside Potential

21Shares crypto research strategist Matt Mena suggests that as the market shakeout ends, as monetary policy becomes more accommodative, and structural demand rises, the outlook for digital assets will strengthen as the year ends. BTC could advance toward the $150,000 level.

Start trading BTC in the spot market now: https://www.gate.com/trade/BTC_USDT

Conclusion

Absent new bullish drivers, Bitcoin may again approach the $100,000 support zone in the short term. However, both macroeconomic and structural factors point to the likelihood of a strong rally by year-end or into 2025. For long-term investors, this period of consolidation could present a prime opportunity to enter the market.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article